Bitcoin’s increasing correlation with risk assets is bringing into question its role as a safe haven in times of economic crisis, undermining the cryptocurrency’s relatively recent acceptance as an avenue for investment.

Bitcoin’s price denominated in U.S. dollars started correlating with the Nasdaq Composite around late 2021, a Forkast analysis showed. Prior to that, prices of the cryptocurrency had been on the rise since July 2021, data showed.

A Rising Tide

“There should be more of a decoupling between Bitcoin and tech stocks or the Nasdaq over the years,” Ben Caselin, head of research and strategy at cryptocurrency exchange AAX, told Forkast. “A recession would definitely imbue that conversation that’s being held around inflation and around loss of purchasing power and the rising and proliferating conversation around sound money,” he added.

The 21-million coin limit of Bitcoin was seen as a bulwark in a sea of incessant monetary supply by central banks around the world. Faced with the prospect of a recession amid Covid-19 related lockdowns, governments and central banks resorted to fiscal and monetary stimuluses despite the specter of inflation.

Through May 2020, central banks and governments had unveiled US$15 trillion of economic stimulus, or about 17% of a US$87 trillion global economy in the year prior, according to estimates by Reuters. The figure covered the “G10” group of major economies plus China, where total stimulus was harder to track, the news agency said.

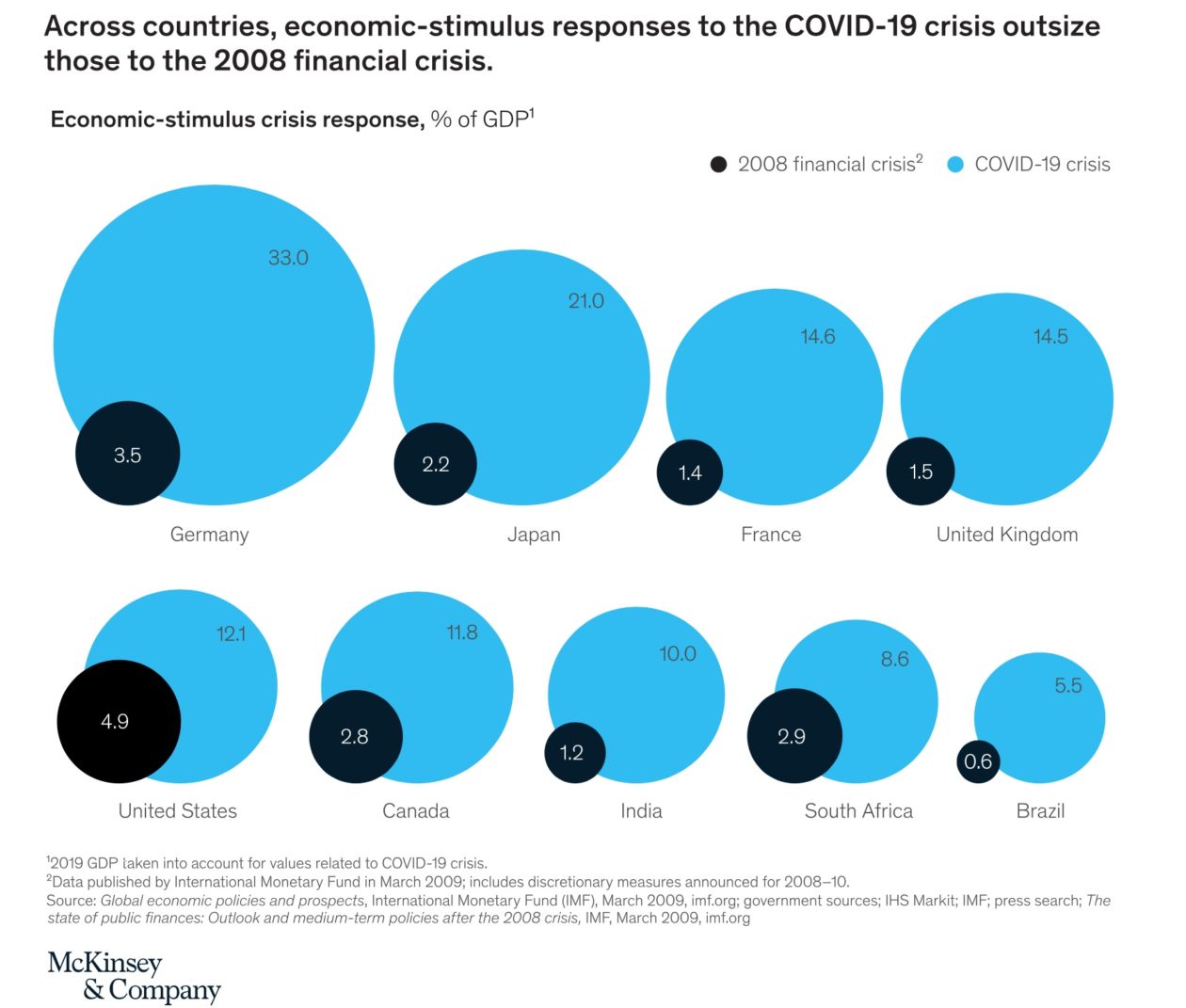

Even at a conservative estimate of about US$10 trillion in economic stimulus, some countries’ response as a percentage of GDP was nearly 10 times what it was in the financial crisis of 2008–09, McKinsey & Co. estimated.

This in turn led to increased prices across asset classes, ranging from real estate to non-fungible tokens (NFTs).

The Nasdaq Composite roughly doubled in value between March 2020 and November 2021 before dropping off sharply in recent months — roughly the same time that Bitcoin peaked as well. Meanwhile, historically inverse correlations between equity markets and gold, and bonds, were also upended.

“That really was the initial propulsion which set Bitcoin up towards that 65,000 high almost a year later,” said Tony Sycamore, a financial markets analyst at City Index, a global FX and CFD trading provider.

But supply shocks resulting from the pandemic-related lockdowns in China, an ongoing war in Ukraine, and rising asset prices are driving inflation. In the U.S., inflation is already at its highest level in 40 years.

The Federal Reserve kicked off its two-day policy meeting on Tuesday, with traders seeing a 93.9% chance of a 50-basis-points increase. If that happens, it would be the second time since 2018 that the Fed has raised the fed funds target rate by a half-percentage point.

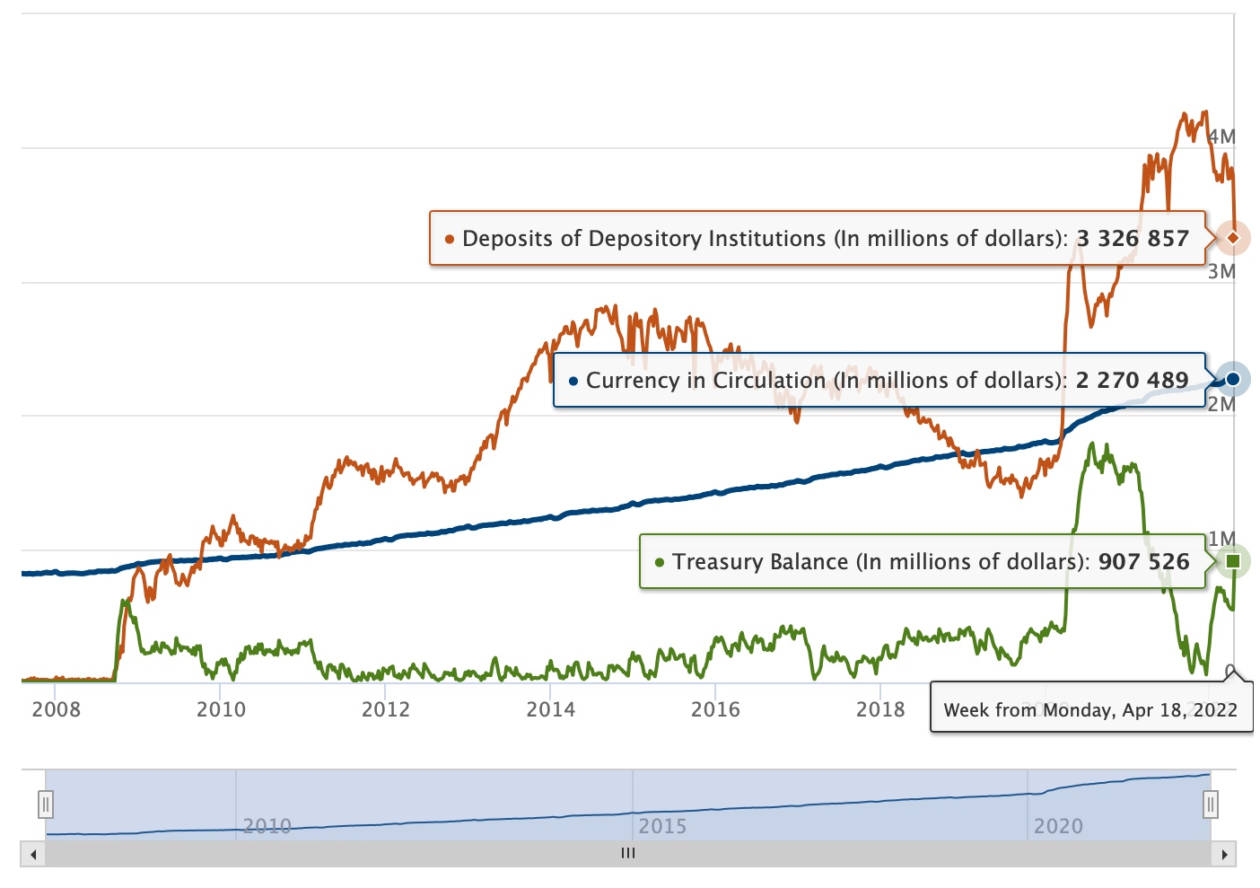

With limited firepower to tweak interest rates, the Fed has also been tapering its bond buying program which had swelled its balance sheet in recent years.

It is widely expected to launch a program to reduce its massive bond holdings by US$95 billion a month, starting in June. All eyes are hence on Chair Jerome Powell’s press conference on Wednesday for insight into what the world’s most important central bank is thinking.

Closer to home, the Reserve Bank of Australia (RBA) increased its interest rates for the first time in 11 years, announcing a 25-basis-points increase to take the cash rate target to 0.35%.

“The Fed and RBA should have started to act probably late last year instead of leaving it till now,” City Index’s Sycamore said. “The fact that growth now looks to be under threat from multiple sources does create the grounds for concerns over a policy mistake,” he added. “And that’s what’s sparking the talk of recession.”

Slamming the breaks

A pivot to a more hawkish policy after years of propping up the economy could potentially lead to heavy volatility and even a recession, Mohamed El-Erian, the chief economic adviser at Allianz AG, the corporate parent of PIMCO, wrote in an op-ed column for the Financial Times.

“[The Fed] will need to move aggressively in hitting the brakes, including by ‘front-end loading’ rate increases as it simultaneously starts to reduce a bloated balance sheet that expanded to a staggering $9tn,” PIMCO’s former CEO and co-chief investment officer wrote. “The risk of recession associated with this is unsettling,” the former chair of President Obama’s Global Development Council added.

“The risk of recession associated with this is unsettling.”

Mohamed El-Erian

His comments came after Singaporean Prime Minister Lee Hsien Loong said the city-state must prepare for more economic challenges as inflation will remain high and central banks are tightening policies. He warned that the world may face a recession within the next two years.

While not calling for an outright recession, economists at Goldman Sachs put the probability of a U.S. recession within the next 24 months at 38% in April.

Bitcoin’s future

Likening Bitcoin to the “jet fueled version” of the Nasdaq, Sycamore said he expects the cryptocurrency’s correlation to traditional markets to continue, striking a less optimistic tone for the world’s leading cryptocurrency.

“These correlations do snap back and revert and change as the narrative changes, but right now it’s very difficult to see that happening,” Sycamore said. “Could that change? Of course, it can,” he admitted.

Clouding matters further is the fact that Bitcoin’s next halving event is expected in 2024. Bitcoin halving refers to when the reward for mining the cryptocurrency is cut in half, theoretically increasing its price but limiting its supply. This would align with the path of a recession, should it occur.

But some opine that the halving event itself won’t affect Bitcoin as much, similar to when there is a stock split.

“Price is not just a dynamic that’s related to the mining rate,” said AAX’s Caselin. With over 19 million Bitcoin in circulation and a market capitalization of over US$700 billion, the impact of the halving is unlikely to be as significant as previously, he added.

Caselin expects some price surge in the lead-up to the event but believes the asset’s market capitalization will hold it in good stead.

“There are now so many different factors at play that it’s difficult for just one to have much of an impact,” Caselin said. “The price is also indicative of the state of the world and the awareness that people have of Bitcoin and how they treat the asset,” he added. “So [the market is] still a very short-term gratification mindset.”

“If we indeed see a recession and then see liquidity start to dry up, see borrowing price start to go up, and people are more critical or deliberate when it comes to their allocation, you may see a rotation back from [altcoins] back to Bitcoin,” said Igneus Terrenus, head of communications at crypto exchange Bybit.

There are key differences between Bitcoin and risk-on assets such as technology stocks tracked by the Nasdaq Composite, pointed out Terrenus. He expects Bitcoin to emerge the stronger of the two as its technology becomes better understood by the broader market.

“Bitcoin is not beholden to any board of directors or corporate structure, nor any transparency issues,” Terrenus noted, adding that it is censorship-resistant (as proven recently in Russia and Canada), has verifiable scarcity, and is more portable and liquid than traditional stores of value.

Add to that its ease of access to regular traders who do not need to be accredited traders to gain access to it, and you have a technology that is likely to weather the storm of recession, Terrenus argued.

“When a recession is coming in, people are going to go out and search for another narrative because this is a technology that is very malleable, very versatile,” Terrenus told Forkast. “It can fit in a myriad of narratives.”

— Sarah Chang contributed to this article.