In this issue

- Grayscale: Bitcoin bears growl

- Circle: SPAC listing and pitching

- NFTs: Piracy on OpenSea

From the Editor’s Desk

Dear Reader,

Once in a while it doesn’t hurt to get back to Econ 101 and the basic law of supply and demand.

Bitcoin holders may want to recall that tenet of economic orthodoxy as the world’s biggest BTC fund prepares to release an avalanche of Bitcoin shares to its investors after a six-month lockup. The headlines are practically writing themselves as people (who should know better) panic over the prospect of a flood of BTC.

In this week’s Current Forkast, we read the small print: supplies of shares are one thing, but supplies of coins are another.

Speaking of supply, there’s an embarrassment of riches at stablecoin issuer Circle as it looks to list in New York. A thumping US$26 billion of Circle’s USD Coins are in circulation, and amid fresh questions over the assets backing them, a law firm has the listing in its crosshairs and a chairman has a target on his back. There may well be much more where that came from, so stay tuned.

Something else that’s in abundance this week is a digital product whose entire USP is scarcity: non-fungible tokens. It turns out that NFTs, like so many things, have spawned a knock-off industry.

When the supply of digital art rises, economics tells us, the price of it will fall. As the unauthorized copycat photo affair casts a shadow over the NFT industry, it seems that scarcity may be harder to commodify than some may have thought.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Grayscale’s Bitcoin fund: fears vs. fundamentals

By the numbers: GBTC unlock date — over 5,000% increase in Google search volume

On Sunday, Grayscale Bitcoin Trust shares with a value of 16,240 Bitcoins will be unlocked after a six-month grace period. They’re among nearly 40,000 BTC worth of GBTC shares to be unlocked this month. The potential impact of the unlocking of more than US$530 million worth of Bitcoin has prompted a mix of predictions from experts and analysts.

- J.P. Morgan strategists are arguing that the GBTC release will prolong Bitcoin’s current bear market.

- But Sam Bankman-Fried, chief executive of crypto exchange FTX, doesn’t believe there would be much of a fallout. “Most GBTC creators are doing arbs [arbitrage trades]; most people getting long are buying in markets,” he tweeted. “So the unlock prob doesn’t really matter for BTC, if people sell GBTC most will buy BTC against it.”

- Meanwhile, Grayscale has announced that its large cap digital currency investment fund has become an SEC-reporting company.

- Grayscale has filed additional registration statements for its Bitcoin Cash Trust, Ethereum Classic Trust and Litecoin Trust.

- Grayscale’s Bitcoin and Ethereum trusts are already SEC-reporting products.

Forkast.Insights | What does it mean?

The unlocking of such a large volume of Bitcoin-backed shares has led many to expect a huge drop in BTC’s price. But if that occurs, it will likely be a result of market panic due to a lack of understanding of how Grayscale’s trust operates.

The Grayscale Bitcoin Trust is the largest traded crypto fund in the world. It is an investment vehicle that allows both accredited individuals and institutional investors to gain exposure to the movements of Bitcoin without having direct exposure to it. They instead purchase GBTC shares, sidestepping the hands-on process of buying, storing and keeping Bitcoin safe.

After an investor buys GBTC shares, their investment is locked up for a six-month period. Once it is unlocked, the investor has the option of either liquidating their shares immediately at the current market price or continuing to hold them to sell later.

An important aspect of Grayscale’s unlocking that many commentators appear to be overlooking is that it is not a cache of Bitcoin itself that is being unlocked — it is GBTC shares purchased by investors six months ago. It’s also important to note that the trust has no redemption mechanism, so share liquidations won’t necessarily force Grayscale to sell the Bitcoin holdings that back the shares.

The unlocking of the GBTC shares and even their subsequent liquidation should not directly affect the price of Bitcoin itself, but a lack of understanding about how Grayscale’s trust works could create short-term bearish anxiety in crypto markets and a self-fulfilling prophecy of a Bitcoin dip.

Bitcoin holders might take comfort from the words of former U.S. President Franklin D. Roosevelt: “The only thing we have to fear is fear itself.”

2. Circle’s USD Coin: What goes around comes around

By the numbers: Circle SPAC — over 5,000% increase in Google search volume

Circle, the issuer of USD Coin, the second-biggest stablecoin by market cap, is planning to list on the New York Stock Exchange via a merger with a special purpose acquisition company. The planned US$4.5 billion deal will see Circle merge with Concord Acquisition Corp.

- Circle will have to file Form S-4 with the Securities and Exchange Commission, disclosing the assets that back the U.S. dollar-pegged stablecoin. Tether, another greenback-pegged stablecoin, revealed its reserves earlier this year, confirming that it was not 100% backed by cash, as many had assumed amid a lack of information to the contrary.

- Circle’s SPAC merger will not be the first time that a cryptocurrency company has gone public in this manner. Last year, a backdoor Nasdaq listing by Diginex — now renamed Eqonex — created what CEO Richard Byworth described as “a buzz” among crypto firms looking to follow suit.

- Law firm Brodsky & Smith has announced an investigation of the planned merger agreement, saying it may violate the law and Concord’s fiduciary duties. Brodsky & Smith says Concord’s shareholders would retain only 4.9% of the combined entity if the deal goes ahead. According to a press release from Circle, Circle’s shareholders would own around 86% of the merged business.

Forkast.Insights | What does it mean?

Circle’s USD Coin has always maintained a transparency advantage over Tether, the world’s biggest stablecoin, whose eponymous operator was eventually shown not to have backed up the currency fully with U.S. dollars. However, Circle’s listing via a backdoor deal comes at a time when transparency around its own coin is in decline.

USD Coin has historically gained points for good governance thanks to its practice of issuing periodic attestation reports disclosing the value of Circle’s investments — a practice Tether has also adopted since reaching a settlement with the New York Attorney General. In an attestation report, an independent auditor verifies information about the investments a coin issuer holds to back its stablecoin.

Before March last year, Circle held all of its customer funds in federally insured U.S. banks. But that had changed by the end of March, following the declaration of Covid as a pandemic and ensuing turmoil on financial markets. According to an attestation report dated March 31, 2020, Circle had begun to invest its customers’ funds in various types of financial assets it referred to as “approved investments.”

Although the March 31 report asserted that the U.S. dollars that Circle held in custody still more than backed its USDC at a 1:1 ratio, the company provided no further information about the nature of its “approved investments,” or even the proportion of customers’ funds it had committed to them.

What’s raising eyebrows is the fact that when Circle changed how it invested its customers’ funds, it had minted only around US$400 million of USDC. Now, however, more than US$26 billion worth of USDC is in circulation.

Circle may very well be investing its customers’ funds in the most prudent possible way, but investors might be forgiven for suggesting that a little more transparency may be in order.

Circle’s decision to list may be comforting to those investors, subjecting the company to more robust reporting requirements and oversight by the U.S. Securities and Exchange Commission. But the timing of the deal’s announcement was unfortunate, coming on the same day that Senator Elizabeth Warren warned of the “highly opaque and volatile” nature of the cryptocurrencies.

And the legal investigation of the merger — to say nothing of the possibility of a lawsuit — raises questions of its own. As does the name on one corner-office door at Concord.

Concord’s chairman is Bob Diamond, a former CEO of Barclays during the global financial crisis. Diamond resigned from the bank in 2012 during the Libor scandal, in which Barclays staff were implicated in the manipulation of global money market rates.

Diamond has been blamed for fostering a profit-at-all-costs culture at Barclays that led to the scandal. Longtime Financial Times economics commentator Martin Wolf said of him: “After the financial crisis, the British establishment became very divided over what’s the model for the big banks that we want to see. Bob represented investment banking big time. He represented the success of it — but also the sense that investment banking is dicey and not a completely sound business. He represented a way of doing business that we’ve become very uncomfortable with.”

Diamond is in line to join Circle’s board following the planned merger, becoming a key figure in decisions about the USDC stablecoin at a time when its issuer’s investment strategy is at its most opaque.

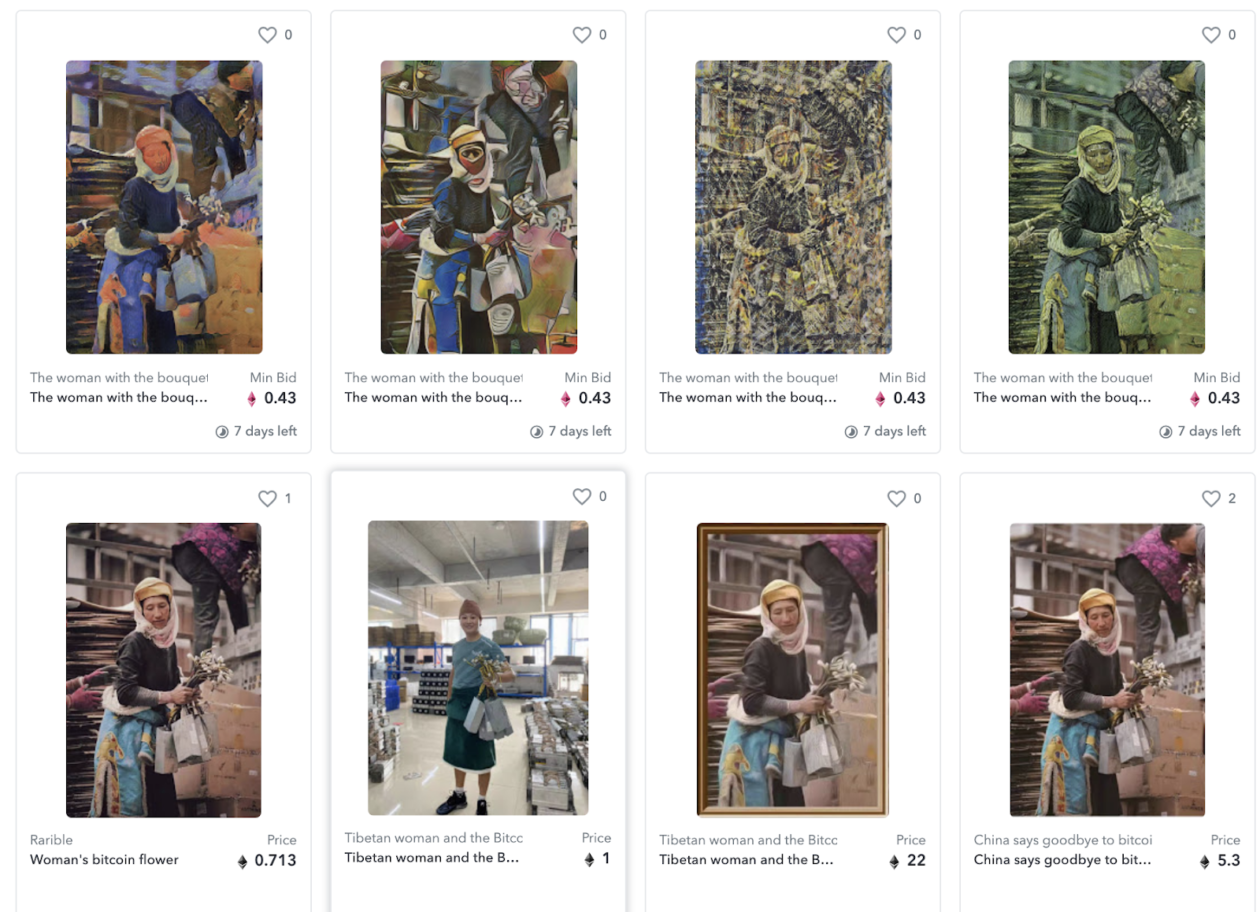

3. In China: the NFT copy-and-paste crowd

A photo of a Tibetan woman holding crypto mining computer components went viral on social media in China this week and spawned a slew of non-fungible tokens, all for sale, associated with unauthorized copies of the original. The episode is raising concerns over what protection of property rights NFTs afford their creators and owners.

- On Monday, Chinese business media outlet Caixin published a story on the exodus of cryptocurrency miners from the country. The story was accompanied by a photo of a woman clutching a number of crypto rig components — an image that took social media by storm. Users of Weibo, the Twitter-like microblog platform, said the picture had captured an historic moment in the industry and — with no apparent irony in a country where independent journalism is not tolerated — that it deserved a Pulitzer prize.

- In less than two days, more than 30 artworks derived from the photo had been listed on OpenSea, an NFT trading platform. One user listed an NFT entitled “The Woman with the Bouquet in Her Hand” for 2,021 ETH on the platform, eventually selling it for just 0.1 ETH. The wave of copycat versions of the photo has triggered questions about whether Caixin’s copyright was infringed and the risks that NFTs may pose to the intellectual property rights of artists and other creators.

Forkast.Insights | What does it mean?

The market for NFTs appears to be going from strength to strength, but the pirating of Caixin’s copyrighted photo is certain to prompt lively discussions of intellectual property rights.

Art theft in the digital world is not a new problem, and although NFTs have been lauded for supposedly giving digital artists a bigger market and greater control over their creations, the technology may have also handed unscrupulous individuals an easier means to profit from other people’s art.

As reports of NFTs selling for astronomical prices continue to make headlines, an alarming parallel trend has emerged, with a proliferation of renegade NFT creators selling art and media they didn’t create.

All over Twitter, creative types are reporting seeing their original art for sale as an NFT on NFT platforms. Some so-called fans have even been brazen about what they assert is their right to mint such pieces. Artists are entitled to legal protections when their work is stolen, but copyright enforcement in the borderless and often anonymous digital world is difficult.

In the U.S., one mechanism for creators who believe their work is being misappropriated is to file a Digital Millennium Copyright Act takedown notice against any site selling an NFT copy of those works. The DCMA was established to address the dissemination of copyrighted material online, but it is only valid in the U.S.

Intellectual property rules in China are, at least to outsiders, less clear cut. At present, legal issues specific to NFTs from a regulatory standpoint and the protection of intellectual property have not been tested in Chinese courts. However, according to the Copyright Protection Center of China, “anyone who exploits a work created by others shall conclude a contract with, or otherwise obtain permission from, the copyright owner.”

In the case of Caixin’s photo, it appears that anyone who has minted an NFT from the original may be in straight-out violation of China’s copyright rules, despite the pretty filter. But how to catch a digital thief — and is the chase and litigation worthwhile when the damages amount to just 0.1 ETH?