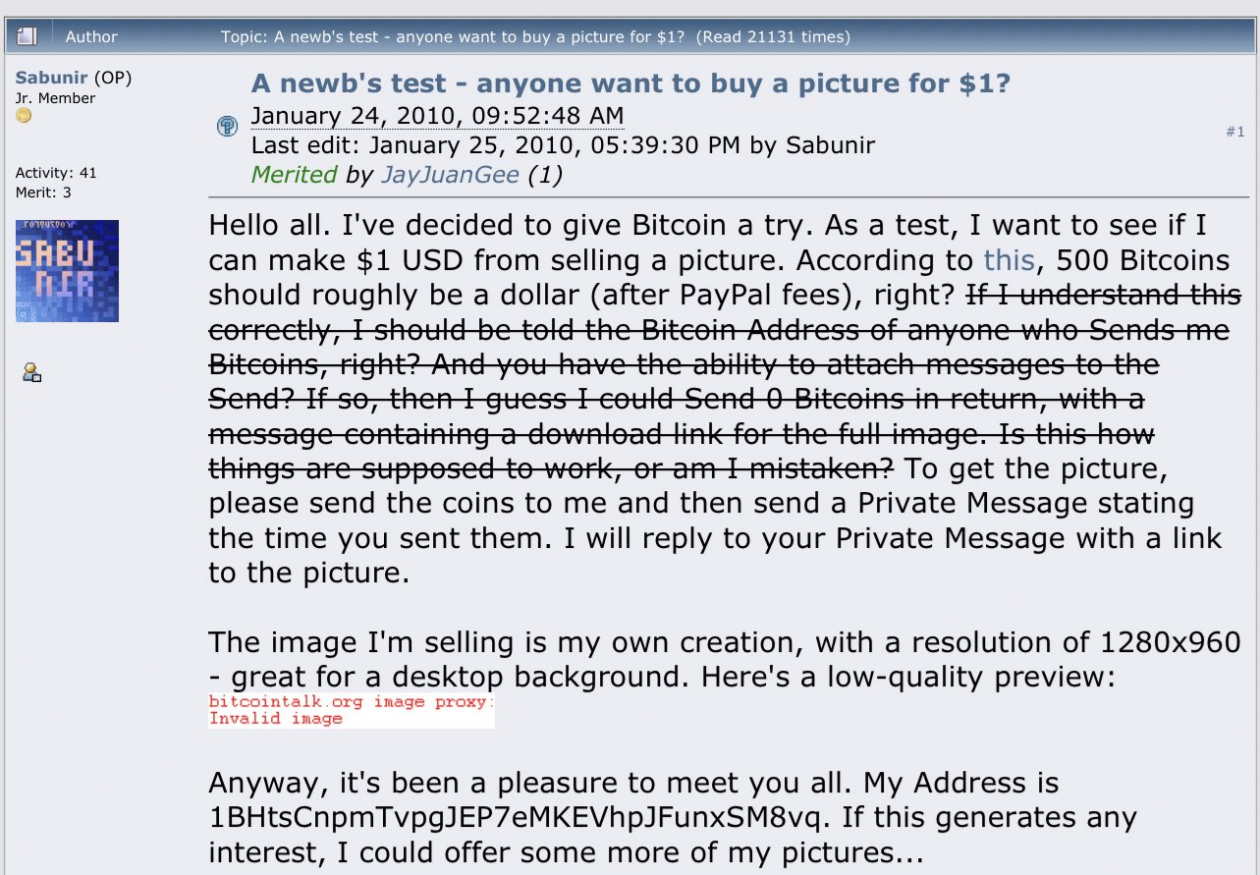

Sometimes the most noteworthy thing in non-fungible tokens isn’t an NFT. A nugget of blockchain history was unearthed this weekend when internet sleuths uncovered the first documented financial transaction on the world’s first blockchain. In January 2010, a user named Sabunir decided to try Bitcoin, and as a test, sold a digital picture for US$1 in Bitcoin.

Was this the world’s first NFT sale? No, but it is a perfect example of the use case of NFTs; preserving the provenance and ownership history of literally anything digital (not just a jpeg).

This 500 BTC jpeg sale would be worth about US$13.7 million today. Had the image been tokenized as an NFT, it would have gone down as the most significant NFT in history. If the image is recovered in the future, it would hold no value. But if it started as an NFT, the world would know exactly which copy was the original, and one lucky person would have generational wealth from it.

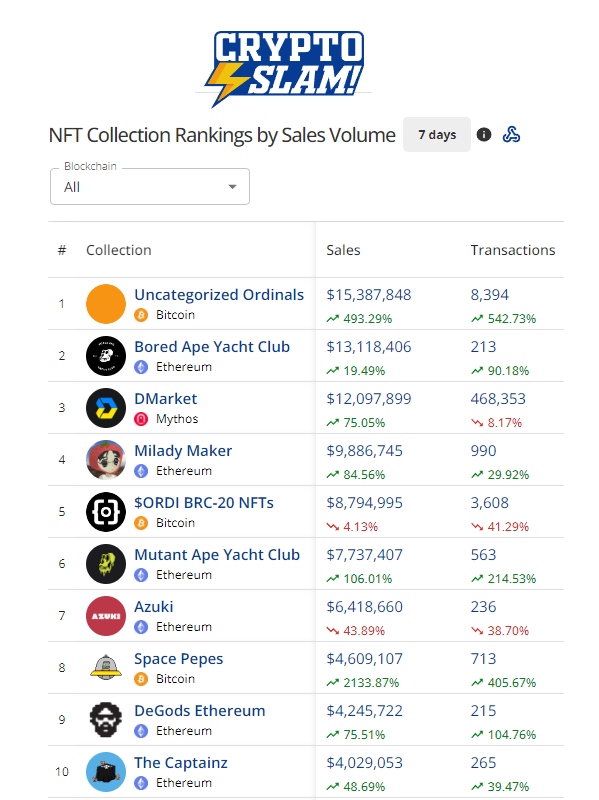

In the past 30 days, Bitcoin Ordinals and BRC-20s have turned the OG blockchain into the blockchain with the second-highest sales volume in the world. Bitcoin NFTs are just getting started and in the long run, I expect Bitcoin to compete head-to-head with Ethereum’s all-time sales. It may actually exceed them too.

Mythos Chain is also doing big numbers, as people are beginning to take notice of the gaming blockchain and their impressive products. I’m a gamer and didn’t know until recently that they have the world’s largest CS:GO skins secondary market along with new hit NFL Rivals, Blankos Block Party and more on the horizon.

Fun fact: There is a gaming blockchain doing the 3rd most NFT volume this week.

— apix🎮 (@apixtwts) May 13, 2023

More than Solana, Polygon, Immutable and co.

Fun thing is, all the volume is in CSGO skin sales which are recorded on the blockchain.

Sadly it's not through web3 games (yet) pic.twitter.com/udDeU7clT9

At the time of this writing, three of the top 10 collections in 24 hours are all gaming NFTs, and the biggest game makers like Square Enix, Ubisoft, Konomi and Atari are only just now beginning to touch NFTs.

Lots are going on outside of the NFT markets. NFT communities and those who build them are preparing to descend on the second annual VeeCon conference this week, as Gary Vaynerchuck again shows the world the pinnacle of Web3. Those who believe NFTs can function as access passes, art, and collectibles all in one are in for a treat when, what I call the State of the NFTs, kicks off at Lucas Oil Stadium on May 18. CryptoSlam will be there shaking hands and filling our brains with all of the latest happenings in NFTs. It’s going to be a special time and we’re hoping to get to meet some of you there!

I’m expecting markets to be slow while many are off networking, but we also know that degens are going to degen. Keep your eyes on cryptoslam.io, the Forkast 500 NFT Index, and our ETH, Solana, Polygon, and Cardano composites to see how the market is affected when many in the space take a break from trading.

In the past seven days, the Forkast 500 NFT Index reflects the market being down around 2.5%. We can again attribute it to low volume and high transacting fees from crypto trading.