In this issue

- Binance and FTX: Winner takes all

- U.S. midterms: Bills coming due

- Hong Kong: Lots of ‘fin,’ too little ‘tech’

From the Editor’s Desk

Dear Reader,

What happened.

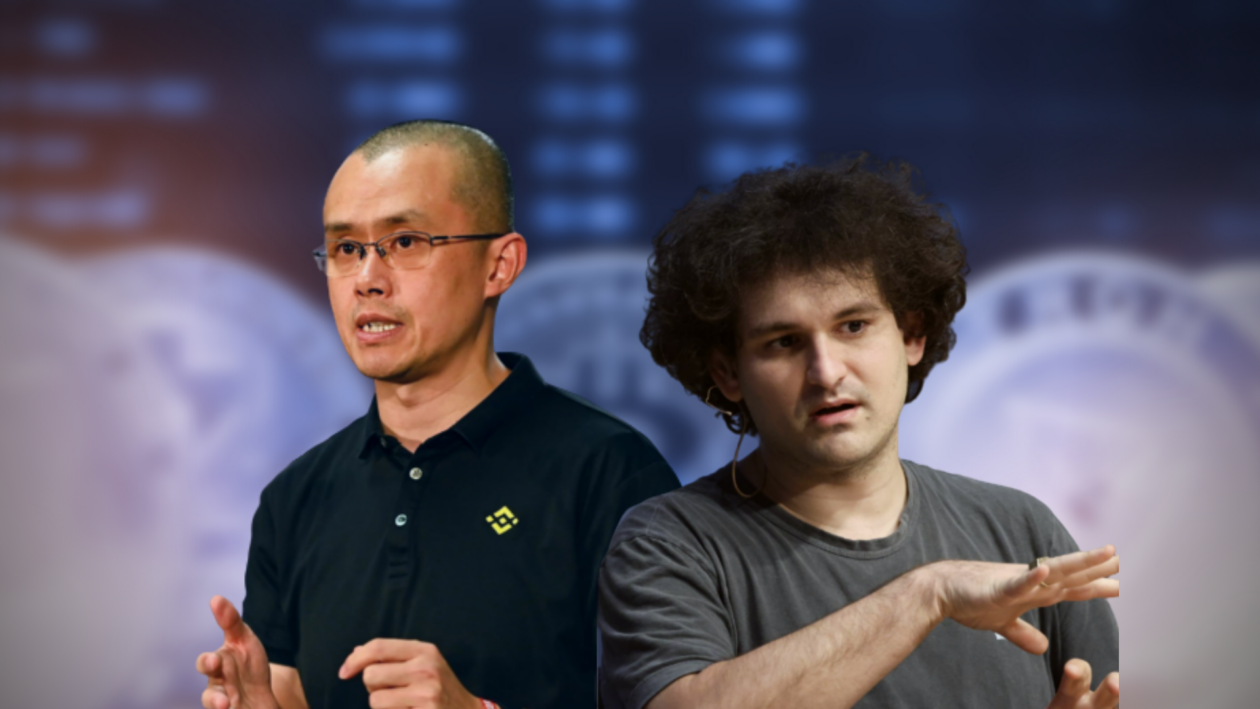

That’s the question ricocheting across the crypto and finance landscape today. Jaws remain agape. Shock is still sinking in. In just the past 24 hours, crypto exchange giant FTX went from defending itself against Binance’s allegations and insinuations of insolvency, with its chief, Sam Bankman-Fried proclaiming on Twitter that: “A competitor is trying to go after us with false rumors,” and that “FTX is fine. Assets are fine,” to proclaiming that the very same competitor — Binance — is now its new savior and overlord.

How the mighty have fallen. But how FTX fell should trigger deeper questions about the industry as a whole. The once crypto white knight that rode in to bail out BlockFi, Voyager and others is now being bailed out by the very challenger that instigated the run on it. How did this happen, and so quickly?

This very public dispute that we’ve been monitoring raises serious questions that extend beyond the event itself. In a move that one might consider brilliant game theory, CZ at Binance triggered a crypto bank run on a direct competitor by proclaiming publicly that it would divest itself of its FTT tokens, only to come riding in to sweep up the biggest prize of all — FTX itself. As one Forkast reader rightfully observed: “Binance accelerated a run on $FTT which has the effect of $FTT token holders indirectly financing Binance’s acquisition of FTX.”

A non-binding letter of intent to acquire FTX is now in place, with SBF calling Binance its “first, and last” investor. More than that, the affair is indicative of the tightly woven and contagion-vulnerable crypto world built up from the capital of a few.

But note that no U.S. customer of FTX was affected by this meltdown. FTX US is very strictly ring-fenced by U.S. regulators, which has restricted U.S. residents from buying $FTT, and FTX’s U.S. entity remained functional and immune to the withdrawal chaos. U.S. regulations protected their own. However, in this US$32 billion wipeout (FTX’s valuation based on its most recent fundraise) in just 24 hours, it’s an entirely different story for other FTX investors. The likes of Temasek, SoftBank, Sequoia and countless other venture capital firms may be staring at a total wipeout.

In the biggest fire sale in crypto history, Binance is now conducting its own due diligence. It’s not an unfamiliar process, considering its appetite to expand its influence, with more such moves likely to come.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. CZeckmate

By the numbers: FTX — over 5,000% increase in Google search volume.

Binance has agreed to acquire rival cryptocurrency exchange FTX after FTX experienced sudden liquidity issues, FTX Chief Executive Sam Bankman-Fried and Binance Chief Executive Changpeng Zhao said on Tuesday.

- Both Bankman-Fried and Zhao said that working out the details of the deal will take time, but the Binance founder also cautioned that his exchange could “pull out from the deal at any time.”

- The development follows an increasingly heated and public feud between the founders of two of the largest crypto exchanges, and reports of liquidity and withdrawal issues at FTX as Binance liquidated its remaining FTX tokens (FTT) on Sunday.

- Last year, Binance received roughly US$2.1 billion worth of Binance USD (BUSD) and FTT stablecoins as part of the company’s exit from FTX equity. Zhao, also widely known as “CZ,” tweeted this past weekend: “Due to recent revelations that have [come] to light, we have decided to liquidate any remaining FTT on our books.”

- The Binance chief was alluding to a Coindesk report saying that a leaked balance sheet showed that Alameda Research, FTX’s sister crypto trading and investment firm, had debt that accounted for about 54% of its assets as of June 30 and that a significant portion of the company’s assets was held in FTT, suggesting that Alameda’s solvency may be problematic.

- Alameda chief executive Caroline Ellison at first responded that the balance sheet in question was for a subset of corporate investors, tweeting: “We have > $10b of assets that aren’t reflected there.”

- Zhao countered: “Liquidating our FTT is just post-exit risk management, learning from LUNA.” He also hinted at anger over Bankman-Fried’s advocacy of more crypto regulations, including calls for “more public disclosures and transparency” and government crackdowns on illicit crypto activity. “We won’t support people who lobby against other industry players behind their backs,” Zhao said on Twitter.

- Within hours of the Binance acquisition announcement, FTT shed 77.2% of its value to trade at US$5.07 at 03:28 am in Hong Kong according to CoinGecko data. FTT was trading at US$4.75 at midweek Hong Kong time, according to CoinGecko data.

- Binance’s BNB coin briefly rallied to US$393.93 before losing 9.1% of its value within hours. BNB was trading at US$318.49 as of midweek in Hong Kong.

Forkast.Insights | What does it mean?

The intensifying rivalry between two of crypto’s biggest players, Binance and FTX, just came to a sudden end. How did it come to this?

The two exchanges, arguably the most influential in the crypto world, with two of the industry’s most recognizable public figures at their helms, had been engaged in the crypto equivalent of a cold war over the past few years, and it now appears it’s over.

It all started in 2019 when Puerto Rico-based lawyer and crypto enthusiast Pavel Pogodin filed a US$150 million lawsuit claiming FTX tried to manipulate the price of Bitcoin futures on the Binance exchange. CZ appeared to tentatively agree with the notion that “a smaller futures exchange” had been trying to manipulate prices. Alameda Research called the accusations a “nuisance,” and the lawsuit was dismissed, but a few months later, Binance hit back by delisting all FTX-related assets.

A period of détente followed as the two exchanges agreed on a strategic partnership that would let Binance buy a significant amount of FTX assets to help it grow. That all changed last year, when FTX bought back its stake from Binance, citing differences over how the two businesses were run.

Things deteriorated further earlier this year, when Binance alleged that Bankman-Fried had been spreading misinformation about the exchange when lobbying the U.S. Congress. Bankman-Fried then mocked CZ personally in a tweet that he appears to have subsequently deleted.

Although Zhao and Binance now appear to be having the last laugh, the proposed acquisition of a top-five crypto exchange by the world’s largest crypto exchange is drawing new concerns. Will the deal pass muster when it comes to antitrust rules?

2. Voting on governance

By the numbers: midterm election — over 5,000% increase in Google search volume.

The crypto industry has been watching the U.S. Congressional midterm elections with bated breath, as the results could be crucial for the sector as it faces potential regulation and disputes over policy.

- Among the long-awaited pieces of legislation is the Lummis-Gillibrand bill, also known as the U.S. stablecoin bill, which aims to introduce more regulatory oversight for centralized service providers and more transparency and user protection for decentralized finance (DeFi).

- The bipartisan bill also seeks to lay the groundwork for depository institutions to issue “payment stablecoins,” which must be fully reserved and 100% backed by high-quality liquid assets.

- The bill has suffered delays as negotiations remain unresolved. Senators said during Bloomberg’s Crypto Summit in July that the bill likely would be delayed until next year due to its complexity. Co-sponsor Senator Cynthia Lummis said: “I think both [co-sponsor Senator] Kirsten [Gillibrand] and I believe that the bill, in one piece, as a total bill, is more likely to be deferred until next year.”

- The Republican Party was leading the House votes with 195 seats to the Democrat’s 166, at press time. The GOP was also ahead in the Senate race at 47 seats, just a single seat ahead, and four away from securing a majority.

- According to a Washington Post-ABC News poll, votes for the House are split nearly evenly, with 49% of respondents intending to vote for Republican candidates in their districts and 48% saying they will vote Democrat. The respondents were 50% Republican and 48% Democrat.

- The S&P 500 index has climbed every year since 1950 by an average of 16% in the 12 months following the midterm elections, according to data from State Street Global Advisors.

- As equity markets are now highly correlated with the crypto market, a rally on the S&P 500 may also inject some bullish momentum into the crypto space.

- Yet fears of a potential recession could end the positive track record of U.S. stocks following the midterms. “Recession outweighs factors in previous U.S. midterm elections that were seen as positive for stocks, such as resulting policy gridlock,” BlackRock strategists wrote in a note seen by Reuters, adding that they were “not chasing bear market rebounds.”

- The global crypto market cap was US$946 billion at press time, having shed 7.8% of its value within the previous 24 hours. Bitcoin fell by 7.1% in the same timeframe to US$18,363, and Ether also lost 13.8% of its value to trade at US$1,289, according to CoinGecko data.

Forkast.Insights | What does it mean?

Crypto, it appears, needs politics more than ever. As markets languish and the prospect of a protracted crypto winter seems to grow more certain, many crypto watchers are betting that regulation is what’s needed to lift the sector’s fortunes. That’s a far cry from the industry’s freewheeling and avowedly anti-regulation days.

Although this should be seen as a positive sign of the character of the people now running the industry’s biggest crypto projects, hopes for better regulation are not what’s holding the industry back — they’re just a symptom of a bigger issue. The sharp decline in asset prices, in step with the broader global economic slowdown, highlights a key feature of the crypto space: the fact that it’s still — for the overwhelming majority of token holders — a vehicle for speculation and little else. That has an outsized impact on the industry.

For exchanges and other companies in the space whose customers are in the business of speculation, the downturn is part of the cyclical nature of assets. But for projects that have tried to build communities and move away from speculation, it has led to bigger questions over their value. The rout of the NFT industry is a case in point.

Whatever the outcome of the U.S. midterms, crypto needs to do more than be a solution looking for a problem.

3. Hong Kong is back

Hong Kong’s government last week announced a series of crypto-related policy measures, signaling an ambition to reclaim the city’s role as a global crypto hub. Now, Hong Kong needs to attract the engineering talent that will build the infrastructure to fulfill those ambitions.

- Hong Kong’s rulers announced their pivot during this year’s edition of the city’s flagship blockchain event, Hong Kong FinTech Week. “The digital transformation of our financial services sector is a central priority,” said Hong Kong Financial Secretary Paul Chan in a pre-recorded video statement.

- The city is planning a series of digital asset pilot projects, including non-fungible tokens (NFTs), green bond tokenization and a retail digital Hong Kong dollar.

- Neil Tan, chairman of the Fintech Association of Hong Kong, said that building a solid crypto ecosystem would require large numbers of engineers. “We have a lot of the ‘fin,’ but we’re missing a lot of the ‘tech,’ and I think this is probably the key challenge in terms of talent acquisition and retention,” Tan told Forkast in an interview.

- In line with recent industry hiring trends, Hong Kong will likely tap mainland China for talent, particularly the Greater Bay Area, a region comprising the special administrative regions of Hong Kong and Macau, and nine mainland Chinese cities.

- “If you really think about it, the China market, with a lot of Big Tech actually shedding a lot of headcount, there is a lot of tech capability on the other side of the border,” Tan said. “The ability for us to access that will be important — whether it’s through programs or whether it’s actually encouraging them to immigrate to Hong Kong.”

- Although the city announced its ambitions only last week, a Shanghai-based headhunter who asked not to be identified told Forkast that demand for Web3 talent in Hong Kong has been increasing steadily. “I was only handling five or six [job] openings in Hong Kong in September, but that has grown to over a dozen as of last week,” the recruiter said.

- Hong Kong was a global digital asset hub until last year, when the territory’s authorities introduced a licensing regime that closed crypto exchanges to all but “professional investors” with portfolios worth at least HK$8 million (US$1.03 million), and the Chinese government — which has been bringing Hong Kong closer into the fold — intensified its crackdowns on crypto and announced a crypto ban for the mainland.

Forkast.Insights | What does it mean?

Hong Kong’s lack of engineering talent will likely be the major challenge it faces in its efforts to reclaim its position as a crypto hub, chairs of both the city’s blockchain and fintech industry bodies have told Forkast.

The most convenient and obvious way for Hong Kong to obtain talent is to seek it across the border in mainland China. Under Beijing’s Greater Bay Area initiative, Hong Kong is exploring the possibilities for facilitating talent flows within the region.

Chinese mainland engineers are known for expertise and a willingness to work long hours — so much so that many Web3 firms, often with roots in China, locate their engineering teams in China and other work functions overseas. Singapore-headquartered NFT data analytics firm NFTGo, for instance, has its engineering department in Hangzhou, where Alibaba is headquartered, and its marketing and sales team in Singapore.

With so much Web3 infrastructure and coding work done in China, one Chinese blockchain entrepreneur once even jokingly said that the global Web3 industry could see a wave of “made in China 2.0.”

As the demand for fintech and Web3 talent grows, Hong Kong authorities will need to find a way to make the territory an attractive place to live and work again following the government’s crushing of speech and press freedoms as well as its imposition of draconian Covid control measures, to make it easier to recruit talent — especially from the still partly-locked down Chinese mainland.