The biggest buzz in cryptocurrencies is The Merge – a long-awaited upgrade set to take place around Sept. 14 that will see Ethereum, the world’s second-largest blockchain, move from a proof-of-work to a proof-of-stake mechanism, an event that has been planned since 2014.

The upgrade is expected to help Ethereum move to a less energy-intensive method of verifying blockchain transactions and lower the barrier to entry. Ethereum’s website also says proof-of-stake will bring scalability and security, though there is some debate over those issues.

Meantime, Ethereum’s blockchain team has said to holders of the Ether token: “You do not need to do anything with your funds or wallet before The Merge.”

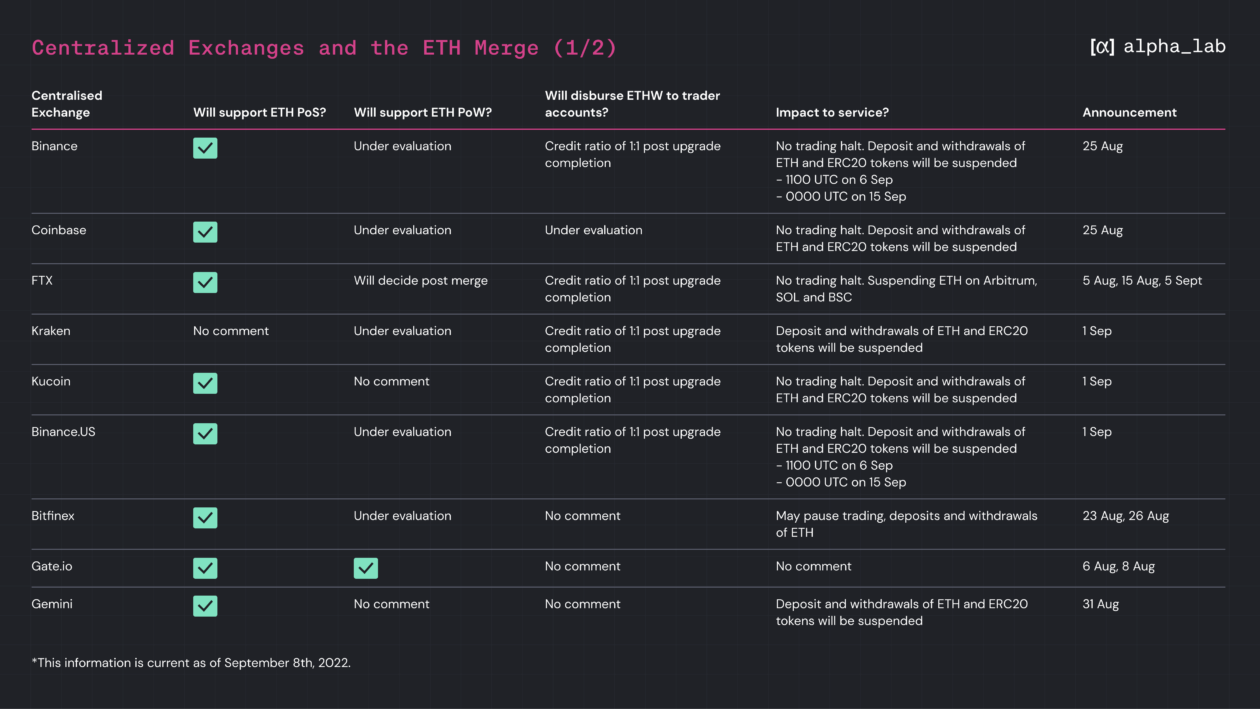

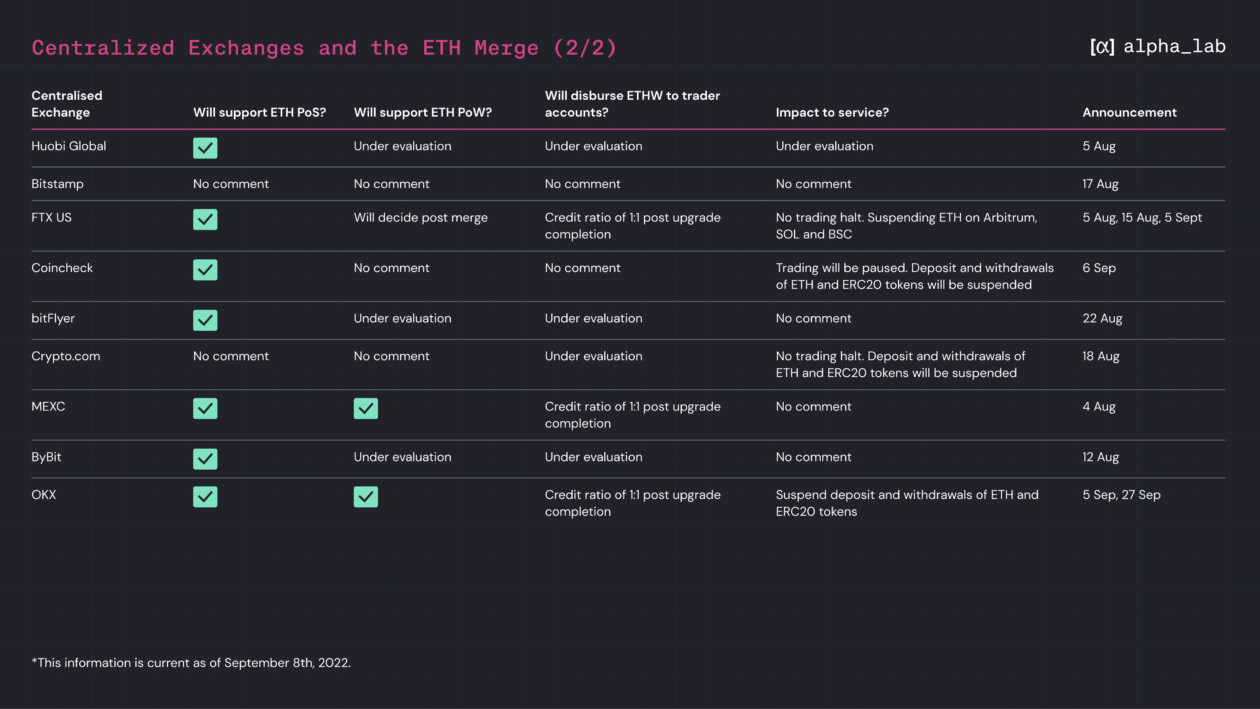

But for those experiencing something similar to Y2K anxiety regarding their Ether holdings, Singapore-based Alphalab Capital pulled together the charts below on what the world’s largest centralized digital asset exchanges have announced in regards to the Merge and Ether.

Alphalab Capital trades more than US$2 billion daily in cryptocurrencies, according to its website.