FTX’s exchange token — FTT — has reached a new all-time high following the exchange’s acquisition of crypto derivatives platform LedgerX earlier this week.

Fast facts

- The token hit US$66.33 this morning, according to CoinMarketCap, breaking its previous high of US$61.28, which it set back on May 11, right before the market-wide crash. FTT had been rallying along with the rest of the market from mid-July, but its price jumped over 40% in a matter of days following the acquisition.

- FTT has a market cap of US$6.19 billion, making it the second-largest exchange token behind Binance’s BNB.

- It has not been revealed how much FTX acquired LedgerX for, but the deal will expand the Hong Kong-based exchange’s product offerings to futures and options trading in the U.S. “This acquisition marks a significant milestone for [FTX’s] rapidly growing US business and is a key part of our strategy to bring regulated crypto derivatives to our US user base,” said Brett Harrison, FTX US president, in a statement.

- Founded in 2017, LedgerX is a U.S. Commodity Futures Trading Commission regulated designated contract market (DCM), swap execution facility (SEF) and derivatives clearing organization (DCO).

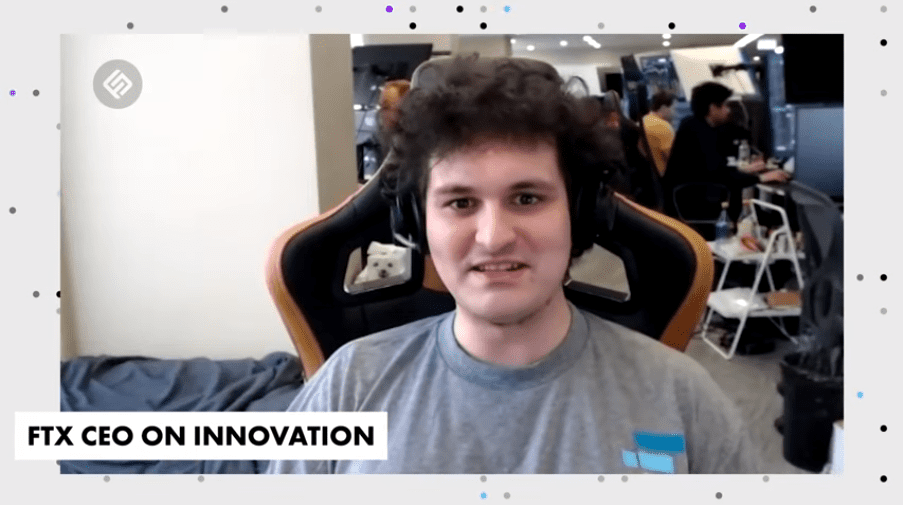

- Speaking with Forkast.News earlier this year, FTX CEO Sam Bankman-Fried said the company was already looking at moving into derivates: “We’re excited for governments to start building out regulatory frameworks and licensing regimes for us to be able to offer that we can acquire for crypto derivatives,” Bankman-Fried said. “That’s going to play a big role in where we shift a lot of our resources to and we’re having a lot of conversations behind the scenes right now and scoping places.” He added that there will be some announcements on that later this year.

- Asked whether there was any chance of FTX going public, he said: “We’re doing the due diligence on that … it’s something it’d be crazy of us not to not to be looking into and trying to understand.”