Listen to the podcast

Key Highlights

- “Within the G7, within the G20, there’s a lot of concern among governments, and I think that some of the concerns are valid. I mean, some of the concerns have to do with control, of course, but they also have to do with money laundering, and I also think that governments are very, very worried about taxation. If consumers around the world can transact by Facebook, if companies at some point down the road may be able to start paying employees via Libra, taxation issues become a very, very big problem, not only for, say, the states in the US or Australia or prefectures in Japan, but it becomes a concern for national governments.”

- “The issue of “is [crypto] a good thing or a bad thing” is something we’ll sort out over time, but I do think the most important issue to consider is that this is inevitable, this is coming, this is happening. And governments can put up their hands and say, “Not so fast,” and examine the parameters and try to figure out some kind of regulatory structure, but this is happening.”

- “The most important thing right now is for governments like Japan, for example, to figure out how to set the stage for private currencies like Libra to trade, to prosper, and to operate safely. Because as I said a moment ago, this is inevitable, it’s not going away.”

- “Japan is this really interesting paradox in that you will not find a more risk-averse financial society. You also will not find a place that’s had more problems with Bitcoin, you can argue, thus far. Three of the biggest hacks have been in Japan. Mt. Gox in 2014, Coincheck in 2018, Bitpoint more recently… so you can argue that no government in the world has more incentive to say “No thanks, stay away.” Japan’s going exactly in the opposite direction… what Japan is seeing is that the blockchain revolution is an incredible business opportunity… They want more unicorns, they want more startups, and they see the cryptocurrency space as an ideal opportunity for Japan to become a bigger financial hub around the world.”

- “Once Bitcoin and once the currency space grows up and realizes what it wants to be in two years, Japan will be very well positioned to be a financial hub for it.”

- “Japan will be an interesting test case come 2020 for practical uses for, say, Bitcoin. Given the kind of fluctuations in the valuations that you see, it’s a bit difficult at the moment. But Japan is trying to… transact more in crypto currencies. And so I do think you will see cryptocurrency become a bigger mode, or medium of exchange, rather, for the 2020 Olympics, or at least at this point, we hope so.”

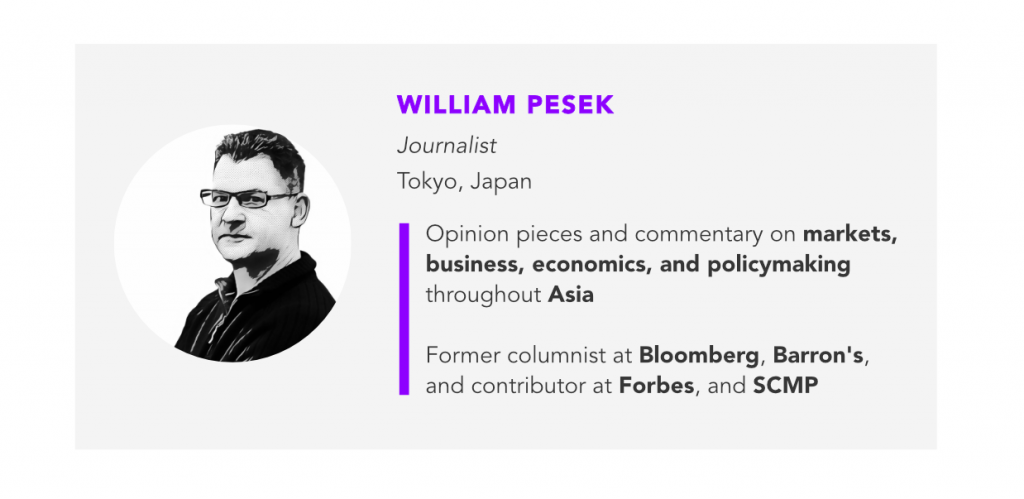

A month after Facebook announced Libra, its new blockchain and eponymous cryptocurrency project, the world has not only had a chance to sit down, research, and process the news, but to form opinions on it and draw lines of defense. William Pesek, award-winning, Tokyo-based journalist and author, breaks down two opposing reactions to Libra.

On the one hand, federal distrust of Libra has become well-known, following a series of Congressional hearings during which Facebook was put in the hot seat by skeptical legislators. Pesek speculates that the concerns about Libra revolve around lack of understanding of its technology and function, and worries about the loss of control over transactions and currency markets that its adoption could mean for Congress and the Treasury Department.

The US is not alone in their distrust of Libra – the G7 nations are purportedly in agreement over the risks that Libra, and cryptocurrencies at large, ostensibly pose. Their concerns are not unfounded – as Pesek points out, besides the obvious money laundering doubts and Facebook-related security concerns, Libra raises serious questions about the implications that its transactions will have on taxation.

One member of the G7, however, is less hesitant about the idea of Libra. Despite having a historically risk-averse corporate culture, Japan has shown remarkable enthusiasm about the prospect of cryptocurrency, welcoming startups in the space and implementing new regulations to facilitate the trade of crypto. Pesek explains that Japan sees the blockchain revolution as “an incredible business opportunity” for it to stay ahead of (or, arguably, catch up with) fast-growing Asian nations such as Indonesia.

Japan’s early adoption of cryptocurrency places it in a strategic position if the blockchain revolution does continue to unfold. Should Japan succeed in implementing Bitcoin for everyday practical use, overcoming its volatility, it stands to gain much in terms of innovation’s market value and asserting its place as a financial hub of the world. And if Pesek is right in saying that the advent of private currencies like Libra are inevitable, then the only thing left to do is not to reject them as something unknown, but to seek to understand, control, and regulate the world of cryptocurrencies.

Full Transcript

So welcome to Word on the Block, the series that takes a deeper dive into the topics we cover right here on Forkast.News.

I’m Editor-in-Chief Angie Lau, and today we take a closer look at Facebook Libra, and the intense backlash from both sides of the US Congressional aisle. Even US President Donald Trump weighed in on his favorite platform, Twitter. So let’s connect right now to our Forkast.News award-winning journalist, author, and columnist Willie Pesek, on why Japan may be Facebook’s best friend at the moment as it struggles to get buy-in for Libra. So welcome, Willie.

Greetings, Angie.

Let’s talk about your piece about Facebook’s Libra getting a timely like from Japan. First, why is Libra under attack?

Well, I think when you look at the Congressional hearings you’ve seen so far, it clearly is under attack. I think certainly from the standpoint of, say, the US Congress, it’s partly about a learning curve. They’re not really sure what to make of it. It’s partly about control. I think they’re certainly very worried about Congress and the US Treasury Department feeling like they are losing control of not only payments, but of the currency markets.

And I think also when you look at the response so far from, say, the Group of Seven nations, there’s a lot of skepticism there. You see Steve Mnuchin, US Treasury Secretary, saying, “Not so fast.” You see the Germans and the French in rare alignment at the moment. And it’s really funny to think that Libra, Facebook, it’s the one thing that the G7 has had to agree on in the Trump era, which is that this is an idea that needs to be looked at very carefully, it needs to be examined very carefully before Facebook is allowed to go ahead, and before any copycats step up to do exactly what Facebook is proposing.

Well, the interesting thing here is that it seems that the nations are aligned on the one thing that is what Facebook presents itself, with Libra, is that it’s a systematic change that will be forced on all these nations. 2.7 billion people who could potentially be using digital asset or crypto-currency or whatever you want to call it – that really poses a systemic risk. Is that why we’re hearing the pushback?

Well, that’s certainly part of it. I also think this is a loaded issue for Facebook, because Facebook, since the 2016 election in the US, has come under fire quite a bit for helping to elect Donald Trump. And the US has a lot of concerns about privacy, about the way in which Facebook is not only taking personal data, but marketing it for profit.

So I think in some ways, it’d be interesting to see what would have happened if another tech company had introduced Libra and not Facebook. What if Apple had done this, what if Amazon had done this? You probably would see a bit of a backlash from Capitol Hill. But I do wonder if it would have been as visceral, if you will. So I think that’s kind of an interesting thought experiment.

It is. It’s an interesting hypothetical, but what’s real is, US President Trump saying, beyond even Facebook Libra, that he’s not a fan of Bitcoin, of crypto-currency in general, and he argues that it’s not money, its value is highly volatile and based on the thin air. Is he right?

Well, time will tell. But I think we’ve seen pretty clearly that Donald Trump’s economic literacy is pretty damn low.

Any given day when you look at his quotes, about the economy, about markets, it’s really a wonder the guy has any money at all, so who knows? But I do think in many ways his concerns to some extent speak to what you’re seeing around the world. Within the G7, within the G20, there’s a lot of concern among governments, and I think that some of the concerns are valid. I mean, some of the concerns have to do with control, of course, but they also have to do with money laundering, and I also think that governments are very, very worried about taxation. If consumers around the world can transact by Facebook, if companies at some point down the road may be able to start paying employees via Libra, taxation issues become a very, very big problem, not only for, say, the states in the US or Australia or prefectures in Japan, but it becomes a concern for national governments. And so, what Facebook has done here, is it’s provoked a very, very interesting debate that will take time to sort out, but it is really interesting to watch governments around the world trying to reason this out.

And that’s the kind of systemic risk that really is part of this thought process in conversation, in that if the liquidity comes out of the market and people, the average person, finds another system in which to engage economically, suddenly central banks lose power, the ability to control or print money because the liquidity and the demand is somewhere else. Is this a good thing? Is this a bad thing? And what does it pose for society and our future economy in general?

Well, I think in some ways, the issue of “is it a good thing or a bad thing,” is something we’ll sort out over time, but I do think the most important issue to consider is that this is inevitable, this is coming, this is happening. And governments can put up their hands and say, “Not so fast,” and examine the parameters and try to figure out some kind of regulatory structure, but this is happening and you certainly have to expect that Silicon Valley right now is scrambling to come up with its own Libra competitors, if you will. There’s no way that Elon Musk is sitting around right now saying, “Well you know, we’ll let Zuckerberg have this market.” There’s no way that Amazon’s sitting around saying, “Yes, Facebook can have this Google…” And I think one of the interesting issues that governments are probably considering and worrying about is, what happens if Facebook begins turning to companies and saying, “Look, you don’t really have to sell stock in the conventional sense. You can actually go public via Facebook, via Libra.” Will companies be able to begin selling the equivalent of bonds in Libra?

And I think that’s part of the issue. There’s a lot of concerns about what this means for the future. But I think the most important thing to remember, as I said a second ago, is this is inevitable. The barn door is open, and the most important thing right now is for governments like Japan, for example, to figure out how to set the stage for private currencies like Libra to trade, to prosper, and to operate safely. Because as I said a moment ago, this is inevitable, it’s not going away.

That inevitability is potentially what Japan is also seeing. How are they trying to position themselves in this conversation? We saw that at the G20 in Osaka, we’re seeing it right now with its very specific crypto regulations, and we’re also even seeing it in defense of Facebook.

Right, Japan is this really interesting paradox in that you will not find a more risk-averse financial society. You also will not find a place that’s had more problems with Bitcoin, you can argue, thus far. Three of the biggest hacks have been in Japan. Mt. Gox in 2014, Coincheck in 2018, Bitpoint more recently… so you can argue that no government in the world has more incentive to say “No thanks, stay away.” Japan’s going exactly in the opposite direction. When the G20 recently came out, essentially, with lots of statements about how Libra is a terrible idea, and we have to tread carefully on this, Japan is the country that was saying, “Well why don’t we take a deep breath together and work together and talk about it.” I think what Japan is seeing is that the blockchain revolution is an incredible business opportunity. We can debate the valuations of cryptocurrencies, but blockchain-related technology and advancements is here to stay. And Japan has been trying to figure out how to find a new business line, if you will. They want more unicorns, they want more startups, and they see the cryptocurrency space as an ideal opportunity for Japan to become a bigger financial hub around the world.

So you do see Japan being a lot more proactive, and if you will, a lot more creative, when it comes to coming up with a regulatory structure to… once Bitcoin and once the currency space grows up and realizes what it wants to be in two years, Japan will be very well positioned to be a financial hub for it.

In terms of current status, its dominance in tech is waning. Even if you take a look at Southeast Asia, we’ve got more unicorns in Indonesia than n Japan.

And Masayoshi Son, of Softbank, who was currently in Jakarta today, and he’s looking to invest more money in Grab, he’s looking to invest more money in Tokopedia, in Indonesia; he’s not investing a lot of money in Japan, and part of Japan’s challenge is to get the nation’s richest man, the man who’s single-handedly remaking the global venture capital game, to invest more money in his native land. It’s an interesting moment for Japan, but I do think, hats off to Japan. Credit where it’s due. Japan is keeping an open mind about the cryptocurrency space. And again, I’m not sure anyone can tell you where it will be in a year or two from now – we’ll be talking about different issues or different challenges, but Japan will be part of the conversation. And I think it’s a surprising contribution by a very risk-averse society, but Japan again will be very well positioned to be a financial hub for any kind of start-up, seeing any kind of startup boom that grows up around crypto.

And you say it right in your article on Forkast.News that no less than 110 crypto exchanges are lining up to launch in Japan

Yes, in fact, that apparently is a conservative estimate. There could be a higher number. And I do think crypto exchanges are looking at Japan saying, “Look, this is a country that, better than most, is open to us, and in some ways they get the future, and they’re edging in that direction.”

One reason why a foreigner like me loves living in Tokyo so much is because you will find no place in the world that’s more in conflict with the past and with the future. They’re kind of straddling both. They’re very proud of the Japan of 200 years ago, but they’re very interested in where the world is going 2, 5, 10 years from now, and this is a perfect microcosm of that balancing act. And I do think hats off to Japan for keeping an open mind and for not putting its hands up and saying, “Absolutely not.”

Well, it made waves with G20 in introducing that crypto language and conversation amongst global leaders. And then the next world stage that everyone’s taking a look at is the Olympics in 2020. What do you think that Japan is going to be like then in terms of real world adoption, ability to use crypto, and even regulation itself?

Well, I think Japan will be an interesting test case come 2020 for practical uses for, say, Bitcoin. Given the kind of fluctuations in the valuations that you see, it’s a bit difficult at the moment. Because, say if you’re buying a camera in downtown Tokyo, and the transaction takes five minutes to complete, you’re not really sure who’s gonna be on the losing end or the winning end of that transaction given the volatility you’re seeing. But Japan is trying to… A lot of companies like Bic Camera for example, a very big electronics company here, they are trying to transact more in crypto currencies. And so I do think you will see cryptocurrency become a bigger mode, or medium of exchange, rather, for the 2020 Olympics, or at least at this point, we hope so.

And potentially Japan could be leading the way. Well thanks, Willie, that was some great insight right there, and really appreciate you joining us from your home base in Japan.

My pleasure.

And thank you everyone, for joining us here as well on Word on the Block. That’s it, for now. I’m Editor-in-Chief of Forkast.News, Angie Lau. Until the next time.