As institutional interest in crypto grows, most investors are entering the digital asset space through OTC trading or investing in digital asset index funds. However, many institutional investors are seeking new ways of exposure to this nascent asset class that secure predictable returns without the extra steps and volatility that traditional digital assets investments involve. For these investors, cloud mining products have been touted as a viable alternative.

Between the explosion of computing capabilities, daunting complications of mining site management and increasingly complex technology required to mine bitcoin at a profitable hash rate, institutional investors are hesitant to undertake mining on their own. These institutions have turned to cloud mining products as a way to gain mining exposure without fronting necessary overhead costs and physical operations, such as storage and electricity bills. While the cloud mining industry’s reputation has been knocked in the past by bad-faith actors, increasing interest from institutional investment and a rise in professional service providers are bringing new credibility to the space.

So, what is bitcoin mining, why is cloud mining better than running your own mining farm, and how can institutional investors determine which cloud mining partner best fits their needs?

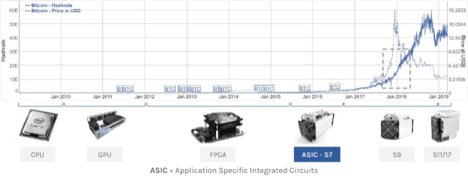

Bitcoin Mining, Past to Present

Bitcoin mining has become much more complicated than it used to be. The technology necessary for bitcoin mining has evolved rapidly since cryptocurrency was first introduced. Originally using CPU power, bitcoin mining quickly moved into GPU as capabilities improved in order to harness the higher computing power of multi-core parallel processing. In early 2014, high-efficiency Field Programmable Gate Array (FPGA) first emerged in cryptocurrency mining. It uses configurable ‘logic blocks’ to achieve better mining performance but has failed to achieve mass adoption due to the high cost of production. In 2016, the first major Application-Specific Integrated Circuit (ASIC) model was produced by Bitmain, known as the S7 model, which marked bitcoin mining’s entrance into the ASIC era.

At the circuit level ASIC miners are tailored to the SHA 256 algorithm to maximize efficiency in hashing. The majority of ASICs are produced in China by well-known firms including, but not limited to Bitmain, MicroBT, and Cannan. These firms design the chip in-house, conduct fix and fabrication with traditional semiconductor industry giants like Samsung and TSMC, and then complete the post-build processes including PCB design, heat extraction system and casing to produce the end product. The superiority of ASIC’s mining efficiency now makes amateur mining almost impossible. In today’s world, only industrial-level mining farms with access to the most advanced machines can stay profitable, especially as ‘bitcoin halving’ reduces the number of bitcoins rewarded to miners for adding blocks to the blockchain. While this may present a problem for less efficient mining operations, those with advanced miner technology can maintain the same profitability.

Furthermore, these miners, similar to manufacturing plants, require hosting sites with a variety of considerations that have evolved with the technology. Electricity costs, proximity to miner manufacturers and an active secondary market are all integral to mining production. In recent years, emerging hosting service providers have been working diligently to upgrade infrastructures, to gain a competitive advantage during industrial consolidation. These efforts have improved the operational services significantly, bringing bitcoin mining to a new level more capable of meeting demand from institutional buyers.

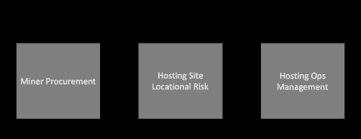

Unique Operational Risks

Running a bitcoin mining operation carries similar risks to running a traditional labor-intensive business such as manufacturing, but with its own unique challenges. These risks include:

- Access to supply: Consistent access to supply of the latest miners trumps all other operational parameters. Relationships with miner manufacturers directly impact a farm’s ability to adjust its output in response to bitcoin price volatility and changes of mining difficulty, thus affecting its profitability. Therefore, a reliable relationship is essential.

- Geographic location: Different geographic locations bear various operational risks, such as the local political and business environment, electricity supply, site safety and cost of labor. Obtaining the optimal location is critical to the continuity of the mining business.

- Operational management: The hosting farm’s operational management experience and knowledge directly impact miner uptime – and uptime directly translates to mining efficiency and profitability.

Sifting through the nuances of running a mining farm requires time, financial resources and luck. It demands in-depth knowledge of the cryptocurrency ecosystem, close relationships with suppliers and experience running a factory in a remote environment. These are lofty, daunting asks for investors entering the asset class, which is why some eager investors have sourced a better way to profit from the proliferation of digital assets.

Cloud Mining: Mining, Without the Overhead

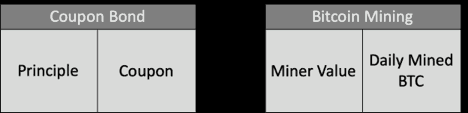

Cloud Mining effectively removes investors from the operational burden associated with physically running a mining operation, while maintaining the same financial return profile. It can also be tailored to various sized institutional or retail clients to suit their different needs. To better understand the returns that cloud mining can provide, consider a comparison to a fixed income product similar to a coupon bond.

The fixed income portion of the bond, namely the coupon, resembles the mined bitcoins distributed. The major difference is that bond principle is returned after expiration, but cloud mining principle is in linear depreciation with fluctuating market value. Cloud mining gives investors the option to receive constant bitcoin inflow with an underlying asset ownership, at no operational risk.

Institutional investors can include cloud mining as an alternative digital asset investment in their portfolio due to unique features, including:

- Exposure to the underlying mining industry that captures inefficiencies between supply created by mining and global demand.

- An uncorrelated risk and return profile for investors looking to diversify their portfolios.

- Discounted and effective long-term exposure to bitcoin through the daily distribution of mining profits.

- Cost savings when compared to mining directly. It removes large upfront investment requirement in procurement, hosting, long-term electricity purchases and the operational risks.

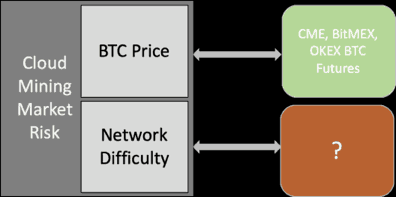

The Remaining Risk? Market Risk

Since cloud mining removes the operational risks from investors, it only leaves market risk. Market risk consists of two factors: bitcoin network difficulty, which determines the amount of bitcoin produced by fixed computing power, and bitcoin spot pricing, which determines the dollar return of mined bitcoin. These two factors also impact each other as miners that are marginally profitable will need to be switched on and off to avoid losses.

As illustrated below, hedging the price risk of incoming bitcoin is feasible, as the current futures market is relatively liquid at CME, Bitmex and OKEX. However, there are currently no financial derivatives with adequate liquidity that investors can use to hedge bitcoin network difficulty risk, or the desired mining exposure, in the market.

Mining profitability is largely dependent on the revenue earned, as the cost of miners and electricity are relatively fixed. This revenue is determined by two main factors, network difficulty and bitcoin price. Because the steadily increasing current difficulty level has not reached the point of breakeven yet, more efficient mining technology will increase the amount of bitcoin mined per kilowatt hour. This ensures that cloud mining contracts based on more efficient miners will remain profitable in the current market.

Volatility Considerations

While volatility is a constant concern for the cryptocurrency industry, even for institutional investors, mining yield volatility is significantly lower than spot bitcoin price volatility, as shown in the graph below. The residual value of miners, even though in constant depreciation due to consistent improvements in miner technology, also minimizes the downside risk.

This is an important consideration for institutional investors with previous experience trading cryptocurrency through OTC trading or investing in index funds, in which volatility is a key factor.

Ready to Select a Cloud Mining Partner? Here’s What to Consider

The cloud mining industry has been questioned in the past due to some bad faith actors, which is why it’s important to carefully consider cloud mining partners before selection a contract. There are some overarching criteria institutional investors should evaluate, which include:

- Price per Tera hashrate: This unit price of each Terahash computing power. The cheaper the unit price, the better return for investors.

- Investment size, tenor and distribution: These terms can be specifically tailored to each investor to meet their demand. Institutional clients are often offered a discount due to larger investment size and longer lockup period as opposed to retail investors.

- Credibility: Institutional investors rely on the issuing company to manage operations and mining rewards distribution. Therefore, the credit-worthiness of the issuing company also impacts the viability of the product.

- Hosting site safety: Site maintenance, staff training and management, monitoring tool and cyber security all indirectly impact mining efficiency.

- Product specifications3:

| Product Specifications | Definition | Range | Institutions |

| Rent | The daily fee that charged by the hosting side per TH*. | $0.103-$0.106 | $0.072 |

| Fee | The daily electricity cost per TH*. | $0.097-$0.099 | $0.099 |

| Longest Plan | The maximum period of cloud mining contract. | 270-360 Days | 730 Days |

| Max TH* | The maximum amount of TH* that an individual can purchase. | 1,000 TH* | 38,000 TH* |

*TH: Terahash

There are a number of factors to take into consideration before

investing in cloud mining – and each institutional investor has unique needs.

As more institutional investors look to alternative assets and as

cryptocurrency continues its venture into mainstream alternative investments,

cloud mining will continue to thrive as a viable alternative for growing number

of institutional investors.

[1] Bitcoin Hashrate vs. Price in USD historical chart. Retrieved from https://bitinfocharts.com/comparison/hashrate-price-btc.html

[2] Bitcoin Mining Profitability vs. Price in USD historical chart. Retrieved from https://bitinfocharts.com/comparison/mining_profitability-price-btc.html