A portfolio balanced by digital assets

This is part of our December 2020 report into:

The Unstoppable Rise of Digital Assets

Do cryptocurrencies follow broader market trends?

Cryptocurrency has long been perceived as a hedge against the fluctuations of the broader equities market. The idea of cryptocurrency as an alternative investment has taken off during the Covid-19 pandemic as equity prices rose to stratospheric highs despite the fundamentals of the economy significantly weakening.

An example that underscores the thesis of digital assets, namely crypto, as a hedge against the equities market can be found in an analysis of crypto’s performance during the “Covid period”, which for the purpose of data collection is defined as the 2020 calendar year through to August 1.

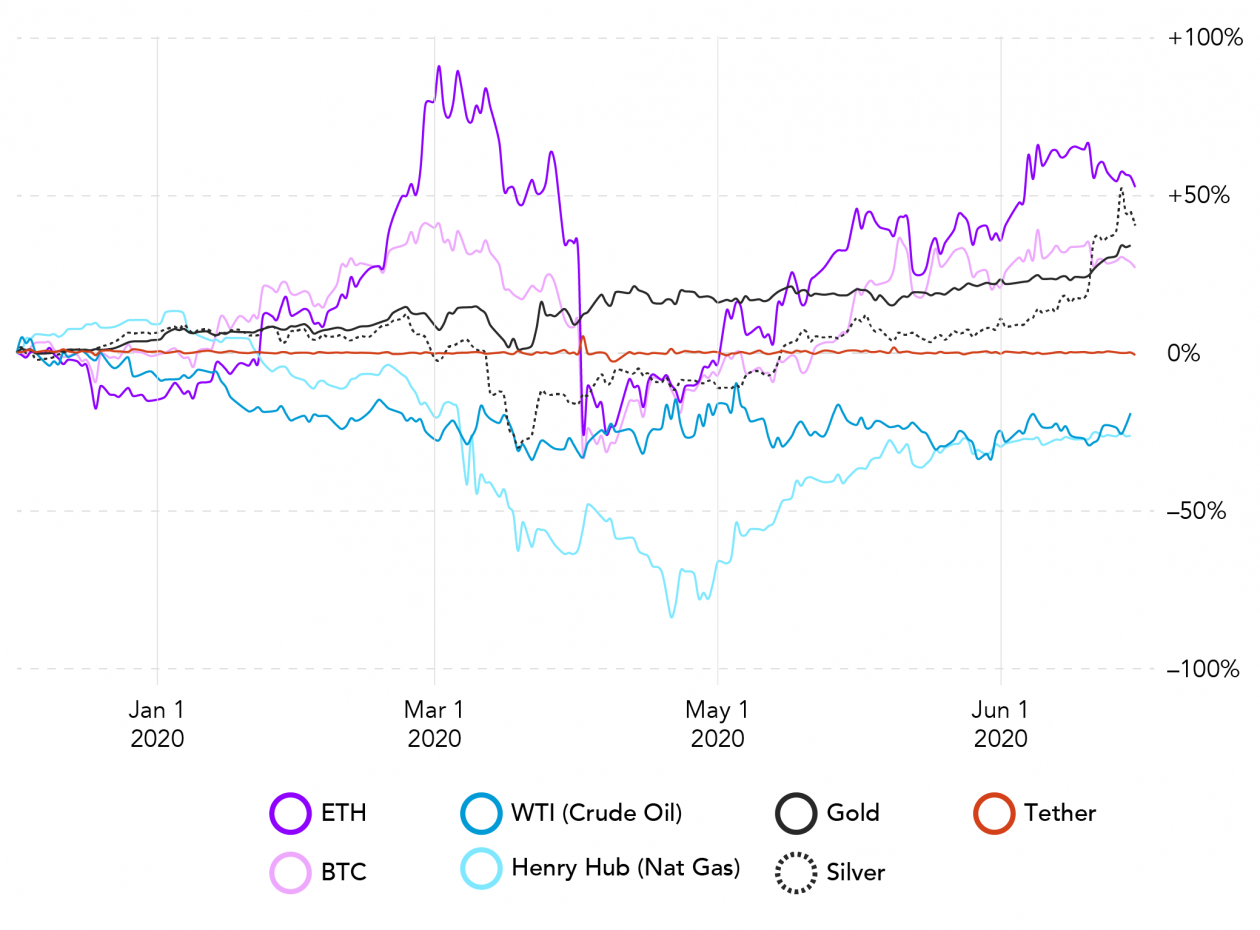

Individual Returns – COVID

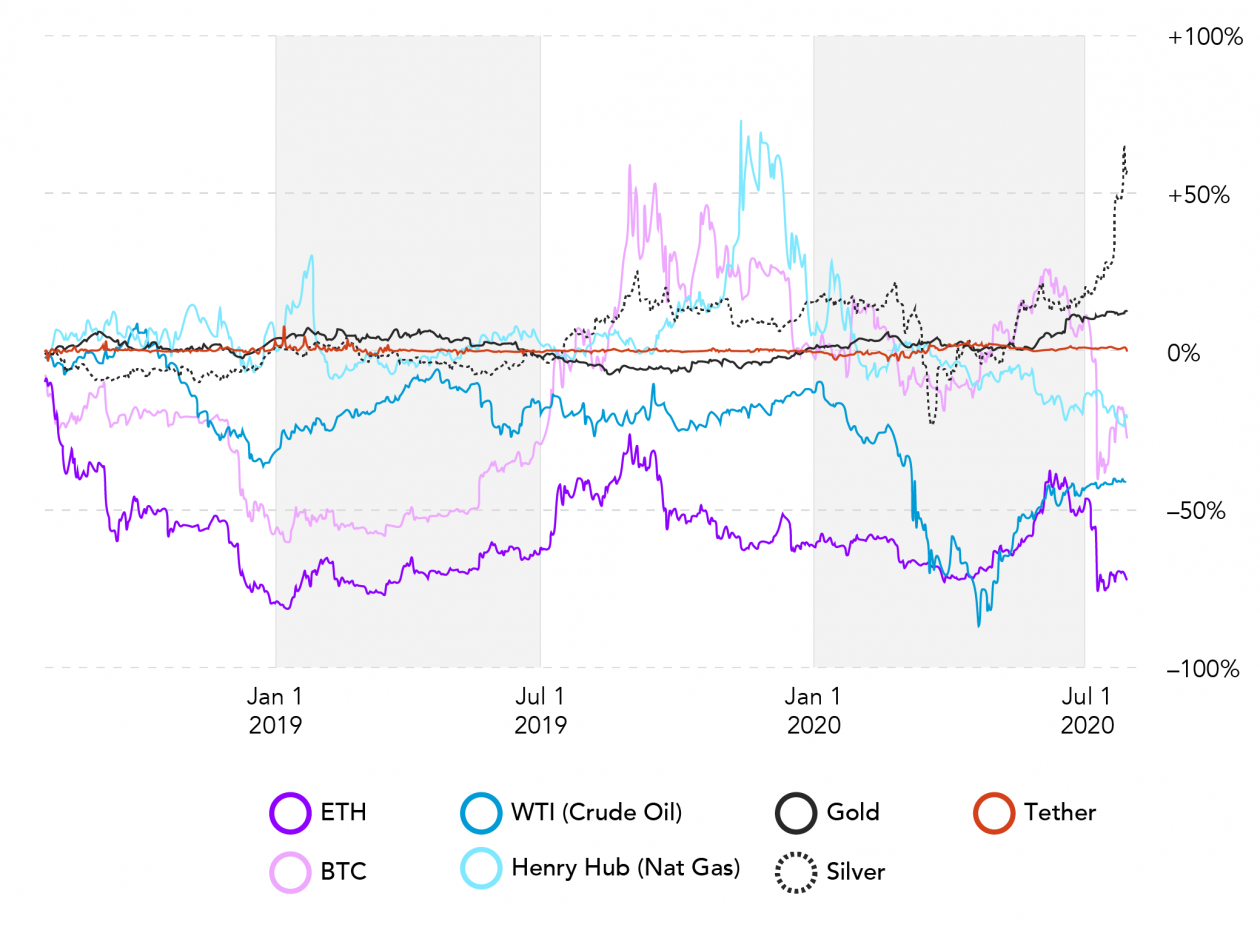

Aside from a dramatic dip in March, our analysis shows that two of the most prominent cryptocurrencies outperformed some of most commonly held traditional assets: gold, silver, natural gas and oil. That said, when the data-gathering period is extended to a two-year period, the conventional assets outperformed the two listed cryptocurrencies.

Individual Returns – 2 years

So, what is the best strategy to hedge against fluctuations in the commodity and cryptocurrency market? A basket that balances both crypto and traditional commodities.

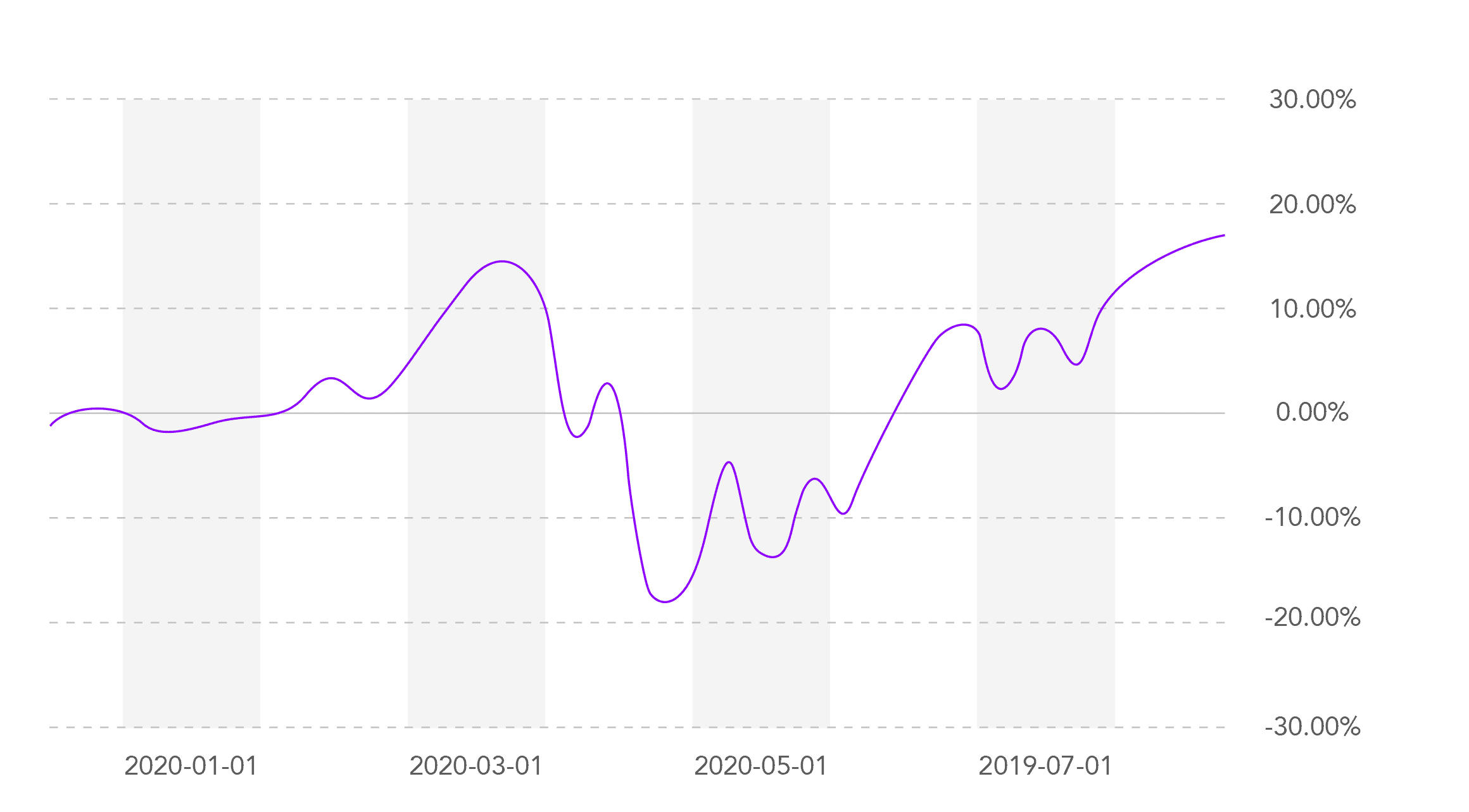

During the Covid period, this simulated basket finished the period up 13% as cryptocurrencies buoyed losses in the traditional commodities market.

Basket Returns – COVID

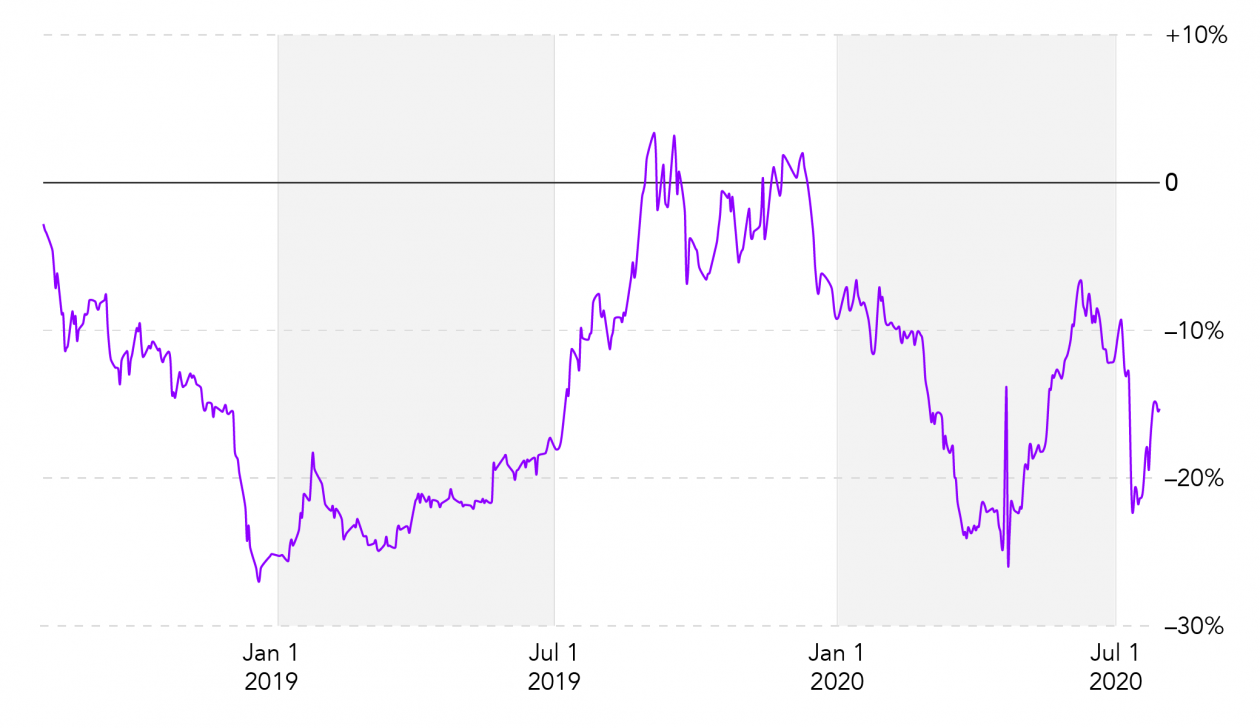

However, when this data-collection period was expanded to the last two years, it proved to be a loss given the extreme volatility of the cryptocurrency market.

Basket Returns – 2 Years

This shows that a long-time holder of crypto (a HODLer in industry parlance) will be exposed to significant risk if they are not actively trading. However, macroeconomic factors affect crypto and commodities in different ways. Thanks to digitized assets, a portfolio that is balanced between the two will tends to lessen overall losses, so a certain degree of active trading is needed to mitigate risk.

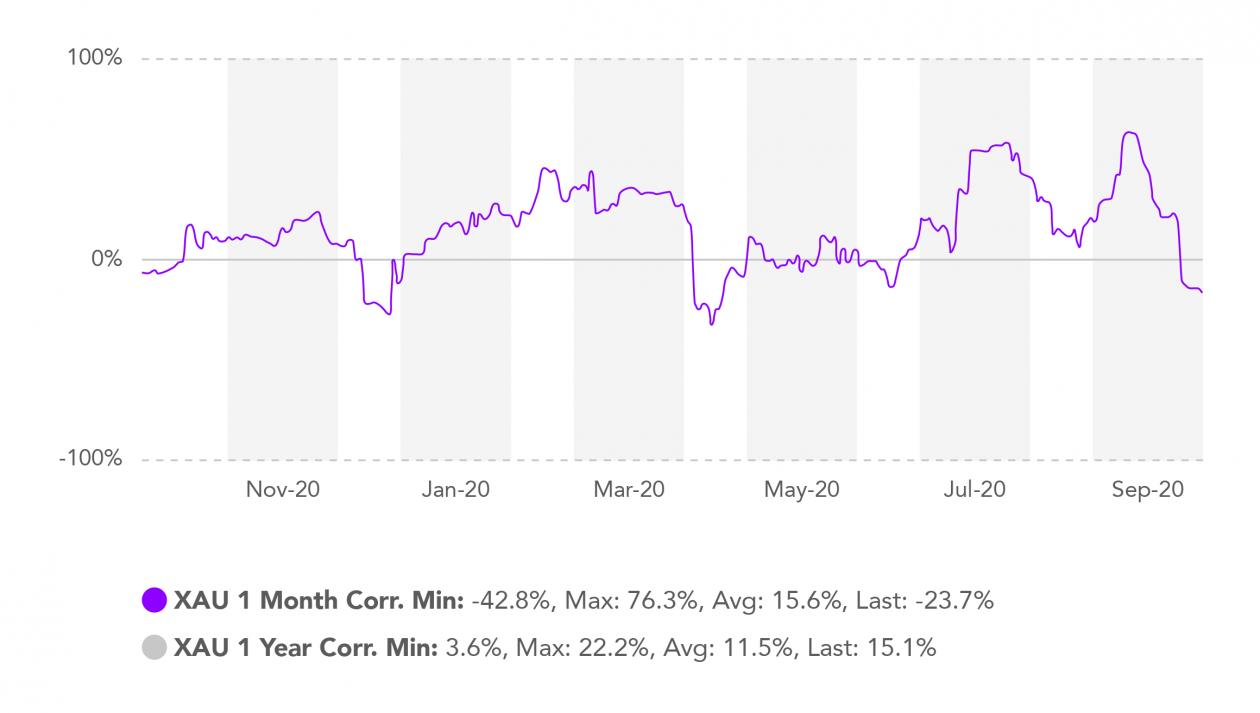

Bitcoin and gold have enjoyed a strong correlation throughout the year as investors treat both as stores of value, typically for amounts less than US$1 million.

Bitcoin-Gold Realized Correlation

Cryptocurrencies and the equities market

But is crypto an effective hedge against fluctuations in the equities market? It is often said that crypto is a safe-haven against the equities market. To test this thesis, crypto prices were compared to a variety of different ETFs. The results show a moderate correlation between the price of Bitcoin and broader equities. However, Covid wreaked havoc on the economy, and it did so unevenly – the technology sector, for instance, showed gains, while sectors like commercial real estate have been heavily impacted given the trend toward working from home.

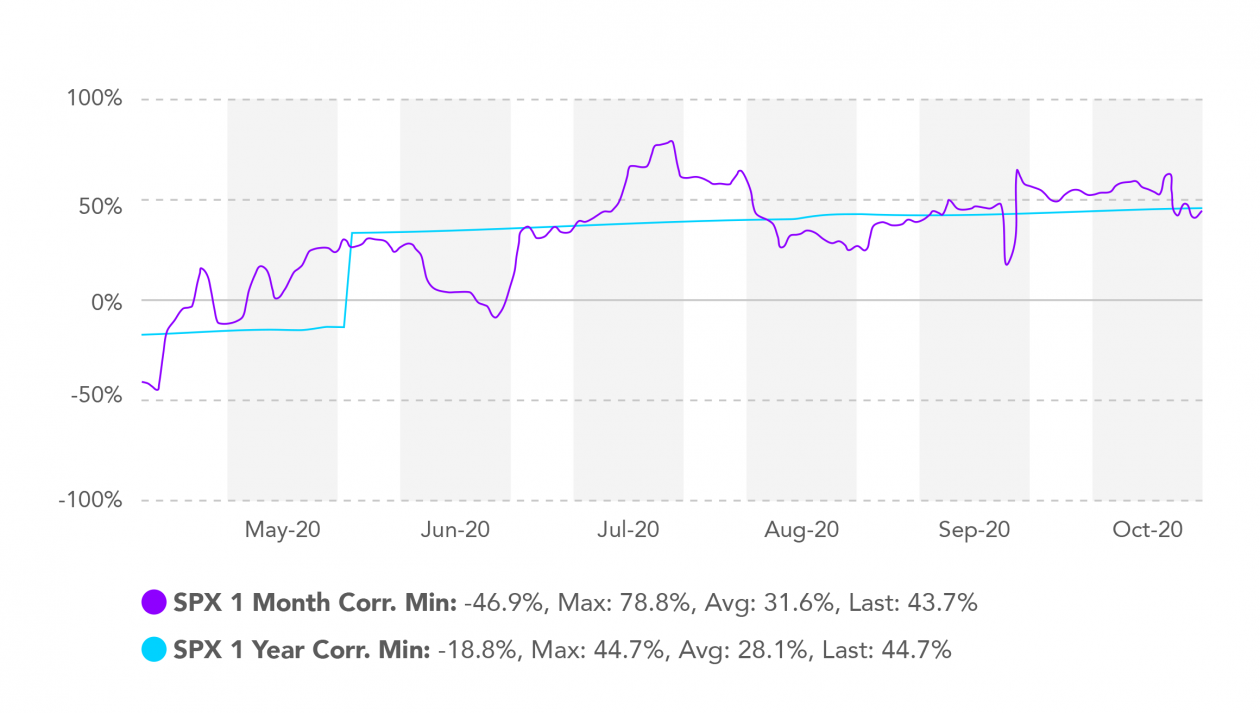

The height of the summer’s stock market rally saw the strongest correlation between equities prices via the S&P 500 and crypto, which peaked at almost 78% before dropping back to around 40% in October. The near-tandem movement could be seen in the summer, as investors hunted for opportunities and assets that were moved from the initial market crash to safe, low-interest rate assets were placed back in the market.

Bitcoin-S&P500 Realized Correlation

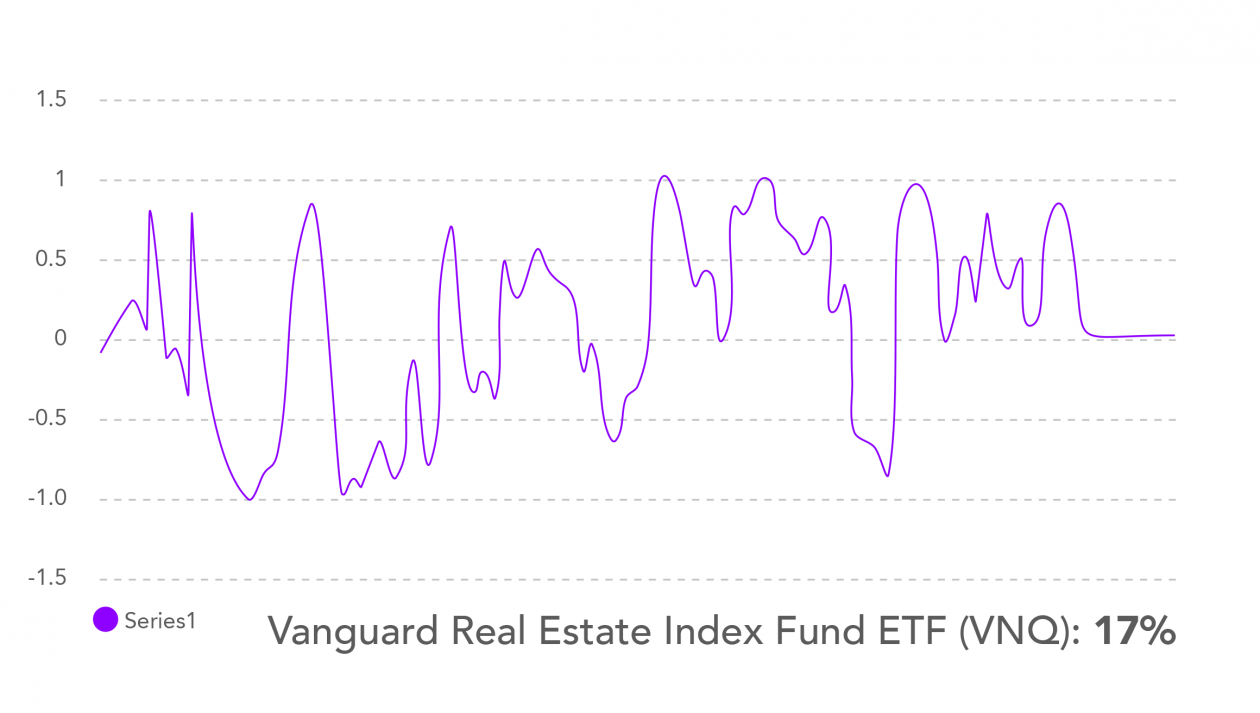

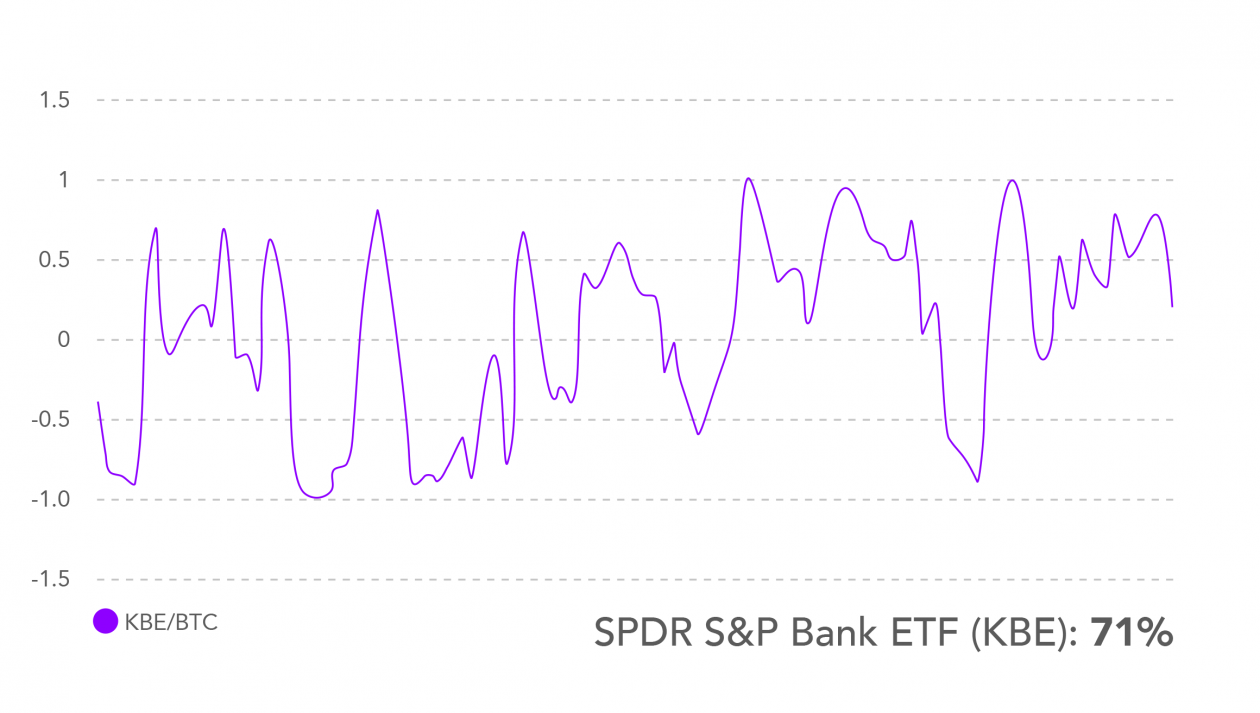

By analyzing a basket of different ETFs, a variety of different correlations between prices could be seen for a data-collection period that spanned from May to September 22.

VNQ/BTC

KBE/BTC

The relationship between Bitcoin and the equities market comes and goes, and the correlation is arguably the product of an unprecedented year. The weakening of the correlation between BTC and the S&P 500 in the fall of 2020 shows that it still is a unique asset class for investors looking to diversify. While there may be some correlation between crypto prices and tech stocks, the S&P 500 is more than just technology. Removing tech stocks from the basket – for example, looking at real estate – tells a different story, but correlation remains between crypto and bank ETFs, showing that Bitcoin might be viewed as part of the broader financial sector.