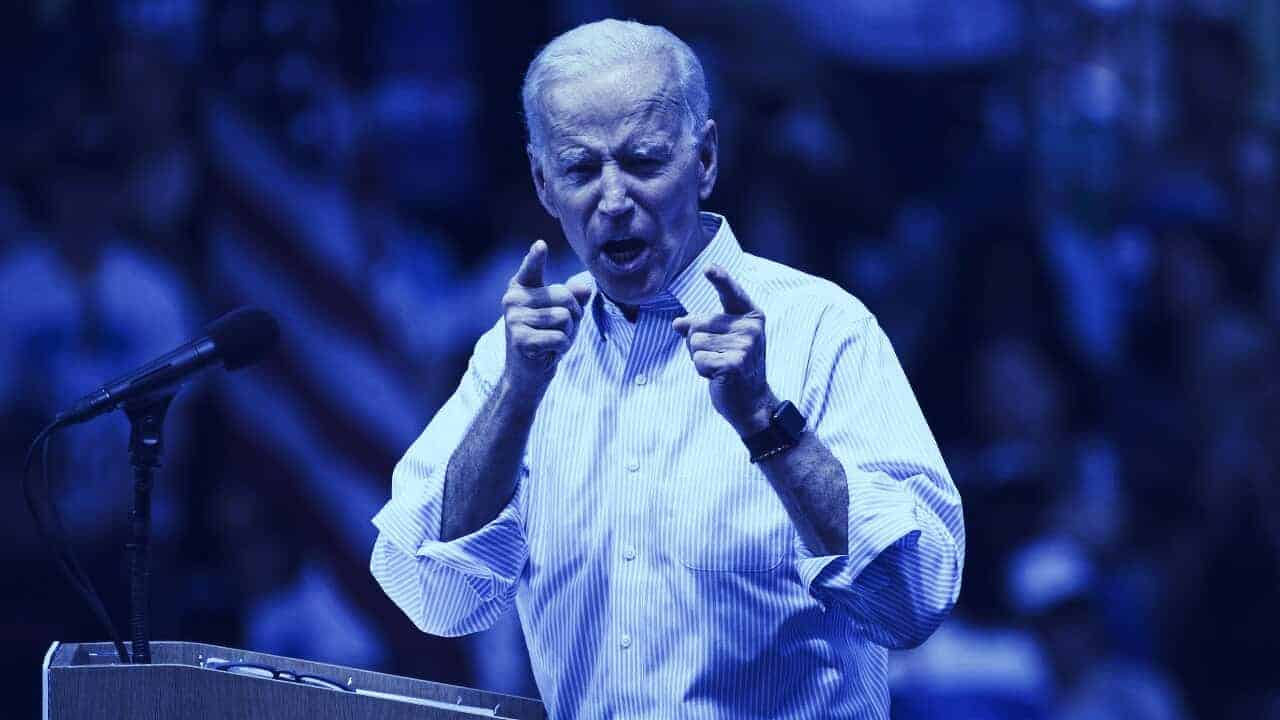

On his first day in office, U.S. President Joe Biden has put a freeze on any “new or pending” Trump-era rules until members of his administration are able to review them.

That includes a rule proposed by the Financial Crimes Enforcement Network (FinCEN) on Dec. 18 under then-U.S. Treasury Secretary Steven Mnuchin. The bureau’s proposed rule would “require banks and money service businesses” to “submit reports, keep records, and verify the identity of customers” who engage in transactions with private cryptocurrency wallets.

President Biden has frozen all agency rulemaking pending further review. This includes former Secretary Mnuchin’s proposal on “unhosted wallets.”

— Jake Chervinsky (@jchervinsky) January 21, 2021

We fought hard & earned the right to take a breath & reset. Janet Yellen isn’t Steve Mnuchin. I’m optimistic.https://t.co/0EAmYhbqa5

The proposed rule had set off a firestorm. Cryptocurrency companies and advocacy organizations lobbied the Treasury to rethink the rule, submitting thousands of public comments within a shortened 15-day period as the Treasury tried to force through the regulations before the end of Donald Trump’s term.

Part of the game plan for opponents of the rule was to run out the clock and await new referees.

“Thanks in part to the community’s response, the rulemaking was extended into the Biden administration,” Neeraj Agrawal, communications director at Coin Center, told Decrypt. “When a new administration takes office, it’s standard practice to freeze and evaluate ongoing rule-making.”

Today’s memorandum from Ronald Klain, the new White House chief of staff, asks all agencies to “consider postponing the rules’ effective dates for 60 days from the date of this memorandum, consistent with applicable law…for the purpose of reviewing any questions of fact, law and policy the rules may raise.”

It also asks agencies to consider allowing a 30-day comment period.

Ultimately, the memorandum is to ensure that any in-process rules, including all rules affecting cryptocurrencies, are first vetted by President Biden’s appointees. Biden has appointed Janet Yellen to take over as Treasury Secretary, whose nomination must first be approved by the Senate. FinCEN, the Treasury bureau that proposed the rule, is still led by Mnuchin-appointee Kenneth Blanco.

Agrawal told Decrypt the freeze will give the cryptocurrency industry more time and a more solid footing when negotiating regulatory issues with the U.S. government.

“Without the time pressure of a midnight rule, we have a much better opportunity to engage thoughtfully with FinCEN,” Agrawal said.

This story originally appeared in Decrypt, a Forkast.News syndication partner, and appears here with additional updates by Forkast.News.