Trading volumes on non-fungible token (NFT) marketplace LooksRare dropped by more than half its daily volume since developers withdrew roughly US$30 million of its native LOOKS token and cashed out in wrapped Ether (wETH)

Fast facts

- LooksRare was averaging daily sales volumes of around US$550 million but fell more than 50% overnight in early February when the developers began cashing out wETH through Ethereum mixing service Tornado Cash.

- Similarly, the price of the LOOKS token has fallen almost 60% since Feb. 10, and was trading at US$1.69 at press time.

- Feb. 8 reports suggest developers had cashed out 23,116 wETH (US$73 million at the time) and ran it through Ethereum mixer Tornado Cash, though pseudonymous LooksRare developer Zodd later confirmed this figure to be closer to 10,500 ETH.

- Zodd said many staff had not taken any compensation for over six months after fronting large sums of capital for the project and that the team earned wETH is publicly disclosed information.

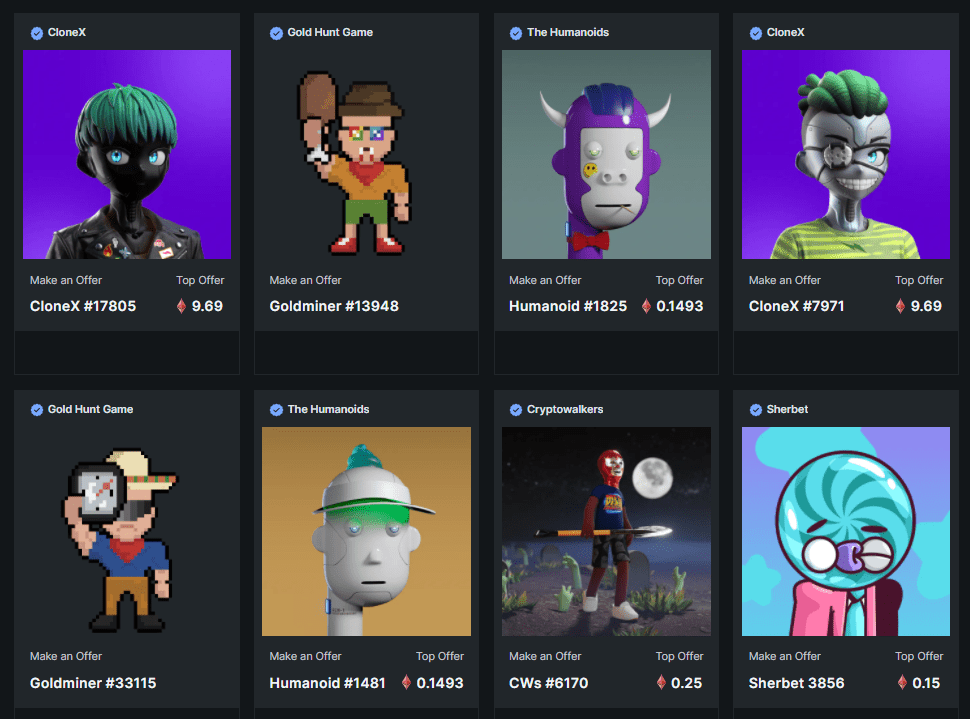

- LooksRare launched on Jan. 10 and quickly overtook OpenSea to be the leading NFT marketplace in terms of sales volumes, but has recently fallen behind the older exchange.

- LooksRare rewards users with LOOKS tokens based on sales, but some industry watchers have claimed this system led to many users engaging in wash trading, artificially increasing LooksRare’s and their own sales volumes.