Terra has increased its initial token float — tokens that are tradable upon issuance — from 15% to 30% for pre-attack Anchor Protocol UST stakers (aUST) and post-attack LUNA and UST holders, in the latest update to the plan to revive its reeling ecosystem.

See related article: No hard fork, governance vote in Kwon’s updated Terra revival proposal

Fast facts

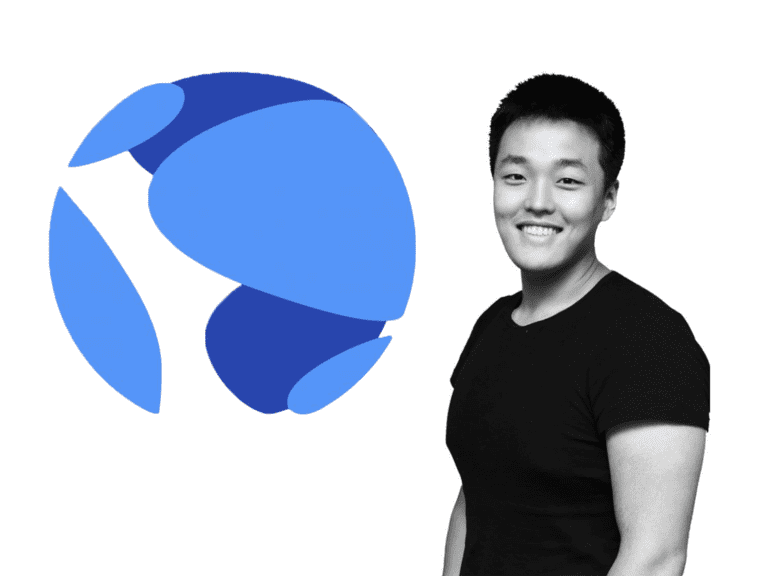

- Terraform Labs CEO Do Kwon’s “Ecosystem Revival Plan 2” was amended at around 10 a.m. Hong Kong time Friday to update token allocation following Terra community pushback.

- Wallets that held 10,000 LUNA or less before the attack — the exploit that led to the depegging — will have 30% of their holdings unlocked at the launch of the new Terra network, with the remaining 70% held in a two-year vesting period with a six-month cliff.

- The amendments place small LUNA holders in similar liquidity profiles, which cover over 99% of all existing LUNA wallets that held about 6.45% of the LUNA supply before the incident.

- The distribution for post-attack UST holders has decreased from 20% to 15%, with the reduced 5% now reallocated to the community pool, the amendment proposed.

- It also notified the community that UST or LUNA that bridged off of Terra or that is on less identifiable Terra protocols may not be included in the snapshots that determine pre-attack and post-attack ownership.

- Despite the changes, many online community comments on Terra’s proposal are still expressing disapproval toward Do Kwon’s idea of creating a new blockchain.

See related article: Knock, knock Do Kwon, investors have quite a lot of questions for you