Nasdaq-listed Coinbase, the largest cryptocurrency exchange in the United States, announced today its plans to expand its business internationally as it seeks to improve its asset-listing process and build a crypto app store.

Fast facts:

- “We’re seeing crypto quickly mature from its initial use case of trading bitcoin to the trading of thousands of new assets, and the adoption of new use cases like decentralized finance (DeFi), NFTs, smart contracts, Decentralized Autonomous Organizations (DAOs), and more,” wrote Coinbase CEO Brian Armstrong in a blog post. “Much of this is relatively new and there are challenges to using it, but I see it as the future of where this industry is going.”

- Coinbase, which is the third-largest cryptocurrency exchange in the world by 24-hour volume after Binance and Huobi, plans to bring more assets more quickly onto its platform by improving its listing process and simplifying its review process.

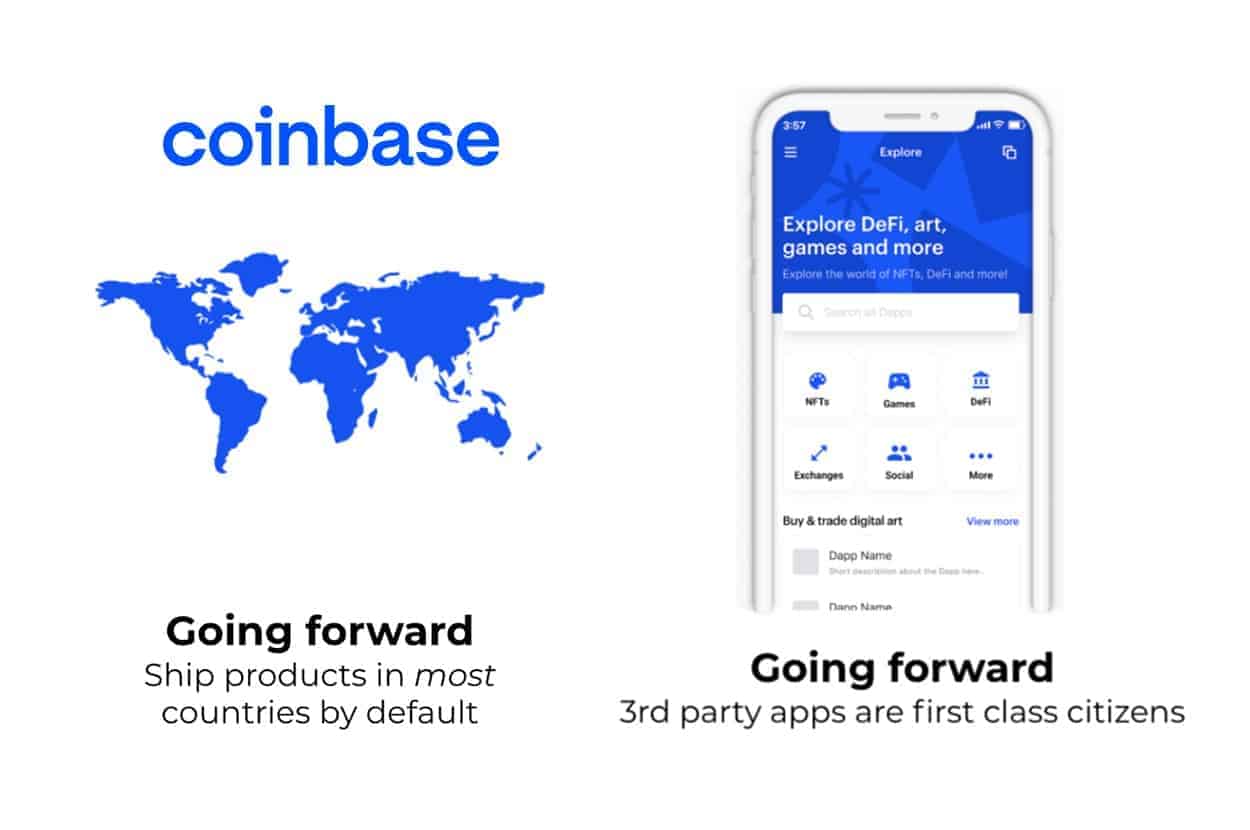

- A crypto app store for third-party apps, accessible via the Coinbase app, is also in the works. “Apple didn’t attempt to build every app for the iPhone, it empowered developers and gave mobile users an easy way to access new innovative apps. We need to do the same in crypto,” Armstrong wrote. “There is now 10s of billions of dollars of economic activity running on dApps, and a new trend coming out every three months.”

- Armstrong also intends to shift Coinbase’s current U.S.-centric focus and adopt an “international-first mindset” by “shipping more products in international markets on day one, while still partnering with regulators in more established markets to ensure our products are compliant with their local rules.”

- Armstrong’s comments come amid increasing scrutiny on cryptocurrency exchanges from regulators around the world such as in Ontario, Canada’s most populous province, as well as South Korea and Thailand. “The pressure to put in place regulations is mounting and we can expect an increase in both regulations and enforcement over the next few months,” Claire Wilson, partner at Holland & Marie, a compliance consultancy, told Forkast.News.

- Binance in particular, has been facing the brunt of scrutiny from regulators around the world such as in the United States, United Kingdom, Japan and Germany. According to a Chainlysis 2020 crypto crime report, Binance also leads all other cryptocurrency exchanges in terms of Bitcoin received from criminal sources in 2019.