The US$258 billion lawsuit filed against Tesla CEO Elon Musk by an American Dogecoin investor accusing him of running a Dogecoin cryptocurrency pyramid scheme is heating up as new players are summoned in the case.

See related article: Markets: Dogecoin still in the dog house; Bitcoin, Ether make up some ground

Fast facts

- First filed in June by New England electrician Keith Johnson, the lawsuit has added seven new plaintiffs, all investors who lost money in Dogecoin, and six new defendants. In addition, summonses in the civil action case were sent to Musk and other defendants on Wednesday.

- New defendants include Musk’s tunnel construction business Boring Co. and the Dogecoin Foundation, which calls itself a nonprofit that provides governance and support for Dogecoin.

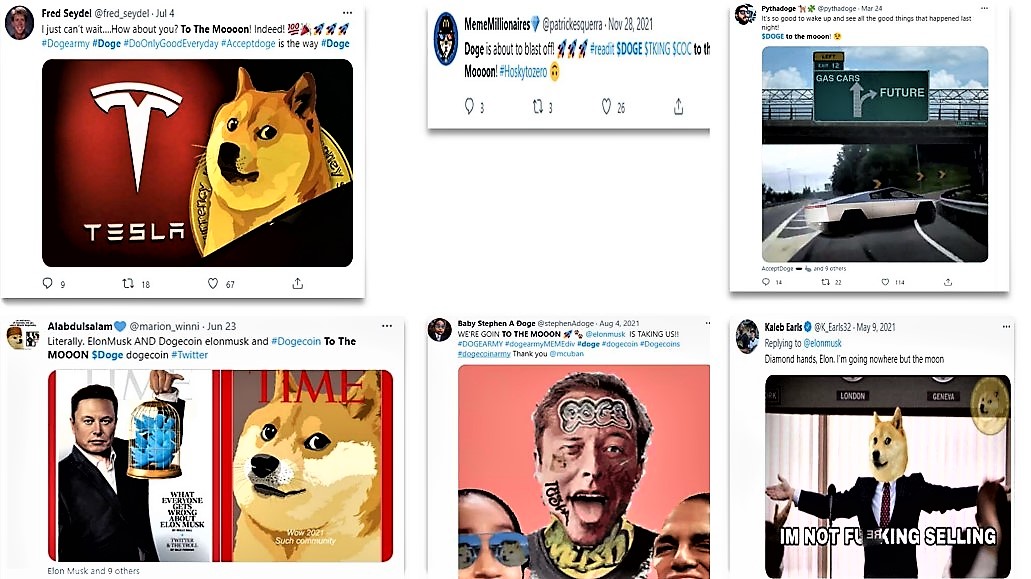

- Other defendants in the case include various developers of Dogecoin, online influencers who pushed the digital asset, and Billy Markus and Jackson Palmer, the software developers who founded Dogecoin, initially referring to the project as a joke.

- The suit alleges the defendants drove up the price of Dogecoin more than 36,000% over two years and then let it crash, walking away with tens of billions at the expense of other investors.

- In a May 2021 appearance on Saturday Night Live, Musk called Dogecoin a “hustle” during a sketch, which triggered a real-time crash in Dogecoin prices. The coin never recovered, dropping about 90% in value since, according to CoinGecko data.

- The recent press surrounding Musk’s case has correlated with jumps in the price of Dogecoin, with it up about 5% to US$0.06 since the filing, according to CoinGecko at publishing time.

See related article: Pumped by Elon Musk, Dogecoin gains amid slow market recovery