India’s crypto industry received a major boost this week following the Supreme Court’s decision to overturn a 2018 ban on banks handling transactions from cryptocurrency exchanges. The move paves the way for greater adoption of digital assets, blockchain-related enterprises and investment in the world’s second most populous country after China.

Sumit Gupta, co-founder and CEO of CoinDCX, India’s largest cryptocurrency trading platform and liquidity aggregator, told Forkast.News that the decision clarifies the public’s previous confusion regarding the legal status of cryptocurrencies, now that people are free to buy and sell assets on exchanges linked to banks.

“More importantly, what will happen is that we will see lots of new projects, startups coming out in the enterprise space in India, which is going to be a game changer,” Gupta said. “[The] judgment is a big win for all the people involved and more importantly for the overall crypto industry in India.”

Highlights

- “I think the circular that was passed by the RBI (Reserve Bank of India) is unconstitutional because the RBI does not have the power to stop individuals from investing in any asset class. It is not under the RBI’s purview.”

- “There are less than 1% who are in crypto in the Indian market, and in those 99% of the people who are not in the crypto area, there has been growing interest from both those communities and those investors who want to deploy a certain part of their savings in this asset class.”

- “The one-minute fix would be to regulate the exchanges, because once the exchanges are regulated, they have to follow a certain process, all the exchanges in India will follow that process, and I think it would be easier for the government as well to track any such wrong behavior by individuals.”

- “I think in terms of regulations, because this is not the [only] victory, this is just a good beginning for us. This makes the government’s job very important as well, so that they can come up with a regulatory framework as soon as possible, because now that the banking ban is removed there will be a lot of exchanges that will come up.”

- “There has been significant growth in terms of digital transactions in the Indian market, given that there is heavy penetration of mobile internet in India after the… penetration in tier 2 and 3 cities. Now, what will happen is because of the domestic market opening up, there will be new investments coming up. I think this will drastically improve the overall economy and we will see a lot of innovative businesses coming out from India in the near future.”

Listen to the Podcast

See related article: Crypto has the potential to revitalize India’s economy

The Reserve Bank of India (RBI) — the country’s central bank — had previously blocked banks from doing business with cryptocurrency exchanges such as CoinDCX, stating that “Virtual Currencies (VCs), also variously referred to as crypto currencies and crypto assets, raise concerns of consumer protection, market integrity and money laundering, among others.”

The move crushed cryptocurrency-related activity in India, with a number of companies shuttering or leaving India for countries with more business-friendly regulatory environments.

“After the ban, what happened was that liquidity in India went drastically down, [trade] volumes that were around $500 million a day went down to around a few million dollars. That is just less than 1% of what it used to be before the ban,” Gupta said. “I think the circular that was passed by the RBI is unconstitutional because the RBI does not have the power to stop individuals from investing in any asset class. It is not under the RBI’s purview.”

A lack of evidence of exchanges creating issues for banks, as well as the fact that cryptocurrencies are not banned in India, resulted in the Supreme Court deciding to remove the ban on the grounds that it was not proportionate to the risk that the central bank sought to curb.

“While we have recognized… the power of RBI to take a pre-emptive action, we are testing… the proportionality of such measure, for the determination of which RBI needs to show at least some semblance of any damage suffered by its regulated entities. But there is none,” explained the court, in its March 4 judgment. “When the consistent stand of RBI is that they have not banned VCs and when the Government of India is unable to take a call despite several committees coming up with several proposals including two draft bills, both of which advocated exactly opposite positions, it is not possible for us to hold that the impugned measure is proportionate.”

Future of crypto in India?

Under the RBI’s two-year ban, India’s cryptocurrency sector withered. But now, the Supreme Court has effectively given India a green-light to develop this emerging technology.

“The judgment is a positive step towards the freedom of trade in India and also highlights the approach of Indian courts, which is positively tailored toward making India’s software industry in sync with countries like the United States, United Kingdom, Singapore, and Japan, where the trade in virtual-currency is regulated,” Senior Advocate Nakul Dewan, who argued on behalf of CoinDCX and other crypto exchanges before the Supreme Court, said in a statement.

According to Ikigai Law, the firm that engaged Dewan, the court also directed the unfreezing of bank accounts of the crypto exchanges and repayment of funds blocked.

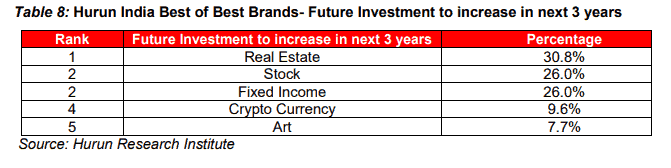

With the global crypto market reaching a $300 billion market cap in February, almost 10% of India’s wealthy said they would ramp up investment in cryptocurrency, according to a 2019 Hurun Report. Their most popular digital asset is bitcoin.

India could soon see exchanges returning to the country. Investors are also likely to inject more liquidity into the market, and fuel a surge in new crypto projects.

“We’ll see a lot of startups coming out from the Indian ecosystem,” said Gupta, predicting that the ruling would also encourage more engineers, developers and other tech talent to join the scene. “Overall, it’s a win-win for everyone in the Indian market.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the emerging technology that shapes our world, it’s what we cover on Forkast.News. I’m Editor-in-Chief Angie Lau. Well, India is about to enter a whole new ball game, and for the international cryptocurrency and blockchain community, it is a game changer. India’s Supreme Court just came out with a ruling that overturned the Reserve Bank of India—India’s central bank—crypto ban that came into effect July 2018.

The court’s reversal of the RBI ban could not be more timely to a global population staring into the abyss of financial markets being impacted by concerns about coronavirus contagion that is slowing global growth. India’s Supreme Court may have read Sumit Gupta’s open letter to regulators and policymakers in India, published right here on Forkast.News. Indeed, they would have heard his point of view directly, and you’ll understand why shortly.

Sumit Gupta is co-founder and CEO of CoinDCX, an Indian cryptocurrency exchange who very clearly outlined how cryptocurrency has the potential to revitalize India’s economy in his op-ed for Forkast.News. Sumit, welcome.

Sumit Gupta: Thank you for inviting me.

Lau: All right, let’s dive in. Big news indeed, where were you when you heard the news that India’s Supreme Court justices sided with you, reversing the RBI ban as being unconstitutional?

Gupta: Yeah, that was a very historic moment, and I was actually jumping with joy when I heard the news. I was on the way to the office, and when I arrived, everyone was congratulating each other. The whole office was celebrating yesterday. So it was not just the office, I think all the people who have been working hard from the last few years and in this space, everyone must be really excited and joyous at the same time. So yesterday was a great day for all of us.

Lau: Here’s the very, very interesting thing. There were four cryptocurrency exchanges in India that petitioned the Supreme Court two years ago when the RBI initiated its crypto ban. How many of you are left standing?

Gupta: There’s one of us, that is, CoinDCX, which is currently operational. There are a few exchanges which were petitioners, but they are not functional as of now. For example, Finex, they did a great job. They had great liquidity, but because of the banking ban that was imposed, the liquidity fell down, the business is not running as much as it was earlier. So all those exchanges, because of the banking ban, had to shut down their shop. So this unfortunate thing happened. But because we had a unique business model, we were consistently having good liquidity and then we continued to survive off the ban as well, using the innovative peer-to-peer method.

Lau: All right, so, explain what the court ruling means. Take us back two years ago. What was the RBI ban? What did it do to India’s crypto scene, and what does the court ruling mean today?

Gupta: I’ll tell you right from the start. So in April 2018, the RBI imposed a banking ban asking all institutions working under the RBI, that is – banks – to stop giving counter exchanges for operations. So what that means is exchanges like CoinDCX will no longer have access to a bank account of which we can use for our deposits and withdrawals from the clients. And in the circular, it was mentioned that within three months, banks were instructed to shut shop with any crypto exchange rate. So they were instructed to stop any relationship with exchanges that are running in India.

So what happened as a result of this? Exchanges were shutting down their shops or moving outside India. How CoinDCX stayed on, was that we innovated a peer to peer product where people can buy or sell bitcoins or any other digital asset using the peer-to-peer method — that is, they don’t need to directly transfer funds to exchanges’ bank accounts. And with that, the people who still wanted to buy and sell these assets were using other people’s bank accounts to do the transactions.

So after the ban, what happened was that liquidity in India went drastically down, the volumes that were around 500 million dollars a day went down to around a few million dollars. That is just less than 1% of what it used to be before the ban. Then there were a few exchanges who filed a petition to the Supreme Court. And as you know, yesterday’s judgment is a big win for all the people involved and more importantly for the overall crypto industry in India.

Lau: Why is that? Why is this such a game changer for India, in your view?

Gupta: What I think is important to see here is that in the last few years, I have personally seen a lot of people not having clarity about the legality of crypto in India, because in the last two years there has been a lot of negative news in the media saying that it’s illegal to buy and sell crypto, and then combined with the case that was going on, so people were not having clarity.

Now, what this judgment shows is that it’s definitely legal to buy and sell these assets with exchanges as well. So now people who were confused earlier, now they can freely buy and sell these assets on exchanges because exchanges now have access to banking channels. More importantly, what will happen is that we will see lots of new projects, startups coming out in the enterprise space in India, which is going to be a game changer.

Lau: You were part of the group of crypto exchanges that did the tough work of challenging the RBI ban, making arguments to India’s Supreme Court. What do you think was the most powerful argument that swayed the justices?

Gupta: I think the circular that was passed by the RBI is unconstitutional because the RBI does not have the power to stop individuals from investing in any asset class. It is not under the RBI’s purview. That was the reason that during the discussions from the RBI side… it was clear that they cannot impose this ban. They can restate that challenge, but I think overall, the circular that was passed by them was unconstitutional, it doesn’t come under the RBI’s purview.

Lau: So it’s unconstitutional. But does it leave any questions unanswered?

Gupta: In terms of the ban, I think there are a few more drafts that are being circulated in the parliament. I think that is yet to be discussed, which might happen in the next few months. But I think in terms of banking, now that it’s all clear, people are allowed to freely buy and sell these assets with Indian rupees. So I think that is going to be a great move in the direction of regulations.

Lau: Are you already starting to see pick up? What’s the buzz right now in India? What is not only the crypto community saying, but what is the reaction or impact amongst the regular population, just kind of piquing interest of potentially investing rupees into cryptocurrencies?

Gupta: Yes, we have seen tremendous interest from a lot of people, especially from our users, a lot of people who were not trading or buying and selling these assets with Indian rupees are now activated, and they are going back to the platform doing these transactions. In addition to that, there are less than 1% who are in crypto in the Indian market, and in those 99% of the people who are not in the crypto area, there has been growing interest from both those communities and those investors who want to deploy a certain part of their savings in this asset class. So there has been a lot of interest in the community on our support channels. In fact, personally to us as well, that they wanted to deploy some of their investments in bitcoin and other digital assets.

Lau: And that really provides a kind of liquidity that we’ve never seen before in India because it was illegal. You’ve already said that there has been interest amongst people who are potentially providing that liquidity, that liquidity must go somewhere. How are the projects? Are there talents, blockchain talent, blockchain projects that potentially could really soak up some of this interest and build something really interesting in India?

Gupta: Well sure, so what might happen is, we even see a lot of new projects coming out from the Indian ecosystem and the crypto ecosystem. For those projects, I think it would be easier for them now to raise capital, because now they get access to capital, not just from foreign investors, but as well as from Indian investors, which was not very easy earlier. Now Indian investors are also very interested in evaluating this space overall in terms of liquidity because of the increasing interest from traders and additional asset investors, the liquidity will drastically rise from now on, and I think there is no looking back. So the liquidity will continue to increase, exchanges will continue to provide better services.

Overall, we’ll see a lot of startups coming out from the Indian ecosystem. In addition to this, what will also happen is that a lot of people, especially tech engineers, developers who wanted to enter into the space, but they were just waiting for some clarity. And now that it is clear, we will see a lot of people, engineers either venturing into this space or joining big banks. Overall, it’s a win-win for everyone in the Indian market.

Lau: The economy in India is something that needs to be improved. There is no doubt about it, it’s a decades long problem, it’s a political conundrum, a financial conundrum. In your op-ed, a very powerful one on Forkast.News, you say that cryptocurrency and blockchain could revitalize India’s economy. In what way do you see that?

Gupta: That’s a very interesting question. So as I mentioned, because India is aggressively focusing on making all the payments digital — let’s take the example of the United Payments Interface (UPI). UPI was launched three years back, where you can do instant payments free to anyone in the country. That was a substantial increase in terms of doing digital transactions. So there has been significant growth in terms of digital transactions in the Indian market, given that there is heavy penetration of mobile internet in India after the… penetration in tier 2 and 3 cities.

Now, what will happen is, because of the domestic market opening up, there will be new investments coming up. The Indian fintech industry has definitely had the highest growth in the last few years. So this industry in particular will open up a new range of possibilities. We will see a lot of innovative products coming out in the Indian fintech ecosystem combined with the technologies that the government has provided us. So I think overall this will drastically improve the overall economy and we will see a lot of innovative businesses coming out from India in the near future.

Lau: What do you think has the potential to really be a seismic shift for India’s economy? Which industry do you see will experience the most impact?

Gupta: I think because of the judgment, the banking industry will grow rapidly. The reason I’m saying this is because in 2017, when the banking ban was not there, there were a few payment gateways and banks which processed nearly thousands of transactions every minute. That is simply because there was heavy interest from Indian traders and investors to invest and put their wealth in bitcoin or other asset classes. So I think in terms of payment gateways, in terms of companies facilitating these transactions using automated payment systems which enables instant detection, I think overall in the very near future this business will have a very positive impact.

In fact, since yesterday we got a few requests from these partners who want to work very closely with exchanges, so that they can also grow their business as well. It’s good for the investors who are now planning to enter into this asset class.

Lau: That’s phenomenal, that is the opportunity. But to counter that, one of the very big concerns and one of the big reasons why the crypto ban was put in place by the RBI — and also a political fear — of people skirting the system, not paying taxes. We saw [Prime Minister] Narendra Modi’s very dramatic moves with even the rupee and trying to create ways in which people have to report their income, their wealth for taxes. How do you as a crypto exchange in India — knowing full well of these loopholes and how they’re actually being exploited — how do you ensure that you’re maintaining ultimately this policy goal that’s ultimately fruitful for India?

Gupta: I think with respect to exchanges, it is very important for exchanges to be self regulated, given that there is no framework in place for Indian exchanges by the government. Meanwhile, Indian government officials are studying the regulations of other geographies. What is important as an exchange is to be very strict when it comes to users buying and selling these digital assets.

So what we are doing as a company is we have a very stringent know-your-customer process. We are following the similar norms as the banks are, and we particularly monitor each and every transaction, there are systems in place which identify any wrong behavior by any individual and whenever people cross a certain threshold. We have a lot of systems in place in the exchange which identifies these individuals combined with self-regulations followed by normal banks. I think this solves a lot of problems, and in addition to that there has been mail and messages from these government officials where if they ask for any data, we are very happy to share that with them so that they can ensure that people are not exploiting the system.

So we work very closely with the government and we share information with them whenever it is asked. So I think in terms of that, that is how we want to work. We want to look as an exchange, so we don’t want to do anything which is against the regulations. So as and when the government asks for any information or anyone from the government does it, we share the information with them.

I think the one-minute fix would be to regulate the exchanges, because once the exchanges are regulated, they have to follow a certain process, all the exchanges in India will follow that process, and I think it would be easier for the government as well to track any such wrong behavior by individuals.

Lau: Well, the supreme court’s ruling really shows an evolution of understanding. Two years ago, you could say that every regulator in the space really acted based on fear and was completely reactionary. Now, that’s changing, the space is evolving, people are understanding a little bit differently. Do you feel that that is what’s happening in India at the moment? Are policymakers catching up to feeling like they could collaborate rather than police exchanges such as yourself, that the policy, the regulatory environment might be more collaborative rather than antagonistic?

Gupta: Yes, certainly I think in terms of the regulations, what needs to happen is that we feel regulators should work very closely with the industry players. Talk to people in the space, understand their point of view. And come up with a very versatile framework which is fluid in nature, because this is an evolving technology and things happen rapidly.

The framework should not be very rigid. If it is very open and takes care of the inputs from the industry players and exchanges like us, I think that way we can also tell them our learnings and what they can study in detail so that they can come up with the best framework to regulate crypto in India. I think they’re going in the right direction with the hearing’s judgment yesterday. This was definitely a big positive step in that direction. But I think in parallel, they are also studying the regulations of other geographies. And in order to come up with the best framework, they need to study other regulations, talk to other governments and see what is best for India as a country.

Lau: So what do you think’s going to happen next in India’s crypto regulation landscape? What do you think the next areas of focus are going to be for regulations?

Gupta: I think in terms of regulations, because this is not the [only] victory, this is just a good beginning for us. This makes the government’s job very important as well, so that they can come up with a regulatory framework as soon as possible, because now that the banking ban is removed there will be a lot of exchanges that will come up. We will see a lot of new exchanges restarting their shops, some exchanges which were shut down earlier might come back again, might make an entry to the Indian market.

International exchanges are now focusing on Indian users. All of this is going to happen now that the banking ban is removed, and there’s a lot of interest in the Indian market. I think it’s important to come up with the framework quickly, and I expect that the government is studying it really aggressively and is trying their best to come up with a framework as soon as possible.

Lau: Well, there’s incredible engineering, developer and programming talent in India. This could be the trigger that really opens up a brand new industry in India. Where do you foresee this in even five years from now?

Gupta: I think in five years, what we’ll see is because of the high quality of talented developers and engineers in India, we will see higher numbers of blockchain startups coming out from here. That is definitely something that I believe in, and most probably might see that happening in the next two or three years as well.

There are already good examples like Matic Network… these are great companies which can potentially be billion dollar companies in the future. If there are multiple startups coming forth from India, which become billion dollar companies in this space, I think that is going to be a great thing for the overall Indian crypto industry.

Lau: Well you’ve got the talent, you’ve definitely got the population base, you’ve got the market and now you have the beginning of what is very interesting, friendlier regulations and collaboration at the highest level. Sumit Gupta, congratulations on two years of work. They listened, they heard, and the ban is now down. But I think, as we all know, your job has only just begun. And we at Forkast.News will be paying very close attention to this very exciting space that we’re beginning to see right now and starts today in India.

Thank you so much for joining us, Sumit, and thank you, everyone, for joining us on this latest episode of Word on the Block. I’m Editor-in-Chief Angie Lau, Forkast.News. Until next time.