As Meta (Facebook’s parent company) presented a livestream update of its vision for artificial intelligence (AI) and the metaverse going forward, data shows many decentralized metaverse projects were heating up, with bigger players entering the space.

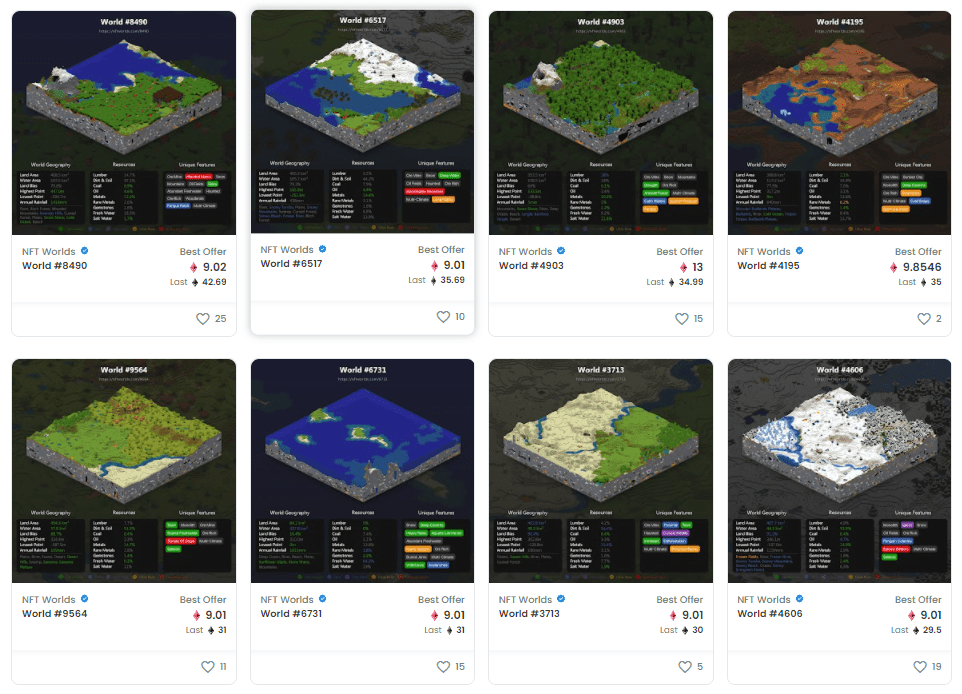

Projects such as NFTWorlds and Webbland have been in the top five non-fungible token (NFT) series by sales volume recently, according to data from CryptoSlam. Banking giant JPMorgan recently became one of the first major banks to enter the metaverse by purchasing land on blockchain-enabled Decentraland in February.

“I see a larger macro trend of large institutions and companies like Facebook going and trending towards the metaverse,” said Yohann Calpu, CryptoSlam’s chief blockchain officer, telling Forkast it was these macro trends that were driving interest in smaller metaverse projects as well.

While Facebook is outlining its initial forays into the space, dozens of other companies are trying to beat the social media giant to the punch by building their versions faster.

A project consisting of 10,000 plots of digital land on Ethereum, NFTWorlds’ sales volumes topped US$52 million in February — a more than 2,000% rise in monthly sales figures from November. The series was the third-highest selling in the past 24 hours on Tuesday, outselling leading series like Axie Infinity and Bored Ape Yacht Club

Other projects like BYOLand, Treeverse and Wolf Game all saw significant sales volumes in the closing days of February and have been within the top 20 NFT series throughout that time.

Crypto Voxels, another decentralized metaverse project on the Ethereum blockchain, recently announced a land cap of 70,000 plots after significant public interest, which Calpu said was a further driver of interest in the project.

“The one thing about metaverse is that there will never be a shortage of digital land, so it’s just about what makes yours unique,” he said. “If you’re looking to invest in a metaverse [on a large scale] you want to know what the land cap is.”

Legendary NFT series Axie Infinity reached a significant landmark recently as well, becoming the first series to reach US$4 billion in sales volume — almost double that of second-place CryptoPunks. Axie Infinity exploded in popularity and helped launch the play-to-earn function of video games by featuring NFTs as playable characters in a video game.

This is why, Calpu says, NFTs and blockchain will play such a significant part in the burgeoning metaverse as they allow for ownership of gaming items and interoperability between games.

“The dream that all game players had [prior to blockchain] was that they could own their in-game items,” he said.

Despite this fact, if leading metaverse developer Meta has any plans to incorporate blockchain into its vision for the metaverse, it is being very quiet about it.

The social media giant used its livestreamed event last week to provide updates on an upcoming AI-enabled voice assistant program “CAIRaoke” (pronounced karaoke) and to outline how AI will be incorporated into the metaverse. Throughout the event and at a follow-up roundtable event attended by Forkast, the firm made little reference to blockchain.

Calpu sees this as a missed opportunity for the social media giant, explaining that all the features of the metaverse, like decorating avatars and exploring digital worlds that Meta was announcing, will be greatly improved through blockchain by introducing ownership of these assets to the space.

Nonetheless, Meta’s ongoing interest is impacting the interest in the decentralized metaverse, too.

“When you have leaders in the industry from Web 2.0 that are making these shifts into their business, people start to take notice,” he said.