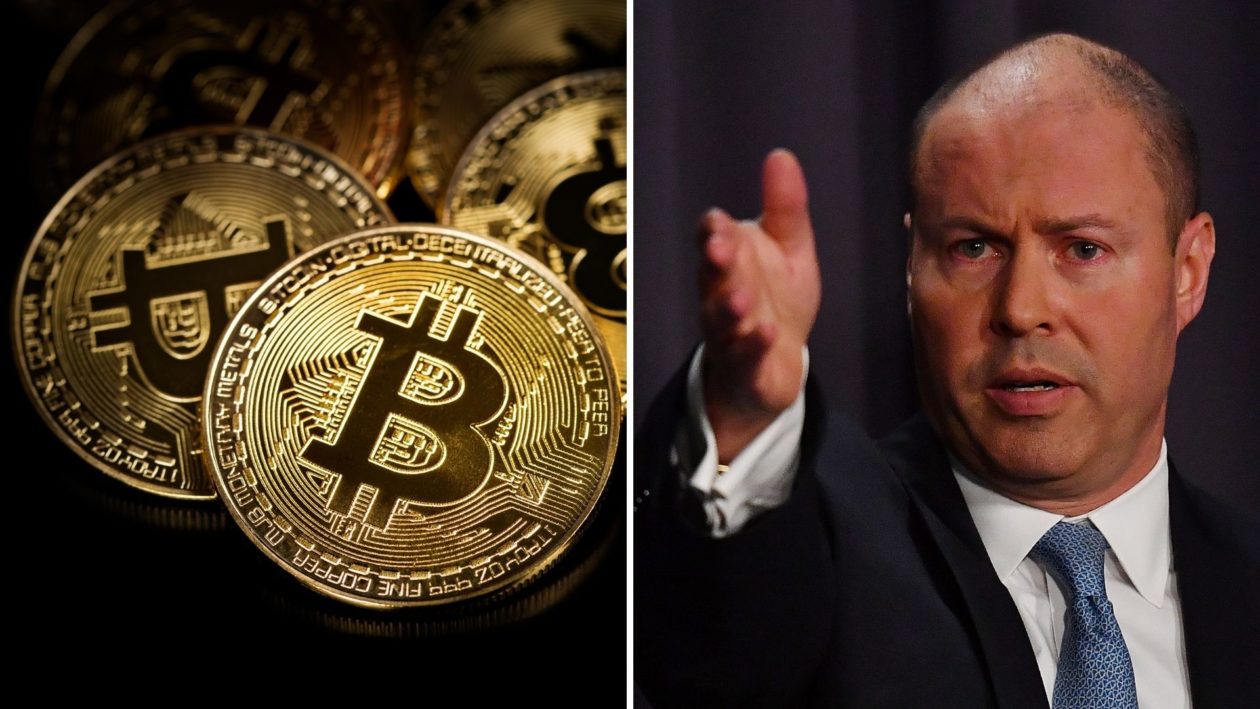

Following a long-awaited report by a Senate committee on Australia’s fintech industry, the country’s treasurer, Josh Frydenberg, today announced sweeping new proposals aimed at updating the country’s payments sector — including cryptocurrencies. Speaking at the Australia-Israel Chamber of Commerce in Melbourne today, Frydenberg said the reforms being considered are the most significant in 25 years, as the treasury is considering requiring domestic crypto exchanges to hold digital assets for local clients on-shore, to introduce licensing regimes for exchanges and to reveal further details on the development of a central bank digital currency (CBDC) in the country.

“The call for regulation from the [Senate] report has set some wheels in motion, and it seems the treasury team are the ones that are going to be picking it up,” Jonathon Miller, Australian managing director of crypto exchange Kraken, told Forkast.News. “My hope here is that the way they look at this is as an emerging industry, not as an established one. Whether or not the custody regime maps to an existing asset class or not, it’s impossible to tell. But I would say that crypto remains a very unique asset class and needs probably its own unique treatment.”

While the recommendations announced today align with many of the recommendations made in the recent Senate Select Committee on Australia as a Technology and Financial Center report, one highly publicized one will not be adopted. The report had recommended offering a 10% tax concession to crypto mining operations that use 100% renewable energy, but that was knocked back despite industry enthusiasm. Forkast.News recently reported that Australia’s largest Bitcoin mining operation was set to open in Byron Bay and that it would be powered by 100% green energy. Spearheaded by local digital infrastructure company Mawson Infrastructure Group, Nick Hughes-Jones, chief commercial officer of the company, told local media the proposal helped justify building larger-scale projects in Australia.

Miller expressed disappointment that the proposal would not be adopted by the Australian government, which is regarded as having taken a conservative approach to climate policy in recent years. “It’s unfortunate that there hasn’t been some form of leaning in here to applying crypto to the renewable space; there’s a good opportunity there,” he said. “The recommendation was progressive and perhaps too progressive for this government.”

Licensing regimes

The treasurer will also outline a timeframe for increased cryptocurrency licensing for digital assets and exchanges, with most expecting it to be in place by the middle of next year. While few details were made available at this stage, one expert told Forkast.News she welcomed any regulation that sought to put investor protections in place, and she believed the government was on the right track to assist Australia’s crypto industry to flourish.

“Our concern was that the regulation would try to regulate us out of existence,” Caroline Bowler, CEO of digital asset exchange BTC Markets, who also sits on the board of Blockchain Australia, told Forkast.News, saying that BTC Markets had been preparing for these announcements for the past 18 months.

This announcement comes in the same week that liquidators were appointed to Australian exchange MyCryptoWallet, leaving the platform’s reported 20,000 users in the dark as to the future of their holdings. This marks the second Australian exchange to collapse recently as another exchange, ACX, had 117 BTC, or US$6.24 million, frozen in a Supreme Court order following a claim by 94 investors that they lost more than US$7.13 million when ACX shut down services in late 2019.

These two cases represent a vast minority of the close to 500 digital asset exchanges registered in Australia, Bowler said. Amid these cases and the updated licensing requirements, the local industry is likely to undergo a period of consolidation as smaller players may arise to address some of the additional costs required to upskill larger workforces.

While largely silent on the details on these requirements, one aspect Frydenberg did outline was custodianship. As it stands at the moment, there are no domestic custody options available in Australia, and any exchanges are required to outsource this to the U.S. Bowler saw this as an opportunity for the domestic custody industry, as well as to allow the treasury greater oversight if the assets are stored locally. But not everyone was so sure of the impact of such attempts at regulation.

“In particular, you’re talking about blockchain technology, which exists by definition globally,” said Miller, unsure of how best to go about ensuring local custodianship of a digital asset that is not tied to any location. “So, I’m interested in seeing how the Reserve Bank approaches this problem set because we’re talking about inherently non-spatial technology. It’s a multinational technology, it exists outside of the constraints that we apply to other asset classes, and its major strength is that it’s everywhere all at once.”

CBDCs and DAOs

Australian regulators have seemingly completed a backflip from their original standing on CBDCs, where only in September 2020 it released a report that said “at present, there does not seem to be a strong public policy case for issuance in Australia.” Now, echoing calls from Reserve Bank of Australia (RBA) assistant governor Michele Bullock, Frydenberg has announced the government is indeed looking to establish a CBDC in Australia.

Speaking at a Women in Payments event late last month, Bullock said she believed ultra-low interest rates have driven interest in cryptocurrency globally and that the RBA was looking to introduce a wholesale CBDC project to reduce transaction speeds and costs in wholesale markets and across borders. The RBA is already part of an international group of central banks as well as the Bank for International Settlements, to participate in a cross-border payments project called “Project Dunbar.”

It is unclear as to whether Frydenberg was referring to the wholesale CBDC already discussed or is intending to expand the project out to a retail variety as well. While surely welcome news for Australian wholesale participants, Miller said introducing a wholesale CBDC does nothing but further entrench the status quo of the existing financial system as it doesn’t make use of the core innovation of blockchain-based assets — which is open-source compatibility.

“If you create a walled garden, which is what a wholesale CBDC would be, it would be a CBDC that’s only available to certain participants,” Miller said. “It just won’t be as valuable, it won’t be as useful. We have one of those already; the interbank payment system is essentially one of those. For a CBDC to be actually useful, it would need to be open and composable, much like we see stablecoins or any other cryptocurrency today.

Miller acknowledged it would be an interesting addition to the crypto ecosystem, but whether or not it actually would have any broad adoption remains to be seen.

Three weeks ago, 17,437 virtual strangers teamed up as ConstitutionDAO to raise over US$40 million to buy an original copy of the U.S. Constitution, only to be outbid at the last minute of the Sotheby’s auction. While they failed to win the auction, the huge sums they were working with and the fact they were doing so as a decentralized autonomous organization helped put the concept of a DAO on the radar of crypto watchers.

Despite this complexity, Frydenberg also announced the treasury was looking to attempt to regulate DAOs in what might be the most progressive aspect of the regulation announced today. While Bowler has no idea how a centralized organization such as a national government could possibly approach regulating something that by its very definition is so decentralized, she is impressed the government is trying to do just that.

“I was really pleased to see … the inclusion around DAO’s,” Bowler said. “I think it’s really going to put Australia on the map against our international peers. I’ve described it as audacious, but I also think it’s really ambitious and just really puts out the right signals about where Australia sees itself from the new digital economy.”