For weeks now, we’ve been watching the non-fungible tokens market fluctuate between all-time low prices in most NFT collections, and then bouncebacks that ultimately do little more than tease traders.

Some argue that the Blur marketplace incentivizing the trading of floor NFTs is the cause of falling NFT prices. But really, it actually has added demand for specific collections. May’s 70,000 unique buyers compared to 501,000 in January 2022 shows that legitimate NFT collectors have largely stopped trading. So without the volume that Blur brings in, sellers would be aggressively undercutting each other in the hunt for liquidity.

People blaming gamified marketplaces for the nft price collapse don’t understand economics. Without these innovations, the market would be dead. It would have near zero participant interest and more importantly no liquidity. But we’ll get to that point soon when farm rewards end.

— Beanie (@beaniemaxi) July 5, 2023

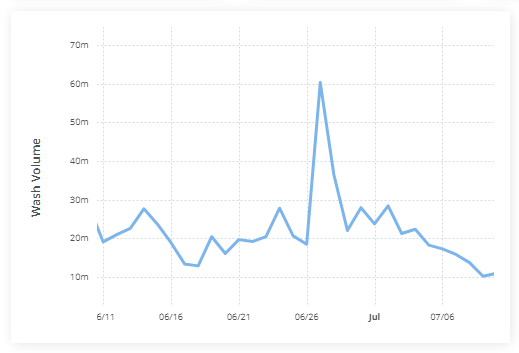

Consider how low collections prices could have fallen after Azuki’s Elementals tanked the broader NFT market if wash trading wasn’t there to inject volume and liquidity. Most of the top collections fell 25% or more, and that’s with over US$645 million in wash trades propping up prices.

Yes, wash trading is still a large part of NFTs and it’s largely keeping the NFT market active. Over 62% of Ethereum’s total sales in the past thirty days were wash trades, and the $645m in wash trades is more than double the combined legitimate sales on the other top ten blockchains combined.

Now that we have entered a price discovery phase in the blockchain collectibles ecosystem, the NFT market probably needs a few years to fully correct from 2022’s all-time highs. While traders discover what prices are real and what products are real, hopefully, they’ll come to appreciate what Blur offers. Most aren’t taking advantage of the farming rewards, but they’re almost certainly benefiting from the platform’s volume without even realizing it. Love it or hate it, Blur is a real product that brings innovation to the trading ecosystem, and it just may be there to save the day (again) when the NFT market has its next freefall.

Peep the charts

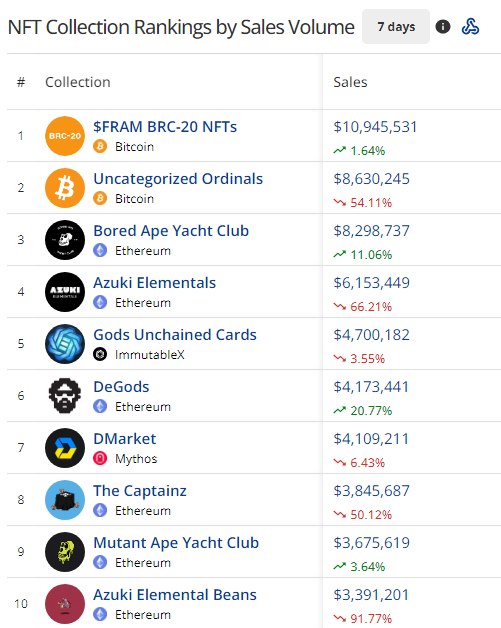

- $FRAM is the latest BRC-20 on Bitcoin to dominate the CryptoSlam Top Collection Rankings, doing over US$10 million in seven days thanks to big sales on the OKX NFT marketplace.

- Bored Ape Yacht Club sales are up 36% following the collection’s lowest floor price in nearly 2 years of 26 ETH on July 5. One of BAYC’s top farmers also exited the collection, easing the selling pressure and giving buyers some confidence that their purchase could hold value.

- Azuki Elementals‘ sales are down 66% from last week, but their floor price is up from 0.8 ETH to 1.2 ETH on OpenSea.

- The Captainz announced details for their $MEME coin allowlist and waitlist. Priority allowlist spots will be given to rare Captainz, complete “crews”, and bonus waitlists spots for their Potatoz NFT holders.

- Global NFT total transactions hit a seven-week low on July 10th with 245,381 transactions, the lowest since May 21’s 240,592 total transactions.

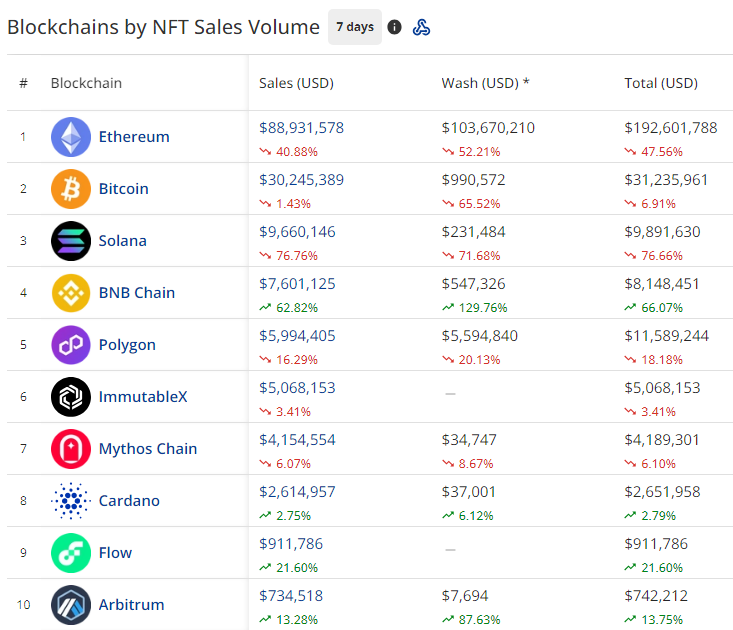

- Ethereum NFT sales are down 40% which should be expected as last week’s numbers included the US$55 million Azuki Elementals mint.

- Bitcoin NFT sales are down 1% but BRC-20 collections like $FRAM, $$RUN, and $INSC combined saw over US$15 million in sales.

- Solana sales are down 76%, which like Ethereum, is expected following their big numbers when Solana Monkey Business Barrel Raffle tickets added US$29 million in sales to their weekly total in the prior period.

- Binance NFTs had a big week behind 3 noteworthy collections called PLAYNFT, ACTNFT and Chinese Rabbit. Combined the collections traded for US$2.4 million.

Noteworthy Happenings

- Azuki derivative Fatzuki is eating up the competition with over US$728,000 in sales in just 48 hours, proving that memes and derivatives power the NFT space.

- Solana’s SMB Gen3 NFTs arrived on Friday, and with only a third of the supply minted, the collection has already done over $1.7m in sales in the past seven days.

- Ether Capsule’s mint came to an abrupt stop as there was little demand for the 0.65 ETH mint while the floor price tumbled on secondary markets to under 0.55ETH.

NFT Forkast

The NFT market continues to fall as the Forkast 500 NFT Index reflects a decline of 1.58%. Though many collections on Ethereum recovered double-digit percentages it still hasn’t been enough to turn the broader market around. Polygon leads this week’s declines, down 2.04%, while Ethereum is down 0.89%, Solana 0.90% and Cardano 0.38%

There’s not much on the horizon that could turn this market around, and instead, I see prices falling much further when traders realize last week’s recovery was short-lived. The end of Blur’s season two rewards could be a turning point, bringing the end of mass wash trading or the beginning of fresh new rewards. Either way, it’s probably the most important moment for NFTs this fall.