When former U.S. Democratic presidential candidate Andrew Yang was touting universal basic income — direct cash payments to the public — many scoffed at the idea as absurd or unaffordable on a national scale.

The coronavirus pandemic has changed everything, including conversations worldwide about public cash handouts.

In the United States, Senate Republicans — which traditionally have been against government handouts — are now proposing to give up to $1,200 in direct cash payments to each American. Britain, Japan, Australia and Hong Kong are also considering or already providing cash payments to the masses.

These public handouts are intended to be temporary. Though as Milton Friedman once warned, “Nothing is so permanent as a temporary government program.”

In this “Big Think” — an opinion piece about a future society shaped by emerging technologies like blockchain — we consider the profound effects a permanent universal basic income (UBI) could have.

What you’ll learn in this article:

- How blockchain and automation could trigger high unemployment in certain sectors

- How much UBI would cost, in dollars

- Whether higher taxes on corporations and the rich could fund UBI

- The likely impact that a permanent UBI would have on society

Nottingham, England, 1811 — He looked at his hands, roughened by work, mangled but still strong. He didn’t just make rugs. He made art. This was not supposed to be his fate. He had a family. A man had obligations.

They called for him and he got up. Like the others, he blackened his face to hide in the night, and picked up his hammer.

He joined the small group of men marching to the master weaver’s shop. They kicked in the door, stormed inside and destroyed half a dozen weaving frames. In a three-week period, over 200 stocking frames were smashed in similar attacks.

The textile workers, also known as Luddites, had reclaimed their livelihood from the infernal machines. Or so they thought ….

“Luddite” is now a term used to describe anyone who resists new technology.

As everyone who has taken an economics course knows, the Luddites were very wrong about the effects of technology on total employment. Textile machines did not destroy jobs, they created more jobs. Albeit under very different working conditions — the Dickensian environment of 19th century English factories.

Since the Luddites, economic theory about how technological advances affect the labor market has been elegant and accurate. Innovations that initially reduce jobs create more profit. Whether the company reinvests that profit or puts it in a bank for others to invest, ultimately more jobs are created.

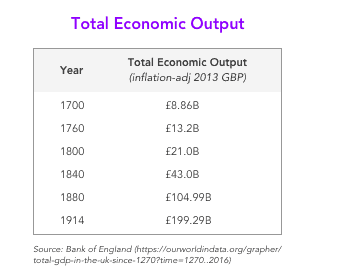

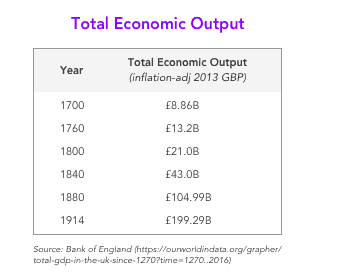

Coined by Joseph Schumpeter as “creative destruction,” the phenomenon for 250 years has lifted far more boats than it sank. The chart below from the Bank of England shows the dramatic rise of total economic output in England from the start of the Industrial Revolution in 1760:

The short-term problem of labor-disrupting technologies is politics. New job creation takes time, while job losses are immediate. If you don’t have a job on June 1, that’s how you vote — or protest — regardless of whatever job you may get on October 1.

In the West, this first led to the creation of unemployment insurance, then to the more problematic “nanny state” of welfare and public housing. For over 100 years, such programs have tried to insulate workers from the temporary effects of creative destruction.

Enter the robots

According to a recent report by Oxford Economics, up to 20 million jobs worldwide could be lost to robots by 2030. The good news: robots likely will do more good than harm in terms of productivity and profitability.

The Oxford report found that a 1% increase in robots per manufacturing worker leads to a 0.1% boost to productivity, measured by output per worker across the labor market — enough to drive meaningful economic growth. A very possible 30% rise in robots above its modest baseline prediction for 2030 would trigger a 5.3% boost to global GDP — or an extra $4.9 trillion, an amount greater than Germany’s economy.

The bad news: an estimated 1.7 million manufacturing jobs have been lost to robots since 2000, including 260,000 in the U.S., 400,000 in Europe, and 550,000 in China. The study found that half of those leaving manufacturing jobs in the past two decades found new work in three main sectors: transport, construction and office administration.

The very bad news: these sectors are likely among the most vulnerable to automation over the next decade and beyond. Think about the potential disruptive effects of blockchain on employment in the back offices of banks and insurance companies. In the U.S., administrative assistants, bill collectors and bookkeepers lost a combined 226,000 jobs from 2012 to 2017. Like the early days of industrialization, technology like blockchain could create an unemployment tsunami.

See related article: How Blockchain Fights Modern Slavery: Mark Blick, Diginex

Does creative destruction apply to a blockchained world?

The numbers from the last 20 years are not encouraging.

One of the chief political complaints since 2008 is economic recovery, and surging stock markets have benefitted too few and primarily those at the top. In the United States, the number of billionaires has more than doubled in the last decade, from 267 in 2008 to 607 last year. Federal Reserve data found the wealthiest fifth of Americans now hold 88% of the nation’s wealth.

However, U.S. median household income, adjusted for inflation, has barely recovered to just above where it was in 2000. There are now 39 million Americans on food stamps, down from a record 47.6 million recipients in 2013, but still 40% higher than it was in 2008 despite the 8% population growth.

The problem appears to be, the trickle-down from the very rich has created a service-based economy with a vast working class and a shrunken middle class. Call it the Starbucks-Whole Foods economy — a return to quasi-feudalism where the rich have estates and the masses toil as servants.

Now add to the mix robots stocking shelves, making lattes, cleaning houses and collecting bed pans, and you have a formula for mass unemployment.

In response, some U.S. cities are mandating higher minimum wages. But such laws are backfiring.

A University of Washington study found that Seattle’s minimum wage hikes led to low-wage workers losing an average of $80 a month in pay because the higher labor cost made employers cut hours.

In New York, the city’s recent minimum wage increases led to the loss of 6,000 restaurant jobs.

Let’s be charitable and not accuse left-wing politicians of trying to buy votes with policies they know fail. However, it is clear this kind of redistribution from rich to poor does not work.

Hong Kong, which was rocked by months of violent street protests, provides a different warning. Its average income is very high at $64,216, or ninth in the world, but the median income is only $9,705, or 18th in the world. As in the US, household income in Hong Kong has just started trending up again after almost 15 years of stagnation.

A chief reason: most of the domestic market is “competition” between two firms controlled by the same five family conglomerates. Since they have massive piles of capital, they also suck up new opportunities and keep out competition.

Some people in Hong Kong give 80% of what they spend in a day to companies run by Li Ka-shing, one of the world’s richest men.

Trends in the developing world are no less troubling. Countries like India and Vietnam enjoy GDP growth exceeding 6.5% annually. But their population is expanding so quickly that they need more like 8-9% annual GDP growth to create enough jobs for all. Those economies also need the low-skill jobs that robots are poised to take.

Low-skill workers in China are already being replaced. One out of three new robots in the world is in the People’s Republic, which now has one-fifth of the world’s robots — up from just 0.1% in 2000, according to Oxford. Yet, 500 million Chinese remain in poverty, living on $5.50 a day or less.

As Eastern Europeans of a certain age can tell you, Marxism is a terrible prescription for the flaws of capitalism. However, it diagnoses capitalism’s biggest problem: without redistribution, capital ends up in the hands of very few people.

Is universal basic income the cure?

UBI would be one way to transfer wealth from the very rich to those at middle income and below. It could cover basic cost of living and provide financial security, to offset job losses caused by technology and robotization. Among its supporters are the world’s best and brightest.

“We should explore ideas like universal basic income to give everyone a cushion to try new things,” Facebook CEO Mark Zuckerberg said in a 2017 speech at Harvard University. “And yes, giving everyone the freedom to pursue purpose isn’t free. People like me should pay for it.”

Long before the coronavirus pandemic panic and politicians jumped on the idea of cash handouts, UBI was also backed by Bill Gates as well as Tesla CEO Elon Musk, who said “it’s going to be necessary” as robots take jobs.

Plans differ on who would get paid. Some would pay every citizen, regardless of income. Others would only pay only the poor whether or not they work. Another proposal, supported by nearly half of Americans, would pay only those left jobless by advanced technologies.

A role for blockchain?

For developers of blockchain applications, UBI could be a boon. Governments will need to transfer possibly billions in payments.

The U.S. Social Security Administration, with 60,000 employees and 1,200 field offices, already struggles to make 63 million payments a month. Every month, about 10,000 new Americans reach retirement age, and retirees are living longer than ever. Average wait times at SSA offices have increased by 42% since 2010, and wait times at some field offices more than doubled.

According to the U.S. government, an astounding 10.6% of all welfare payments are improper, costing $77.3 billion in 2017. So the need for a verifiable payment system that can’t be tampered with is obvious.

What is a fair universal income?

What would make the masses forgo a revolution to overrun their high-tech overlords and their robots?

Let’s use the U.S. as our test case. In America, the official poverty line for a family of four is $25,750. That provides a very meager lifestyle.

The median household income is about $63,179 — on which you pay tax. So let’s make our UBI $60,000 tax free. Let’s face it: we’re only going to avoid class wars if most people feel comfortable.

How much will it cost?

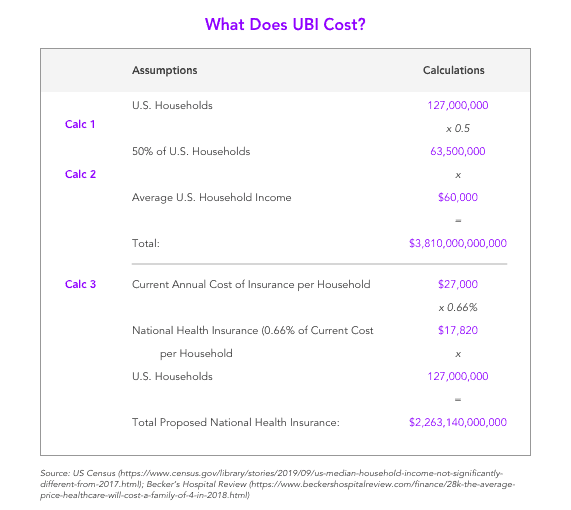

There are 127 million households in the U.S. Let’s say robots and technologies like blockchain eliminate jobs for 50% of them. Project the Oxford study’s trend line, and that’s not unreasonable without significant new job creation.

That means we would need about $3.8 trillion for our UBI. (Follow my math here … all calculations rounded to nearest hundred million). (CALC 1&2)

To put that in perspective, the entire 2019 U.S. government budget was $4.5 trillion. That pays for things like defense, NASA, the Interstate freeway system and federal courts.

So how could we pay for UBI?

The federal budget does include $1 trillion for Social Security. If we’re giving every household $60,000, we won’t need to give retirees Social Security. So we save a trillion.

Medicare and Medicaid are another $1 trillion. In America, if we don’t provide health care to our non-working households, it eats almost half of their income.

In 2017, private health insurance for a family of four cost on average $27,000. For the vast majority of Americans with private health insurance, most of that cost is paid by their employer.

Tackling the flaws of the U.S. healthcare system is beyond the scope of this article. But let’s agree that if we can implement a change as radical as UBI, we can get major health care reform. Let’s also agree that reform drives down the cost to provide health care to every household by 33%.

A family of four is the average household. So, that’s $2.3 trillion for all 127 million U.S. households, and also replaces the cost of Medicare and Medicaid. (CALC 3)

(In a minute, you’ll see the big moral hazard created if we don’t extend health care to our working households, too.)

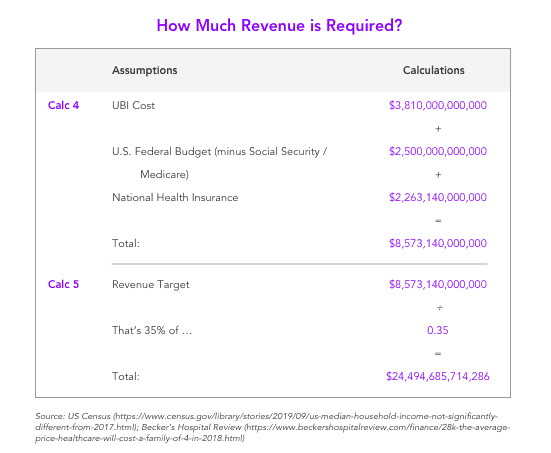

Let’s review our numbers:

- Universal Basic Income: $3.8 trillion

- U.S. federal budget minus Social Security and Medicare: $2.5 trillion

- National Health Insurance Plan: $2.3 trillion

- Total: $8.6 trillion (CALC 4)

In terms of revenue, Uncle Sam took in only $3.5 trillion in taxes last year.

We would have to raise two-and-a-half times as much revenue to pay for our brave new world.

Big corporations can pay for it!

“Social justice” champs like Democrat presidential candidate Bernie Sanders and former candidate Elizabeth Warren have argued bitterly that corporations can pay far more tax. History shows that not to be the case. Historically, business has added about 10% more to total tax revenue collected.

Here’s why smart governments know high business taxes are pyrrhic. Corporations pass on their tax burden to you. They will either raise prices or reduce wages. They have to maintain their profit margins at a certain level to satisfy stockholders — many of whom are international.

It doesn’t matter what happens with the corporate tax rate. There is no way around it. One way or another, the average taxpayer will pay the freight.

Then there’s how business investment decisions are made. It is driven by the return, and taxes dramatically reduce return.

For example, if we need a net 25% return to undertake a project, and effective corporate taxes are 39%, we need a gross return of 34.75%. (25% X 39% = 34.75%)

Most investments just aren’t that obvious a slam dunk. The higher taxes are on companies, the less investment they’ll make. That means fewer jobs and less income.

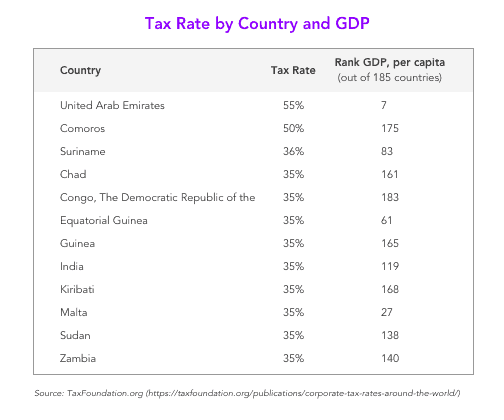

Here’s another reality check. This is a list of countries with the highest tax rates and their rank in GDP per person:

Other than the UAE, which produces three million barrels of oil a day and has a population of 10 million, countries with the highest corporate tax rates do a terrible job generating wealth for their people.

In fact, the vast majority of wealthy countries have lowered published corporate tax rates in the last decade to reflect the effective tax rate business pays. Practice shows higher rates don’t generate more revenue, and instead create massive compliance issues.

Bottom line, we’ll get our historic 10% from corporations. In 2015, before the Trump tax cuts, that yielded $350 billion on roughly $3.5 trillion in gross reported revenue

That barely moves the revenue needle for UBI.

What if the rich pay more?

That leads us to tax reform. Mark, Elon and Bill say they would pay a little more. Would that work?

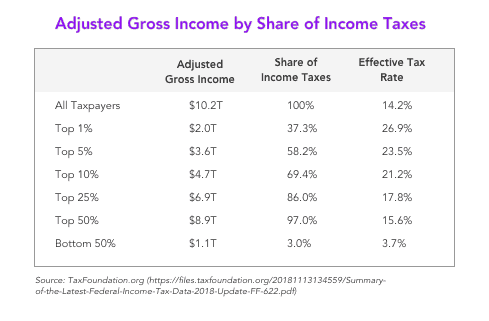

Take a look at this chart.

Adjusted Gross Income (AGI) is what the IRS taxes you on after some very basic deductions like pension contributions and cost of health care. The IRS doesn’t break down total gross income, but it does report the amount, which was $10.4 trillion. Not much more than AGI.

After all deductions, that $10.4 trillion yielded $1.8 trillion in tax paid to the government. That’s about a 17.3% effective tax rate.

The IRS’ other main source of revenue is payroll tax, which generated $1.2 trillion. Employees and employers evenly split the cost of payroll taxes.

That means the same two sources — individuals and businesses — pay 95% of all taxes, and there’s only so much government can squeeze out of them. We’ve already dealt with how much business will pay.

For individuals, refer again to the chart above. The top 25% or wage earners pay 86% of taxes. From a revenue perspective, the bottom 50% contribute almost nothing.

What about the super rich? The top 1% pay 37.35 of all income taxes and have an effective tax rate of almost 27%.

There are 205 people in America who earn more than $50 million a year in wages alone. But their earnings totaled to a combined $19.95 billion. Taxing the entire amount still comes nowhere close to paying for UBI.

The only real way for the government to make up the gap between $8.5 trillion and $3.5 trillion would be to make the effective tax rate about 75%.

And if you were giving 75% of your income to the government, would you support this plan? Or work very hard? Of course not.

In other words, the only way to pay for UBI is to significantly grow the economic pie.

So realistically, how much total income must the economy generate to make UBI work?

Progressive taxation is done with marginal rates. The more you make, the more you pay. The Laffer Curve shows that at some point, raising taxes will reduce revenue collected because new investment yields so little gain that the risk is not worth the reward.

A society where half of the people get paid to not work already has large disincentives for being employed.

Jeff Bezos may not need his net worth to go up 50% go into work. Unfortunately for UBI proponents, he’s not just the top 1%, he’s the top 0.0000001%.

If you’re getting $60,000 to sit on a beach all day and sip piña coladas served by robot waiters, it’s going to require me making something like $90,000 a year to go to work for the current average of 1811 hours a year (that’s 38.7 hours a week at 46.8 work weeks a year).

To incentivize people to go to work, we have to get those between 50% and 26% up from the median income of $63,000 a year to more like $90,000 a year minimum. That’s half our remaining workers. Then consider: if the apprentice is making $90,000, the master is going to want more like $150,000.

The top 1% of wage earners starts at $718,766 and the top 10% at $118,400. The rich aren’t that rich.

The wage increases required to keep people working will be proportional almost until we reach those 205 people in America who earn more than $50 million a year.

Uncle Sam needs a total of about $8.5 trillion to pay for UBI world and he’s got just $2.4 trillion. But per the Laffer Curve, to get that revenue, the sources of revenue can’t just grow by the $6.1 trillion gap.

Our two main sources of revenue are individual income and business tax (reminder: payroll tax comes from those sources) which currently totals about $13.9 trillion ($3.5 trillion from business and $10.4 trillion from individuals).

Our taxpayers will still have to pay state and local taxes on top of federal taxes. So our effective federal tax rate can’t exceed about 25%, or we risk going far enough along the Laffer Curve that we will generate less revenue. Note that effective tax rate is about 10% higher than the 15.6% the Top 50% pay now.

That means we will need our combined sources of potential revenue from individual income and business tax to be about $24 trillion. (CALC 5)

If we assume that for that to happen, our total economic output also has to almost double in size. We can refer again to our chart showing the rise in English economic output after the Industrial Revolution.

That happened. But it generally took about 40 years, and the U.S. hasn’t seen anything like the sustained growth rates achieved during the Industrial Revolution for half a century.

So that would seem to be that. The 30% rise in productivity generated by robots is nowhere near enough for a UBI.

And yet, you would think Zuckerberg, Musk and Gates can do the math. So why is this idea gaining traction?

Progressive Utopia

For that, you have to understand the world “progressives” want to build, which underscores the biggest difference between capitalism and socialism.

Adam Smith didn’t dream up the invisible hand of the market, where supply meets demand. He observed its effect. As Schumpeter did with creative destruction. Neither was concerned with righting wrongs. Their models explain the world as it is.

However, socialism is the world as leftists wish it to be. Saint-Simon, Fourier, Lassalle and Marx hated the rich. So they first made the moral case for socialism and imagined what that system would look like. That’s why it’s often an accurate diagnosis of the flaws of capitalism but also a terrible prescription.

Will our brave new world produce the enlightened, socially just, politically correct class they envision? Their track record is against them.

In the West, the best predictor of being on welfare is having parents on welfare. There are places in the U.S. and Britain where families are on their fourth generation of living on the dole.

Much of our purpose in life and sense of self-worth comes from having a job — particularly among men. Idle hands are the devil’s maker.

A McKinsey automation study anticipates men will make up 53% of workers displaced by robots. Based on the current gender share of occupations, their modeling also suggests that women could capture 58% of net job growth through 2030.

The roots of Islamic rage are complex and some high-profile terrorists have come from middle and upper class backgrounds. But Muslim countries also have some of the highest rates of male unemployment in the world.

Welfare is not the only example of how giving people things for free can backfire disastrously. Take a look at failed social housing projects like America’s Cabrini-Green or Britain’s Willow Tree Lane Estate, where violence, intimidation and drug dealing are the way of life — not meditation, yoga and pottery-making.

They may be a preview of a UBI world where our worker class will cluster together in “elite” cities. Twenty-five megacities in the U.S. have accounted for more than two-thirds of job growth in the last decade, although they have just 44% of the population.

Children in our worker cities will see mommy and/or daddy go to work and will want to work.

Our non-worker class will move to places where their money goes further. Their children will see mommy and daddy never going to work, and they will grow up to not want to work. We would be creating a permanent underclass.

Imagine what that could mean for education. Why would you toil in school for years if you’re not guaranteed a job and a better life? Would people still learn quantum physics for the sake of learning? Progressives say yes. But I think human experience tells us most would not be so keen.

What would a semi-literate, math-illiterate society produce over the long term? Anyone who has seen the satirical movie Idiocracy just winced.

Much of the problem may be the “progressive” class itself. Orwell posited what a party of permanent progressive elites might produce in 1984 and Animal Farm.

While it is true that his books are about the totalitarian nightmare of fascism and communism, Orwell was a disaffected socialist who had fought for the communists in the Spanish civil war.

He thought Stalin and his brand of Marxism were far more dangerous than the grotesque tribal rantings of Hitler because “fairness” appeals to the elite mind. Much of Orwell’s thesis can be paraphrased this way: be most wary of those pursuing power using progress and equality; they’re almost always about neither.

Which brings us back to the Luddites. With the rapid advances in technologies like robotics and blockchain, we’ve begun a new era of massive job disruption like the Industrial Revolution. But rather than pursuing social engineering schemes like UBI, as the lesson of the Luddites shows, we need to give creative destruction a chance to lift most boats.

The view expressed is solely the opinion of the author and does not necessarily reflect the editorial view of Forkast.News.

Care to rebut?

Send us an email or opposing editorial, and we’ll consider it for publication.