Bitcoin, cryptocurrency, blockchain technology and decentralized finance have become household terms of late. The momentum of cryptocurrency has been accelerating with El Salvador using Bitcoin as legal tender, PayPal accepting crypto transactions, big-name athletes taking their salaries in Bitcoin, and high-profile entrepreneurs frequently touting one coin or another. Unsurprisingly, as cryptocurrency — a concept born and sustained out of the desire for individual sovereignty through sound money and decentralization — grows in popularity, it is coming under the specter of increased regulation and government scrutiny.

In May of 2021, the U.S. Treasury Department announced that it is taking steps to crack down on crypto markets and transactions, and stated that it will require any transfer worth US$10,000 or more to be reported to the Internal Revenue Service. President Joe Biden has proposed providing additional resources to the IRS to address the growth of crypto assets, in a more holistic effort to crack down on tax evasion and promote better compliance. According to government estimates, the difference between taxes owed to the U.S. government and those actually paid totaled nearly US$600 billion in 2019. The view that a significant fraction of this tax gap is attributable to crypto transactions, is evidenced by these IRS releases and has made crypto a very attractive target for IRS attention in the year to come. In its most pronounced form, this increased scrutiny comes in the form of the much-feared IRS audit.

Are there any clues an audit is coming?

A. You received a notice from the IRS

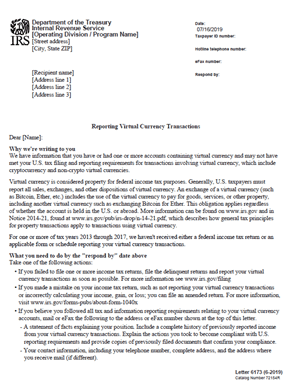

The IRS introduced a virtual currency letter campaign beginning in late summer of 2019. This initially took the form of warning letters to cryptocurrency holders, indicating that they might not be in compliance with their tax filing obligations with respect to their cryptocurrency trading activity or investments. Depending on the IRS’s perception of the taxpayer’s specific cryptocurrency infraction, three different versions of the letter (Letters 6174, 6174-A, and 6173) were sent to taxpayers. Specifically, Letter 6174 purports to have an educational component for taxpayers that the IRS believes have or had convertible virtual currency (CVC) transactions, explaining that the transactions mandated reporting. Letter 6174 included language indicating that the taxpayer may not have known of the requirements.

In contrast, Letter 6174-A includes elevated language that CVCs may not have been properly reported and indicates that the IRS ‘‘might’’ send correspondence about potential enforcement activity in the future. Taxpayers who received either version of this letter (6174 or 6174-A) are advised to work with their tax team to engage in a review of their transactions involving CVCs.

Letter 6173 was sent to taxpayers whom the IRS believes have not met their reporting obligations. Recipients of this letter need to act with urgency and should respond with significant thought and care. These taxpayers are being required to either (1) provide an explanation as to why they believe that they have properly complied with their reporting obligations, or (2) file amended or delinquent tax returns. Unlike Letter 6174 and Letter 6174-A, Letter 6173 contains a date by which the recipient is required to respond under penalties of perjury.

The implication of the IRS sending out these letters is clear: the IRS is taking a hard look at cryptocurrency transactions.

It is strongly advisable that recipients of these letters, especially those who received Letter 6173, take it seriously and take steps to get audit-ready. It is recommended that they seek tax counsel from a tax team experienced with cryptocurrency and consider options to correct mistakes.

B. Your data has been provided to the IRS from a third party

Many holders of Bitcoin, Ethereum and various other crypto assets have received letters, e-mails or other notices explaining that their personal data has been turned over to the IRS.

Perhaps the most discussed and publicized event came in 2016 when the IRS requested Coinbase, one of the markets largest exchanges, to serve a “John Doe” summons to its customer base of nearly 6 million users at the time. In United States v. Coinbase, Inc., Coinbase was ultimately ordered to turn over information to the IRS for 13,000 customers.

With over 4,000 cryptocurrencies and a multitude of crypto banks and exchanges, the IRS will likely make similar requests of other crypto institutions and, before long, you may find yourself the recipient of one of these notes indicating that your personal data has been provided to the IRS.

You might expect such details provided to the IRS to include a full packet sufficient to identify noncompliance and link the noncompliance directly to the taxpayer, such as:

- Standard KYC data, including:

- Full name

- Social security number (a direct link to your tax return)

- Birth date

- Address

- Full on & off chain account activity showing all transactions; and

- Periodic statements of account or invoices (or the equivalent)

It should not, therefore, come as a surprise to receive an audit notice once your data has gone over to the IRS by way of a third party.

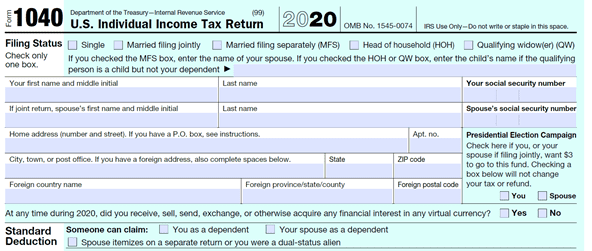

C. You file a US income tax return that reports cryptocurrency assets

Your 2020 tax return includes a simple flag for the IRS to identify the presence of crypto assets within your portfolio. This new flag is so important it is prominently placed at the very top of the return (right after your name and basic identifying information, and before any income information). You can see in the snapshot below how this information is highlighted to the IRS and how easily the field can be data-mined by the IRS for audit selection.

The IRS has consistently signaled that virtual currency will be a high priority. Beyond adding the flag to the return, the IRS has enhanced internal hiring and solicitation of outside contractors who are experts in cryptocurrency as well as engaged in John Doe summons to identify noncompliance.

II. What can I do to prepare for and prevail in a crypto audit?

- Watch your social media postings and avoid making yourself a target

IRS auditors use a variety of methods in establishing a case against taxpayers — including run-of-the-mill internet searches, which can reveal a plethora of interesting personal taxpayer information and color an agent’s view of a taxpayer and the case against the taxpayer.

Accordingly, watch what you post. The IRS argued in the recent Coinbase case that some taxpayers openly acknowledged that a consideration in investing in Bitcoin is the desire to avoid tax reporting requirements. It should go without saying that a person who posts that type of sentiment in an online forum may be inviting additional scrutiny as well as higher penalty rates.

While social media posts are an easy way to identify tax avoidance rhetoric, letters, e-mails and other documents can contain such sentiments as well. Be careful about what you say and to whom you say it.

- A focus on 2020

Even if you have made mistakes in the past, your 2020 return should be sure to properly, timely and correctly report your virtual currency transactions. If you have been doing your own returns, have a professional double check your computations and your reporting draft. If you are under (or over) reporting, the practitioner can help.

- Be audit ready

Your tax counsel can help you prepare an audit binder and do a historic return double-check.

The audit binder should include all backup data and work papers tying directly to your return. It should be keyed to a current cryptocurrency information document request (IDR) so that it includes many of the response items you would be expected to produce in an audit. This will help you to feel prepared and confident that you will be able to sustain the positions taken on your return in an IRS audit.

Specifically, on audit — even if the audit is not specifically geared towards cryptocurrency transactions — agents are routinely asking for detailed information regarding cryptocurrency holdings and transactions.

At the most basic level, you will certainly need to establish the purchase and sales price for each crypto transaction you have made. What that looks like will depend on how you acquired your crypto asset, how it was held, and how it was transacted. In an effort to organize your records, consider the following critical documents:

- All transaction records, receipts and screenshots maintained by your respective crypto blockchain, exchange, broker, or peer-to-peer facilitator. If you acquired your crypto assets through an electronic payment, keep the proof — such as wire transfer or EFT records.

- In the event of alternative transactions like hard forks, faucets, tipping and airdrops, maintain as much detail as you can on each transaction.

- When purchasing or receiving payment for goods and services, it is critical that you maintain records of value at the time of purchase and disposal (such as prints from other sources).

- A list of all blockchain addresses that you own or control, a spreadsheet of all digital currency exchanges, banks and peer-to-peer facilitators with associated user IDs, email addresses, IP addresses and account numbers relating to these platforms.

- Copies of all correspondence — such as emails, texts and tweets — with counterparties to any cryptocurrency transactions.

- Records of all transactions relating to the lending of cryptocurrency or the use of cryptocurrency as collateral for a loan.

Crypto asset IDRs are lengthy and invasive, and the responses required are often voluminous. Having the luxury of time to frame your potential response and collect all of the needed data could be a critical factor in the ultimate outcome of the audit. While we can expect the IRS to evolve its requests over time, they are likely to become more detailed and technical in the future.

This preparation can also highlight weak areas or mistakes that can be proactively addressed. It can also help you to adjust how you use crypto assets for accountant and audit efficiency. In the same way that if you had a large block of stock in a company you would generally not use tiny bits to make thousands of transactions in a year for a few dollars at a time, it is also not yet efficient — for accounting purposes — to use cryptocurrency to buy coffee every day, unless the record-keeping is not too onerous and the records provided are sufficiently detailed for the IRS and your accountant. New web-based tools will make such micro-transaction record-keeping easier in the near future if you take advantage of them.

III. How can I correct mistakes before I am audited?

While there is not currently a special crypto-only voluntary disclosure regime, the IRS has several options for taxpayers to come into compliance where errors are identified. Reach out to your tax lawyer to discuss which option best fits your situation. As with foreign bank account noncompliance, you will have the most and best options if you reach out before your identity is disclosed to the IRS.

IV. On the horizon: IRS compliance initiatives related to crypto assets

The crypto industry is still in its infancy, with early adopters just beginning to make room for institutional investors, large scale companies adding crypto to their balance sheets, and more countries preparing to make Bitcoin a form of legal tender, just as El Salvador has done. As this innovation continues, it will be important for enhanced regulation of the industry. This will pave the way for more mainstream adoption by consumers and businesses alike.

All signs point to the fact that the IRS is up to the task with regard to enhanced regulation of crypto assets. We can expect a great deal of change in the coming years with respect to IRS surveillance of cryptocurrency transactions, as the IRS seeks to understand, define and monitor this burgeoning virtual asset class. One area where the government is poised to enhance regulation of crypto assets pertains to the Report of Foreign Bank and Financial Accounts (FBAR). Currently, a foreign account holding virtual currency does not need to be reported on the FBAR. However, FinCEN has recently announced that it intends to propose the amendment of the regulations implementing the Bank Secrecy Act (BSA) to include virtual currency as a type of reportable account for purposes of the FBAR. This will enable the IRS to assess draconian penalties, civil and criminal, for noncompliance and also provide the IRS with another audit avenue in this realm — the dreaded FBAR audit. For this reason, it is critical that crypto investors adopt best practices now that include keeping detailed records relating to all things crypto while also being mindful about the paper trail that they generate, as it may all need to be turned over to the IRS if the bright light of justice shines unfavorably on you.