Amid rising retail and institutional investor interest in cryptocurrencies like Bitcoin and Ethereum, investments poured into crypto firms in Southeast Asia in the first nine months of 2021 surged by over 400% compared with full year 2020 to US$356 million, according to the FinTech in ASEAN 2021 report by UOB, PwC Singapore and the Singapore FinTech Association (SFA) published this week.

Fast facts

- Funding in financial technology (fintech) companies in Southeast Asia surged the first nine months of 2021 to a record high of US$3.5 billion — more than three times compared with 2020. Investment in tech and crypto firms saw strong growth, taking the second and third spots after payments in terms of share of funding, with crypto edging out alternative lending (e.g. peer-to-peer lending platforms) from the top three spots for the first time in six years, the report said. Singapore continues to lead in fintech funding in the region, accounting for 44% of total funding.

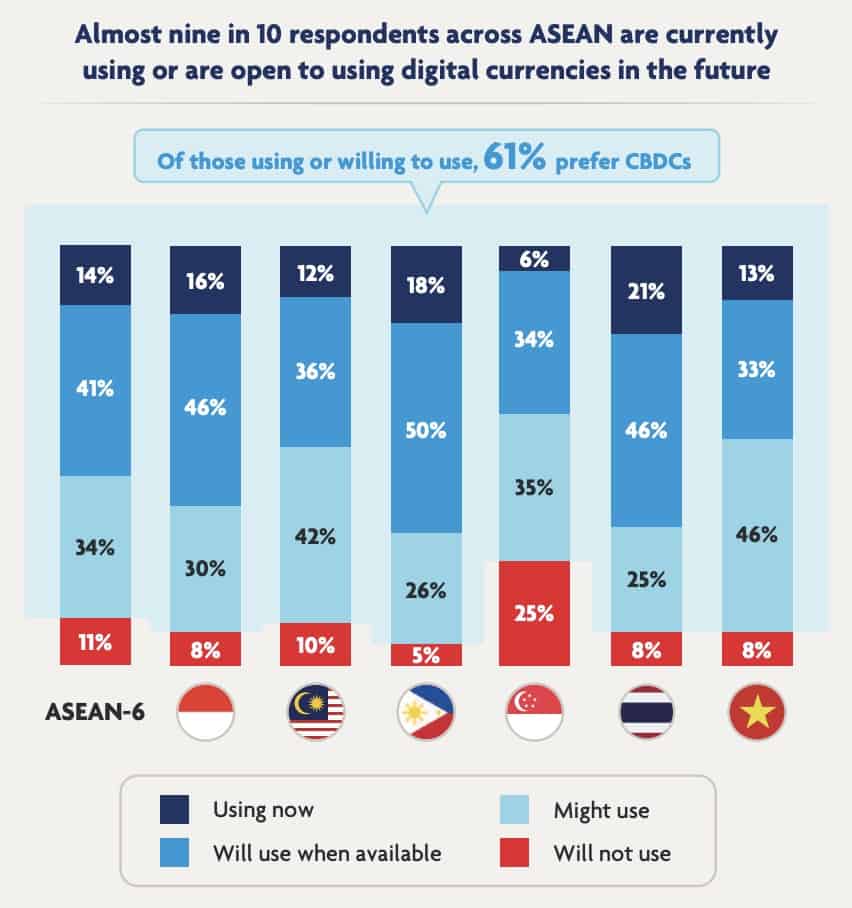

- Although almost nine in 10 in a survey of over 3,000 respondents said they currently used or were open to using digital currencies in the future, only 14% were actually using digital currencies. 61% expressed a preference to use central bank digital currencies (CBDCs). “This shows that digital currencies in ASEAN have not yet reached the tipping point where they enter the mainstream,” the report said. “Most people are still happy to ‘wait and see’ but are encouraged by the growing acceptance of digital currency by established corporations, as well as crypto exchanges being accepted by regulators.”

- “We see fintech regulations in ASEAN evolving … towards the creation of sandboxes and frameworks around emerging infrastructure like decentralized tech (e.g. blockchain), as crypto-based platforms and blockchain startups garner more funding and grow on top of increasing consumer interest in decentralized finance,” said Tan Yinglan, founding managing partner at Insignia Ventures Partners, in the report.

See related article: How Singapore is looking at Web 3.0 and DeFi as it prepares for a digital Singapore dollar