Well, there’s no sugarcoating it, this has been an extremely rough week for crypto and non-fungible tokens (NFTs) due to the U.S. Securities and Exchange Commission (SEC) filing lawsuits against Binance and Coinbase.

During this new phase of scrutiny on, well, everything on the blockchain, the NFT community has really banded together to support the builders. And make no mistake, there’s plenty of building happening. Bitcoin NFTs are still going parabolic, the Polygon blockchain is teasing something major by having projects tease the number 2, art sales keep ripping, and there are some major developments coming related to intellectual property licensing for NFT holders.

— Frank (@frankdegods) June 8, 2023

With everything happening in the news these stories were easy to miss, so let’s get you caught up.

Noteworthy Happenings

- Pudgy Penguins’ owner Luca Netz was on the NFT Now podcast and talked about an upcoming new NFT IP licensing platform he’s releasing in the next few weeks called Overpass. Pudgy Penguins holders will be able to connect with entities who want to license their NFT, and with a few clicks of a mouse, will take part in the future of licensing.

- Art remains a hot topic in NFTs over the past few weeks, and this week is no exception. From some of Tyler Hobbs’ Fidenzas (#545 and #25), which sold for US$1.17 million and US$129,000 this week, to the sale of XCOPY’s Hackproof 2049 for US$73,000, collectors are grabbing their art grails. Are they anticipating a run on art, or did they just finally find the liquidity after meme coin season?

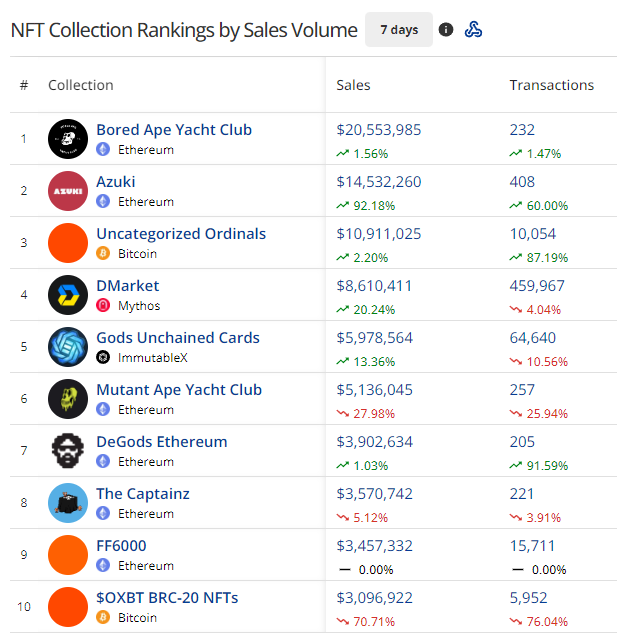

- Blur.io cycled in a new group of projects to receive 2x rewards for points farming, and with Bored Ape Yacht Club (BAYC) included, the race was on. Traders quickly threw their Bored Apes into the Blend lending protocol, and with no creator fees to pay, could buy them back and repeat the cycle over and over again. This relatively new type of wash trading might have fooled some into thinking NFT sales were starting to take off, but we instead flagged nearly 75% of BAYC as wash trades at their peak.

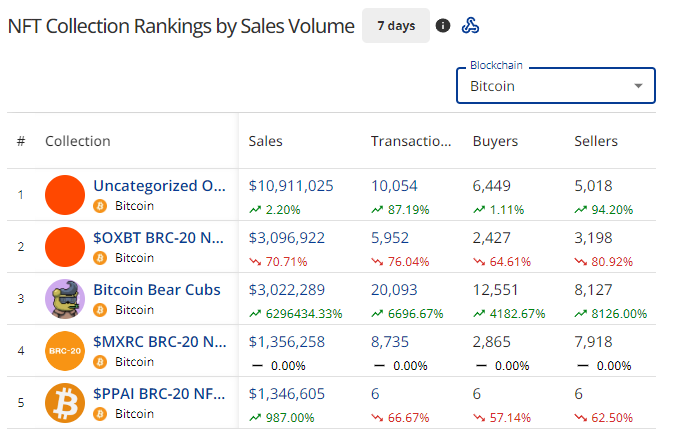

- Bitcoin had 2 recent noteworthy events with another new BRC-20 drop called $MXRC, and Magic Eden’s first Bitcoin drop on their launchpad called Bitcoin Bears Club. $MXRC wasn’t as smooth as some hoped, and bots seemed to grab up a decent percentage of the supply.

- Bitcoin Bears Club on the other hand was a big success, and in just a few days is the 2nd most traded BTC collection on Magic Eden.

Peep the charts

- BAYC dropped a teaser video this week that showed off apes, dogs, and HV-MTL characters all being drawn into a puzzle. Between wash trades and maybe some hype, BAYC remains on top.

- DMarket and Gods Unchained at times this week occupied the top 2 spots on the 24-hour rankings. With the SEC news and some buyers pausing to watch the landscape, it’s possible that gaming NFTs with cheaper assets may be the exact type of projects built to weather the storm.

- Wash trades on Ethereum are trending up, and will probably hang around this level until Blur’s Season 2 rewards are distributed. There are rumors that this is coming up imminently.

- Bitcoin still holds onto number two and seems to be on auto-pilot. More traders are being onboarded into the Ordinals ecosystem as the appeal of taking part in the early days of the historic chain’s NFT scene becomes too big to miss.

- Polygon and Solana are still battling for third and fourth, but it still remains to be seen if their native tokens being called securities will impact their NFT ecosystems.