Non-fungible token (NFT) sales fell for the fifth straight month in September to just over US$500 million in sales, its lowest level since July 2021, according to NFT aggregation site CryptoSlam.

Driven by an ongoing drop in Ethereum prices, the blockchain that hosts the vast majority of NFT collections, September’s monthly sales volume represents a roughly 90% reduction since the record US$4.7 billion in sales posted in January 2022.

While the number of unique buyers grew slightly from the previous month, the figure still failed to break half a million, recording around 480,000 for the month — representing a 55% drop from January’s peak.

“It’s down and it’s down tremendously,” Yehudah Petscher, NFT relations strategist for CryptoSlam, said of the NFT market in an interview with Forkast. “And I don’t think that changes any time soon.”

Regarded as a crucial component of the reimagined internet of Web3 — in which gaming, social media and financial services are run through decentralized applications controlled by users’ wallets — a lagging NFT market could stifle adoption of this burgeoning field.

“NFTs are key to what’s coming to this whole Web3 experience — it’s essential to it I think,” Petscher said. “I don’t think blockchain really was going to become mass adopted until NFTs became a thing. I think it would have happened inevitably, but NFTs are accelerating that.”

Merge disrupts

September was also a significant month for the Ethereum network, as the long-awaited “Merge” took place on Sept. 15, which saw the network drastically change its fundamental infrastructure.

There were some concerns this may have wreaked havoc on the NFT marketplace as some Ethereum miners looking to resist the merge forked the network, effectively duplicating the NFTs from the original network. In preparation for this fork, many marketplaces, including market leader OpenSea, announced they would only continue to support NFTs on the main Ethereum network.

Quiet adoption

Despite the downturn in the market, Petscher told Forkast that there is still a great deal of building occurring in the industry, and adoption continued to grow in September, albeit more quietly.

Tech giant Apple Inc. caused a buzz recently by announcing it was adding support for NFTs to its app store, bringing NFTs and Web3 to one of the largest app stores in the world.

Rather than welcome the move, however, NFT advocates balked at the fact Apple would be funneling the transactions as in-app purchases, subjecting the NFT purchases to a 30% transaction fee.

While this may be standard in the app store, the high fee sets Apple apart from contemporaries such as OpenSea, which charges only a 2.5% fee. “Now Apple is killing all NFT app businesses it can’t tax, crushing another nascent technology that could rival its grotesquely overpriced in-app payment service. Apple must be stopped,” tweeted Epic Games chief executive officer Tim Sweeney.

Entertainment giant Walt Disney Co. also subtly signaled a move into the world of Web3 recently, by advertising for a lawyer specializing in NFTs, the metaverse, blockchain and decentralized finance.

The job posting says the counsel will provide legal advice for the firm on global NFT products, and “provide thought leadership and strategic direction on products involving digital currency and blockchain technology.”

After a flurry of crypto advertisements in the industry earlier this year, sporting teams are also furthering their push into the space. Through a partnership with blockchain infrastructure firm Chain, American football team the New England Patriots are now registered with the Ethereum Name Service (ENS) at “patriots.eth.”

The ENS is a protocol that condenses lengthy wallet addresses to readable phrases that end with “.eth,” reducing possible confusion and speeding up transactions on the Ethereum blockchain.

“During these periods, this is when people are putting their heads down and building products and innovating,” Petscher said. “Everywhere I look, it’s very active … it’s just starting and we’re feeling this momentum and the payoff will be down the road in a few years.”

Apes at the top

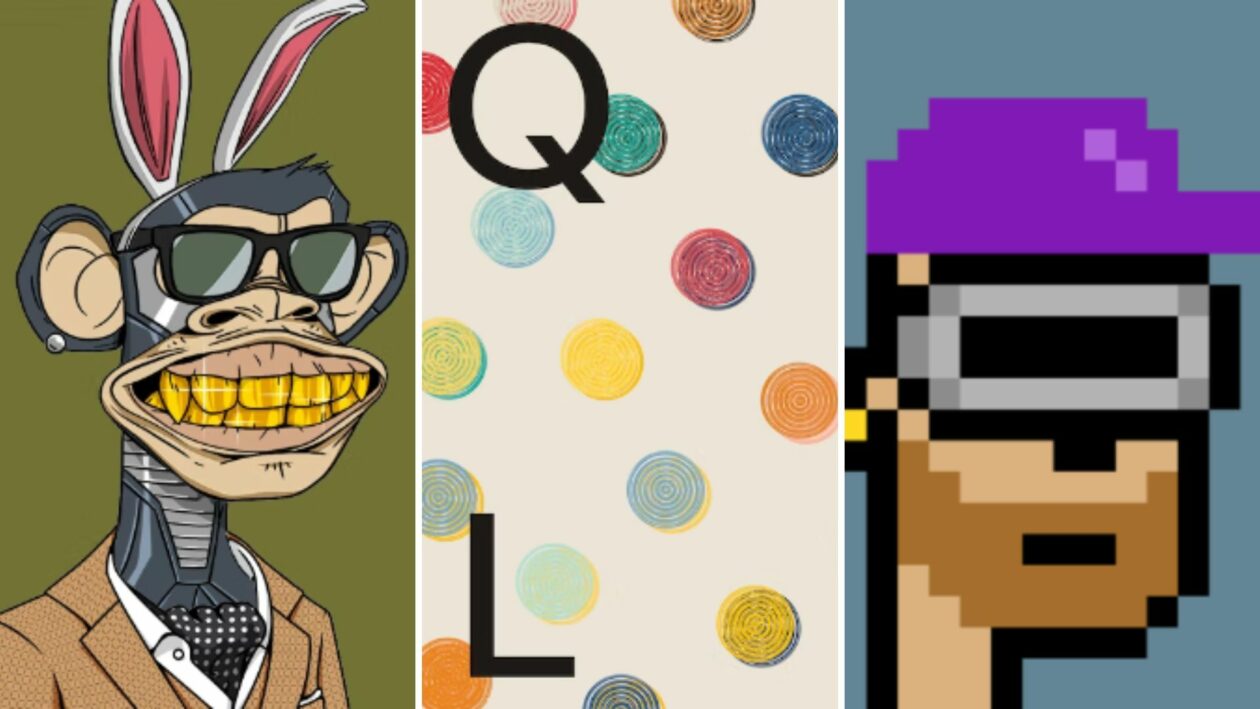

As usual, the top five selling collections for the month featured the heavyweights of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), CryptoPunks and fantasy football series Sorare.

However, QQL Mint Pass, a generative art project that only debuted in September, ranked second with over US$25 million in sales volumes for the month.

BAYC was the highest-grossing collection at US$32 million in sales.

Petscher told Forkast that as the market matures, buyers are looking for more utility out of NFT projects. While profile pictures drove earlier bull cycles of the market, that was becoming less and less the case.

BAYC, MAYC and CryptoPunks all belong to the same extended universe and feature in the BAYC metaverse project the Otherside, whose NFT land sales are also bestsellers in their own right, recording over US$14 million in sales for September.

But as the bear market continues, Petscher argues that many projects that do not offer anything beyond the profile picture utility may struggle to maintain a community and could collapse entirely.

This is cause for concern, as he believes the bear market is just getting started.

“I still think that we’re in a prolonged bear,” Petscher said. “I think we’re a couple of years at least away from the market returning to anything that resembles what it just was [at the beginning of this year].”