Asians are known to have a love for property. In Singapore, 88% of residents own their homes. Hong Kong’s home ownership rate is much lower at 50%, as sky-high property prices keep out aspiring homeowners. But the territory’s investment appetite also includes smaller and more affordable real estate assets — such as parking lots.

Real estate assets for investment purposes are about to get smaller and even more affordable for the masses, as blockchain technology enables the fractionalization of real-life property into digital tokens for sale.

Fraction, a fintech startup based in Hong Kong and Bangkok that uses blockchain technology to fractionalize real estate for ownership and trading, announced today that it has been awarded a license by Thailand’s Securities Exchange and Commission to tokenize, list and trade assets such as real estate properties.

Fraction’s platform, which was built on a permissioned blockchain based on Ethereum, covers the initial digitization and fractionalization of an asset, an “initial fraction offering” (IFO) to investors, secondary market trading of fractional tokens between investors, as well as related intermediary services. The assets will be digitized as non-fungible tokens (NFTs), which represent ownership in the underlying physical assets and then tokenized.

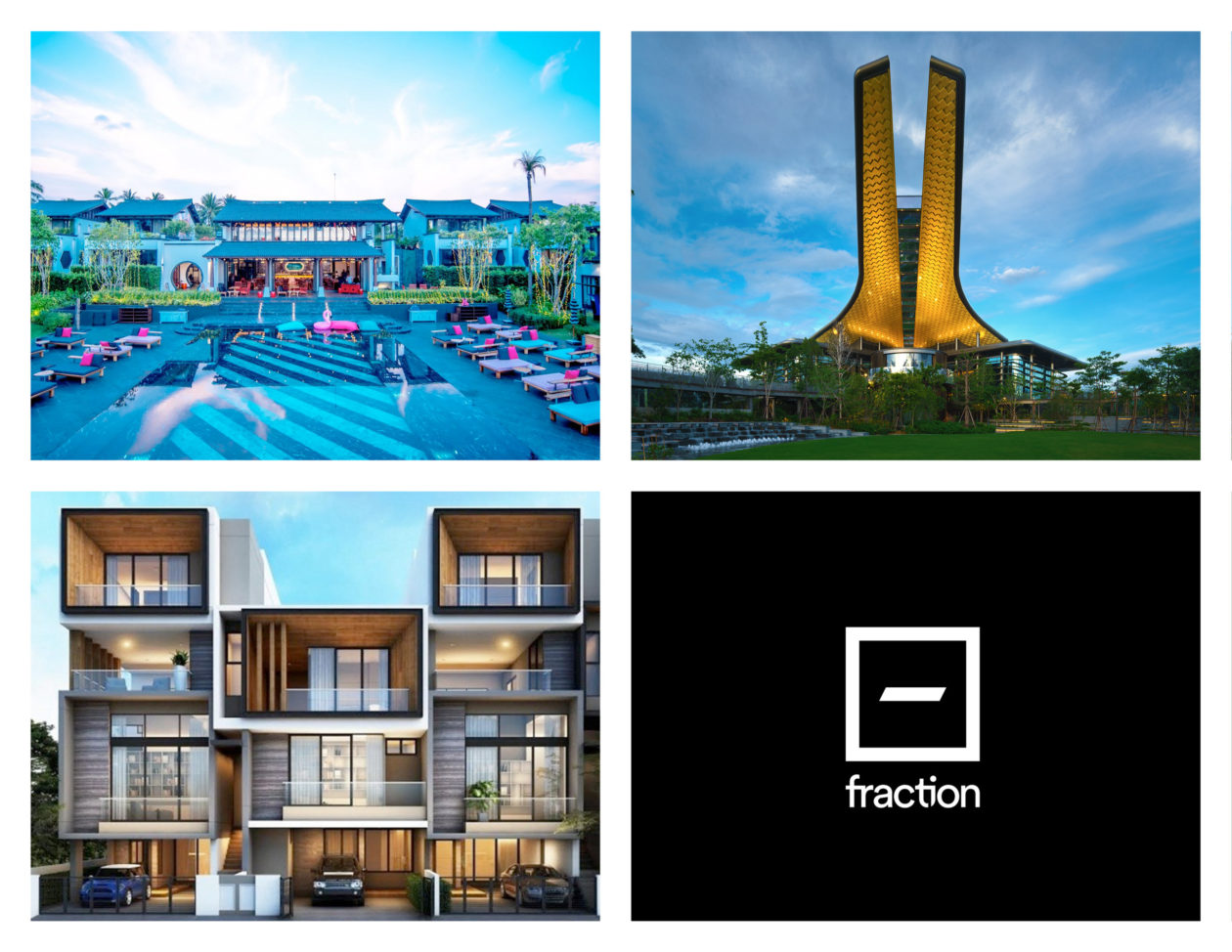

With its license in Thailand in hand, Fraction is partnering with some of Thailand’s largest property developers — Magnolia Quality Development Corporation (MQDC), Charn Issara Development and Nirvana Daii — to tokenize properties with a total value of over THB15 billion (US$462 million) into small fractions for sale.

According to Fraction, investors can invest as little as THB5,000 (US$150) to own a part of properties such as MQDC’s THB350 million (US$10.6 million) penthouse unit in The Forestias in Bangkok, or Charn Issara’s resort projects in Phuket, Natai and Hua Hin. Work on the offering structures and documentation for approval with the Thai SEC is underway, and Fraction expects the first IFOs to be open for investing in the first quarter of 2022. KULAP, an Thai SEC licensed digital asset broker, will provide the initial secondary market liquidity post-IFO.

“After 3 years of laying the technical foundations and the real-world legal structure, we have obtained regulatory approval and can now enable financial inclusion, letting small investors participate in attractive asset classes that used to be previously inaccessible,” said Eka Nirapathpongporn, co-founder and CEO of Fraction, in a statement.

Nirapathpongporn — a former managing director and partner at Lazard, a New York-based global financial advisory and asset management firm — told Forkast.News in an interview that Fraction aims to democratize investing and access to capital to everyone, especially retail investors and small businesses that do not have access to large amounts of capital. Fraction works in a similar way as the stock market or capital markets, Nirapathpongporn added. “You own the asset and it’s like having shares in the company. If that asset produces income and declares a dividend, you’ll get paid on what you own.”

Starting with real estate was a natural choice for the company, Nirapathpongporn said. “It’s an asset class people know well, it’s a massive asset class that is a proven wealth creator, and one that needs fractionalization.”

With fractionalization, investors can diversify their investment portfolios and invest the amounts they want and can afford. Fractionalizing a multi-million dollar beachfront property, for example, would turn real estate that was previously out of reach for small investors into assets accessible to many more buyers.

Fraction also seeks to redefine the idea of home ownership. Nirapathpongporn added. Instead of striving to own 100% of their home, people could treat their homes like a company and tokenize a part of it to raise capital or to finance the cost of the property, rather than taking out a traditional mortgage or a home-equity bank loan. With tokenization, the interest that would otherwise be paid to a bank for a property loan would go instead to investors.

Beyond the initial property listings, Fraction intends to list other types of assets such as art and expand its geographical footprint, including to Hong Kong.