Floptober is in full effect in NFTs, with sales now falling for the seventh consecutive week. It’s not just the market that’s taking a beating this season, as some of NFT’s biggest native brands like Yuga Labs and Proof Collective last week announced substantial layoffs. Never before has the impact of the market’s downturn been more tangible.

Along with their first major layoffs, Yuga Labs disclosed that they would be changing the core focus of their business. Instead of building auxiliary games in-house, they’ll now turn entirely to third parties who bring more experience, and allow them to focus on their Otherside metaverse and on the community.

As the poster child or roadmap for NFT projects to follow, many projects followed Yuga Labs’ lead down the road of game development. But the difficulty of building fun and engaging games can’t be understated, and we’re now seeing where that game plan potentially leads. While Yuga Labs has resources to outsource future games and focus on their Made with Apes intellectual property licensing platform, many projects went all in on gaming. It could prove to be a costly mistake.

The Pudgy Penguins are winning during this crypto winter with a similar two-tiered gaming and IP-focused model, but their brute force marketing outside of the existing NFT community demonstrates that money can be raised in a bear market. Through viral social media campaigns and business savvy, Pudgy Penguins toys are now on shelves in 2,000 Walmart stores across the U.S., and as of last week, also in Smyths stores in the U.K.

So far, 25% of Walmart’s Pudgy Penguins toy inventory has sold out, and although it’s impossible right now to know the value of those sales (the total Walmart supply is valued at around US$300 million) it’s safe to say that the Pudgy Penguins have crafted a recipe for success.

This success translates directly to their NFT value, as the average Pudgy Penguin NFT price in October climbed to US$8,875, up over 11% from January. NFT holders whose NFTs are featured as these toys also benefit each time their corresponding toy is sold, earning royalties which are currently estimated to be around US$2,000 this year.

The difference between Yuga Labs’ and Pudgy Penguins’ licensing platforms seems to be that the Pudgy Penguins team does the heavy lifting to find deals for holders, while Yuga Labs serves as a middle man for anyone who is ready to deal. In the end, both strategies may work, but the real takeaway here is that the Pudgy Penguins are finding success that was elusive for most during a bear market.

Both projects’ current game plans point to the importance of IP for NFT projects, with it being Pudgy Penguins’ main objective, and Yuga Labs now making it a much bigger focus. In the infancy of the new IP meta, we get to sit back and watch how today’s elite NFT businesses blaze a trail for the rest to follow. Future NFT builders, I hope you’re paying attention, because this is a road you’ll probably be heading down soon. It will just be less bumpy thanks to the efforts of a few bored and weathered animals.

- Peep the charts

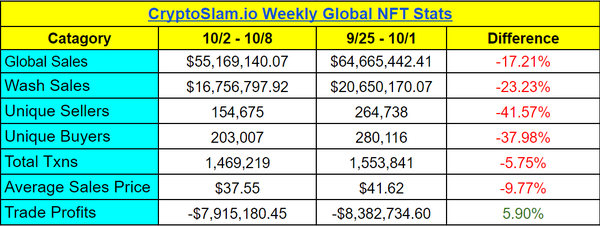

The NFT market was down almost across the board last week, and will continue to decline until collectors find value. How low that can go depends on what’s being offered by NFTs, but so far there’s not much being offered. Last week finished with just US$55 million in global NFT sales, marking the first time sales have fallen below US$60 million since the week of Feb. 8, 2021. Unique sellers, buyers, and transactions all fell from the previous week, though all were still exponentially up from Feb. 8, 2021.

- DMarket and their gaming skin NFTs (CounterStrike, DOTA2, etc) saw over US$8.9 million in sales, again outperforming the #2 and #3 ranked collections combined.

- Cryptoadz are in the top ten this week thanks to a single “fat finger” 1,055 ETH sale of Cryptoadz #4030. The bid was actually intended to be 1.055 ETH.

- Pudgy Penguins sales are ramping up to over US$1.3 million this week, and have quietly climbed to the #19 ranked all-time NFT collection.

- DeGods are back in style again this week with US$877,000 in, and a fresh new collection “reset” to look forward to.

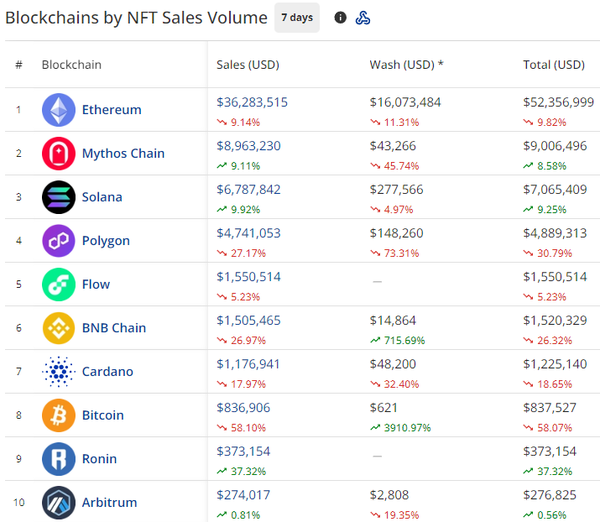

- Ethereum sales are down 9.14% this week to US$36 million, and washtrading continues to fall as speculators still farm SoFi platforms.

- DMarket is again driving 99% of Mythos Chain’s US$8.9 million in sales, even with the launch of the blockchain’s latest game, Nitro Nation World Tour.

- Solana’s US$6.7 million in sales came from multiple collections that showed up in the 24-hour top 10 last week including Bozo Collective, Reavers, and Fidelion.

- Polygon saw US$4.7 million in sales in a week when co-founder Jaynti Kanani announced that he would be stepping back from the “day-to-day grind”.