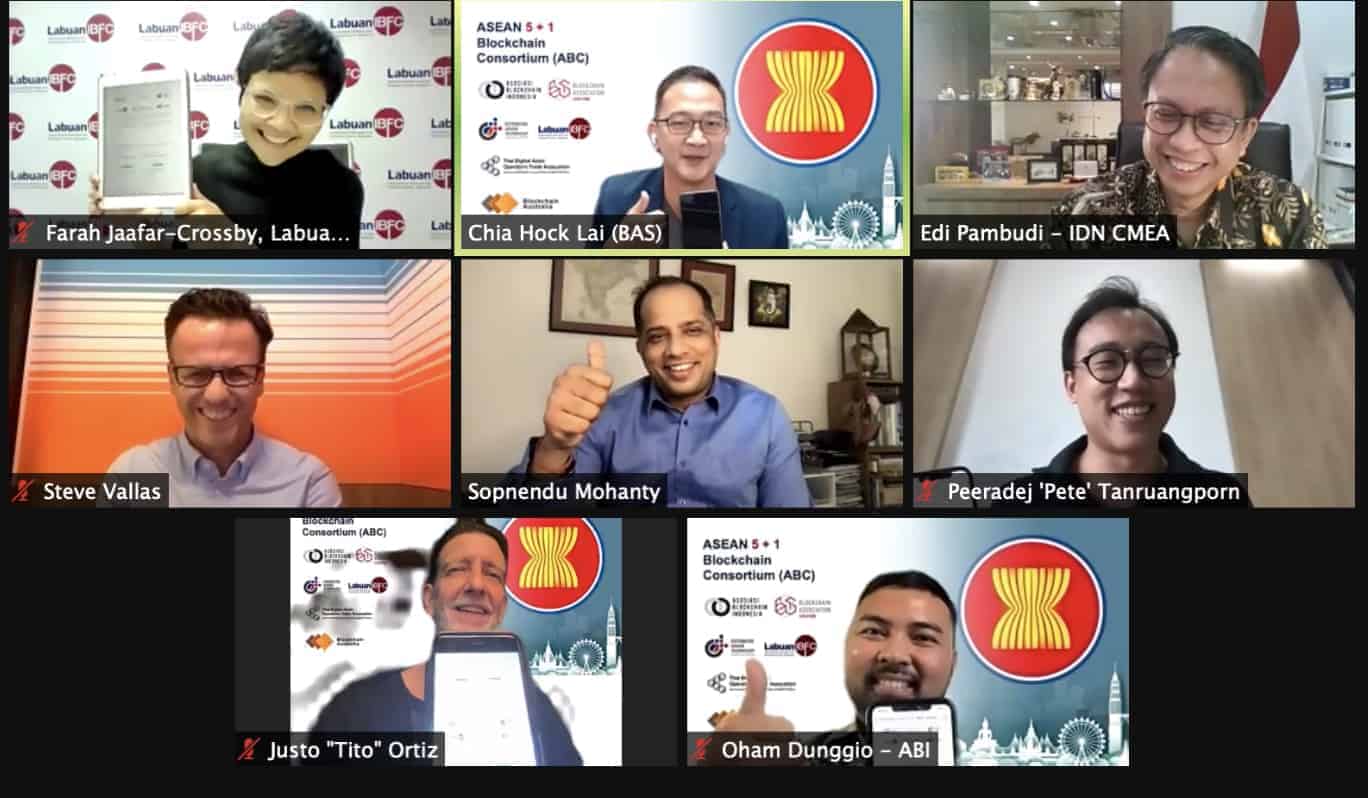

Six blockchain organizations in the Asia Pacific signed a memorandum of understanding (MOU) today to collaborate on advocacy and public education in blockchain.

It is the first formal agreement among the different blockchain organizations across ASEAN and Australia, said Chia Hock Lai, co-chairman of the Blockchain Association Singapore, in an interview with Forkast.News. “The most effective blockchain networks are those that are cross-border with a large number of stakeholders.”

The ASEAN Blockchain Consortium (ABC) includes Asosiasi Blockchain Indonesia, Blockchain Australia, Blockchain Association Singapore, Distributed Ledger Technology Association of the Philippines, Malaysia’s Labuan International Business and Financial Center, Thailand Digital Asset Operators Trade Association and Blockchain Australia.

The digital signing ceremony was backed by Dedoco, a blockchain-based digital signing platform.

“Digital connectivity is an urgent matter during the occurring pandemic to keep the business running,” said Edi Prio Pambudi, senior advisor to the coordinating minister for economic affairs in Indonesia, in a news release. “Then, it is the opportunity for blockchain to reimagine digital connectivity with advanced adaptations.”

The consortium aims to increase blockchain education, share knowledge on digital assets development, and promote the use of blockchain technology across Southeast Asia and Australia.

Blockchain developments in the Asia Pacific region

“There’s no better time to do it than now, because if you look at, for example, the last six months, we see tremendous institutional interest in the digital assets industry,” Chia said, noting that institutional players including Singapore’s DBS Bank, Southeast Asia’s largest bank, have gone into digital assets.

Large scale implementation of blockchain systems, particularly in trade finance has also been on the rise. “There are a lot of efficiency gains by using blockchain technology for certain domain areas,” Chia said. “This is an area where there can be more sharing of experience and knowledge.”

There has been an acceleration in innovation in this space, Chia said. “Over the last nine months, we’ve seen tremendous growth in the decentralized finance space, and more recently in the last three months, a lot of interest in the area of non-fungible tokens, especially in the art and collectibles space.”

We are also witnessing increasing regulatory certainty in this space, said Chia. Noting that the recent draft guidance from the Financial Action Task Force (FATF) — the global money laundering and terrorist financing watchdog — made references to decentralized finance, Chia said, “This signifies that regulators are paying much attention, and they are even updating their regulatory guidance on a timely basis.”

See related article: Singapore’s DBS bank becomes first in Asia to offer crypto exchange

MOU’s areas of focus

The organizations in the consortium intend to provide better advocacy to foster the digital assets industry and enterprise blockchain and address misconceptions about cryptocurrency being used for illicit activities, Chia said.

Concerns about the use of Bitcoin and other cryptocurrencies in illicit finance have been significantly overstated, wrote former Central Intelligence Agency director Michael Morell in a paper on “An Analysis of Bitcoin’s Use in Illicit Finance” published this month. In 2020, the illicit share of all cryptocurrency activity fell to just 0.34%, or US$10 billion in transaction volume, compared to 2% to 4% of global GDP for traditional fiat money.

See related article: Asian governments urge ‘extreme caution’ before buying cryptocurrency

Chia believes that the consortium can play an important role in building awareness, such as educating the general public about digital assets and how to not fall for scams. The consortium is also looking to engage regulators on blockchain technology so that regulations can strike a good balance in promoting innovation while mitigating the negative impact that the new technology can bring to the financial system. Moreover, the consortium wants to build up blockchain talent — from developers to compliance specialists — to support the growth of the sector.

Earlier this week, the Blockchain Association of Singapore, together with the Global FinTech Institute and Elliptic Singapore, a digital asset risk management solution provider, signed an MOU to develop a digital asset compliance training program in Singapore. “We hope to sponsor some of the regional regulators for training and certification during the Singapore FinTech Festival 2021,” Chia said.

See related article: Digital payments — not cash — is now king in Asia’s payment ecosystem

Other plans on the consortium’s agenda include organizing networking events and webinars to share knowledge and best practices and knowledge as well as promote the adoption of blockchain-based technology that can facilitate more trade and travel within the group, such as a blockchain-based health certification platform for vaccines or Covid-19 test results.

See related article: Using blockchain to bolster vaccines and trust in public health | Part 3

Chia said that the various members of the consortium have specific strengths, and the organizations could leverage each other’s strengths to nurture the region’s blockchain development.

Australia, for example, had a national blockchain roadmap and leading efforts to standards in the International Organization for Standardization (ISO) for blockchain. Standards Australia, the country’s non-government standards body, is currently the secretariat of an international technical committee for ISO/TC 307 blockchain and distributed ledger technologies.

Singapore, as a financial center, can also take a lead in setting progressive regulations, said Chia adding that the Monetary Authority of Singapore — the country’s central bank and integrated financial regulator — has been releasing consultation papers to adapt to the evolving digital assets space. “That provides a lot of regulatory certainty,” Chia said.

A PwC survey conducted in Singapore in 2020 found that businesses reported optimism over the growth of blockchain adoption in Southeast Asia, with business leaders identifying regulatory clarity as a key factor in influencing their decision to house their blockchain activities in Singapore, according to the 2020 Singapore Blockchain Ecosystem Report.

“Over the last 12 months, I have seen a visible inflow of institutional players into Singapore, players like Chainalysis setting up their regional HQ in Singapore and a few OTC players. Providing regulatory certainty can really attract foreign investment into Singapore and in the process generate new jobs,” Chia said. “If you do regulations right, it is actually a net positive for the country.”

See related article: How blockchain technology’s landscape changed in the tumult of 2020