In this issue

- Is DeFi headed for a brutal fall?

- Brazil wants its own central bank digital currency by 2022

- Bitcoin will soon be accepted for tax payment in Switzerland

- In China: bank unveils e-RMB briefly before cloaking it again; trade war threatens domestic silicon supply and bitcoin farming

- Venture capital highlights in Singapore, Indonesia and China

From the Editor’s Desk

Dear Reader,

DeFi is defying gravity. But the laws of physics, and markets, are making themselves known. In this week’s The Current Forkast, we note that decentralized finance has reached new heights and just as fast, in some instances, tokens have crashed back to familiar lows — a sickly reminder of the 2017 ICO craze that deleted crypto’s legitimacy in many people’s minds. Is this a case of not learning the lessons of the past?

A few days ago, in what I considered to be a very insightful 1:1 with ETC Labs CEO Terry Culver and Kobre & Kim partner, attorney Ben Sauter, who discussed the recent 51% attacks on Ethereum Classic, Sauter brought up a very good point: the industry must police itself. The industry must work to excise its own cancer. Once external agencies and regulators step in, it’s too late — there would be little room for calibration to save as much of the patient; drastic and aggressive action is at times the only response. The damage is done. The response comes only after howls against the Wild West that once again needs tough sheriffs. DeFi is getting to this point. And it behooves the industry — the exchanges, the protocols, the platforms — to interject. We have certainly seen instances of this, and it’s a good start. Legitimacy comes from trust. Trust that can be enforced by rules. That’s the ultimate governance we all need.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. Is DeFi flying too close to the sun?

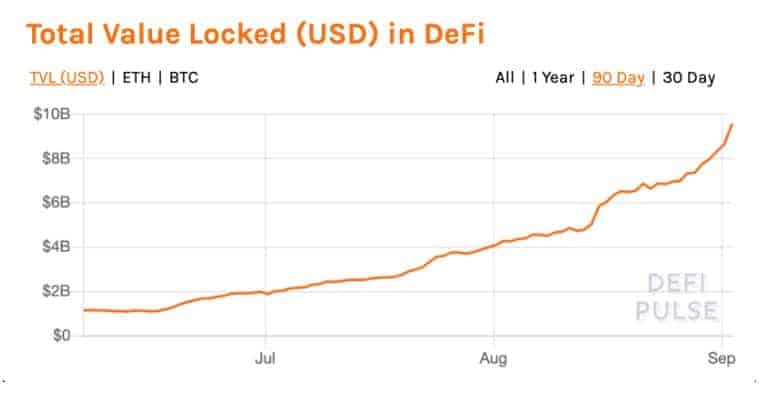

By the numbers: DeFi — over 5,000% increase in Google search volume.

According to the Binance August Trading Report, Decentralized finance (DeFi) continues to reach new heights as Total Value Locked (TVL) in the ecosystem surpassed US$8 billion. At one point this past week, TVL cracked US$9.5 billion. The influx of DeFi projects and soaring token prices are drawing comparisons to the 2017 ICO boom and bust.

- More crypto exchanges are jumping on the bandwagon, such as Binance’s rollout of its DeFi Composite Index Futures that allows users to track and participate in this booming market.

- This week’s surging DeFi projects invoked East Asia’s iconic dishes. SUSHI locked up US$1 billion while its fork, KIMCHI locked in US$500 million in a matter of hours. On the other hand, the price of meme coin Hotdog’s price reached a high of US$6,000 but later on, it only took 5 minutes for it to crash from US$4,000 to $1.

- Then SUSHI, one of the hottest projects on the block, lost 88% of its value in days, per CoinMarketCap data, as its founder cashed out and tried to assure the community that this wasn’t an exit scam. Venture capitalists who were excited about the “10x returns” of the sector were left moaning when their token portfolio imploded. In a plot twist, the creator of SUSHI ceded control of the project to FTX, which resulted in partial price recovery.

Forkast.Insights | What does it mean?

Just as crypto was beginning to shed a certain reputation and become an institutional-grade commodity, things are starting to revert. DeFi liquidity pools are resembling ponzi schemes, where a token is pumped up until people at the top are ready to pull the plug and everything comes crashing down.

Just like the snake of ICOs shed its skin to become STOs — a regulatory compliant investment vehicle — the same may need to happen with DeFi. For starters, perhaps they should attempt to become registered security offerings: SEC Commissioner Hester Peirce said in an interview with Forkast.News that there’s some “soul searching” at the SEC about the Howey Test. That could mean a less rigid version of the test could eventually emerge to give projects a pathway to becoming regulatory compliant without the barriers. But all this will be off if retail investors continue to be wiped out.

Going this route would build confidence in the market as investors would know exactly whom they are dealing with and would have a better fundamental understanding of the product being marketed to them. Part of that means having real names attached to projects. Launching something under a nom-de-block of “ChefNomi” as happened with SUSHI isn’t going to work; regulatory-compliant projects have to verify the identity of all major stakeholders and provide “bad actor checks” (where someone submits a clean criminal record check, and proves they are SEC-sanction free) to keep on the good side of FINRA.

DeFi has value to the broader blockchain economy and ecosystem, but let’s be clear as to what it is: it’s a tool to give whales more liquidity to place big, bold bets. There’s value in that, but unless things change, it would not be surprising if all will come crashing down.

2. Brazil leaps into CBDC race

By the numbers: CBDC — 2,000% increase in Google search volume.

Brazil has jumped into the CBDC race as the central bank president, Roberto Campos Neto, projects that CBDCs could come to Brazil in 2022, according to local media reports. The nation’s central bank recently formed a CBDC research team last month.

- The Central Bank of Brazil launched a data-sharing blockchain platform called Platform for Information Integration of Regulatory Entities (PIER) for foreign banks in April.

- The Central Bank is also targeting November of this year to launch its free and instant payment system PIX.

Forkast.Insights | What does it mean?

Middle economies that are vying for increased dominance in their respective regions have a huge incentive to investigate and develop CBDCs. Right now the U.S. dollar is the de-facto official currency for transaction settlements, even if there’s no direct nexus to the U.S.: a businessman in São Paulo looking to pay a vendor in Santiago would settle the transaction in USD. Why? It’s the most liquid currency on the planet; the chance of encountering steep costs on the exchange is nil. Usually converting USD into a country’s home currency would cost less than 2% as demand for dollars is practically infinite. That wouldn’t be the case when trying to exchange Brazillian reals in Santiago, or Chilean pesos in São Paulo.

Digitizing currency via blockchain or digital ledger technology adds an extra layer of liquidity. Imagine if a digitized real (Rs$) could be exchanged almost instantly for a USD denominated stablecoin, or another similar token. There would be an incredible incentive to settle transactions in a currency that’s not USD — which is part of the logic that guides China’s development of its digital currency, DCEP — if there is no liquidity penalty or costs on the foreign exchange. There’s a huge incentive for Brazil to develop a CBDC if it wants to wield more economic power in South America.

But will CBDC’s actually go anywhere? Tim Draper doesn’t think so. “I wouldn’t want to take Chinese digital currency anymore than I’d want to take renminbi.”

3. Swiss region willing to collect taxes in bitcoin

By the numbers: Bitcoin Suisse — 900% increase in Google search volume.

The Swiss canton of Zug has announced its collaboration with cryptocurrency financial services startup Bitcoin Suisse to accept tax payments in cryptocurrencies starting in February 2021. The Zug municipality had a pilot project in 2016 where it began accepting bitcoin as payments for standard government services.

- “Tax settlement by means of cryptocurrency will be available to both companies and private individuals up to an amount of 100,000 Swiss francs,” said the canton in a press release.

- “We do not take any risk with this new payment method, as we always receive the amount in Swiss francs, even if payment is made in bitcoin or ether,” said Finance Director Heinz Tännler.

- In April, Zug — the area also known as Switzerland’s “Crypto Valley” — announced it was in a financial crisis and sought a government bailout. About 80% of 203 firms surveyed by the Swiss Blockchain Federation recently warned of imminent bankruptcy, reported Blockchain.com

Forkast.Insights | What does it mean?

Zug needs money and doesn’t care where it comes from. The Swiss canton put its name on the map at the peak of the ICO bubble in 2016 and 2017, as firms sought an offshore land to call home that also came with a favorable token-friendly legal framework. But as the vast majority of ICOs failed (with many being outright scams), Zug’s crypto community slumped. The “shedding of the snake’s skin” where some ICO projects morphed into STOs kept the lights on for a while, but the lack of exits meant that lots of firms are on the brink of going bankrupt.

So what does a canton do? Accept payment in cryptocurrency. Assuming that the crypto companies left in Zug are crypto-rich and cash-poor, this is a way to allow them to use what liquidity they have left to pay their tax bill. As discussed before in Forkast.News, cryptocurrency has proven to be not very useful for retail payments — so efforts to collect taxes that way might have fallen short. But these are desperate times.

4. In China: bank trots out DCEP for flash testing; US-China trade war threatens producer and bitcoin mining

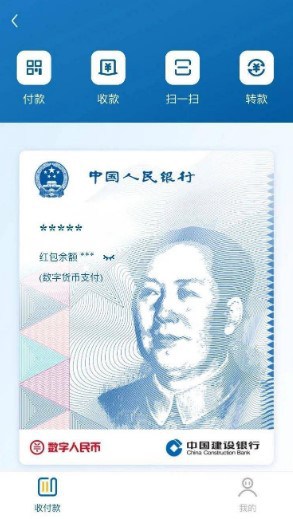

China Construction Bank (CCB), one of the four state-owned banks involved in DCEP’s internal testing, launched a digital RMB wallet for a short period and then disabled it.

- On August 29, CCB launched the DCEP wallet to the public without prior announcement. According to the screenshot circulated online by people who used it, the DCEP wallet was embedded in the CCB mobile app. By linking to a user’s CCB card, the DCEP wallet was able to perform basic financial functions, such as money transfers and payments.

- The DCEP wallet’s surprise open house only lasted for around 6 hours before CCB shut down the service. The DCEP wallets that had been registered successfully by some users were logged out automatically, and the money deposited into the wallet were returned to the original savings accounts.

- CCB explained that the brief appearance of the new DCEP was a functional test of the mobile banking app system, “and the current test has been completed.”

Forkast.Insights | What does it mean?

DCEP is getting closer to launch, with large-scale testing of the platform appearing near completion. In addition, we are getting a better understanding of how the platform would actually work: it seems that it would integrate within existing banking apps rather than being a standalone platform such as Alipay. This makes it much more competitive. It would be a tough sell to build a competitor to the world’s most ubiquitous mobile payment app.

What we still don’t know, however, is the release date. The Ministry of Commerce has said that the policy infrastructure framework of the DCEP would be complete at the end of 2020, in anticipation of launching what it hopes to be the world’s first major central bank digital currency by the end of this year or early 2021. But there’s yet to be anything else more specific.

China’s Semiconductor Manufacturing International Corporation (SMIC) has found itself in the crosshairs of the U.S.-China trade war as the White House mulls trade sanctions against the company.

- SMIC is a semiconductor foundry that competes with the likes of Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Foundry of South Korea.

- Chinese fabrication plants like SMIC lag behind TSMC and Samsung in key technologies such as “process node.” China’s biggest tech companies, like Huawei, look to TSMC for the chips to power their flagship smartphones as domestic firms aren’t yet at this level.

- That was until sanctions against Huawei forced TSMC to cancel its contracts with the telecom company. Suddenly, the hunt was on for a domestic solution. To fund research to catch up to the likes of TSMC, SMIC kicked off the biggest share sale in a decade on the domestic Chinese markets raising a record $7.5 billion.

Forkast.Insights | What does it mean?

It’s no secret that Chinese semiconductor fabs are heavily dependent on U.S. equipment in their manufacturing process. According to research done by Guangzhou-based brokerage GF Securities, 35% of the equipment used within China’s semiconductor manufacturing sector comes from the U.S., and another 32.8% is from Japan.

The foreign origin of this core equipment is in turn a powerful weapon for the U.S. As this equipment is sensitive in nature it requires an export license. Export licenses cannot be obtained to send equipment to firms that are sanctioned.

SMIC was also supposed to provide the chips that power the next-generation of bitcoin miners. Even though Beijing hasn’t sanctioned TSMC, getting silicon into China requires going through the circuitous route of Hong Kong to avoid steep tariffs. And for one company, this has created a choke point that stops silicon from getting to its factory.

All in all, China’s silicon dreams are being challenged. They aren’t yet crushed; Beijing is determined for SMIC to play catch-up and corporate espionage attempts are at an all-time high. But SMIC, with its freshly minted investor capital and ambitions to supply key stakeholders in the bitcoin mining industry might be challenged by these sanctions.

5. Funding spotlight: Singapore, Indonesia and China

MatchMove Pay — Singapore, venture, US$21 million

MatchMove, a Singaporean payment services company, raised $21 million from European and Singaporean venture capital firms, bringing its total funding raised to $83.4 million. Its primary product is a SaaS platform that enables corporations to “move digital cash securely” through proprietary SDKs and APIs. Previous MatchMove ecommerce and research partners include KPMG, Shopmatic and IBM. Earlier this year, MatchMove announced that they would offer cross-border payments on the IBM Blockchain World Wire, which would “enable regulated financial institutions to expand their business ecosystems.”

PasarPolis — Indonesia, Series B, $54 million

Indonesian insurtech startup PasarPolis raised $54 million in a Series B funding round supported by Chinese electronics firm Xiaomi. PasarPolis CEO Nishant Kumar stated that the new funding would be used to further develop the firm’s automated claim processing system. The firm currently operates in Vietnam, Indonesia and Thailand, providing customized insurance policies for consumers.

Linear Finance — China, venture, $1.8 million

Synthetic and decentralized asset protocol Linear Finance announced that it had secured $1.8 million in funding in a round led by NGC Ventures, CMS Holdings, Genesis Block, Alameda Research and Hashed Ventures. Linear’s protocol assists in the rapid creation of synthetic assets (a representation of a tokenized asset, such as USDT, in a liquidity pool) which in turn makes the process of starting a decentralized exchange and DeFi protocol that much faster. This marks the second foray by NGC Ventures into the blockchain space, with the first being the blockchain protocol Zilliqa.

Forkast.Insights | What does it mean?

InsurTech has recently gained ground in the U.S. According to Crunchbase Pro, insurance technology firms have raised approximately $6.2 billion since the start of 2019. Notable entrants in the market include Asurion and SquareTrade, both of which provide any array of customized insurance policies. Integrating automation or AI machine learning for claims management — somewhat akin to Lemonade’s disbursement platform — could help consumers save cash and help companies gather data.

Now it’s time for Asia to catch up. Per Crunchbase data, InsurTech firms in the region raised $4.2 billion during this period. But investor sentiment is strong, and this number is likely to grow higher as consumers in Asia grow wealthier.