On-chain data shows US$18 million worth of USD Coin (USDC) stablecoins were transferred on Monday from a cryptocurrency wallet linked to the imprisoned Terraform Labs chief executive officer Kwon Do-hyeong, said South Korean university professor Cho Jae-woo.

The USDC was swapped into cryptocurrencies that will raise problems for authorities wanting to seize Kwon’s assets, because some of the tokens are “unfreezable,” said Cho, who heads the blockchain data lab at Seoul’s Hansung University.

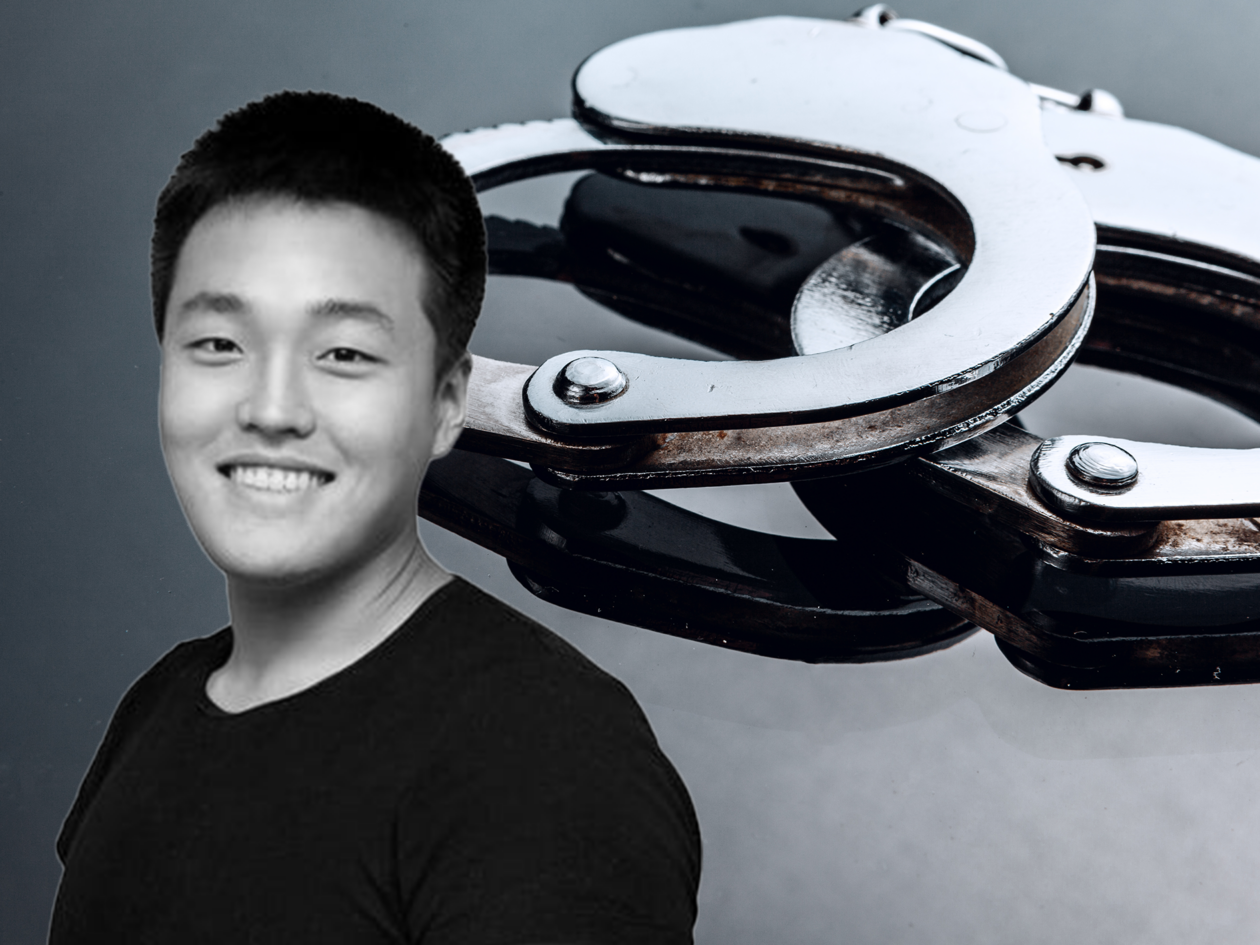

The Terraform founder, known as Do Kwon, faces fraud charges in South Korea and the U.S. linked to the US$40 billion collapse of the Terra-Luna crypto project he led.

The USDC transactions took place the same day that 5,292 Bitcoin worth more than US$160 million was moved from a wallet linked to the Luna Foundation Guard, a unit of Terraform Labs, according to South Korea’s Blockmedia.

The transaction was noted by Whale Alert on Twitter, though it labeled the Bitcoin as moving between two unknown wallets.

As the transactions took place while the Terraform chief is in jail in Montenegro on a passport forgery charge, it suggests he has outside help in moving funds to avoid the reach of authorities, said Cho, who is also an assistant professor of urban planning at Hansung.

“It seems [Kwon] had an aide outside of jail — [moving funds] is possible if he had previously handed over his private keys when he got out on bail the last time or by some other means,” Cho said.

Etherscan tracks

Cho said he spotted the movement of USDC on Etherscan on July 3 and flagged it in a tweet.

“I was monitoring the Ethereum wallet that Kwon Do-hyeong used prior to the Terra-Luna crash and saw that there were 18,732,768 USDC,” said Cho, in an email interview with Forkast. “But the entire amount suddenly moved to another wallet, and the funds became very active.”

In his tweet, Cho says Kwon converted the 18 million stablecoins into 4 million Aave Ethereum USDC (aEthUSDC), 12 wrapped Bitcoin (WBTC), 454 Ether, 500 staked Ether (stETH), and 1.5 million DAI stablecoin.

Another 5.4 million USDC and 1 million DAI were sent to another address used to serve as a liquidity pool in Curve, a decentralized finance (DeFi) protocol offering rewards to users that provide stablecoin liquidity.

“My best guess is that the tokens are being utilized to provide liquidity to DeFi and for staking,” Cho said.

Too late

“It is now too late to freeze Do Kwon’s USDC,” said Cho, who added that USDC’s parent company Circle can manually freeze a user’s account if required. “But ETH or WBTC do not have that kind of functionality.”

Circle on its website says it reserves the right to “block” USDC addresses and freeze associated USDC tokens if they are associated with illegal activities.

Do Kwon, a South Korean national and a computer science graduate of Stanford University in the U.S., started Terraform Labs in 2018. He founded the Terraform algorithmic stablecoin and cryptocurrency project Terra-Luna, which collapsed in May 2022, wiping out over US$40 billion in market capitalization.

Kwon, 31, is wanted in the U.S. and South Korea where prosecutors accuse him of fraud, securities law violations and several other charges related to the Terra-Luna crash. He has denied all the allegations against him.

The Terra-Luna chief was convicted in Montenegro in June for attempting to travel on a forged passport and sentenced to four months in jail. Kwon’s lawyers have filed an appeal. Multiple attempts by Forkast News to reach Do Kwon for comment have not received replies.

South Korean prosecutors investigating the Terra-Luna collapse have been trying to evaluate the total assets that Kwon owns, most of which they consider criminal proceeds.

With cryptocurrencies linked to Kwon now being moved and swapped into other tokens in different private wallets, it becomes more difficult for authorities to track Kwon’s assets, Cho said.

“It seems that he used someone else’s name on centralized crypto exchanges, and realistically it’s difficult to evaluate how much crypto he owns,” Cho said. “At least we could identify the assets that were on-chain, but with the transfer [on July 3], that’s become much more difficult.”