As more countries around the world including China ramp up efforts to digitize fiat currency, experts predict digital currencies will become a global norm within the next 10 years. Should there be greater discussions over how governments’ use of digital currencies will affect privacy?

“I think the topic of central bank digital currencies (CBDCs) at this point just has too much momentum to reverse or go the other way, so I think that 5 to 10 years from now, the world is going to be digital currency-driven,” said Kevin Kelly, co-founder at New York-based Delphi Digital, which provides institutional-grade analysis on digital asset markets.

Highlights

- “I think [Paul Tudor Jones’ endorsement of bitcoin] certainly sets a pretty large tailwind for bitcoin and crypto more broadly, because… it’s not as if they’re putting all their eggs into the bitcoin basket.”

- “A lot of the times these massive sell-offs in bitcoin actually present pretty attractive entry opportunities because the market is able to bounce back relatively quickly.”

- “If this market is going to become a mature asset class, then the regulatory scrutiny and regulation is a byproduct of that”

- “Right now, volatility is certainly something in the short term to be on the lookout for, but, we’ve never had more conviction in the long term value proposition of bitcoin.”

CBDCs are digital versions of cash, which are different from the electronic money consumers are already accustomed to using through credit cards and online payments, which only represent money. Most major economies around the world are racing to develop their own CBDC, and China recently reached the milestone of being the the first major country to trial one. Its electronic renminbi, called Digital Currency Electronic Payment (DCEP), recently piloted in four major areas of the country.

See related article: China hopes its new digital currency will internationalize the RMB. When might that day come?

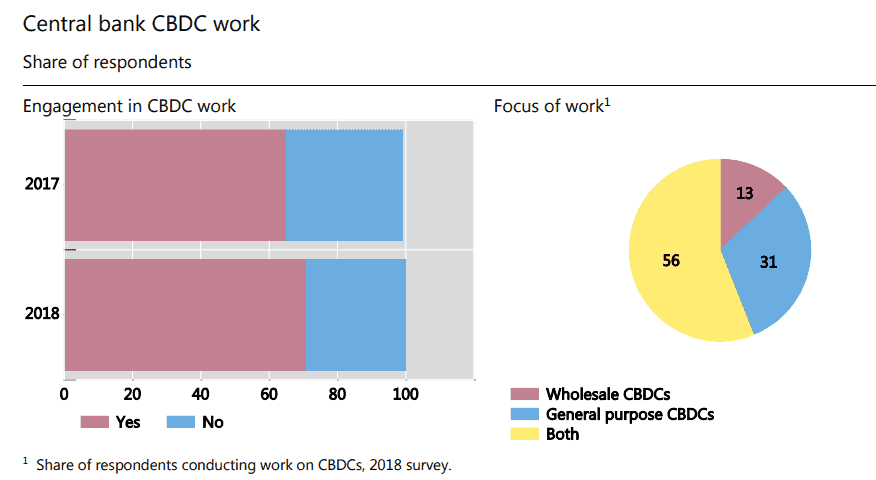

Other countries may not be far behind. A study by the Bank of International Settlements found that 70 percent of central banks participating in the 2019 survey are currently, or will soon be engaged in CBDC work.

Ukraine has also recently revealed that it is testing open-source blockchain protocol Stellar to link its fiat money to cryptocurrency Stellar Lumens as an “off the shelf” solution instead of developing a CBDC from scratch, as reported by Forkast.news.

“CBDCs was exactly the type of digital money Stellar was designed for,” said Stellar CEO Denelle Dixon, at a recent blockchain conference.

The coronavirus pandemic has also triggered lawmakers in the U.S. to propose a digital dollar, stoking the flames for greater adoption of digital assets.

“As older generations become more comfortable with that digitally native world, you can make the argument that that could be an acceleration or a gateway for people to get involved in the emerging digital asset market and I hope things like bitcoin,” said Kelly.

Will CBDCs trigger privacy concerns?

However, privacy concerns relating to CBDCs granting governments greater control over the flow of money, as well as the ability to track transactions, puts a damper on some experts’ assessments.

“Where my concerns around the rise of these central bank digital currencies comes in, is obviously just the flip side of the technological advance in terms of surveillance and ways in which these governments could potentially limit the way in which you use that currency,” Kelly said.

But others believe it likely would be impractical for governments to use CBDCs for surveillance purposes.

“Real time detecting fraud is different from getting to the point where I know everything that a citizen is doing… it was not clear at all that whether [China’s DCEP] gets to the extremely micro level, knowing what everybody is doing.” said Zhiguo He, professor of finance at the University of Chicago Booth School of Business, in an interview with Forkast.News. “To be honest, that’s very, very costly.”

While it remains to be seen how different countries will develop and implement CBDCs, privacy debates around the collection of big data and surveillance will likely become more common.

“I sit in the more optimistic camp that I think [CBDCs] will be more of an organic gateway to the digital asset world,” Kelly said. “But there are certainly risks that we won’t face for at least a few years but are certainly trying to become part of the conversation now that I think people should at least be aware of.”

As CBDCs continue to grow in relevance in the financial world, cryptocurrencies that are decentralized and uncorrelated to conventional assets or fiat may also rise in tandem.

“Bitcoin’s not backed by anything tangible, but if you want to talk about the demand for a non-sovereign, apolitical, digitally native, hard cap supply, censorship-resistant digital asset, I find value in that and there’s a whole cohort of people who find value in that,” Kelly said.

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the world of blockchain and adjacent emerging technologies like AI, 5G, and IoT quantum, all at the intersection of business, politics and economy. It’s what we cover right here on Forkast.News.

Well, multi-trillion dollar relief efforts, monetary stimulus, never-ending, never-ceasing, and a global economy that is on the brink. So what does this mean for bitcoin and cryptocurrency? Has the moment arrived for mass adoption, for institutional investment into bitcoin as a hedge against monetary policies that have run amok?

We’re going to explore all of that. I’m Editor-in-Chief Angie Lau, Forkast.News, and these are questions that Kevin Kelly covers a lot with his team at Delphi Digital, a New York-based independent research boutique providing institutional grade analysis on the wide world of digital assets. So, Kevin, it is great to have you back on the show.

Kevin Kelly: Thanks so much for having me.

Lau: Well, these are interesting times, these are stressed times. In the midst of all of this, you just launched your State of Bitcoin report, and it’s a pretty comprehensive look in assessing the cryptocurrency, digital gold hedge play, whatever you want to call it. Let’s assess what’s happening — especially right now as we remain locked in place and Covid-19 rages on — in terms of the global dynamics that’s driving moves in bitcoin and cryptocurrency right now.

Kelly: Well, first off, thanks so much for having me back. Always love to catch up with you. And yes, it is certainly a very interesting time in the world of global macro, especially as you’re starting to see more interest in bitcoin and crypto assets. We came out, as you mentioned, with this State of Bitcoin report last week, in part because, yes, the bitcoin halving was certainly a major event, but I don’t necessarily think it was just the fact that you had the issuance cut in half. I think the bitcoin halving, the timing of which, we had this most recent halving, is almost more significant.

Because if you think about what happened on a programmatic kind of set schedule, everything went off pretty seamlessly in terms of bitcoin’s own programmable monetary policy reducing its issuance rate of BTC coming to market at a time when the backdrop is this world of fiat abundance that you were just alluding to. You have policymakers — as we start to, I won’t say get used to this new normal, but as we’re starting to get into the third month or so of Covid-19, the aftermath of Covid-19, we’re starting to deal with that — I think policymakers now sit at a very critical juncture because what we’ve seen is, yes, multi-trillion dollar monetary and fiscal stimulus efforts and programs to try and “keep the motor running,” I guess you’d say, on the global economy, because this obviously isn’t just a U.S. issue; this is something that’s happening globally.

So you’ve seen global policymakers really come together in terms of the amount, and even the speed at which they’ve brought the stimulus into the market, trying to keep markets afloat. But I think policymakers right now are at a very critical juncture because I think the idea of a V-shaped recovery, the odds of that are starting to dwindle by the day. And so people are starting to really wake up to the longer term impacts of what’s going on in this new normal we’re going to be in, this paradigm shift after Covid-19 wanes, or the aftermath wanes a bit. And what I think is important is policymakers are going to be forced to basically address two different paths.

They can either address this by continuing to pump money into the markets and creating these large fiscal stimulus efforts to keep the lights on, or they can take a more fiscally conservative route and risk potentially even greater economic damage, in which case they would most likely have to come in and provide some relief anyway, and oftentimes in a much more dramatic form.

And so right now, how it kind of all ties back into the outlook for bitcoin is, I think you’ve seen an acceleration in terms of not only the public, but the institutional awareness of what’s happening right now, people really waking up to and asking the simple questions of where is this money coming from? How is the Fed able to print as much money as it is? How can you have the Fed’s balance sheet expand by north of three trillion dollars in such a short period of time? And people are starting to wake up to what the long-term ramifications or consequences of that will be. And that’s what’s really driving a lot of the interest, both from a retail perspective, but also from an institutional perspective into bitcoin and then, you know, more broadly, crypto assets.

Lau: To your point, Paul Tudor Jones, a legendary name in hedge funds, he’s not the first, but possibly the first one who’s truly opening the doors for a lot of peers and institutional and accredited investors to join alongside his bet into bitcoin. He’s made headlines, essentially, saying that up to 2% of his holdings at the moment is in bitcoin.

This kind of green-lights a lot of the thinking on bitcoin, especially during these macroeconomic headwinds, as you’ve highlighted. What does that sentiment mean for cryptocurrency markets, for liquidity?

Kelly: Absolutely. I think you hit the nail on the head; I think [Jones’ endorsement] certainly sets a pretty large tailwind for bitcoin and crypto more broadly, because again, if you go through and you listen to him talk or you go through their investor letter, it’s not as if they’re putting all their eggs into the bitcoin basket, right? He basically lays out the argument that a lot of us have been at least trying to get into the mainstream for a little while now, and he does it very elegantly. He looks at it and he says, even if you’re just a rational actor and you’re taking a probability-weighted bat, the odds of asymmetric returns and its return profile for bitcoin is so high that a one to two percent allocation can actually be quite material on the upside.

But on the downside, even hypothetically, if there’s a non-zero chance bitcoin goes to zero, it’s not like they’re betting the house on this move. And he talks about what’s going to be the fastest horse in this kind of environment, this kind of race. I just think what he did and what their firm did with that note and really taking the rational, pragmatic approach not only gave investors, a lot of institutions, kind of a wake up call saying, OK, we need to look at this again, but it also gave everyone kind of the green light, because again, you don’t necessarily want to be the first person in the water when it comes to something like bitcoin or an emerging asset class. But now that you have somebody of that caliber who has come out publicly and said they’re investing in this space and are looking to invest potentially even more in this space.

I certainly think that that has a lot of people over the last couple weeks going back to the pad and paper and doing their own due diligence right now. And I can say from our standpoint, we’ve certainly seen an increase in inbound inquiries – just wondering, again, from more sophisticated investors, what is the risk return profile of bitcoin? What are the metrics they should be looking at? How they understand this asset, this emerging asset class. And so it seems like, you know, it was a one day kind of headline type event, but I certainly think, to your point, the longer term ripples of that, we’re going to continue to see.

Lau: Yeah, two things that he’s saying very clearly about it, which is concern about the strength of the U.S. dollar, global economy, stimulus that really dilutes fiat currency, that’s one. But secondly, also valuing bitcoin beyond its utility case and really seeing it as its own version of digital gold. [Jones] very famously made a huge gold play in his early career that really settled him into legendary status. Those two things are coming to a head for bitcoin almost.

Kelly: Absolutely. And yeah, him saying that bitcoin reminds him a lot of gold in the early 70s, I think definitely tipped the hat for a lot of people as well just given his track record and given his prior investment experience with precious metals. What’s interesting there as well is, when you talk about a lot of “crypto adversaries,” I guess you’d say, they point to the fact that bitcoin isn’t backed by anything, right? And a lot of people come back and say, okay, well, what’s a dollar backed by? And then there’s this whole kind of back and forth.

I think what’s really interesting and unique and honestly quite fascinating about bitcoin is the more people you talk to, the more perspectives you get on how subjective bitcoin’s value is. And what I mean by that is, from my perspective, for example, today, I would say, sure, maybe bitcoin’s not backed by anything tangible, but if you want to talk about the demand for a non-sovereign, apolitical, digitally native, hard cap supply, censorship-resistant digital asset, if I find value in that and if there’s a whole cohort of people who find value in that (and again, the way in which the world is accelerating towards, right, and the whole de-globalization movement, you can even toss populism in there if you wanted to), the demand for that type of asset, that is extremely unique, I certainly think warrants a certain value, or I could put a price tag on that.

So I think what’s really interesting is just the kind of evolution of how people are starting to value bitcoin or think about bitcoin. And what fascinates me is I don’t necessarily think there’s ever going to be one perfect metric or indicator of valuation methodology to come up with what the intrinsic value of something like bitcoin should be.

Lau: I mean, that’s a philosophical dilemma, right? But at the end of the day, if you’re going to ask people to back this with a price, it’s got to be tied to something that people can calculate, that can take a look at metrics or formulas that associate the value of bitcoin against the value of other assets. And so in that, as we try to figure out what the fundamentals are in this space, is that an impossibility still, or are we starting to see the real fundamentals starting to be defined for bitcoin right now?

Kelly: Yes, it’s a really great question, it’s what we spend a lot of our time contemplating and trying to work on. I would say if you fast forward to today versus even twelve months ago, I certainly think that fundamentals are becoming more widespread or more accepted. But when we talk about fundamentals, I think it’s important to note that those also can be a bit subjective as well, because something like bitcoin versus Apple stock, as a very easy example, the fundamentals you would evaluate Apple on would be very different than bitcoin, we know that.

What I think the challenge and the excitement is, is trying to come up with ways in which you create these new fundamental indicators using things like on-chain analysis. I’ll give you a really quick example: we look at things like UTXOs (unspent output from bitcoin transactions), which are unspent transaction outputs for bitcoin. And basically what that allows us to do is, you can see, across the entire Bitcoin network, the last time bitcoin was moved, and based on what the price was at that time, you can create these really interesting longer-term kind of trends and look at different cohorts of holders, so people who have held bitcoin, or the amount of bitcoin that hasn’t moved in six months, in a year, in five years. And what that transparency allows you to do that you actually can’t really do in other asset classes, is to create these really interesting fundamental metrics.

And you can look at how the behavior, the trend, the holder trends change over time, through different bitcoin cycles. And again, maybe it’s not something that is as ubiquitous as a price-to-earnings ratio today for the stock market, for example. But I think a lot of these metrics and these fundamental on-chain metrics are starting to become more of the standard for which people are at least evaluating or getting an idea of where bitcoin could be trending or what its price would be, things of that nature.

Lau: Do you think we’re going to get to a point in the next couple of months where we start seeing a much steadier rate of growth and/or even limited bands of volatility? I mean, the one thing that just turns so many people off right now is massive swings, upside, downside, and it’s really just hard to calibrate.

Kelly: It’s certainly, I would say, especially when you talk about institutional investors, who we kind of group into this giant bucket, but even if you go outside that space and you look at financial advisory or private wealth management, that’s a massive market with a ton of capital we’ve got. We’ve seen, again, an increase in the amount of RIA (registered investment advisors) or wealth management clients that we actually serve and talk to. And that is one of the biggest, I won’t say complaints, but hesitations – it’s just the volatility.

Oftentimes, yes, you have to address that, you have to understand that this is going to be a volatile asset on an intraday basis or an intra-week basis, but I think two points that we typically tend to point towards is, one: a lot of the times these massive sell-offs in bitcoin actually present pretty attractive entry opportunities because the market is able to bounce back relatively quickly. A lot of times it’s more technical sell-offs or liquidations because people are using leverage, things of that nature, so they’re much more short term in nature. If you look out over longer periods of time, whether it’s 60 days, 90 days, or looking over a full year, that volatility is still certainly higher than other asset classes, but it’s not as volatile as I think a lot of people expect.

The second point that we tend to push people towards is the fact that volatility itself, I think, is often misunderstood as well, because there are two sides to volatility. You have your downside volatility and your upside volatility. We as a collective group, [are] the Bitcoiners, who really, truly believe in what this thing can be long term – and we expect it to have very outsized returns over the next, let’s call it 10 years or so, it’s almost like we’re trying to have our cake and eat it too; you have to take the good with the bad.

So if you want excess upside volatility for a certain asset, then you’re going to have to accept the fact that there are going to be times in which it rears its ugly twin head and you’re going to have massive sell-offs or potentially, you know, 30, 40, even 50% drawdowns. And so that’s why we feel strongly that it’s important to have a long term conviction and understanding of the thesis and the reasons why you think bitcoin or other crypto assets will have value long term, because that will help you hold steady in those times and even potentially add a little bit to your positions at opportune moments when you see these drawdowns and sell-offs.

It becomes more of, again, thinking about it from an opportunity perspective rather than “I just lost 40% of my bitcoin holdings because there was a huge cascading liquidation effect that happened on one of these largely unregulated exchanges.”

Lau: Speaking of which, a lot of these bitcoin derivative trading platforms have become really popular over the past few years; regulators around the world don’t always appreciate it. They’ve certainly taken a keen interest. We’re seeing a lot of it drive volumes, but how has that impacted the market? And secondly, if regulators start to shut down, wind down and start policing as we’re already seeing them do, how does that affect the liquidity in the market? How does it affect the marketplace?

Kelly: So I’ll take this kind of in reverse. I think if you start to see more regulatory scrutiny around some of these exchanges – and I won’t name them by name, but we can all think of the handful that are kind of ubiquitous within the crypto world if you’re trading these assets — certainly shutting something like that down or even geo-fencing around certain regions would have an adverse effect on the liquidity profile, especially a lot of these alternative crypto assets that really only trade on maybe a handful of centralized exchanges if that, and then potentially some of these emerging decentralized ones. So the liquidity profile would certainly take a hit.

I would say also, you can look at the derivatives volume, or even you’re seeing CME come in with futures and that open interest and that volume has certainly increased quite substantially recently as you see more institutional interest; you can start to kind of pair these narratives around how organic some of these price moves are or downtrends or uptrends within an asset like bitcoin, if it is being driven more so by the spot market where you have true organic buying, or maybe it’s potentially being driven just by, to your point, a lot of people levering up and taking these kind of long margin positions that can unwind very, very quickly on the downside.

So I wouldn’t say there’s any perfect answer to it – I don’t think you’re going to have regulators really take a hard, hard look at this until this asset class becomes bigger, but that’s what we would expect if we want more institutions to come in and more people to have access to these assets. If this market is going to become a mature asset class, then the regulatory scrutiny and regulation is a byproduct of that.

Lau: You know, one of the things that I always appreciate that you guys do at Delphi Digital is taking the macroeconomic context and placing it atop what’s happening in the cryptocurrency space. Having said that, beyond Covid-19, beyond global economic headwinds right now because of Covid-19, how are you also factoring in the stimulus and central-bank-backed digital currency initiatives around the world? How do you factor this into a broader cryptocurrency or bitcoin market play?

Kelly: I think the topic of central bank digital currencies at this point just has too much momentum to reverse or go the other way. So I certainly think that 5, 10 years from now, the world is going to be digital currency-driven. And on one hand, you can make the argument that in that type of environment, in that type of world – I sit in the millennial generation, but as older generations become more comfortable with that digitally native world, you can make the argument that that could be an acceleration or a gateway for people to get involved in the emerging digital asset market and I hope things like bitcoin.

The flip side to that, or where my concerns around the rise of these central bank digital currencies comes in, is obviously just the flip side of the technological advance in terms of surveillance and ways in which these governments could potentially limit the way in which you use that currency. And again, I don’t necessarily foresee some type of huge revolutionary moment where it’s, you know, literally an us versus them and people are literally left bloody in the streets or anything like that.

But I do think it’s going to be an increasingly large part of the conversation as we move to a world of trying to increase privacy and trying to increase the kind of digital native-ness of a lot of business models with some of these assets, coupled with the fact that you now have a potential backdoor lever for governments to have a greater oversight into what you’re doing. I sit in the more optimistic camp that I think it will be more of an organic gateway to the digital asset world. But there are certainly risks that we won’t face for at least a few years but are certainly trying to become part of the conversation now that I think people should at least be aware of.

Lau: Do you think it’s going to dilute people’s interest in holding cryptocurrency or bitcoin?

Kelly: I don’t think necessarily, because when you think about what a central bank digital currency would even represent, it’s basically the digitally native version of fiat currencies today. It’s still going to be largely affected and influenced by the monetary policy of whatever country or government agency is the one that issues it.

And so if you take a digital dollar, for example, backed by a central bank, we’ll call it a Fed dollar for lack of a better term, the amount of Fed dollars and the money supply and things of that nature will still be governed by a central party in the Fed. It’s not like the dollar is going to be some type of decentralized version of the USD today.

So I think it is also important to put in perspective, because that still bolsters the case for holding something like bitcoin, because again, this whole digital scarcity narrative and concept, I think is going to continually gain traction in a world of fiat abundance.

Lau: There’s no doubt that you guys are very busy trying to figure out all of these headwinds and tailwinds. We recently spoke to Tim Draper, who is making the call that bitcoin is going to reach $250,000 dollars by the beginning of 2023. Taking a look at the fundamentals, taking a look at the macro, the micro, the markets, all of that, the recent halving the future halvings… is that a possibility? Do you see that price range coming to fruition?

Kelly: I certainly would not complain about bitcoin hitting $250,000 within the next two to three years, certainly.

Lau: But is it realistic?

Kelly: So I think it’s realistic, but in a longer time horizon; I don’t think we get there by 2023. And the reason for that is, the way in which you’ll see institutions come into this space, a lot of it will be top of the funnel, a lot of them will get attracted to bitcoin, a lot of them, quite frankly, might even just find the value proposition of bitcoin more attractive than some of these other alternative crypto assets.

But at the same time, I think you get to more of a one-, probably two trillion dollar market cap for bitcoin potentially in that timeframe, which puts you closer. You could see six-figure bitcoin within the next three to four years, certainly, because, again, the starting point I think matters immensely.

We did a simple exercise on a recent daily note we put out. If you look at the gold market versus bitcoin, which are often compared to one another, potentially you could get to a situation where gold in nominal dollar terms, actually the total value of gold, increases by magnitudes more than the bitcoin market does. But at the same time, that doesn’t make gold necessarily a better investment, because if you had six trillion flooding the gold market, but you had a trillion flooding the bitcoin, your annualized return over the next 10 years would still be 45x on holding bitcoin today.

So the point being, starting points certainly matter. I just think when you’re talking about 20x type returns over a shorter time period… To say it’s impossible? Absolutely not. I just think a lot of things have to go right for it to hit $250,000 within that time frame.

Lau: A lot of things have to go right and/or a lot of things have to go wrong, which is kind of what we’re experiencing right now.

Kelly: Yes, exactly.

Lau: Look, your State of Bitcoin report, very comprehensive. Top takeaways for our audience?

Kelly: I would say from a macro perspective, we laid a lot of them out here. Getting into some of the other pieces that two of my partners did an incredible job on, we go through some of the upcoming upgrades, things of that nature for people who are a little more technical or interested in that. My other partner, Yan Liberman, actually does an incredible job looking at some of the UTXO analysis, holder trends, on-train exchange flows, etc.

Basically some of his takeaways were that we’re starting to see, actually, the dispersion of bitcoin from a wallet basis or from the amount of bitcoin that’s out there for smaller holders, that certainly increased, so it’s becoming a bit more widespread. We’re seeing new addresses and wallets that that growth accelerates, which is certainly a great sign if you’re talking about adoption. And then the UTXO trends and looking at things of that nature really tell us that a lot of people are still very steadfast in their holdings.

I think a lot of the volatility recently has shaken out some of the weaker hands. So from our perspective, we’ve started to kind of formulate this new holder base, and as we start to see the macro backdrop deteriorate a bit and you start to see more of these larger, sophisticated institutional investors come into this market, you just have that really strong holder base that’s there to support it and push things along and push price higher. So right now, again, volatility is certainly something in the short term to be on the lookout for, but, we’ve never had more conviction in the long-term value proposition of bitcoin.

Lau: So, just to translate what Kevin said to the audience, that may not have really caught up to the internal nomenclature or vernacular of this industry: a lot of people are interested in Bitcoin because what’s happening with money and stimulus right now is driving a lot of concerns about what the future economy holds, and Bitcoin is an alternative, and a lot more people are certainly finding themselves in the space — the Muggles among us, including J.K. Rowling, who very recently wondered aloud on Twitter, what’s Bitcoin all about? But this kind of dynamic is only increasing.

Kelly: You absolutely summarized that much better than I did, so I appreciate that. And I would say there is no better way for anybody out there who is, and I wouldn’t put J.K. Rowling in the tier two celebrity status, but if you’re a tier two or tier three celebrity, I mean, tweet about Bitcoin and let us do the rest, because you will get an absolute flock of people liking, retweeting, commenting DM-ing, the moment you light that fire. Which again, tying it back to fundamentals in this space, on a final note, if you’re betting against bitcoin and crypto and this entire industry, then you better dive into this industry and talk to the people who are working on this stuff.

Because to be honest with you, I’ve met some of the smartest people I’ve ever come across in my entire life working on some projects that most of you have never even heard of. And so just having those types of conversations makes you all the more bullish on where we’re going in this parallel digital world that’s being built out, because again, you never want to bet against innovation. When you talk to a lot of these people about the conviction they have about what they’re building, it’s contagious. It’s electrifying. And to be honest, it only makes us want to double down and batten down the hatches and really focus on where this world’s going.

Lau: Well, that’s a bet you are making for sure. Trying to help explain it to the rest of us, that’s a bet that we’re making at Forkast.News, only because we find it enormously interesting and really want to just empower people to understand the technology that is shaping the world of tomorrow. If you don’t understand it, how can you participate in it? So if you can start to understand it now, it certainly will hold you in good stead, whatever generation you’re from.

Kelly: Couldn’t agree more.

Lau: From my 3 year old to his grandparents, it’s certainly a brave new world. Kevin Kelly, always a pleasure to speak with you. And congratulations again on the report. Thanks for translating it for us as much as you did, and we really appreciate it.

Kelly: Absolutely. Thanks so much for having me.

Lau: And thank you, everyone, for joining us on this latest episode of Word on the Block. I’m Editor-in-Chief Angie Lau, Forkast.News. Until the next time.