Executives at U.S-based cryptocurrency mining company Marathon Digital Holdings are cooperating with subpoenas from the U.S. Securities and Exchange Commission (SEC) to produce documents and communications concerning its Hardin, Montana, data center facility, the company stated in its latest 10-Q filing on Monday. The disclosure sent the company’s stock price down, however, it also raised US$650 million in debt to buy Bitcoin and mining equipment.

Fast facts

- The SEC may be investigating violations of the federal securities law, according to the 10-Q filing. Marathon Digital said it was cooperating with the SEC investigation but did not disclose any details of the possible violations.

- Marathon stated on Oct. 6, 2020, it entered into a series of agreements with multiple parties to design and build a data center for up to 100-megawatts in Hardin, a small town in south-central Montana. It issued 6 million restricted Marathon common shares “in transactions exempt from registration,” the statement continued.

- Marathon Digital’s shares have plummeted 24% to US$55.37 from Monday’s market opening to Tuesday’s close, according to Yahoo Finance data.

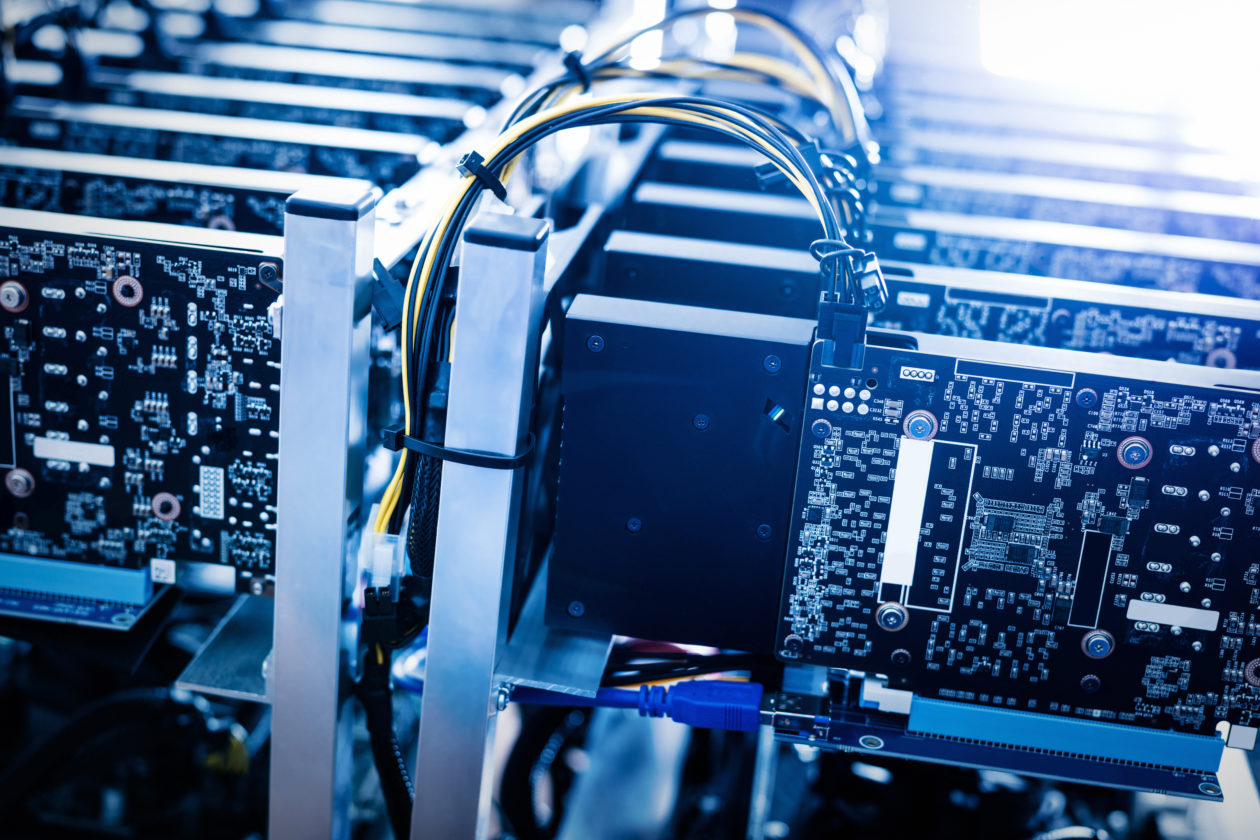

- Separately, the company announced Monday morning its intention to raise $500 million in convertible debt for general corporate purposes including to buy more Bitcoin and Bitcoin mining equipment. By end of day the offering was upsized to $650 million, the company stated. The announcement said that the private debt offer will feature a $650 million aggregate principal amount of 1.00% convertible senior notes due in 2026.

- On Nov. 3, Marathon Digital’s stock reached a six-year high as the company holds more than $460 million in Bitcoin. In August, the Nasdaq-listed company (MARA) announced a deal to buy an additional 30,000 mining machines from Bitmain to boost its mining capacity.