Trends and opportunities

This is part of our December 2020 report into:

The Unstoppable Rise of Digital Assets

Top three digital asset market trends shaping the future

Three key trends in the digital asset market are:

- Tokenization of widely traded traditional assets, such as stocks and bonds;

- Tokenization of previously untraded or under-traded assets, such as real estate and fine art;

- Institutional adoption and trading of digital tokens.

During the past year the number of projects attempting to tokenize assets has grown, but as discussed later in this report, some of these have liquidity challenges.

“100% of the stocks and bonds trading on Wall Street today could be tokenized, and in five years, 100% of the stocks and bonds on Wall Street WILL be tokenized.”

Robert Greifeld, former chairman and CEO of NASDAQ (Jan 30th, 2019, via Twitter)

Tokenization

The tokenization of assets refers to “the process of issuing a blockchain token that digitally represents a real tradable asset—in many ways similar to the traditional process of securitization, with a modern twist… These security tokens can then be traded on a secondary market.”

Any asset, physical or virtual, can be tokenized. In the world of traditional assets, tokenization is inevitable. Major institutions—including the People’s Bank of China, the Austrian Government, the World Bank, and Daimler—have all directly issued tokenized assets, like securities, bonds, loans, and commodities. As pilots evolve into commercially available products, and as regulation is clarified, this trend is set to explode.

More on tokenization from this report:

Interview with Trent Barnes of Zerocap

“A digital age requires digital assets. If we were to invent money today, we wouldn’t invent paper money, coins and credit cards. We’d be smart enough to create a digital ecosystem of assets that allows us to tokenize anything of value in the real world”

While digitizing traditional assets is itself a huge opportunity, the emergence of novel digital assets represents, perhaps, an even greater opportunity for capital markets growth. Previously untraded or under-traded assets that have already been tokenized (at relatively small scales thus far) include real estate, fine art, warehouse receipts, digital items in virtual spaces, sports teams, and even people.

Drivers

The three key advantages of tokenization driving the trend are:

1 Fractionalization

Tokenization and fractionalization enable assets to be broken down into manageable pieces, thereby lowering the barrier to entry for investments. In the real estate sector, for example, the 1.675 million ASPEN tokens, which were minted in 2018 in what is widely considered the first real estate security token offering, represent US$18 million worth of indirect ownership in the St. Regis Aspen Resort—a five-star, 179-room hotel situated in Colorado. This made each stake in the hotel, at the time of purchase, worth just US$20. ASPEN tokens are tradeable 24/7 on a third-party exchange.

Fractionalization along such lines will also facilitate the creation of new trading markets into assets that were previously difficult to trade. Take the example of fine art. As expensive art pieces are fractionalized into tradeable tokens, it brings in new traders and new money by lowering the barrier to entry.

2 Automated compliance

Digital security tokens can be designed so that compliance is baked in. For example, assets that are only available to accredited investors can be coded such that exchanges of the tokens can only be made between whitelisted traders. Security offerings that are only available to a limited number of traders can also have their tokens coded to ensure such compliance. This programmability of trading reduces the cost of compliance and eliminates the risk of violations.

Digitalization of securities can significantly lower the barrier to entry for entities looking to raise capital. The concept of a security token offering (STO), which emerged in 2017 as a regulatory-compliant alternative to the initial token offering used by start-ups to raise capital, is already gaining momentum. The amount collectively raised through STOs grew from US$22 million in 2017 to US$452 million in 2019, but STOs are just getting started.

It is likely that digitally issuing securities will completely replace legacy methods for both private and public offerings due to the lower costs, baked-in compliance, and ease with which secondary trading is made possible. In Europe, where regulatory clarity around STOs is already largely clarified, it is projected that the trading volume for security tokens will reach €500 billion by 2022.

3 Liquidity

With assets broken down into smaller pieces, and with earlier access to buy and sell thanks to the increased speed with which tokens can be brought to secondary markets, the tokenization process increases liquidity. This enables more direct access to capital and more efficient price discovery, ultimately providing more direct capital markets. For example, investors in a private equity offering for an early-stage start-up can be issued security tokens rather than having to wait five to ten years for liquidity as they do now.

Provided the rules baked into the token allow for it (defined vesting periods, for example, may be built in), investors can begin trading the asset almost immediately. The decreased risk taken on by investors thanks to this improved liquidity should in turn facilitate access to capital for enterprises.

Tokenization also brings with it the possibility of providing liquidity to a wide range of novel assets. Going back to the example of tokenizing fine art, owners of fine art can turn a previously illiquid asset into an extremely liquid asset, thereby freeing up capital. By issuing tokens to represent a portion of the artwork, owners can liquidate a portion of their asset while retaining possession of it. The same can be said for practically any asset that was previously illiquid, from antiques to homes.

Digital asset funds

Another key trend in the digital asset market is the emergence of digital asset funds. These are investment vehicles that enable investors to gain exposure to the emerging global digital asset ecosystem without the burden of taking custody of the assets themselves. This is attractive for institutional investors, who typically lack the legal framework to be a custodian of their own digital assets.

More on AAX from this report:

Interview with Thor Chan of AAX

“institutional-grade technology is our commitment to market integrity, and the conditions required to make our trading value more suitable for institutional investors.”

An additional consideration is around so-called “tainted coins”, or coins that may have been involved in criminal activity in the past. Purchasing digital assets directly exposes the buyer to the possibility of being connected with such coins, which is an unacceptable risk for institutional investors. Gaining exposure to digital assets through a fund, however, eliminates that risk.

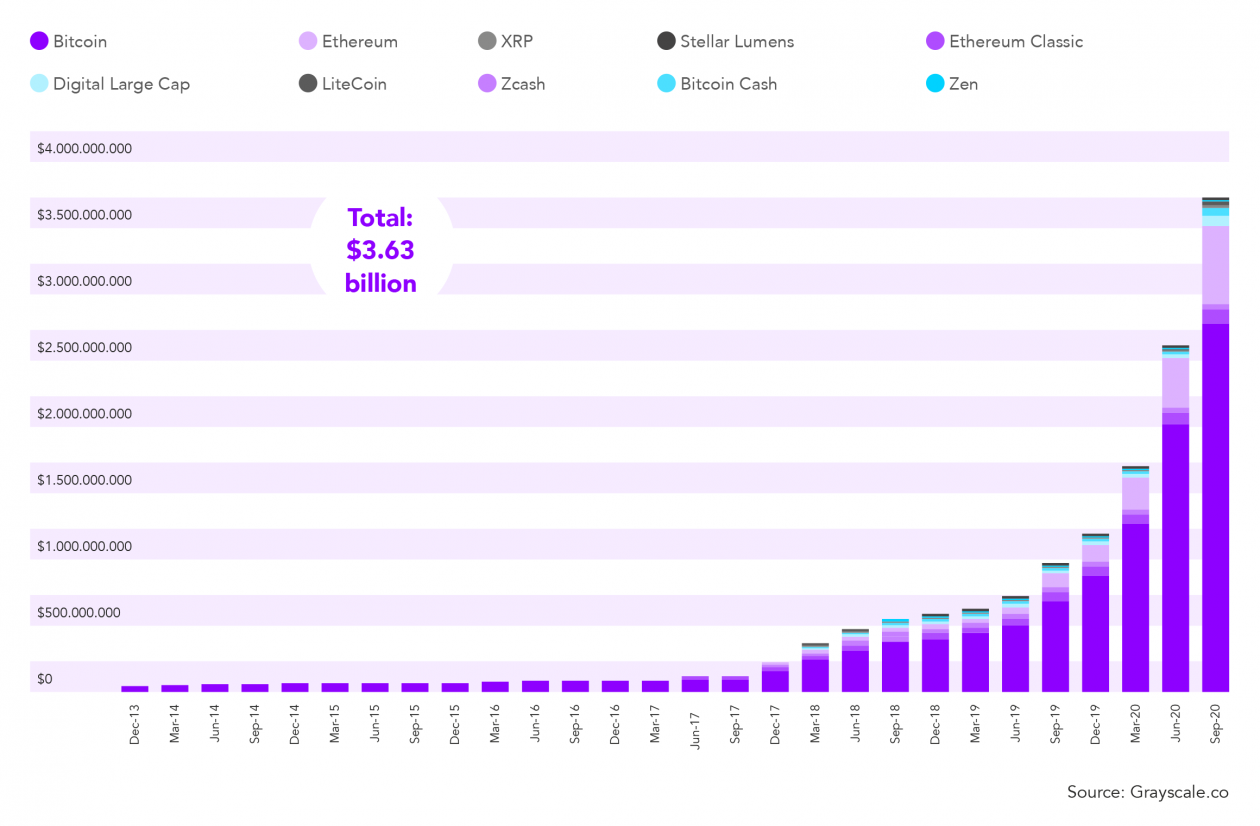

Digital asset funds have been steadily gaining traction since 2017, but in the last year, uptake has been explosive. New York-based Grayscale Investments, the world’s premier digital asset fund manager, recorded US$1.4 billion in inflows in the first half of 2020, moving its total assets under management to over US$2.5 billion. According to Grayscale’s Q2-2020 report, institutional investors continued to be the primary source of investment capital in 2020, accounting for 84% of inflows.

Some digital investment funds offer exposure to more than just a basket of the top cryptocurrencies. Digital asset hedge funds, such as the Canada-based Digital Asset Fund from Exponential Ventures, may include a broad range of assets, such as real estate, venture, precious metals, digital currencies, bonds, digital utilities, public equities and commodities, as well as other digital assets.

In Asia, the appetite for exposure to digital assets through the fund structure is likely to accelerate thanks to the addition of a slew of high-quality fund managers in recent months. Singapore-based Stack, for instance, launched Asia’s first Bitcoin index fund in January 2020, with inflows of US$200 million in the first month and projections to capture US$750 million in assets under management by the end of 2020. In April 2020, in Hong Kong, the Securities and Futures Commission approved the jurisdiction’s first-ever digital asset manager to launch a crypto fund.

A New Asset Class

Digital assets have become a “new institutional investment class”

Morgan Stanley

Investors are attracted to digital assets due to their historical performance, as well as the perception that digital assets offer a unique portfolio diversification opportunity moving forward, particularly given the instability in traditional markets. Critically, digital assets have now reached institutional-grade status. This means that more and more family offices, hedge funds, and even endowments will allocate a portion of their capital to the growing array of digital assets becoming available.

We’ve seen a dramatic increase in the number of investors seeking to diversify their portfolios using Bitcoin. Fears of a global recession, combined with deteriorating trade relations globally, are accelerating this process considerably. Bitcoin is one of the best-performing assets in history—with 19 times returns since 2014—and is uncorrelated with traditional markets, making it an attractive prospective investment for both individuals and institutions.

Stack co-founder Matthew Dibb

Opportunities

Ultimately, declaring ownership rights of assets in digital form has the potential to create new streams of capital for businesses and markets globally. The growth of tradable digital assets necessitates concurrent growth in the infrastructure for trading them. This bodes well for digital asset exchanges, which will take their place as foundational infrastructure in the digital asset ecosystem.

More on custodians from this report:

Interview with Phil Mochan of UK custody provider Koine

“The role of a custodian is the administration of assets. A new engineering solution called Digital Airlocks guarantees that humans never touch the private keys, and delivers huge scalability and a lower unit cost without impairing the security model.”

Early digital asset exchanges are just now starting to take off. For example, tZERO, a platform for the trading of security tokens, saw trading volume increase 15 times from US$125,000 to US$2.02 million between June and July 2020, following the listing of a security token generated by the online retailer Overstock.

Forward-thinking traditional exchanges, recognizing the opportunity, are also making efforts to facilitate the issuing and trading of digital assets. For example, since 2017, the Swiss Stock Exchange has been developing a digital exchange that enables the issuance of digital security tokens, live trading, and instant settlement. The SIX Digital Exchange platform went live with a pilot in late 2019 and is expected to launch its full version in Q4 2020.

With increasing regulatory clarity in key markets on issues such as digital asset custody and security token offerings, the stage is set for rapid uptake.