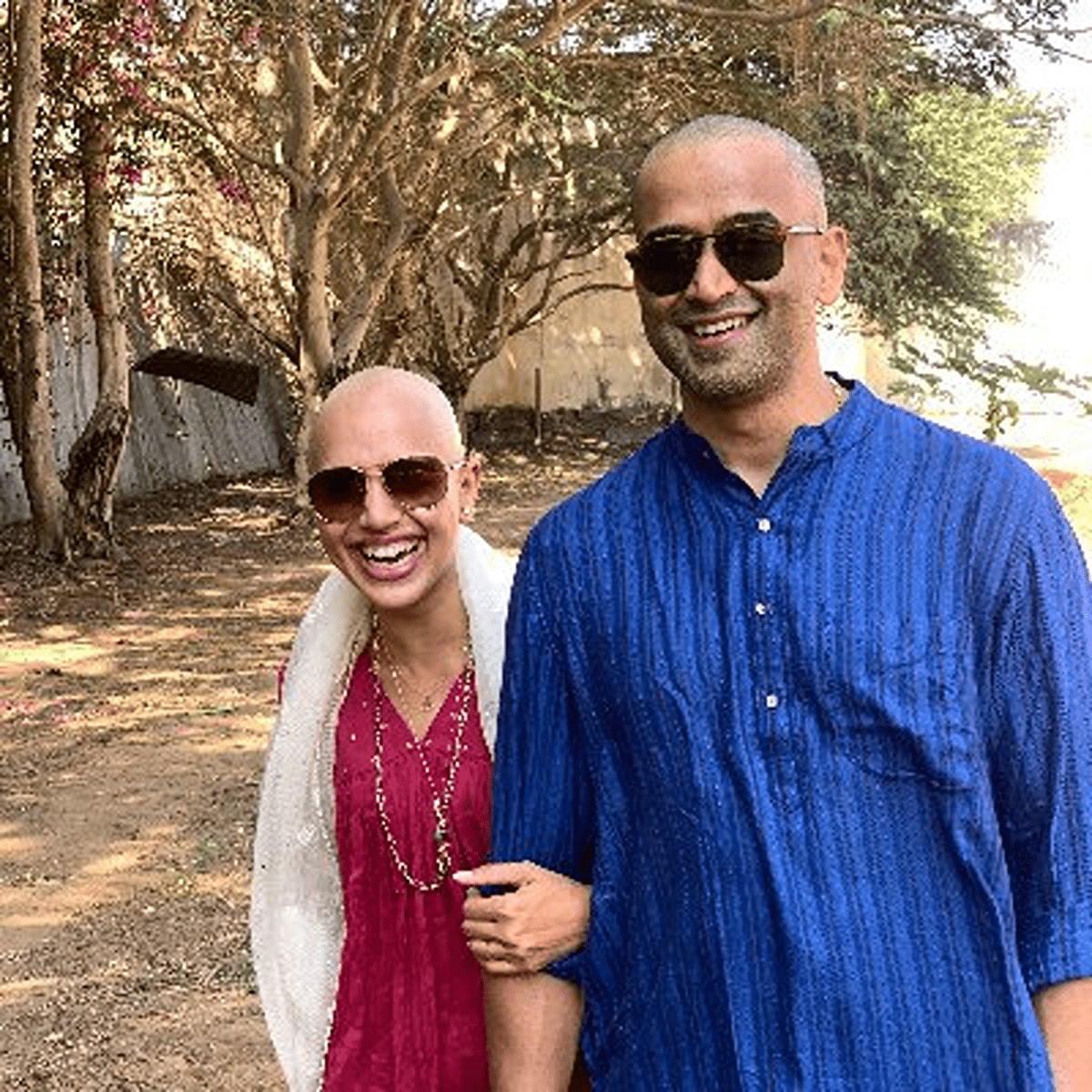

Indian crypto investors got lucky after February’s tax announcements reduced trading activities ahead of the market crash, Nithin Kamath, founder and CEO of online stockbroker Zerodha said.

See related article: Short selling is good for any market, including crypto: Jim Rogers

Fast facts

- “Even when trading stocks, the biggest reason for losses is trying to make a wrong trade right by throwing good money at bad money. That is averaging down when the price moves against the trade, without considering if the portfolio is getting concentrated or not,” Kamath said on Twitter.

- Many investors in India have reduced their exposure to cryptocurrencies in the hope to avoid paying hefty taxes or liquidity shortages.

- India imposed a 30% tax on crypto income from April 2022, and an additional 1% tax deducted at source (TDS) on transactions above Rs 10,000 (US$128) starts July.

- Factors contributing to uncertain market conditions have extended Bitcoin’s losing streak as the U.S. Federal Reserve considers raising interest rates further to tame surging inflation.

- The Reserve Bank of India (RBI) governor Shaktikanta Das said that the central bank has rightly been cautioning against cryptocurrencies, following the collapse of Terra’s UST and LUNA.

See related article: Cryptocurrencies like ‘world of Caribbean pirates’: India chief economic adviser