In this issue

- SEC vs. Bitcoin ETFs: Lawmakers call

- NFTs: Down but not dead

- Mixin: US$200 million lost in crypto hack

From the Editor’s Desk

Dear Reader,

It takes a lot for U.S. Democrats and Republicans to come together these days – particularly given the Trump-trance into which the latter have fallen in recent years – but congratulations are in order for Securities and Exchange Commission Chair Gary Gensler for having united lawmakers from the two sides.

Having distinguished himself for leading a crusade against crypto companies of all shapes and sizes, Mr. Gensler can now add the epithet “peace broker” to his résumé.

Unfortunately for him, however, peace is the last thing with which he was rewarded at the House Financial Services Committee hearing on SEC oversight this week. His roasting before the committee came hot on the heels of a strongly worded letter from four of its members – two Democrat and two Republican – that described the SEC’s stance on spot Bitcoin exchange-traded funds as “untenable” and accused the regulator of applying “inconsistent and discriminatory standards” to applications to set up those ETFs.

The barbequing the SEC boss received on Wednesday wasn’t his first brush with legislators’ hostility. Just last month, he was the target of a tirade by lawmakers following the SEC’s court defeat in its case against Grayscale’s Bitcoin ETF application. Two months before that, one of the signatories of this week’s letter, committee member Tom Emmer, co-sponsored the SEC Stabilization Act, a bill expressly aimed at removing the regulator from his post following what Emmer said were “his long series of abuses” in the role.

So, a rough few months for the SEC chief, then. And a probable win for the crypto industry as the pressure to accommodate the inevitable – in this instance a Bitcoin ETF – becomes impossible to resist.

Mr. Gensler and his colleagues may dig their heels in, but the SEC is ultimately accountable to Congress, whose “crypto caucus” looks likely to become one of the most powerful blocs in the legislature in the years ahead.

Ranged against such remarkable and staunch bipartisanship, the SEC’s Canute syndrome just won’t cut it. Bring on the tide.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Lawmakers enter the fray

The U.S. Securities and Exchange Commission (SEC) should stop rejecting Bitcoin exchange-traded fund applications “under inconsistent and discriminatory standards, four members of the House Financial Services Committee wrote in a Tuesday letter to SEC Chair Gary Gensler, after the U.S. financial regulator was ordered by a court last month to review Grayscale’s spot Bitcoin application.

- The letter was meant to ensure the SEC “does not continue to discriminate against” spot Bitcoin ETFs, the Tuesday letter said, urging the SEC to approve the multiple pending spot Bitcoin ETF applications immediately.

- The letter was written by Congress members Tom Emmer, who is the majority whip of the House of Representatives, Mike Flood, Ritchie Torres and Wiley Nickel.

- The letter cited a court decision on Aug. 29 that required the SEC to review Grayscale’s spot Bitcoin application it rejected earlier. The court’s finding underscores a “fundamental point” that a spot Bitcoin ETF is “indistinguishable” from a Bitcoin futures ETF that has already been approved by the SEC, thus the agency’s current stance against spot Bitcoin ETFs is “untenable moving forward,” said the letter.

- After the letter was sent on Tuesday, SEC delayed its decision on the Ark Investment Management and 21Shares spot Bitcoin ETF application from Nov. 11 to Jan. 10, 2024. The agency had earlier delayed multiple similar applications, including those from BlackRock, WisdomTree and Invesco Galaxy. BlackRock, the world’s largest asset management company, has its next Bitcoin ETF decision deadline on Oct. 17, which could be postponed again by the SEC.

- At a Wednesday hearing before the House Financial Services Committee, Gensler was questioned about his “crusade against the digital asset ecosystem,” given the agency’s enforcement actions against crypto firms for alleged securities law violations in the past few months.

- Despite the Congress’ pressure, Gensler held to his point that “most crypto tokens are subject to the securities laws,” which makes most crypto intermediaries obliged to comply with securities laws as well. He also added that SEC was still considering what to do with the pending spot Bitcoin ETF applications, which could be further delayed due to a potential U.S. government shutdown in October.

Forkast.Insights | What does it mean?

The cryptocurrency market, including Bitcoin, has been relatively quiet lately. Prices have been stable, with the world’s largest cryptocurrency maintaining a value between US$25,000 and US$30,000 since early August, creating a somewhat unexciting period for investors used to the asset’s usually turbulent nature. However, there are significant events on the horizon that have the potential to shake things up.

One such event is the anticipated Bitcoin halving in April 2024, which is expected to reduce the number of new Bitcoins entering the market and could affect the price. Another potential game-changer is the possibility of the approval of the first U.S. spot Bitcoin ETF. The exact timing is still unknown, but recent legal developments, like the SEC losing a case against Grayscale, are making people think it’s more likely to happen than not.

While the market seems to be in a holding pattern, some, like software company MicroStrategy, are using this time to increase their holdings, seeing it as a chance to buy before potential increases in value. MicroStrategy, recognized as the largest corporate holder of Bitcoin, purchased around US$150 million more of it between August and September, showcasing its unwavering confidence in the long-term value of Bitcoin.

For investors, the current market situation, combined with the potential upcoming events, makes for an interesting landscape. Although things seem calm on the surface, there could be significant opportunities for those willing to look for them. The strategic moves by companies like MicroStrategy to accumulate more assets suggest that there are underlying opportunities in the current market environment.

2. Down but not out

A report came out last week stating that 95% of NFTs are now worthless. While true, the story has been spun into a narrative that NFTs are dead. This couldn’t be further from the truth. However, NFT’s value is down tremendously.

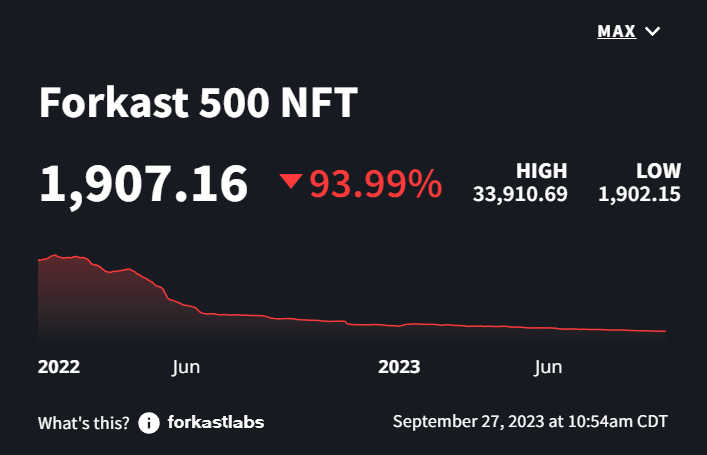

- The Forkast 500 NFT Index fell below 2,000 for the first time in the index’s history.

- The value of the NFT market is down 93.99% since the peak of the market in January 2022.

- The individual blockchain NFT Composites reflect similar all-time declines in NFT value with Solana NFTs down 94.34%, Polygon 93.53%, Ethereum 93.42% and Cardano NFTs performing the best, down just 74.49%.

- In the past seven days, the index has lost 5.68%, indicating an increasing decline in value of NFTs across blockchains.

- Global NFT sales on CryptoSlam declined for the fifth week in a row, with just over US$69 million in total NFT sales in the week ended Sept. 24.

Forkast.Insights | What does it mean?

There is no disputing that the value of NFTs has declined, but there’s a difference between value declining, NFTs being largely worthless, and the adoption of NFTs.

Last week’s “95% worthless” report claimed that NFTs were just a fad that has finally passed. While data supports that 95% of NFT collections are indeed worthless, this phenomenon has been the case on multiple occasions during the many slow periods in the NFT market. Simply put, NFTs quickly become illiquid and are effectively worthless.

There is significance in still-liquid projects like Bored Apes Yacht Club, CryptoPunks, World of Women, and Pudgy Penguins losing roughly 94% of their value. This is the story that the Forkast 500 NFT Index tells, as it reflects the value of the top 500 NFT collections across blockchains, and acts as a proxy for the rest of the NFT market.

Whether the plot has been lost or never understood, there is a picture telling the story of what has happened over the past few years in NFTs. In fact, the growth of the industry has been more significant than most realize and if we’re the only outlet to report the real facts, we’re proud to do just that.

Since 2020, the NFT market has grown exponentially in almost all metrics beyond value. Unique buyers are up 10,100% in 2023 compared to 2020, while global sales are up 31,872%, and transactions are up 52,415% over this time.

The picture is now clear, NFTs have become baked into internet culture. With brands continuing to pour into Web3, the technology around NFTs maturing, and a base of collectors that are convinced that the digital economy is the future, we’re convinced that the value many want so desperately is just a cycle away.

3. Yet another heist

Hong Kong’s crypto sector saw its second major blow in a month with Mixin Network, a cross-chain transaction network for digital assets, suffering a US$200 million exploit on Saturday.

- The database of Mixin Network’s cloud service provider was hacked last Saturday and caused the loss of around US$200 million worth of assets, Mixin announced on X (formerly known as Twitter) on Monday.

- Mixin said it has temporarily suspended its deposits and withdrawal services until the platform’s vulnerabilities are addressed, and has contacted Google and blockchain security firm SlowMist to assist with the investigation, according to the announcement.

- On Monday, Mixin Founder Feng Xiao-dong said Bitcoin was the main asset lost in the hack, and the platform will pay up to 50% of the customers’ losses for now. The rest of the losses will be compensated in the form of bonds and tokens, which the company will repurchase in the future, according to Chinese online news media BlockBeats.

- The hack added to negative sentiment in Hong Kong’s crypto industry. On Sept. 12, Hong Kong-headquartered global crypto exchange CoinEx lost approximately US$70 million from a cyberattack. Last week, Hong Kong police arrested multiple persons related to crypto exchange JPEX, which allegedly misled investors through social media promotions and suspended trading last Monday, charging high withdrawal fees.

- As of Monday, JPEX’s case has involved 11 arrests, at least 2,305 victims, and over US$180 million of investments, according to the South China Morning Post.

- Hong Kong has been implementing a slew of regulatory measures this year amid efforts to be a global hub of crypto trading while preparing guardrails for investors against bad actors. Its new rules, which went into effect on June 1, allowed licensed crypto trading platforms to offer services to retail investors.

Forkast.Insights | What does it mean?

Hong Kong has garnered much attention in crypto circles since its rollout of rules for crypto trading several months ago. That attention has come largely for the right reasons, but this month it’s come for all the wrong ones.

The Mixin Network heist – the biggest crypto hack so far this year – shows that, rules or no rules, basic security remains a challenge in the crypto space. The cyberattack on CoinEx, less than a fortnight earlier, serves only to underline the point.

Mixin bills itself as an “open and transparent decentralized ledger, which is collectively booked and maintained by 35 mainnet nodes.” But Mixin says the vulnerability lay in its cloud service, whose database was hacked. That begs the question of just how decentralized Mixin really is when it comes to security; accessing a database isn’t the same thing as accessing a supposedly decentralized network.

As for CoinEx, the problem was compromised private keys to hot wallets. CoinEx’s hack may have been smaller and its impact relatively quickly addressed, but there’s a whiff of menace around talk that North Korean hackers may have been responsible for it. Indeed, the name of notorious North Korean hacker group Lazarus surfaced with little delay. It shouldn’t be lost on anyone that hackers linked to Pyongyang were responsible for half of the crypto stolen in attacks last year.

None of this is the fault of Hong Kong’s Securities and Futures Commission, whose rules are well-intentioned and a step in the right direction for the city’s aim of realizing its crypto ambitions. The SFC is, after all, a finance regulator, not a cybersecurity enforcer.

Neither can the JPEX debacle be laid at the SFC’s doorstep. Pending proper legal due process, the conduct of the rogue exchange appears to be a textbook case of flouting the rules.

The JPEX case appears already to have shaken local investors’ confidence in crypto, and the two hacks will likewise have done little to foster increased trust. More’s the pity, as Hong Kong’s internationally respected finance regulator has taken an encouraging – if somewhat cautious – step toward bringing crypto back in from the cold following what was arguably its lowest point just 10 months ago.