While most of the market was down around 5% coming into the Asia trading day this morning, altcoin Stacks was up over 70% in 24 hours on Sunday night, according to data from CoinMarketCap, hitting a high of US$2.45 — the highest point the token had reached since the market-wide crash in May. The price has fallen slightly since, however, and was trading around US$2.10 throughout most of today.

Fast facts

- The world’s largest cryptocurrency, Bitcoin was also performing better than average during this time, only trading down around 1% this morning, though this performance is not the only thing these tokens have in common. Stacks is a blockchain with a smart-contract layer built on top of the Bitcoin blockchain, meaning it offers much of the functionality of smart-contract enabled-Ethereum, but with the added security of Bitcoin. It does this through running all the smart-contract applications on its own network, but settling them on the Bitcoin network.

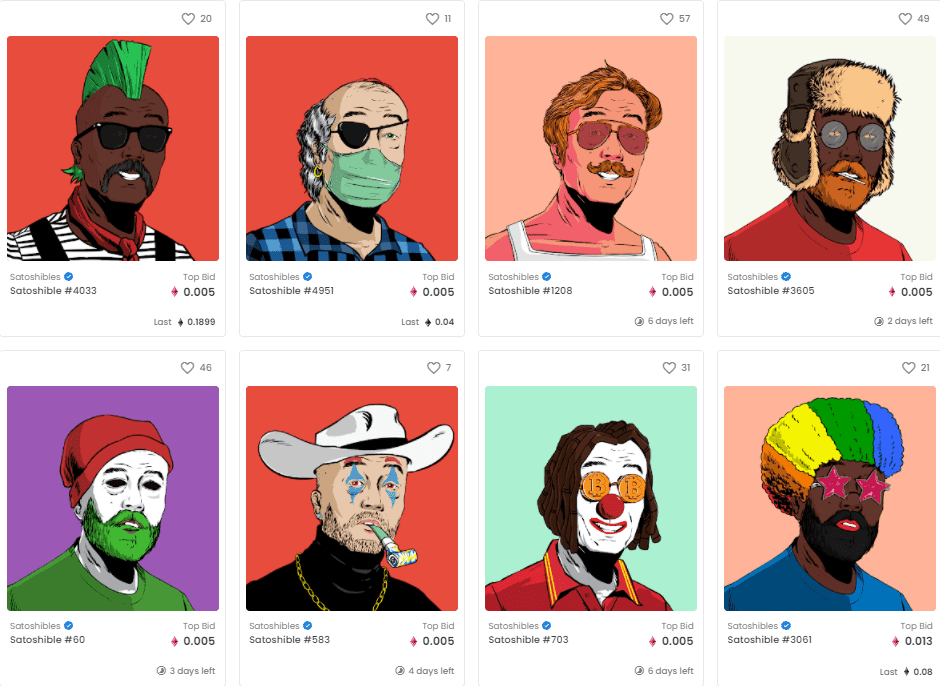

- This allows for non-fungible tokens (NFTs), which have largely been the domain of Ethereum, to be run on Bitcoin, and has created a great deal of interest in Stacks’ own NFT marketplace; last week a 12-year-old sold out a series of hand-drawn pixelated bird NFTs for around US$8,000 in under an hour on the marketplace. It’s also meant that even some Ethereum-based projects are making the move to the Bitcoin blockchain, such as the NFT series Satoshibles, a series of 5,000 hand-drawn illustrations based on the anonymous creator of Bitcoin, Satoshi Nakamoto.

- “Assets moving from Ethereum or other smart contract platforms to the Bitcoin network, albeit on additional layers such as Stacks, is something that we should anticipate [more of],” Ben Caselin, head of research for the exchange AAX, told Forkast.News in an interview. “Generally, I think it’s good from a security point of view, especially as external pressures on smart contract platforms, such as Ethereum, Solana or others may increase over time from regulators who are demanding certain practices be implemented. This is where we can really see the power of Bitcoin’s decentralized nature.”

- “This is a good thing and it is expected,” Caselin added. “However, for it to really take hold and mature, it’s definitely going to take more years of development, research and education. So, to be honest, this rally [on STX] I would say is a little premature. Generally I would say investors should be a little more cautious than simply jumping on the news.”

- As the trading day continued, Bitcoin reversed course, and was trading at US$56,883 at press time, a gain of roughly 2% over the day, as part of an 18% gain over the past seven days, which included it breaking the US$50k mark for the first time since the September selloff. By the end of the Asia trading day, most tokens had also levelled off; Ethereum was up 0.75%.

Correction: Oct. 15, 2021

An earlier version of this story misidentified Stacks as a layer-2 project. According to Stacks, it is a layer-1 blockchain.