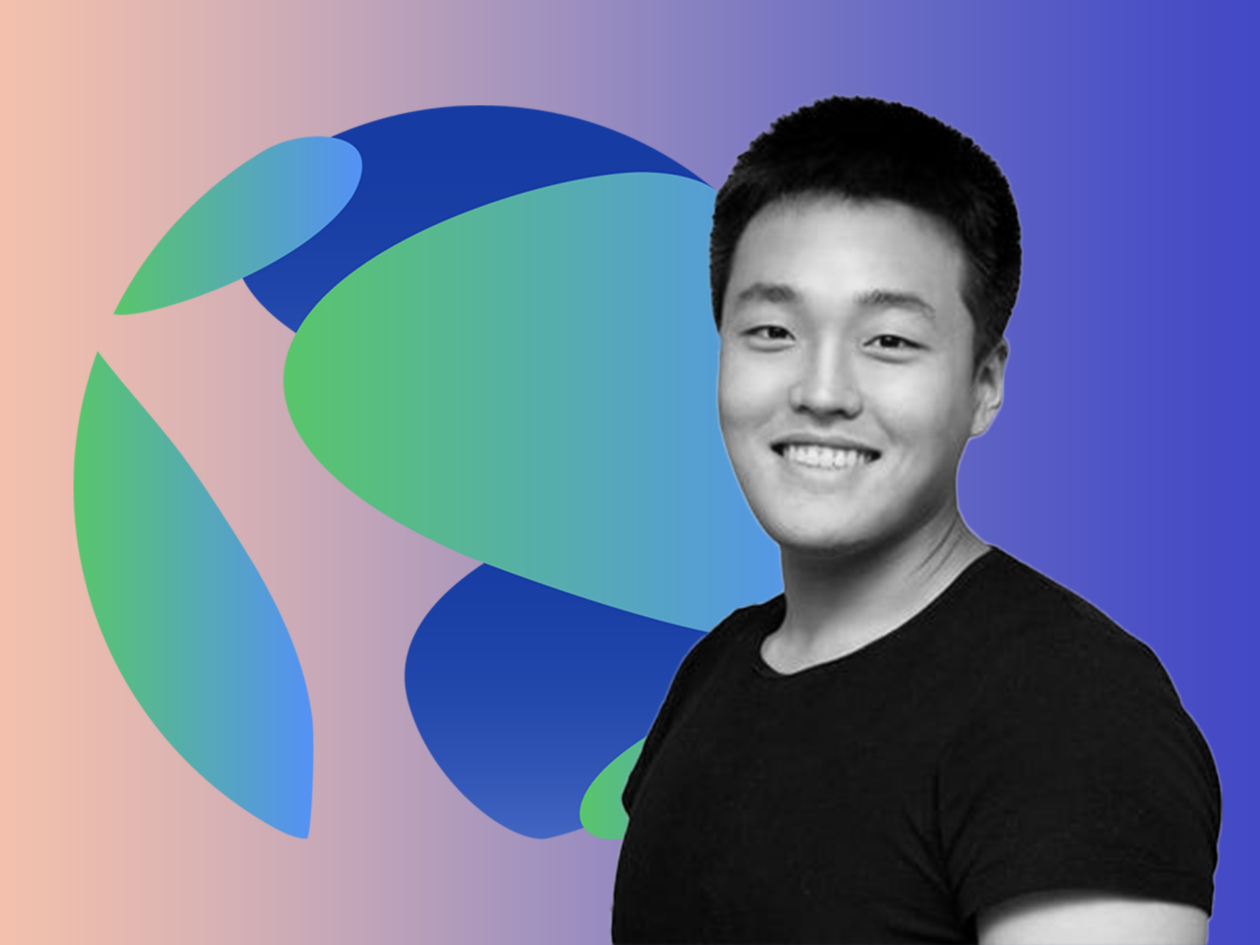

Do Kwon, chief executive officer of Terraform Labs, was denounced as a “bad actor” at Hong Kong Fintech Week on Tuesday by Jerome Wong, the cofounder and chief business officer of blockchain venture studio Everest Ventures Group.

Wong made the comment during a panel discussion on how the Terra-LUNA crash came about, saying that it had caused the wider crypto market crash that followed and it was “very good to expose the bad actors of the space,” including Kwon.

Wong criticized Kwon’s structuring of LUNA as being “very ridiculous,” citing the famous trading aphorism, “If you don’t know where the yield is generated, you are yourself the yield.”

Similar accusations were made in a lawsuit against Kwon filed in Singapore on Sept. 23, claiming he used “fraudulent misrepresentations” to induce investors into purchasing TerraUSD (UST, now called TerraClassicUSD) and was aware of the algorithmic stablecoin’s “structural weaknesses,” according to court documents provided by the Wall Street Journal.

See related article: Terra CEO Do Kwon, wanted in South Korea, left Singapore and flew to parts unknown via Dubai

“All these guys are being washed away in the aftermath of the Luna crash,” Wong said, praising Interpol’s red notice against Kwon as “healthy for the long-term development of the industry, because … as long as regulators are coming and as long as the industry is getting more institutionalized, we want these bad actors to get out of the game.”

Wong argued the crash was the catalyst for the wider market downturn that followed because it was not only LUNA’s holders that suffered losses, “but also institutions who had exposure to [Terra-LUNA], for example, Celsius, BlockFi, Voyager, Three Arrows Capital obviously. All of these institutions also take money from the retail investors. All of them lost money in one go. That’s disastrous, I would say.”

For Wong, this created a situation in which “people lost confidence in DeFi, people lost confidence in stablecoins, and billions evaporated in a matter of days.”

A fellow panelist, global head of digital assets at Fidelity International Luc Froehlich, acknowledged the inherent risk and vulnerability of Kwon’s LUNA as a stablecoin, saying that it showed the need for stablecoins to “go back to basics” because it has created an issue for stablecoins where investors “need to ask, ‘what is the counterparty risk that I have?’” This potential for instability is “missing the point” of the asset, he said.

Froehlich disagreed with Wong, however, over the extent to which Kwon and the Terra-LUNA crash can be blamed for the crypto market downturn that followed, arguing that while Terra-LUNA’s crash was highly significant, so much so that “suddenly, on the street, everyone knew what a stablecoin was,” its influence on the wider crypto crash that followed is an overplayed narrative.

“We were already in an environment that was extremely volatile,” Froehlich said, “so it is probably giving too much credit to [the Terra-LUNA crash] to say they were the trigger for the collapse of cryptocurrency. The market was already sliding.”

See related article: Terra CEO Do Kwon faces lawsuit in Singapore, next hearing on Wednesday

Froehlich also disagreed with Wong’s comparatively pessimistic analysis of the impact of the Terra-LUNA crash, saying that it “helped people understand what a stablecoin was.”

Overall, Froehlich argued the “big impact” of the Terra crash was “when the guillotine fell,” the industry realized how their “overwhelming” scale of creativity had distracted them and regulation needed to be “priority number one.”

This industry debate comes amid a lawsuit filed in Singapore against Kwon on behalf of 359 multinational investors who lost US$57 million in Terra-LUNA’s collapse in May. Though with Kwon “obviously on the run,” according to South Korean prosecutors, as much as he may deny it, it is unclear he will be immediately influenced by the outcome.

NOTE: Attempts to reach Do Kwon for comment were unsuccessful at the time of publication. Terraform Labs declined to comment.