The non-fungible token (NFT) market is finally reacting to the U.S. Securities and Exchange Commission’s (SEC) stepped-up attacks against the cryptocurrency industry. News of the Commission’s attempt to freeze the assets of Binance’s U.S., and that U.S. dollar withdrawals are pausing have traders liquidating NFTs or sitting on the sidelines.

Either way, it’s pretty clear we’re entering another new phase of the NFT market, and traders are being cautious. How low we can go, nobody knows.

When FTX collapsed, the Forkast 500 NFT Index reflected over a 33% loss in value. Today’s market, while showing signs that capitulation is coming, is slowly bleeding out and down nearly 10% in the past seven days. The Forkast 500 NFT Index hit an all-time low yesterday, bottoming out at 2962.

Navigating this market leads me to more questions than answers, and they come to me endlessly throughout the day. I wonder if we have found a floor for NFTs and if today’s active traders are closer to collectors than they are speculators. Can they hold the line until the next wave of innovation that’s set to arrive as blockchain-backed gaming? Will there be more FUD delivered by the SEC, and does the U.S. even have that much impact on markets anymore as builders are driven overseas? Stay tuned for more insight into these questions.

Noteworthy Happenings

There’s no shortage of major developments taking place across the NFT landscape. Bitcoin ordinals are getting a major upgrade with Inscriptions 2.0. With this latest Bitcoin Ordinals update, inscriptions can now reference another inscription which essentially removed the 4MB size limit.

So what can be preserved on-chain now? Video games, generative art, applications, and new tokens that haven’t even been dreamed of yet.

We’ll see what happens when builders get their hands on the new tech, but this advancement shows that we have just been scratching the surface of what the Bitcoin ecosystem will one day look like.

The market is reacting to a new environment of intense SEC scrutiny. On Saturday, a Twitter account named NFTstatistics pointed out that over 93% of all ETH volume on Blur was sellers accepting bids. This means that there were very few sales, and instead was likely points farming, or accepting offers under the floor price in an attempt to get liquidity.

The Polygon blockchain is unveiling an upgrade to its ecosystem called Polygon 2.0. Details will be revealed over the next few weeks, but there’s exciting talk about some drastic changes, including new utility for the network’s native cryptocurrency Matic, changes to governance, and even to the protocol’s architecture. Polygon 2.0 is aiming to build a value layer through infinite scalability and unified liquidity.

1/ Our vision for Polygon is simple: to build the Value Layer of the Internet.

— Polygon (Labs) (@0xPolygonLabs) June 12, 2023

The Internet allows anyone to create and exchange information. The Value Layer allows anyone to create, exchange, and program value.

Enter Polygon 2.0: a blueprint to build the ultimate Value Layer. pic.twitter.com/9eYSr3H1L5

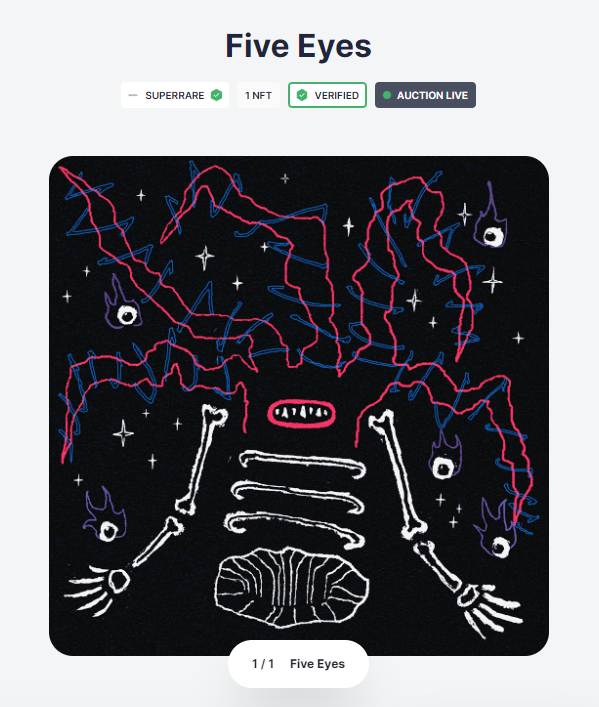

Art may be immune to tough market conditions. In the last edition of On Deck, we mentioned a few large art sales of both Fidenzas by Tyler Hobbs, and XCOPY. We have more of both incoming following a US$370,000 sale of Fidenza #158 on Sunday, and another XCOPY 1/1 called Five Eyes, which is at auction now at 97 ETH currently.

Peep the charts

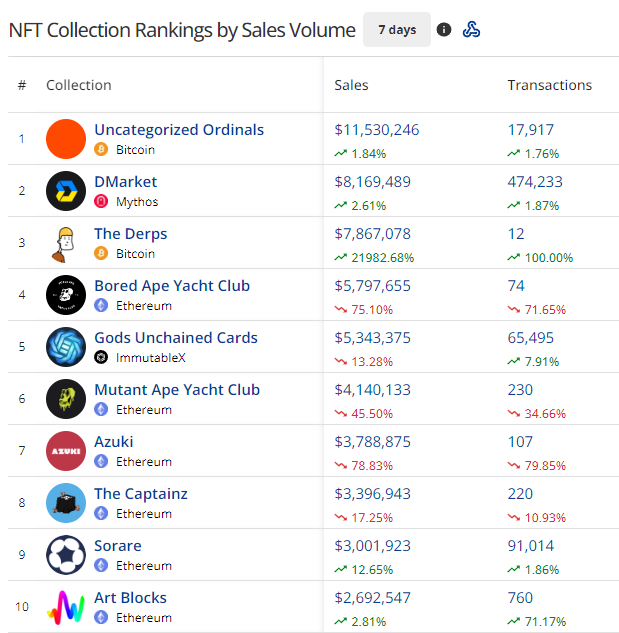

With Bored Ape Yacht Club and profile picture projects on Ethereum cooling off, Bitcoin’s Ordinals and other projects in other chains have their chance to shine. Ordinals has taken the top spot in the past seven days with strong demand, and excitement around Inscriptions 2.0. Gamers are going to game, so DMarket’s CS:GO and other games skins are hardly impacted by the rest of the market. Sorare and their fantasy sports NFTs are usually in the top 10, but it’s in this new market that they may catch some new eyes.

We’ll watch their ranking and see if the affordable, high-volume NFTs can gain more traction like DMarket. Art Blocks is looking strong again on the back of big art sales, with more expected to keep rolling in. Art is hot.

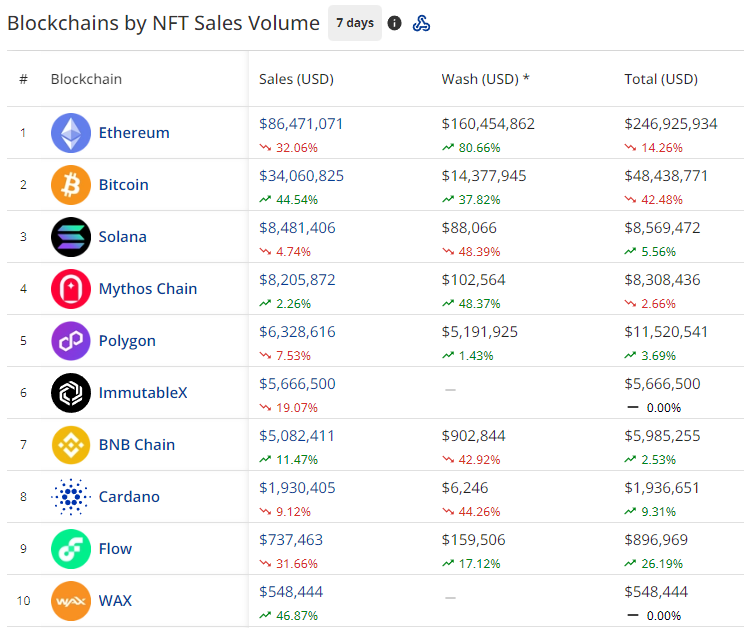

Real NFT sales are cooling off, but wash trades are still ramping up. Ethereum is down, as most would expect, but wash trading continues to climb. Will the end of Blur Season 2 cool off the wash trading, or will they continue if Season 3 is announced?

Bitcoin also has seen its wash trades increase this week, but so did genuine sales. Bitcoin has been up nearly 45% in the past seven days. Solana, Mythos Chain and Polygon are all grouped closely at three to six, but Polygon had quite a few wash trades in the past week in some atypical collections. Last week’s report of some new Polygon projects reaching the top 10 collections by sales volume (Weee Did It Palz, The Zumba Warriors, The Flower Powerz, and The Fladers) turned out to be mostly wash trades. Each collection now reflects those numbers, as does the blockchain ranking.