The start of 2022 marks my sixth year in the crypto industry and an opportunity to reflect on some of the lessons learned since. My entrance into the distributed ledger technology and crypto space in 2016 coincided with two contradictory yet impactful trends: initial coin offerings (ICOs) and enterprise blockchain.

The initial launch of Bitcoin and subsequently Ethereum were the start of a new industry of tokenized protocols supporting decentralized communities and applications. These core innovations spawned a group of fast-follower cryptocurrency networks that leveraged tokenized sales known as ICOs to fundraise in support of their launches.

The frenzy that resulted created media hype, token price volatility and massive fundraising numbers. The industry was labeled by some as a speculative scam that would dissipate quickly. Despite this turbulence, a core group of new tokens and projects were able to get the resourcing necessary to begin their journey towards launch.

In parallel to and in part inspired by these trends, we also saw the first enterprise entrance into this space from the likes of IBM, JPMorgan, R3, Northern Trust, Maersk, Microsoft and more. Organizations ranged in their motivation from tokenized securities to the misguided “blockchain not Bitcoin” movement.

These organizations created open protocols such as Hyperledger Fabric, Quorum and Corda while also drastically accelerating awareness of distributed ledger technology in the enterprise.

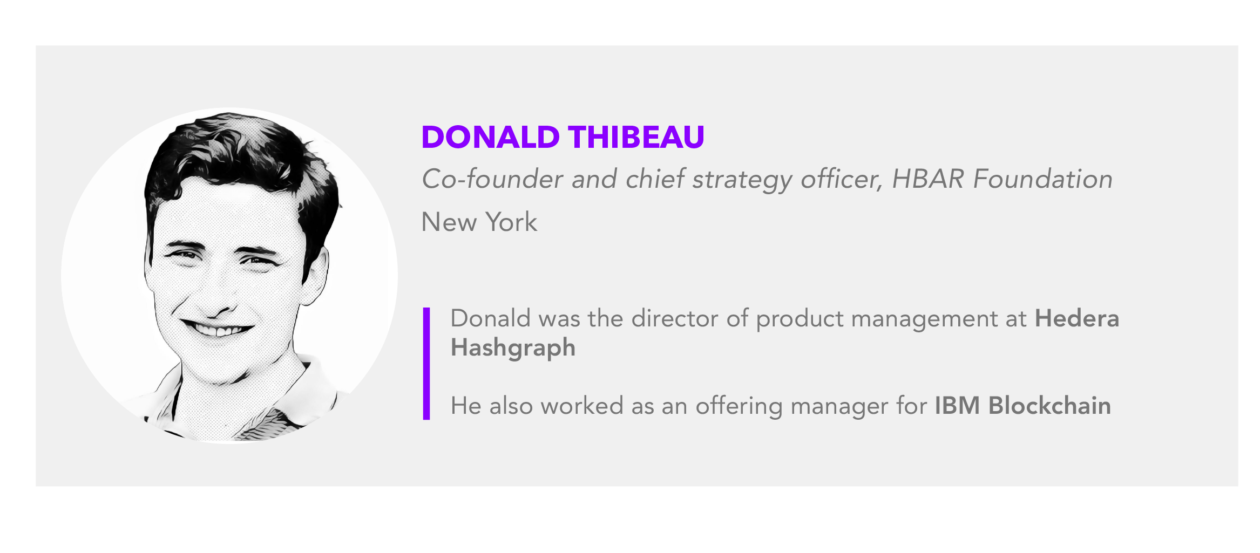

My journey out of school began at one of these organizations, IBM. I saw IBM as an opportunity to break into the crypto space through an organization that was investing rapidly in new applications of distributed ledger technology. While there we contributed aggressively to open source projects like Hyperledger, supported some of the first proofs of concept in trade finance, central bank digital currencies and more while also learning rapidly where innovation would be blocked by the strength of legacy technology and incumbents.

The core lesson that we learned quickly is that success and failure in distributed ledger technology or crypto were defined by the network effects that could be achieved. No signal was greater of these network effects than community growth.

IBM struggled in this area at the onset because the primary way businesses used blockchain was as a back-end database. Access was restricted, data was private, and usage was minimal. As a result, network effects could rarely be generated.

Many in the space are still struggling to learn this same lesson. Social networks like Facebook (now rebranded as Meta) are seeking to protect their centralized control of digital communities by attempting pivots into crypto. They have been attempting to take control by launching their own stablecoins, such as the ill-fated Diem, and creating metaverses through their rebrand.

These efforts will likely similarly struggle as communities form instead around public and openly accessible cryptocurrency networks.

Those projects that are able to embrace community have done so by building in an open, composable and accessible way where individual users are able to control their own assets and data. This trend is referred to as Web 3.0.

Web3 represents an opportunity for everyone from new startups and projects all the way to Fortune 500 organizations to disrupt themselves by embracing individual control, open access and open development. Those who do so will be able to play a role in the growing crypto community. The lessons learned by those organizations who attempted to build in silos with complete control show the challenges that may be faced if not.

It’s time we all learn that putting community first and providing open access are the key ingredients to a successful Web3 enterprise. By doing so, we foster true innovation that’s not bound by the decision-making process of a few individuals in a boardroom. Because that’s not where the true power lies. Rather, it lies with every single one of us.