Key Highlights

- Osaka may be the “Crypto Bretton Woods” in terms of significance to the global economy

- Unlike the current economic system, crypto is “rising from the ground up” and is being forced on the global elites

- “Science-fiction is becoming fact and happening in a way they [governments] can’t ignore.”

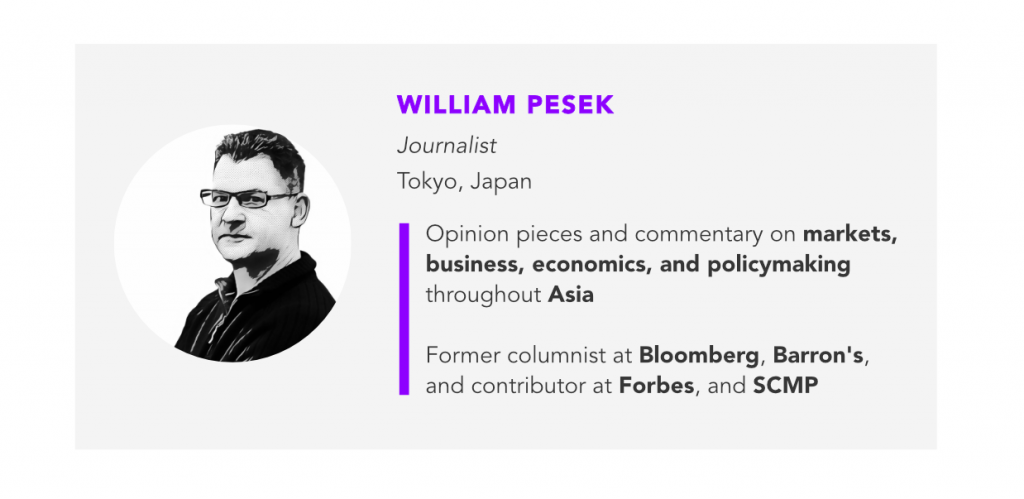

In the latest episode of Word on the Block, Angie speaks with Willie Pesek, Tokyo-based columnist, to discuss the upcoming G20 Summit in Osaka, where the world’s largest economies will discuss the planet’s most pressing political and economic issues. The Osaka meeting is of particular interest because the G20 agreed to initiate dialogue on cryptocurrencies and initial coin offerings.

In Pesek’s view, the upcoming G20 Summit could very well be the “crypto Bretton Woods,” an alternative to the current monetary management system that gave birth to the IMF and the World Bank. The current system is based on the U.S. dollar and was agreed upon by governments and economic elites. What is different about cryptocurrencies is that this is “coming from the ground up” and being imposed on governments rather than decided by them. Established institutions are confronted with changes in payment systems, finance, as well as the rise of the Fintech space, thus posing a tremendous learning curve.

Despite this, Japan sees “incredible investment opportunities” for startup activity and creating wealth around crypto assets. Given the steep learning curve involved in crypto currencies, the G20 serves as a platform for global elites to share ideas and get input from stakeholders and experts, helping them understand what precisely is going on.

The opportunities, though plentiful, are not immune to risk. Governments fear the lack of control in relation to cryptocurrencies. Bitcoin in particular permitted millionaires and billionaires in Mainland China to move their assets out of the country while avoiding taxes. As Pesek puts it, “science fiction is becoming science fact,” and governments cannot ignore this.

Even among political actors that have traditionally supported innovations taking place in Silicon Valley, we are seeing backlash. Facebook is currently developing its own cryptocurrency, Libra. Unlike Bitcoin, however, it will not “free float” and will be based on a basket of fiat currencies. Regardless, given Facebook and Google’s role in the 2016 election, even democrats in the U.S. Congress are skeptical about crypto.

The prospects of mass adoption are still an uphill battle, but leaders in the East are opening their minds and ears. Young members of Abe Shinzo’s party understand that Tokyo has the potential to become a hotbed for crypto asset startups and can quite possibly restore Japan to its former 1980’s glory. The G20 Summit in Osaka could very well function as “a metaphor for the economic energy” of our time. For Pesek, Asia is in a position to lead and become wealth and job creators. Just 20 years ago, the U.S. government was concerned about the growth of digital currencies, while today, cashless payments are a reality in China.

Even if regulators can’t come up with a framework for cryptocurrencies this time around, this doesn’t necessarily signify a setback. Japan is trying to come up with a handbook for this emerging system, recalling their own experiences on hacking scandals in order to provide a baseline for security. Of course, not all of these issues will be solved next week, but if officials go back to their countries to discuss the future of crypto, then this is a mark of progress.

Full Transcript

Welcome to Word on the Block, the series that takes a deeper dive into the topics we cover on Forkast.News.

I’m Editor-in-Chief Angie Lau. The G20, Summit will be held in Osaka, Japan June 28th to 29th. Now the leaders of the world’s 20 largest economies will meet to discuss some very big problems: trade tensions highlighted by the U.S.-China trade war and what the head of the IMF has called a fragile global economic outlook tops the agenda.

Now in the midst of all of that, the G20 has also agreed to discuss rules governing cryptocurrency, the plan is for officials to engage in discussion about best practices for crypto and initial coin offerings. Willie Pesek is following this story for us in this conversation follows his analysis piece on Forkast.News. About this, Willie, welcome.

Now you said Osaka may be crypto’s Bretton Woods moment. What is Bretton Woods and its significance to our modern global economy? 0:00

Well, after the second world war, basically round about 1944 this began, there was a big summit in the town of Bretton Woods, New Hampshire, and that was where the basics of the modern monetary system that we still rely on today was created. That is essentially where everyone agreed on a certain rules based system, a U.S. Dollar based system, a system that would create the Bretton Woods institutions like the International Monetary Fund and the World Bank. And to this day, now we’re talking 70 some odd years ago, that still as a framework that our modern monetary and economic system is based on, and it is that system that you can argue is now feeling a bit embattled if you will as money is being issued by non-government organizations, by non-government entities, and in some ways, these transactions are beginning to take place in a way that the global elites don’t really understand.

And so, one reason why the upcoming G20 here in Osaka will be interesting, as you mentioned, they would be discussing cryptocurrencies and rules related to Blockchain assets for arguably the very first time. And I think that we have to give Japan, some kudos here for putting it on the agenda. I think Japan is an interesting example as you and I have discussed before in this podcast of a country that is very, very rigid and very, very risk averse, but at the same time it sees the incredible and vast opportunities for startup activity and for creating wealth around crypto assets and it wants to be part of wherever the crypto and Blockchain asset phenomenon if you will, heads and I think that’s why Osaka, over the next 10 days, will be a very interesting example of the global elites sitting around sharing ideas, but also getting input from stakeholders, from experts. And as we’ve seen from lawmakers in Washington, for example, when there are concerns about say Facebook and Google, Congressmen and Senators don’t tend to ask good questions. And heads of state, I mean Donald Trump from what I understand, doesn’t even use email. So, you have heads of state who really don’t understand what crypto assets are. So for them the learning curve is very steep but this is a perfect opportunity for them to sit down with stakeholders and learn what in the world is going on.

But the incentive was there back in the day with Bretton Woods, they spent 22 days really hashing it out because the commitment and the political will to do so, was there… Do you think that the time and the equivalent desire to hash out a similar formidable structure is there for cryptocurrency? 3:44

I think what’s different about this is back in 1944 when the Bretton Woods talks were taking place, that was something that came from the government; it grew out of the elites. This is something that’s being imposed on them; in some ways you can argue as being forced on them and this is in some ways, the crypto world is rising from the ground up, in ways that we’ve never seen before, at least in financial history, and it’s forcing governments to confront these new opportunities these changes in the payment system, changes in finance, changes in investment, even the FinTech space has forced a lot of…it’s created a very steep learning curve for leaders. And so I think in some ways, Bretton Woods was an issue where they wanted to come together and create something more stable and more rational. This, in some ways, as being imposed on them, forced on them. And it is good, I would argue, that at the G20 we’re finally going to have an official discussion about what’s what.

Now, your piece you noted a North Korea’s main business right now appears to piece stealing cryptocurrencies. The UN actually thinks Pyongyang has netted more than half a billion dollars from hacking alone, and that’s potentially one reason governments wanna get a handle on crypto, but why else do governments want to control cryptocurrencies? I mean, what challenges do you think they post to fiat-money? 5:13

Well, I mean, one thing they’re worried about is control, they’re worried about central banks being in some ways out of their league. They’re worried about central banks, like the Federal Reserve or The bank of Japan, effectively needing a bigger boat and they’re also worried about tax revenues. One reason why say Bitcoin is really taking… well, for a while, they really took off on the mainland in China was because you had these billionaires and millionaires finding it to be a very convenient way to spirit money out of the mainland in ways that would avoid tax authorities, and so this is not only about control, but it’s also about money. It’s also about remaining relevant. As I wrote a piece for you a couple of months back about the extent to which central banks are very worried about losing all control.

They word it in some ways about their monetary decisions when they raise and lower interest rates. Will it have the same impact 5 to 10 years from now that it has now? And so, I think governments have a very vested interest in this, and I think as there’s a bit of fear involved here. I think that suddenly science fiction is becoming science fact on the watches of Donald Trump, Shinzo Abe, and Angela Merkel and it’s happening in a way that they can no longer ignore.

And absolutely; you have a giant corporate, called Facebook, and they just announced Libra. The social networking giant unveiled plans for its long-rumored cryptocurrency, finally. It’s not gonna free float like Bitcoin or Ethereum. Instead, Facebook has said it’s gonna be a stable coin based on a basket of fiat currencies. So how is Libra a game changer potentially here? 6:55

Well, I think in some ways you can argue that Facebook is going about this the right way.

One of the problems we’re seeing is that certainly cryptocurrencies are an important medium of exchange, but the asset, the values, the valuations can be a bit all over the place and so Facebook is arguably coming together, it’s coming forth with the model that in some ways does without the speculation part. And also, they have been pretty deliberative in terms of…from what we understand from what Jerome Powell said at the Federal Reserve in briefing the Fed on what it plans to do but I think the timing is fascinating because you do have this backlash against Silicon Valley in Washington DC and you will see the Democrats who are normally very, very pro-Silicon Valley very, very pro-tech and some ways on their hind legs. And you guys had a piece yesterday on this.

Yeah, the Democrats in Congress really pounced on it. I mean, Maxine Waters, head of house finance committee called on Facebook to stop working on it, essentially issuing a moratorium. It’s really surprising actually, that they were so skeptical of Libra. Why do you suppose that is? 8:25

Well, I think part of it is controlled, but I think part of it also is just this kind of backlash against big tech. There’s still a lot of waning concerns about the 2016 election and the role in which Facebook and Google and others played in that election, and the election of Donald Trump and the Democrats were finally coming around to regulating big check in a way we haven’t seen before. And I think when you have Facebook stepping forward with such a game-changing idea, it really is quite a wake-up call for Congress. But I do think that once the congresspeople realize that A: this is probably quite a ways off; and two: they will have time to get a handle on this over time, and they will have time to take steps to regulate what Facebook and others are doing. But I think they also realize that this is the future. I mean, how far can Jeff Bezos and Amazon be away from coming forth with their own Libra type medium.

That’s a great point. And then, of course, it brings us back to Osaka; the world leaders who may not even understand the science fiction as it becomes science fact, as you so eloquently said, have the opportunity to actually learn and whether or not they’re going to adopt or evolve their thinking is really the question. Do you think that there’s enough intellectual bandwidth of understanding of cryptocurrency for these conversations to be really solid? 9:46

It’s going to take a while, because I’m sure you, sitting there in your office, you’re also experiencing a bit of intellectual whiplash and schizophrenia, because when you look at, say, a country like South Korea, from week to week, it’s hard to figure out if South Korea is embracing crypto assets or if it wants to ban them completely. In fact, one of the most recent suggestions from South Korea is holding exchanges liable for any hacks or losses completely within their exchanges. But I think that there is a lot of confusion about where the country stands on these issues, and I think that here in Japan is an interesting case because our Finance Minister, Taro Aso is 78 years old, and here in Japan, we’ve had two of the biggest hack scandals yet. In 2014, we have Mt. Gox. In 2018, we had Coincheck. And at the time there were all these interesting cartoons; the cartoon has had a field day with the 78-year-old finance minister sitting down at his desk Googling: What is Bitcoin? What is an ICO? And the learning curve is very, very steep, but again I think we do have to hand it to Japan for keeping an open mind. I think it’s the younger members of Prime Minister Shenzo Abe’s party who realized that this could be an example of Japan leading. Japan has not had the same kind of a success with unicorns, that we’ve seen in… say, Indonesia or Singapore or elsewhere, and Japan, and South Korea as well, they wanna niche, if you will, and if they can turn Tokyo and Seoul into hotbeds of crypto asset startups, wonderful. So, I think Japan’s keeping an open mind and I think that’s why you see Japan putting the issue of cryptocurrencies on the formal discussion table for the very first time.

It’s almost poetically ironic if you think back to Bretton Woods, which was really led by the West, right. I mean, you have United States essentially, the gold standard, it became the reserve currency of the world that it exists today. They really drove that global structure as we know it today for our modern economy, and now the U.S. with the kick case, the Securities Exchange Commission, suing kick and defining cryptocurrency, and ICOS, and as you said almost… Is it a security, is it an asset, what is it, is it a tokin? And so all of these regulatory agencies fighting over to legally define it and what many are seeing in the industry, driving innovation out of the U.S. and it’s re-emerging here in Asia. And to equally see Japan step up and be the Asian equivalent in the 21st century of that moment to potentially define a world economy and the future structure. It’s very ironic. 12:18

It’s a metaphor for where the economic energy of our time is heading isn’t it? You know it’s interesting, I’m not sure that the issue of crypto assets is even something that’s on Donald Trump’s radar screen, so it’ll be interesting to see how he and Steve Mnuchin sit around the table and listen and go back to Washington and try to figure things out. And also President Trump has his own sense of anger and dread towards Facebook.

It’ll be interesting to see how they handle things as well, but I do think that you do see Asia, in a position to lead when it comes to this crypto asset phenomenon, this revolution, if you will, and it’s a wonderful thing to see, and I do think that if you can see the mature economies, in Northeast Asia, South Korea, Japan, finding this to be a kind of a wealth creator, and a job creator and also, think about China. When the People’s Bank of China, one day consider issuing digital currency how would that change the game around the world? What does the Federal Reserve do? I’m old enough to remember 20 years ago when I worked in Washington DC covering the Federal Reserve, back then the Fed was worried about digital currencies, they were worried about cashless societies, they were worried about how will the Federal reserve be relevant when people aren’t using paper money anymore? And you know from your own travels in China, people don’t use cash, anymore. I always feel like I’m the one fool in any restaurant or store pulling paper money out of my pocket.

And so in many ways, China is hurtling down this path that the U.S. has been playing catch-up on and we’re in a very, very different and uncertain and you can argue exciting period right now.

Well, it’s exciting for us, the people who cover it and watch it but at the end of the day, June 28th and 29th it really marks that moment as you said, a potential Bretton Woods moment. But what if governments and regulators can’t come up with a framework for cryptocurrencies what will happen to crypto then? What will be the fate? 15:31

Well, I think certainly next week in Osaka will be an interesting moment, but if we do see a decision by Japan and the U.S. and others to punt the issue forward, that still doesn’t mark a set back in my mind, I do think that this will take time to figure out, and the learning curve as we’ve mentioned a second ago is very, very steep.

So is it too optimistic to think that, I mean Japan for example, is planning to hand out some kind of manual some kind of handbook with things like best practices and also they’re planning to provide information on their own experiences with hacking scandals at exchanges to provide a baseline for issues like security, how to protect assets, issues like due diligence, issues like knowing your customer transparency then trying to figure out that balancing act between transparency and changing the very, very unique nature of crypto assets and I think as you mentioned earlier, there is a lot of concern about terrorism, there’s a lot of concern about what North Korea is up to, the U.S. right now seems to be hurtling towards a war in Iran, who knows?

But certainly, these discussions are going to be part of the crypto asset debate as well for a lot of governments. So I don’t necessarily think that we will settle all of these problems next week or these questions next week but I do think it marks progress. And even if officials go back to their respective home countries and they agree to have their finance ministers pick up the issue again in six weeks or six months, I still think it marks progress.

And that’s all we could ask for. Thanks for being our eyes and ears in Japan, Arigatōgozaimashita, as they say. 17:33

Arigatōgozaimashita. My pleasure Angie.

Thanks Willie. That was Willie Pesek, columnist and Forkast contributor. Thank you for joining us on this edition of Word on the Block. I’m Angie Lau, till the next time. 17:45

Read More from Willie Pesek

Will Osaka Be Crypto’s Bretton Woods Moment?

Can Cryptocurrencies Restore Japan’s Former Economic Glory?

Can Digital Currency End Japan’s Economic Malaise?