Institutional investors continued to buy into Solana investment products despite the market correction last week, according to a report by digital asset manager CoinShares.

Fast facts

- Solana prices, which have soared by over 13,000% this year, reached an all-time high of US$213.47 on Sept. 9, according to CoinGecko data. Solana briefly overtook XRP to become the sixth-largest cryptocurrency by market value last week and is currently back at seventh place. Solana was trading at US$167 as of publishing time.

- “During last week’s price falls Solana’s price was a stalwart, outperforming a basket of the top 10 digital assets by 34%, having risen 24% week-on-week. This was reflected with inflows, dwarfing any other digital asset, totalling almost US$50M,” wrote CoinShares Investment Strategist James Butterfill. “A combination of price appreciation and inflows now brings Solana’s assets under management (AUM) to US$97M, the 5th largest of all investment products.”

- Total digital assets under management (AUM) across all digital asset fund providers last week dropped to US$56.3 billion from US$62.5 billion the week before. Bitcoin — the largest cryptocurrency by market value — accounts for the majority of total digital assets under management with US$37 billion under management, followed by Ethereum (US$15 billion), multi-asset products (US$3 billion), Binance (US$437 million) and Solana (US$97 million).

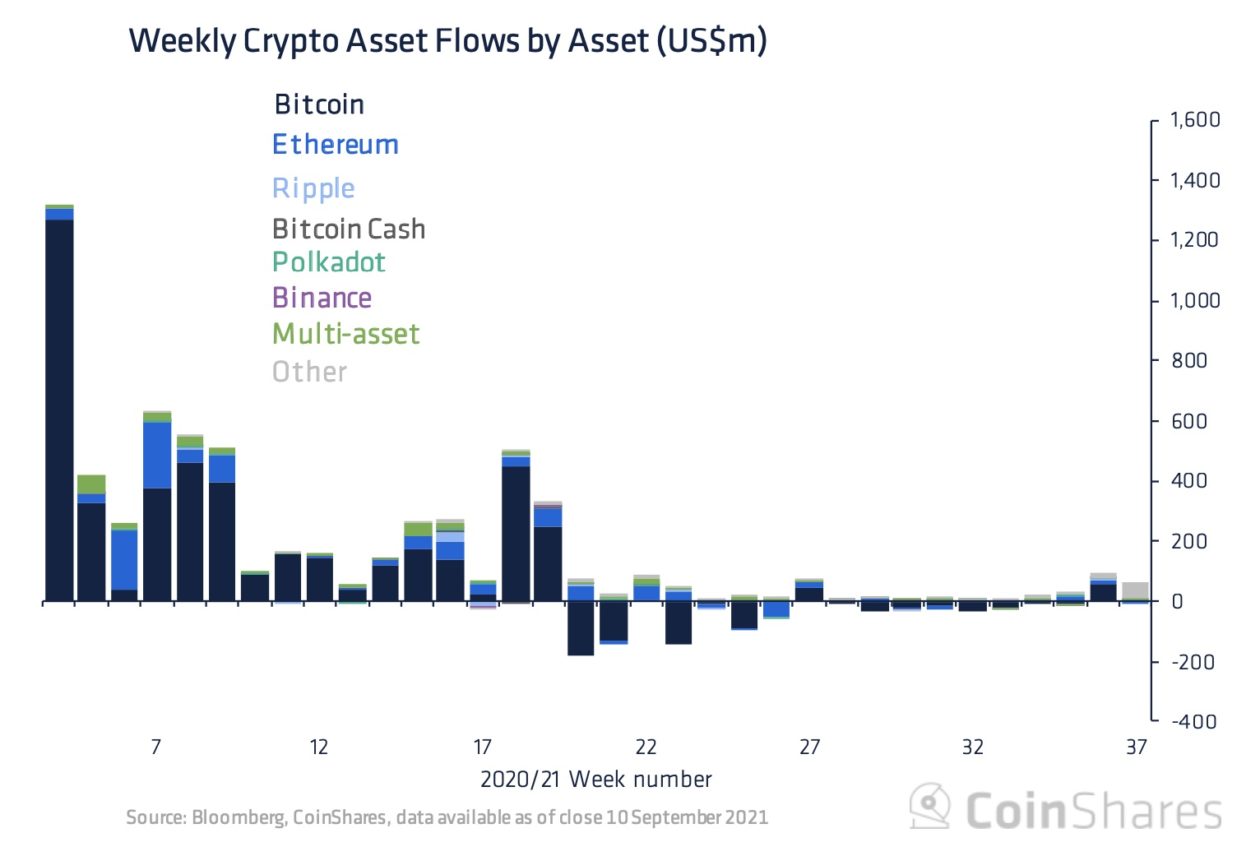

- Digital asset investment products saw inflows of US$57 million last week, the fourth consecutive week of inflows, CoinShares reported. Bitcoin had a miniscule US$0.2 million of inflows, while Ethereum saw minor outflows of US$6.3 million.

- Investors continued to diversify into digital assets, Butterfill wrote. Inflows into Cardano, multi-asset products, XRP and Polkadot last week were US$3.5 million, US$3.2 million, US$3.1 million and US$1.7 million, respectively. Cardano, on Sunday, successfully completed its long-awaited Alonzo upgrade, finally bringing smart contract functionality to the blockchain.