The number of Google searches for “NFTs” has nosedived since the peak of the non-fungible token hype in March, leading some to believe that NFTs — unique digital assets whose authenticity and ownership are tracked on a blockchain — are past their peak. But data shows that the NFT market is still going strong on a number of measures.

According to Nonfungible.com, which tracks NFT projects on the Ethereum blockchain, the NFT market saw over US$700 million in total volume traded in the second quarter of 2021, up from US$500 million the previous quarter. The number of active wallets increased 39% from 127,652 in Q1 to 177,048 in Q2 as the number of buyers and sellers continued to grow.

Collectibles accounted for 66% of all volume traded in Q2, followed by art (14%) and metaverse (7%).

“This explosion in the collectibles segment can be explained by the renewed enthusiasm for CryptoPunks and the launch of MeeBits by the same studio (Larva Labs) over this period,” Nonfungible said.

“Never before have NFTs, in all their forms, had so much visibility as in the recent months,” the platform said. “For better or worse, the future will tell, but without doubt the landscape has fundamentally changed.”

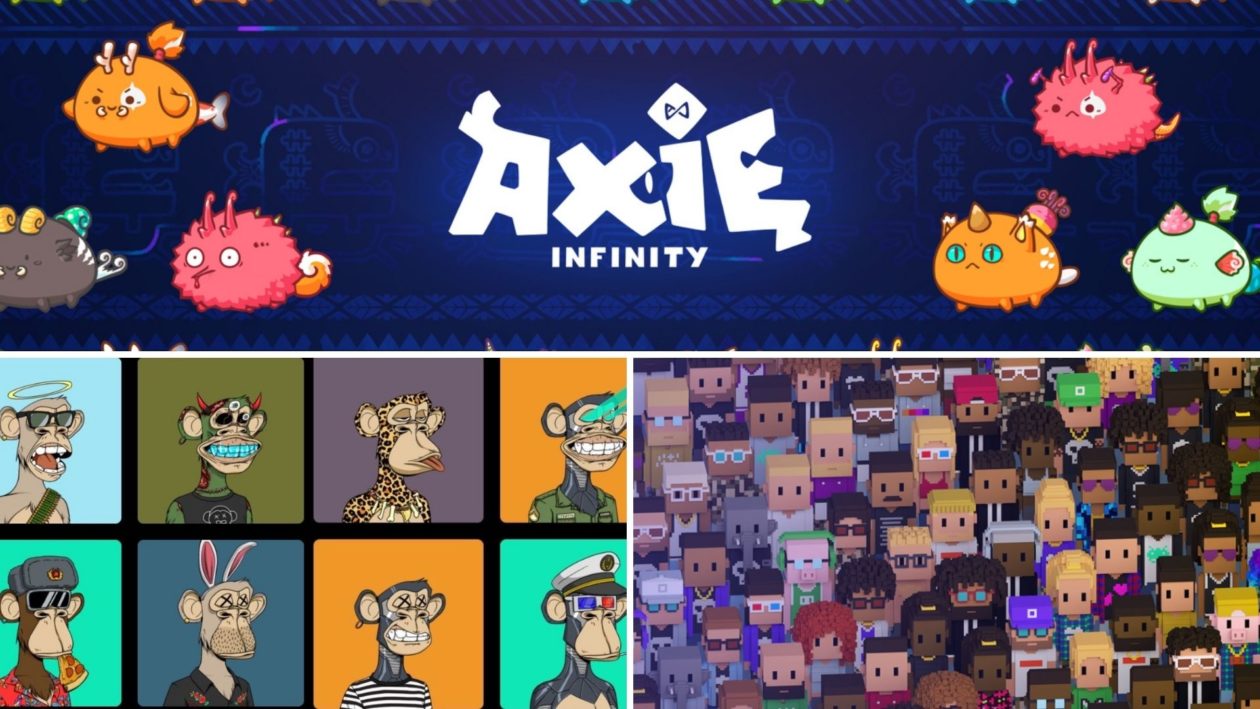

Bored Ape Yacht Club — a collection of 10,000 unique NFTs that launched in April this year — was the top NFT collection on Ethereum at the time of writing, with a trading volume of 1,160 ETH in the previous 24 hours, according to an NFT market data dashboard operated by Nansen, a Singapore-based data analytics platform. The Crypto Punks collection is next, followed by Fame Lady Squad, The Divine Order of the Zodiac and Art Blocks.

Pokemon-inspired blockchain NFT game Axie Infinity, which moved to Ethereum sidechain Ronin earlier this year, has seen phenomenal growth, particularly in the Philippines. Axie Infinity saw US$84.1 million of transactions in Q2, a 769% increase from the previous quarter, with 295,000 daily players, according to a Q2 2021 industry report by DappRadar. The main driver for that growth was the move to Ronin, which allows users to interact with the Axie universe free of transaction fees — or gas fees — the report said.

Another play-to-earn blockchain game, Alien Worlds, which is on the Wax blockchain, is also performing strongly. Alien Worlds, which incorporates NFT and decentralized finance elements, had more than 225,000 users by unique active wallets in Q2 and US$13.8 million in total volume, a 1,397% increase quarter on quarter.

See related article: What blockchain games like Alien Worlds say about life outside metaverses

But NBA Top Shot NFTs on the Flow blockchain, an older, non-gaming related NFT, has been quieter. NBA Top Shot saw its user numbers and trading volume dip by 16.62% and 66.87%, respectively, quarter on quarter, according to DappRadar. Nonetheless, it is still ranked by DappRadar as the second-biggest NFT collection after Axie Infinity based on sales volume and number of traders.

See related article: NFT mania: Are blockchain art and NBA crypto collectibles a fad or the future?

Aside from collectibles and gaming, virtual land sales in metaverses and the “gamification” of DeFi through NFTs are helping the market maintain some momentum.

Other blockchains that offer cheaper and faster transactions are also providing more diverse options in the NFT space. The Binance Smart Chain hosts the projects Battle Pets (gaming NFTs), PancakeSwap (financial NFTs) and BakerySwap (collectible NFTs), and Binance recently launched a “Featured by Binance” decentralized, non-custodial NFT platform in addition to its NFT marketplace. Hic et Nunc, on the Tezos blockchain, has emerged as a popular platform for crypto art NFTs.

“During this bear market little by little, the NFT industry was busy building to the general indifference of most,” Nonfungible said in its report. “The industry had time to prepare itself, grow, experiment and learn, waiting for that moment when the world would start to take an interest. There is still a long way to go and millions of experiences, failures, successes and iterative progress to be made, but the prospects for the NFT Universe is [sic] more than bright.”

See related article: How NFTs are redrawing Asia’s art scene from artists to galleries