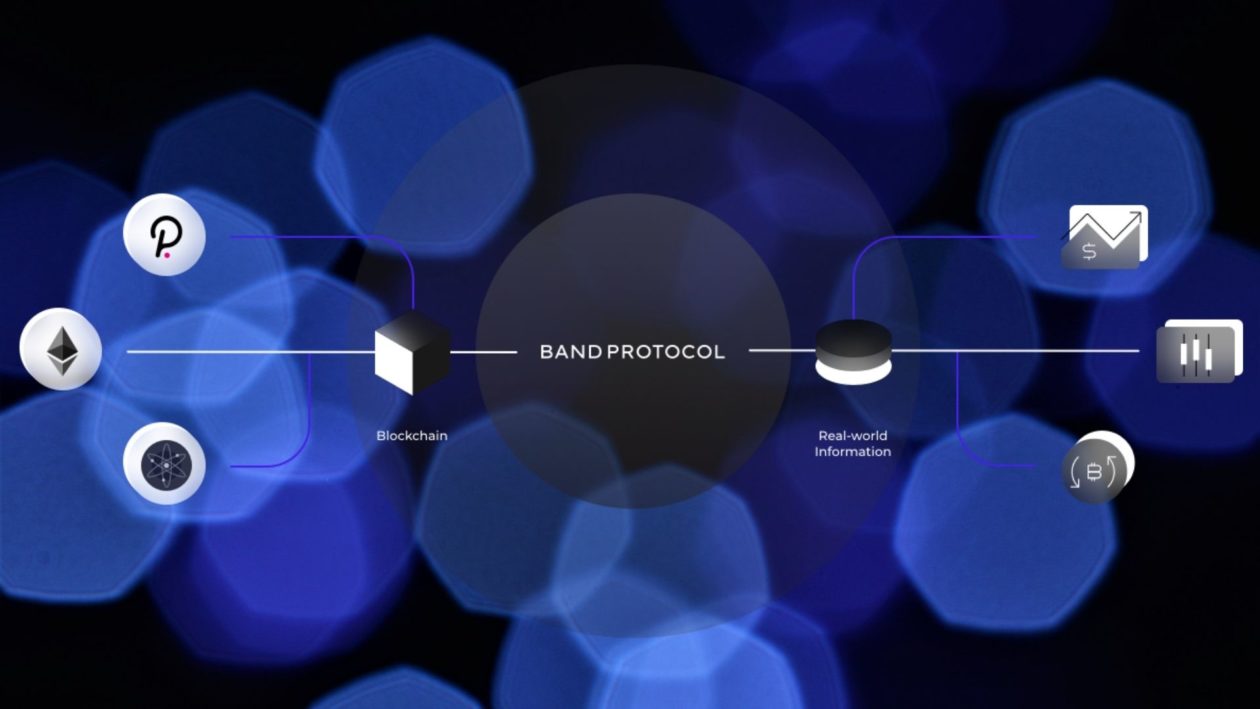

As the blockchain and decentralized finance (DeFi) ecosystem grows, price oracles — data feeds that connect off-chain real-world information like asset prices to smart contracts — have emerged as a critical part of the infrastructure bridging blockchains with the external world.

To create a decentralized lending protocol on a blockchain, the smart contract would, for example, need to have information on asset prices to calculate the collateral needed, which will then enable the smart contract to automatically execute when certain conditions are met. Some oracles — such as cryptocurrency exchange Coinbase’s price oracle — are centralized, while others like Chainlink and Band Protocol are decentralized.

But the reliance on oracles for smart contracts can give rise to an “oracle problem.” The blockchain applications could become vulnerable if the oracle goes down, provides inaccurate data, or is manipulated by bad actors if there is a DeFi flash loan attack. Having decentralized oracles and aggregating data from multiple oracles could minimize the potential risks.

See related article: Alpha Finance Lab launches oracle aggregator to boost scalability, flexibility

Thailand-based Band Protocol, a cross-chain data oracle platform, today announced the launch of BandChain Phase 2, a data oracle network that will allow institutions to provide data such as price feeds, event outcomes and sporting results to the decentralized economy, according to a company statement shared with Forkast.News.

“After prioritizing the onboarding of decentralized applications, we are directing our focus to bridge the gap between mainstream enterprises and the blockchain industry,” said Soravis Srinawakoon, CEO and co-founder of Band Protocol, in the statement. “There is enormous potential for traditional enterprises to create new business models and revenue streams by integrating their valuable data with decentralized ecosystems enabled through Band Protocol.”

BandChain 2 will allow commercial enterprises and traditional data providers like Bloomberg and Google Cloud, which is already working with Band Protocol, to provide data to decentralized applications (DApps) and generate revenue from doing so. Band Protocol also intends to enable smaller data providers to participate by simplifying the onboarding process. By expanding the range of sources, overall data quality would also improve, and DApps developers would be able to access additional and more diverse data sources for their smart contract applications such as DeFi, games and prediction markets, according to Band Protocol.

“With Phase 2, data providers who create and deploy premium oracle scripts i.e. for financial market data, earn a data query fee on a per-call/per-request basis from decentralized applications,” Srinawakoon told Forkast.News in an email. “This means fees are collected in real-time as they are being used — thereby creating streamed revenue that is instantly accessible and controlled by the provider.”

“When data providers supply specific information to smart contracts on the blockchain, they receive financial incentives off-chain i.e. wire transfer,” Srinawakoon said, adding that Band Protocol is one of the first oracle platforms to enable revenue streams directly to data providers on-chain.

See related article: How DeFi exchanges like SynFutures may challenge TradFi and CeFi

Band Protocol’s existing institutional-grade data providers such as Brave New Coin, CoinMarketCap, CoinGecko and CryptoCompare will also be able to expand their data coverage and offerings available on-chain to developers.

“Band Protocol’s major step forward to lower the barriers of entry to the decentralized application space for institutional-grade data providers such as CoinGecko, is a significant enhancement for traditional enterprises to work interoperably with blockchain technology,” said Bobby Ong, co-founder of CoinGecko, a cryptocurrency data aggregator, in a statement. “Providers can earn revenue directly on-chain in a transparent and open format without running into risks of exposing any sensitive information such as private keys to external parties.”

Originally built on Ethereum and now on Cosmos, Band Oracle has over US$10 billion of value locked in smart contracts since its launch in 2018 and has served over 7.7 million data requests. To date, Band Protocol is integrated and supported on blockchain networks including Ethereum, Binance Smart Chain, Polkadot, Polygon (Matic), Arbitrum and Terra.

According to Band Protocol, BandChain Phase 2 will also see greater interoperability through the implementation of the Cosmos inter-blockchain communication (IBC) protocol, which will allow DApps to use BandChain data without the need for additional validation. Phase 2 is also expected to provide support for eight times more requests per block and execute oracle scripts 10 to 15 times faster.

See related article: Gravity DEX brings DeFi into Cosmos network’s orbit

Band Protocol is backed by stakeholders including Silicon Valley venture capital firm Sequoia Capital as well as cryptocurrency exchange Binance, Korean fintech firm Dunamu & Partners, which operates the Upbit cryptocurrency exchange, and The Spartan Group, a Singapore-based blockchain advisory and asset management firm.