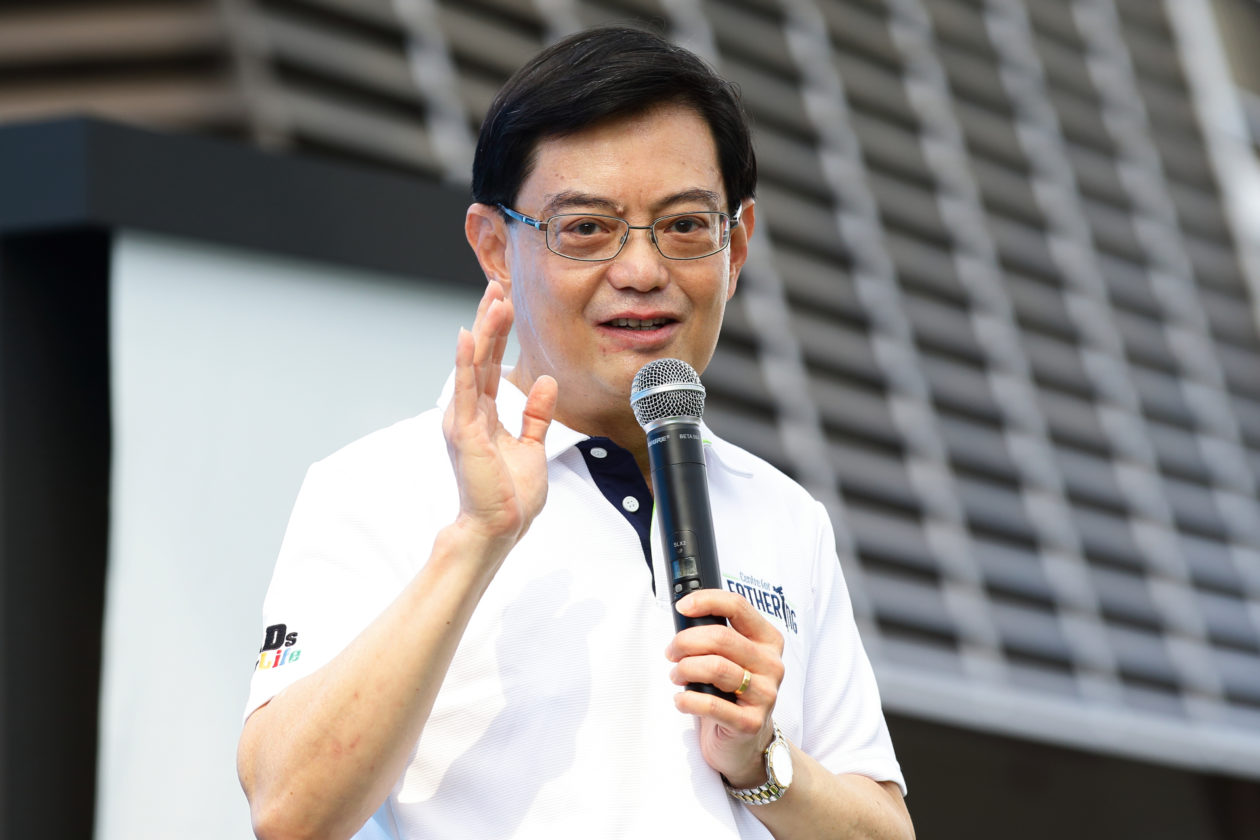

Singapore’s Deputy Prime Minister Heng Swee Keat cautioned retail investors to steer clear of investments in cryptocurrencies, saying the nascent asset class “is a highly risky area.”

See related article: Singapore wants to bring some adult supervision to crypto

Fast facts

- Many investors suffered losses and even lost their life savings in the recent meltdown of TerraUSD and LUNA, which triggered knock-on effects on Bitcoin and other cryptocurrencies, Heng said.

- “Retail investors especially should steer clear of cryptocurrencies,” he said. “We cannot emphasize this enough.”

- The Monetary Authority of Singapore, or MAS, has consistently warned the public against trading in cryptocurrencies, and has taken steps to limit the promotion of cryptocurrencies to the general public earlier this year.

- However, he said that the digital asset ecosystem comprises an entire range of services beyond cryptocurrency trading.

- “We remain keen to work with blockchain and digital asset players to encourage innovation, and build up trust in the sector,” he said in his speech.

- In the past two years, MAS has granted licenses and in-principle approvals to 11 digital payment token service providers, including stablecoin players like Paxos, crypto exchanges like Coinhako, and traditional financial institutions like DBS Vickers.

- The deputy prime minister also said that Singapore will continue to evaluate applications.

See related article: Singapore plans digital assets initiative with financial industry