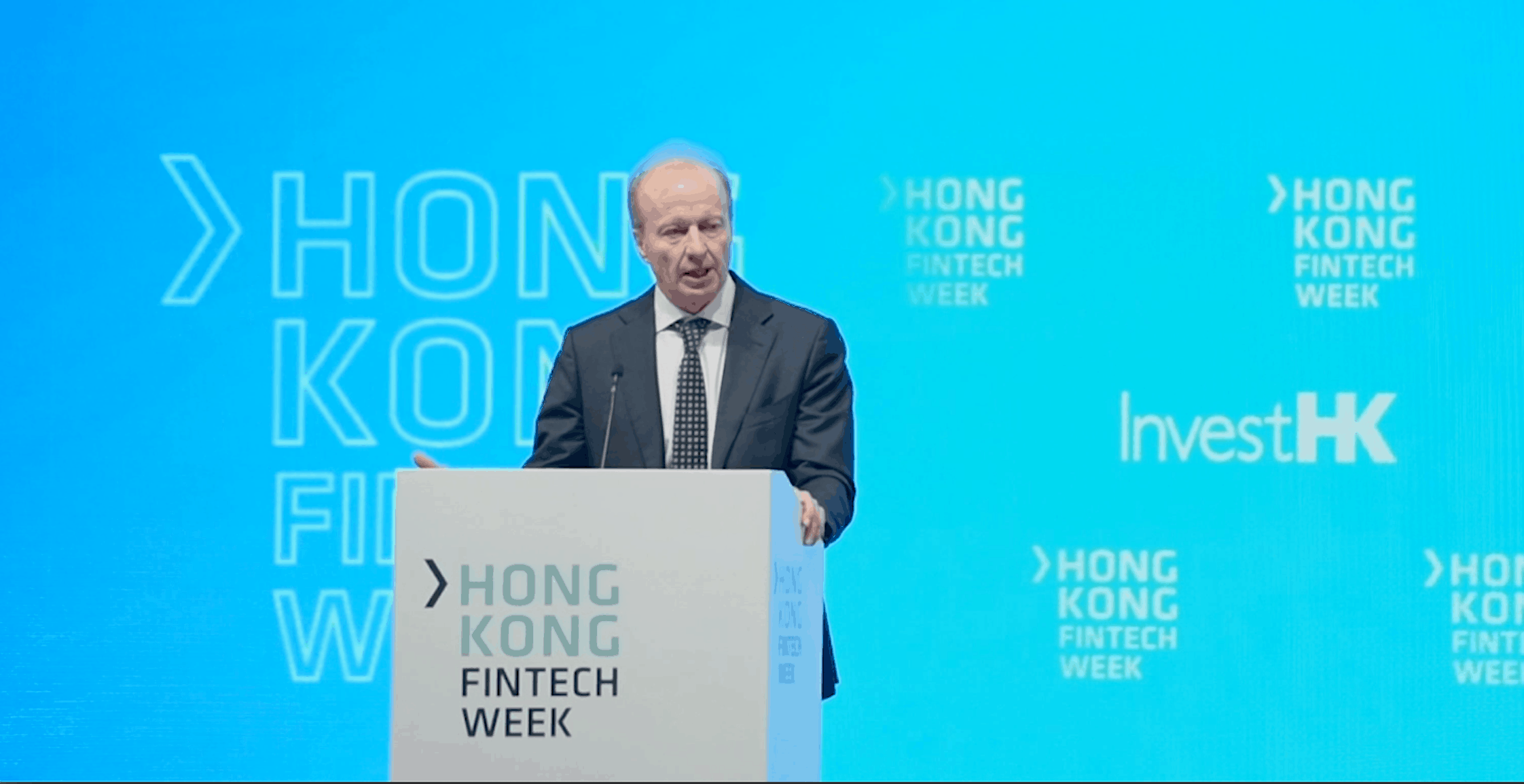

Speaking from the main stage of Hong Kong FinTech Week, Securities Futures Commission (“SFC”) CEO Ashley Alder said the SFC will publish a new regulatory framework that would allow it to regulate virtual asset trading platforms.

In a highly anticipated keynote speech at Asia’s largest global financial technology conference, Alder noted the new regulations will adapt the “standards we expect of conventional securities brokers and automated trading systems” to deal specifically with virtual assets. The framework will seek to accommodate concepts specific to crypto assets – hot and cold wallets, forks and airdrops – within the familiar landscape of traditional financial infrastructure.

See related: WATCH: Behind-the-Scenes Conversation with Ashley Alder, CEO of Securities and Futures Commission

Near the end of his remarks, Alder noted the SFC would issue a second statement later in the day to clarify the illegality of crypto futures trading. “Those who offer virtual asset futures for trading may well be conducting an illegal activity, either under the Securities and Futures Ordinance or the Gambling Ordinance,” he said. In September, cryptocurrency exchange and futures trading platform Bitmex abruptly stopped serving customers in Hong Kong.

While the announcements are seen as a major development in the crypto world, Alder himself acknowledged the SFC’s limited power to regulate exchange platforms. Only platforms that trade crypto assets that are legally “securities” or “futures contracts” would fall under the SFC’s purview. As long as a crypto exchange avoids offering these types of assets, its compliance with SFC regulations would be purely on an “opt-in” basis. Industry watchers will observe how Hong Kong’s crypto exchanges weigh the legitimacy conferred by an SFC license against the cost of voluntary compliance.

The SFC’s decision to regulate Hong Kong’s crypto exchanges is understood to be the first step of many, with Alder vowing “much more to come over the next few months.” Spurred largely by Facebook’s Libra cryptocurrency project, financial authorities and politicians are acutely aware of the possibility that large-scale adoption or implementation of crypto assets — and its potentially disruptive effects — could occur with unprecedented speed through the U.S. social media company’s enormous global user base.

Alder called for an unprecedented level of coordination among the “full range of domestic data privacy, financial stability, competition, anti-money laundering, and consumer and investor protection authorities” both domestically and globally.