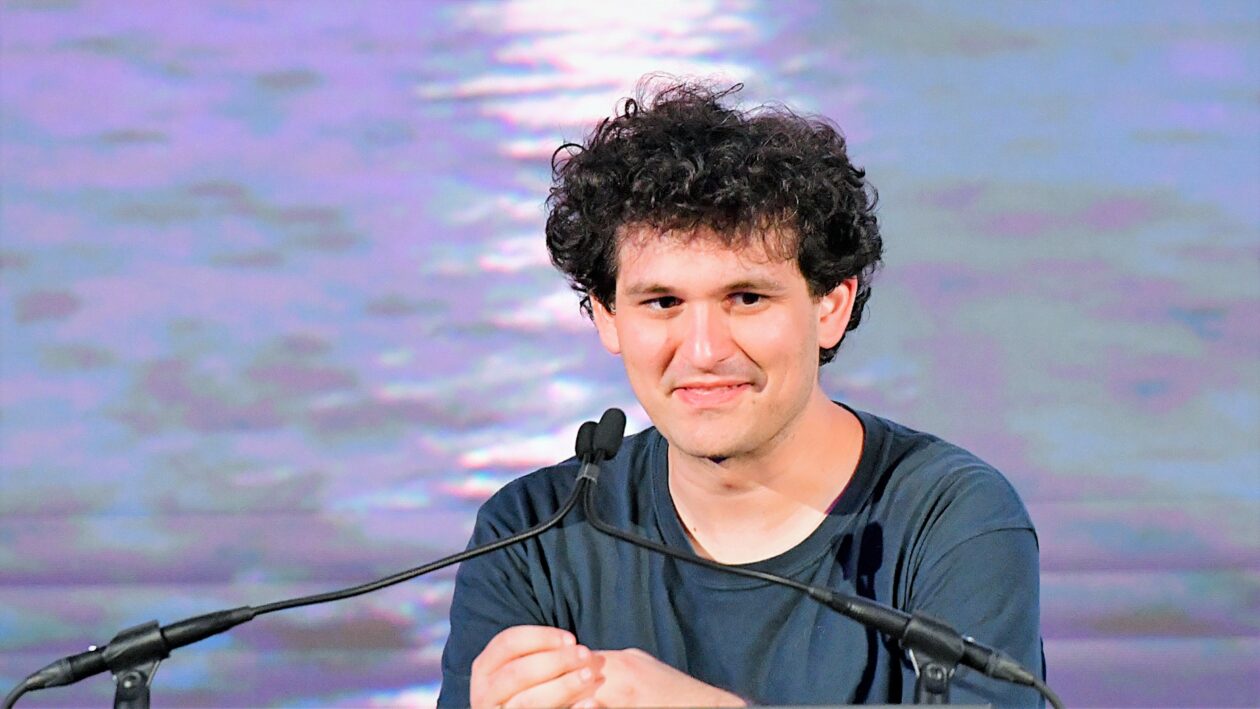

FTX International Chief Executive Officer Sam Bankman-Fried sent his first series of tweets since Binance Global Inc. announced and then reversed an offer to buy his cash-strapped cryptocurrency exchange. He apologized to users, acknowledged he had made mistakes and reiterated his commitment to doing right by FTX users.

See related article: Binance the winner in FTX saga, set to gain more customers

Fast facts

- The thread comprising of 22 tweets begins with “I’m sorry. That’s the biggest thing. I f***** up, and should have done better.” He repeated a similar apology multiple times throughout the thread.

- The tweet comes as data shows transactions have resumed on the exchange, as per data from Etherscan.

- Bankman-Fried, known as SBF, said he should have communicated better over the past few days, but said he couldn’t say much publicly during talks on the possible deal with Binance.

- SBF said that he thought FTX had enough USD liquidity to deliver 24 times the average daily withdrawals, whereas in reality they only had enough for 0.8x of the roughly US$5 billion withdrawn on Sunday.

- The former billionaire said there are still a number of investors who are considering a possible acquisition of FTX, but nothing is confirmed. “Every penny” of those funds and of existing collateral will go straight to users until the company had “done right by them,” he said, and after that investors and employees will be looked after.

- According to the thread, Alameda Research, the brokerage arm of FTX will begin winding down trading. SBF also made clear that the losses were restricted to FTX International, and that FTX US — the exchange that services U.S. customers — is not financially damaged.

- He appeared to acknowledge the tension between himself and Binance Chief Executive Officer Changpeng Zhao, whose tweets last week kicked off the run on FTX’s crypto token FTT. “At some point I might have more to say about a particular sparring partner, so to speak. But you know, glass houses. So for now, all I’ll say is: well played; you won.”

- After the run on FTT deepened FTX’s financial woes, Binance said it was interested in acquiring FTX, only to reverse course little more than 24 hours later, leaving one of the biggest crypto exchanges in the world on the brink of collapse, unless another buyer emerges.

- Amid the uncertainty, Bitcoin fell to its lowest point in two years while the crypto market lost more than 20% of its market capitalization before recovering in Friday morning trading in Asia.

See related article: What a difference a day makes: Options for FTX after Binance ditches buyout?