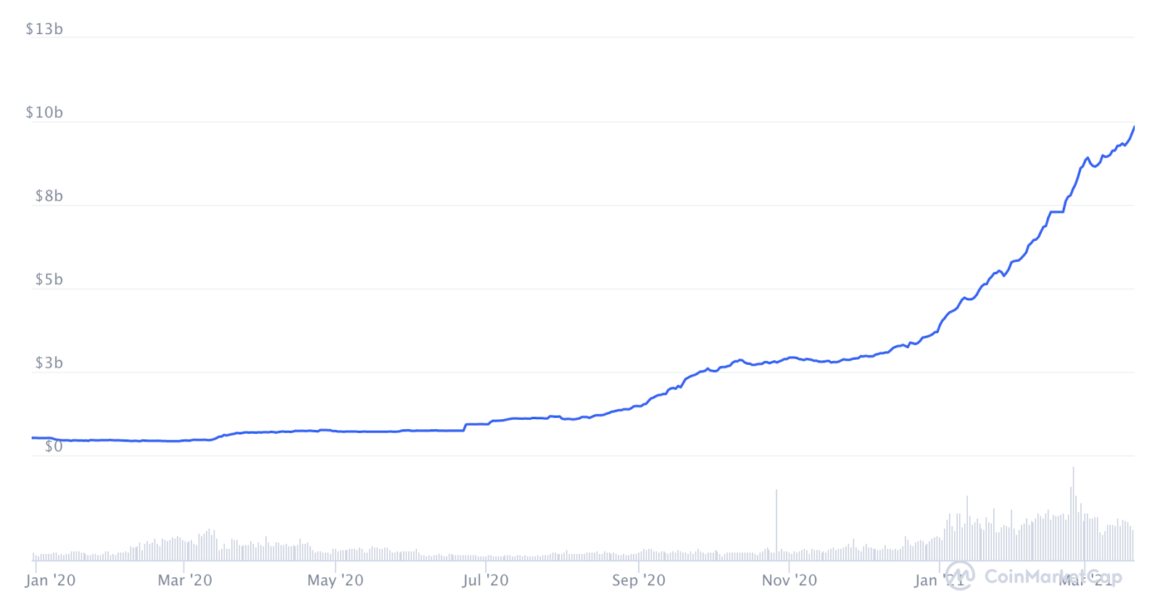

Adoption of new technologies, especially within fintech and payments, has changed a lot over the last year. The Covid-19 pandemic has exacerbated the decline of cash usage and left many individuals and businesses embracing digital and innovative ways to transact. Some have also turned to stablecoins, with the circulating supply of USDC, for example, growing from US$500 million in circulation in January 2020 to US$11.3 billion now.

Increased smartphone adoption has aided payments in emerging economies where transactions need to be processed in real-time, and as cheaply and inclusive as possible. This was one of the motivations behind the mission of the Diem Association, formerly called Libra Association, to enable a simple global payment system and financial infrastructure that empowers billions of people.

Led by Facebook, Diem — the digital currency project formerly called Libra — has the potential to reach billions of people, solving issues like financial inclusion, digital identity, faster and more affordable payments, and more.

On top of this, national central banks are powering ahead with pilots and trials of central bank digital currencies (CBDC), with 80% of countries already experimenting with CBDCs. A CBDC is a digital form of fiat money, backed by a suitable amount of monetary reserves like gold or foreign currency reserves. Each CBDC unit will act as a secure digital instrument equivalent and can be used as a way of payment, a store of value, and an official unit of account.

To help with their public policy objectives and to evolve in this new environment, almost all central banks are actively researching the benefits and risks of offering a digital currency to the public.

Given this context and the objectives of both digital instruments, is there enough room for both Diem and CBDCs to co-exist going forward? We think so. Here’s why:

1. CBDCs and Diem share similar attributes

Since its inception, the Diem project has evolved immensely. Having gone back to the drawing board, Diem has evolved into single-currency stablecoins, such as Diem Dollar, Diem Pound, and Diem Euro akin to Gemini Dollar (GUSD) or USDC, with each token backed 1:1 with local fiat currency.

Similarly, CBDCs will be issued by a country’s central bank, backed by reserves, and subject to regulation. It is this robust regulatory oversight that Diem seeks to secure and operate under before the currency is launched.

2. Diem will help preserve domestic sovereign currency usage

To guarantee the value of a Diem Dollar, for example, the Diem Association has built a robust financial infrastructure to ensure it will mint and burn coins as per the actual amount in its reserve. We can only assume, as per the association’s latest statements, that the Diem team has plans to work closely with central banks across the globe. The goal of the stablecoin, as per the Diem Association, is to complement monetary policies rather than disrupting local fiat currencies.

Furthermore, it stands to reason that, as a result of the Diem Association’s government-friendly approach, as and when the Federal Reserve does decide to go ahead and release a digital version of the U.S. dollar, the association will most likely incorporate a stablecoin version of the asset into its native offering, thus helping increase the dollar’s market accessibility and overall usability.

3. Both will use similar payment rails

Both Diem and CBDCs require an infrastructure to be built for making payments. This infrastructure is pretty similar; it includes the blockchain on which the CBDC is recorded, payment applications, and POS devices that are used to initiate payments. CBDCs and Diem both offer users a new way to transact in the digital economy, which aims to be faster and more efficient than what we currently have, with the possibility of adding new functionality over time.

4. Diem and CBDCs represent the future of digital finance

As and when Diem is able to secure a regulatory nod, as well as a tangible amount of mainstream support, it appears as though governments all over the world will start to recognize the long-term value proposition put forth by the stablecoin and look to incorporate the system into their very own white-label CBDC solutions.

In terms of how the Diem project has been progressing, David Marcus, head of Facebook Financial and former president of PayPal, has expressed confidence that the cryptocurrency will launch later this year, claiming that Diem will probably make inroads into the global finance market by Q4 with Facebook’s own native wallet offering, Novi, leading the way in this regard.

As and when Diem does go live, users all over the world will be given the opportunity to facilitate stablecoin and CBDC payments at the touch of a button without having to wait for the launch of real-life use cases.

5. Together, Diem and CBDCs will redefine the global economic landscape

In closing out this piece, it is clear that the goal of the Diem payment system is to integrate smoothly with the local monetary and macroprudential policies of various nations across the globe, as well as “complement existing currencies” rather than disrupt them.

Also, as pointed out earlier, the Diem Association will actively work with central banks so as to get a move on a wide array of issues, such as facilitating the direct custody of cash or cash equivalents, as well as processing very short-term government securities. In all, the future of the payments market looks increasingly brighter every day, with Diem and central banks together leading the charge, building on the shoulders of the last 10 years of blockchain innovation.