In this issue

- Cybersecurity: Time to ramp up

- Facebook: Unfriended by Bitcoiners

- Metaverses: Too big for Beijing?

From the Editor’s Desk

Dear Reader,

As much of the world continues to get comfortable with the idea that cryptocurrencies and other digital assets are here for the long haul, this past week has seen some timely reminders that it’s never a good idea to get too comfortable.

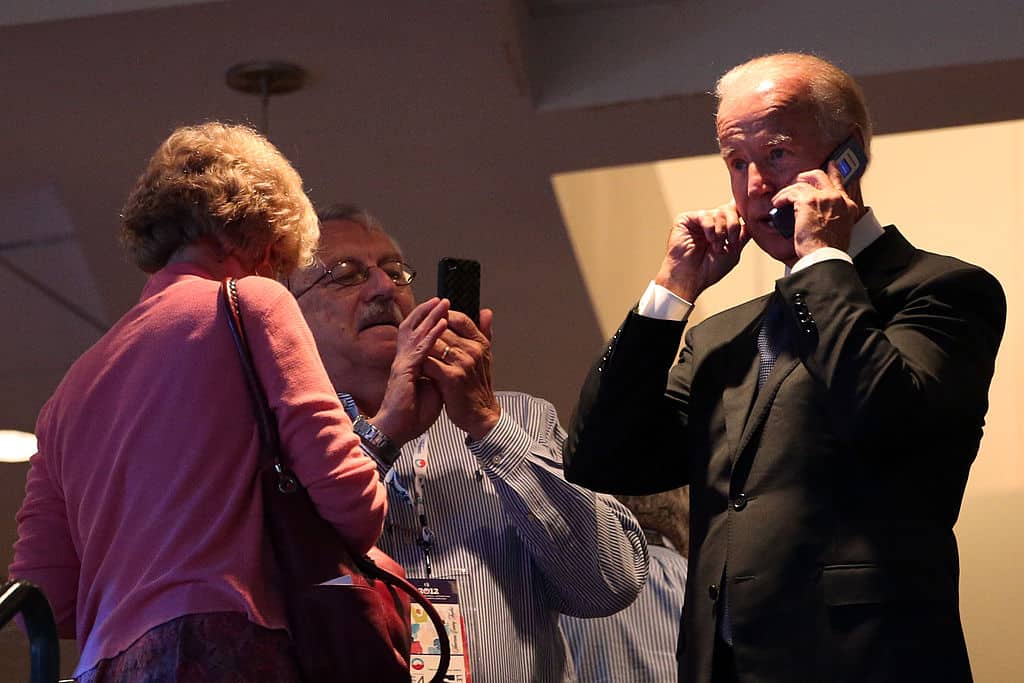

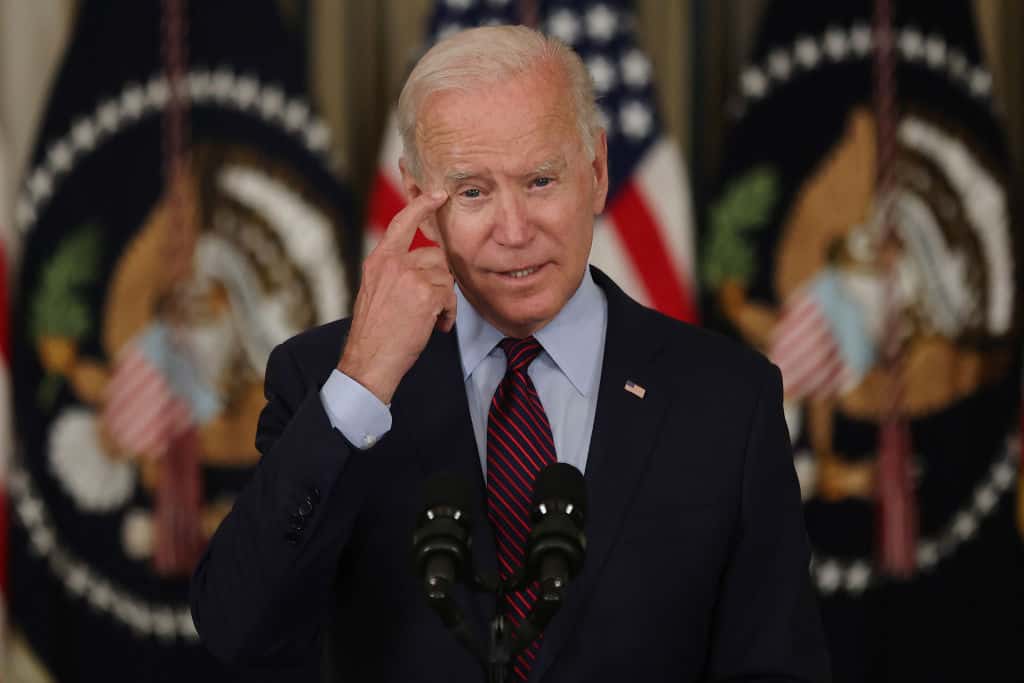

That was certainly the message from the White House on Friday as U.S. President Joe Biden called for redoubled efforts to beef up cybersecurity in the face of threats from both hostile nation-states (read: China and Russia) and your unfriendly neighborhood hacker.

And it’s a message that ought to resonate with members of the cryptocurrency community, whose industry has been plagued with allegations of fraud and dirty dealings — and has suffered disproportionately from cases of the same — right from the get-go. No matter how seemingly solid progress may be in raising the crypto sector to maturity, it remains very much a work in progress, with a corresponding degree of vulnerability to malicious intent and a measure of overall fragility.

Speaking of fragility, Facebook’s huge outage this week demonstrated just how brittle even some of the most sophisticated digital developments can be, let alone emerging ones. Some decentralization devotees were quick to point to the centralized nature of the world’s biggest social media network as its Achilles’ heel. But not so fast. Decentralization may be the touchstone of all things crypto, but few crypto or DeFi projects would find their comfort zone — least of all financially — with the billions of users that Mark Zuckerberg’s monster has drawn in.

In China, meanwhile, “comfort” isn’t the first word that springs to mind when considering the digital asset industry.

Beijing had been making life difficult for cryptocurrency industry players and investors for years before it announced an all-out ban on crypto late last month. Just before that announcement, state media outlets had vented about non-fungible tokens, which crypto enthusiasts had hoped might remain a refuge for the digital asset trade.

Such rumblings are often a sign of an impending crackdown, so when — at almost the same time as their anti-NFT broadsides — the state-controlled press began to nay-say the emerging ecosystem of metaverse developments in China, suggesting they were next on Beijing’s target list, it may have alarmed some.

But then again, given Beijing’s systematic and intensifying campaign against the entire digital asset sector, perhaps they should have seen it coming.

As President Biden rightly pointed out in his cybersecurity briefing, rules and regulatory authority are required to enable any industry to thrive. In some jurisdictions, however, that authority remains just a little too close for comfort.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Eyes on the wires

By the numbers: Joe Biden — 5,000% increase in Google search volume.

This month is Cybersecurity Awareness Month in the U.S., now in its 18th year and as much a manifestation of the need for digital vigilance as it ever was. In a statement released last Friday, President Joe Biden called for the public and private sectors to work together to continue raising awareness of cybersecurity issues.

- Biden said the U.S. would convene a 30-country virtual meeting this month to try to ramp up global efforts to address an expanding range of cyber threats, with topics including the illicit use of cryptocurrencies, ransomware attacks and improvements to collaboration in law enforcement.

- The announcement follows ongoing ransomware attacks, including on critical U.S. infrastructure such as Colonial Pipeline, a major fuel supplier shut down for days after it became the target of one such attack earlier this year.

- On Friday, European Union law enforcement agency Europol announced the arrest of individuals who had allegedly carried out a series of “prolific” ransomware attacks against European and U.S. organizations since April 2020, believed to involve the extortion of at least 5 million euros (US$4.3 million) and as much as 70 million euros. European authorities seized US$375,000 in cash, two luxury vehicles and froze US$1.3 million in cryptocurrencies.

Forkast.Insights | What does it mean?

Biden’s call for better cybersecurity is aimed primarily at combating the increasing threat of Russian, Chinese and North Korean actors preying on America’s creaking infrastructure, of which digital infrastructure is a critical part.

The intensity of covert cyber warfare has been ratcheting up over the past few years as states have found that adding cyber capabilities to their arsenal is far cheaper — and even potentially more deadly — than tooling up with traditional weapons.

Although the focus of the U.S. cybersecurity push will be overwhelmingly on state-led action, there is an equally important need to equip regulators and law enforcement agencies with capabilities to police the Web 3.0 world.

Fraud involving cryptocurrencies is disturbingly widespread. This year is on course to set a record for investment fraud, with 14,079 investment-related scams reported to the U.S. Federal Trade Commission during the first quarter, and with victims having lost US$215 million in the third quarter alone.

As the popularity of decentralized technology grows, so will the need to regulate it and enable more effective policing. Digital asset exchanges, for one, should not be permitted to create obscure and expensive legal pathways to prevent users who have suffered losses or other harm from seeking compensation.

Law enforcement agencies must be given the necessary funds and training to pursue individuals and organizations using cryptocurrencies to finance crime.

Regulators should feel empowered to bring those behind wayward cryptocurrencies to heel if their coins are deemed to be excessively risky or deliberately misleading.

If such efforts are not made — or if they are made but do not succeed — the new and fragile economy of the digital asset space risks being trashed by a toxic mixture of criminal ambition and bureaucratic ineptitude.

2. Bitcoiners light up as Facebook goes dark

By the numbers: Delete Facebook — 5,000% increase in Google search volume.

Facebook — together with related services including Instagram, WhatsApp, Messenger and Oculus — went dark for several hours on Monday, prompting Bitcoin enthusiasts to pour scorn on what they described as the weaknesses of centralized platforms. The outage began at around 11:30 a.m. U.S. Eastern Time, and it was some six hours before the platforms began to return to life, just as a whistleblower was preparing to testify to the U.S. Congress about how Facebook knew that its Instagram platform was toxic to youth mental health. Facebook said no user data had been compromised across its platforms. The company said later on Monday that its engineers had determined that the problem had originated from a networking issue interrupting communications between data centers.

- The six-hour shutdown was one of the longest outages in Facebook’s history, affecting its 2.89 billion global users. The company’s shares lost almost 5% of their value on the day.

- A number of Bitcoin fans were quick to claim that the incident revealed the weakness of centralized platforms, to which the Bitcoin model was not subject, thanks to its decentralized nature. Bitcoin was trading at US$54,000 at press time.

- Twitter is currently developing a decentralized social media initiative. Its CEO, Jack Dorsey, announced almost two years ago that Twitter would be funding a team to develop a decentralized standard for social media, and the company recently hired a crypto developer to lead the group.

Forkast.Insights | What does it mean?

Bitcoin maximalists are right to gloat over their network’s reliability compared with that of the world’s biggest social network. The Bitcoin network has been functional for 99.98% of the time since its launch way back in 2009.

Today’s social networks can only dream of such consistency. Indeed, decentralized networks offer more resistance to outages thanks to the fact that multiple copies of them exist across hundreds, if not thousands of computers and servers. It’s also possible to fork a network before an error occurs to ensure the lights stay on.

For centralized outfits such as Facebook, where command and control is tightly held in the hands of the few, an error in a database, a server or a piece of code can lead to a complete collapse.

But the Bitcoin boosters shouldn’t crow too loudly. Bitcoin’s reliability is enviable — but Bitcoin’s carbon-emissions problems are not. No single company would ever be permitted to run up a power bill bigger than that of many nations.

Decentralized networks are also sensitive to price shocks and skyrocketing fees. Building a community as large as Facebook’s — 2.89 billion users at last count — using blockchain technology would have drained any company’s coffers before it even got started.

So, while Facebook licks its wounds and nurses its stock price, blockchain devotees should be careful what they wish for.

3. Masters of the metaverse

Datang Everbright City, a 2.1-km pedestrian mall in the Chinese city of Xi’an, on Sunday announced the launch of Datang Kaiyuan, a metaverse project based on the culture of the country’s 1,000-year-old Tang Dynasty. Imitating Tang Dynasty architecture, the project aims to present ancient Xi’an in the virtual world using non-fungible token and metaverse elements. Metaverses have become increasingly popular in China.

- The popularity of metaverses in China really took off in late August, when ByteDance, a Chinese internet technology company that developed TikTok, spent US$772 million to acquire virtual reality hardware maker Pico, which was seen as a step into the metaverse space.

- Tencent, the owner of “super-app” WeChat and operator one of the world’s largest video gaming businesses by revenue, has filed nearly 100 applications for trademarks containing the term “metaverse” in Chinese since early September. Trademarks include “QQ Metaverse” and “Kings Metaverse,” corresponding to Tencent’s most popular applications, QQ and Honor of Kings.

- Alibaba followed Tencent’s lead, and has applied for the trademarks “Ali Metaverse,” “Taobao Metaverse” and “DingTalk Metaverse.” Taobao is the flagship online marketplace of Alibaba, and DingTalk is an enterprise communication platform developed by the company.

- Chinese online game developer ZQGame announced in early September that it would launch a metaverse game based on blockchain Master Winemaker in 2022. The company’s shares surged 44% in two days following the news. Chinese news outlets including China Daily were quick to warn investors against “rising metaverse hype.”

Forkast.Insights | What does it mean?

The Chinese government has long been engaged in a campaign of hostile regulatory and enforcement action against cryptocurrencies, and against the digital asset industry as a whole.

It has been gunning for miners, equipment manufacturers and even financiers found to be aiding the development of decentralized (read: not controlled by the Chinese state) technology.

Metaverses have gained attention and popularity as Beijing has tightened its stranglehold on the digital asset sector, in lock-step with decentralized finance activity. That hasn’t escaped the attention of the authorities.

China Daily — one of several state-controlled media outlets that act as a reliable indicator of the government’s policy on any number of issues — has been actively warning investors to stay away from the technology. Among other measures, projects have been required to verify their customers’ identities — a roundabout way of forcing business owners to give up user data to prevent the emergence of networks of anonymous users.

The question isn’t whether China will clamp down on this burgeoning development, but rather when and how. Beijing essentially has two choices: Allow the industry to emerge under its watchful eye, or slam the door on it entirely. As its own digital is being rolled out, China sees blockchain as strategically important and wants to be the biggest player in the space.

The fate of metaverses, like cryptocurrencies, will demonstrate whether Chinese authorities are able to navigate and manage them, or whether they would prefer simply to stamp them out.