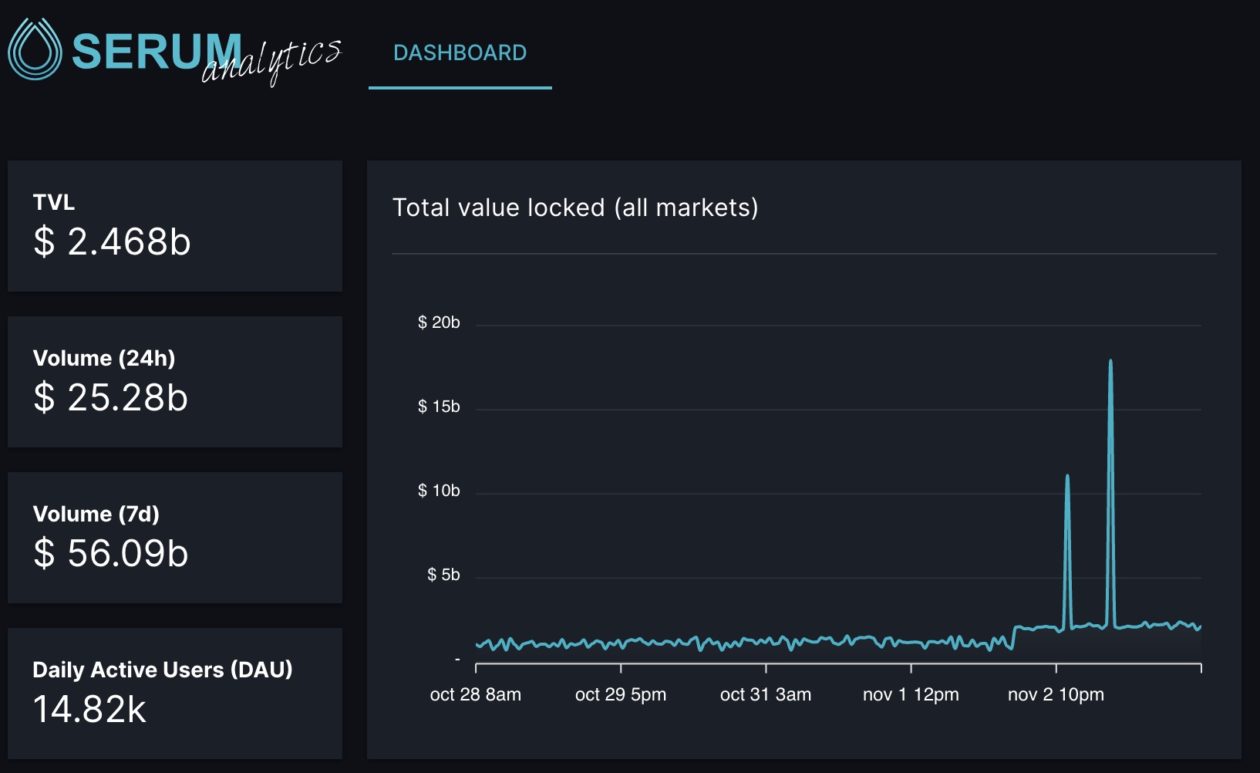

Project Serum, a decentralized exchange on the Solana blockchain, has seen its total value locked (TVL) more than double over the past month to US$2.468 billion, according to data from a new Serum Markets Analytics dashboard launched today.

Fast facts

- Solana — a high performance blockchain and alternative to Ethereum — has been gaining ground in decentralized finance (DeFi) and non-fungible tokens (NFTs). Project Serum is one of the top DeFi projects on Solana. The seven day trading volume on Serum was over US$56 billion, with 14,820 daily active users, according to Serum Markets.

- The newly launched Serum Markets Analytics tool, which uses an indexing solution from Aleph.im, a cross-blockchain computing network and decentralized indexing provider, will enable users to access historical DeFi trading data, including TVL, trading history, daily number of active users, and statistics on the makers and takers (PNL, open orders, fees/rebates) to guide their trades, a media statement said. Users can also search for data on specific market addresses, open orders accounts and owner addresses, which can provide insights into what whales — holders of large amounts of a particular cryptocurrency – are doing.

- Jonathan Schemoul, founder of Aleph.im, told Forkast.News that Serum Markets provides more in-depth data than other tracking apps like DeFi Llama and data on-chain is tracked in real-time.

- “In terms of TVL, Serum Markets page powered by Aleph.im tracks permissioned markets where most high-net worth individuals and institutions trade,” Schemoul said. “One such market is Marinade, a liquid Solana staking market where we can observe a trading volume of US$25 billion in the last day, almost 75% of the entire Serum Markets volume.”