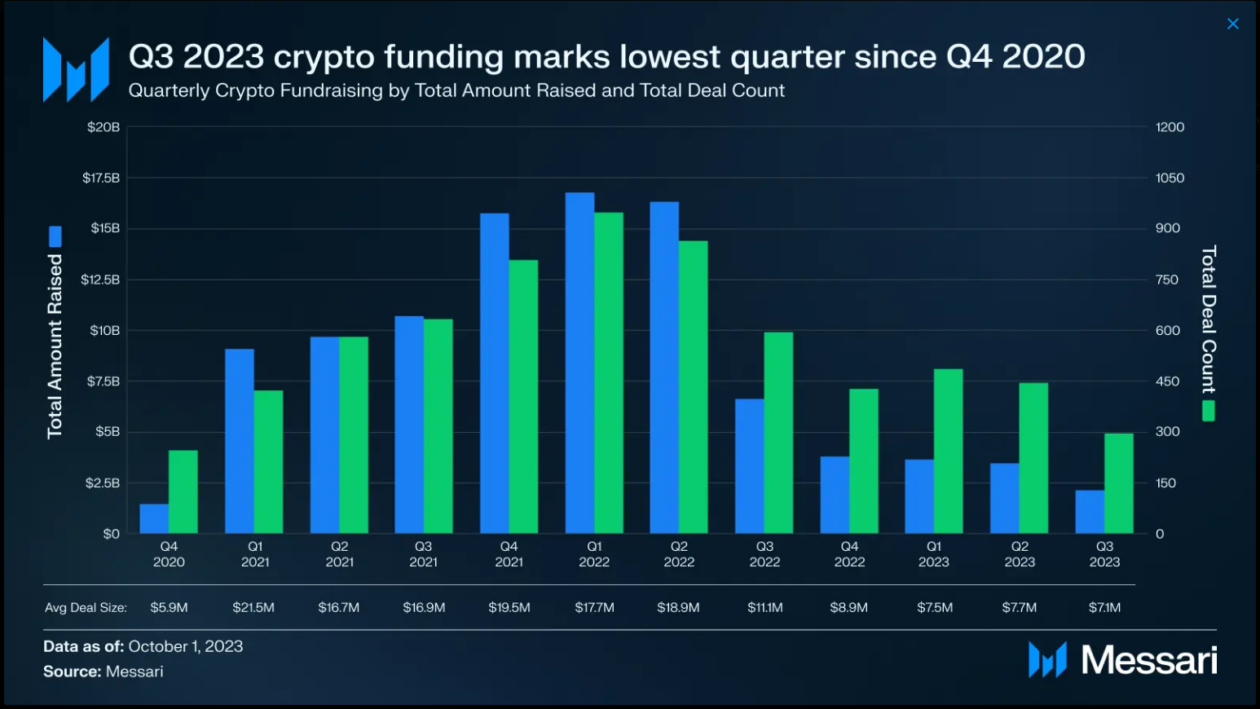

The amount of funds raised by cryptocurrency firms dropped to a three-year low of US$2.1 billion in the third quarter of 2023, according to a new report published by on-chain intelligence firm Messari.

See related article: CMCC Global raises US$100 mln to launch Hong Kong Web3 fund

Fast Facts

- According to Messari’s State of Crypto Fundraising report published on Thursday, crypto firms raised US$2.1 billion across 297 deals in Q3, 36% lower than in Q2.

- Most investments were focused on early-stage funding rounds, with seed funding accounting for a total of US$488 million raised over 98 rounds.

- Series B and later-stage investments fell to a 1.4% deal share in Q3, down from 8% in Q4 2020.

- “This is indicative of strategic bear market positioning as investors attempt to fund projects with asymmetric upside that can return greater multiples when market sentiment eventually shifts in a positive direction,” Messari said in its report.

- The global crypto market capitalization is down 63% from its all-time high of US$3 trillion in November 2021.

- The bear market has caused financial difficulties for several notable crypto companies, such as New York-based crypto intelligence firm Chainalysis, which reportedly cut 150 employees this week.

See related article: HKEX to launch smart contract settlement platform