Last week, in Part 1 of our two-part report, we examined how blockchain technology would impact capital markets. In this second part, we focus on a number of major developments that are happening in 2021. We want to avoid the media hype and focus on actual noteworthy progression.

The key trends include funding for major projects, important regulatory developments, and active platforms that are issuing, trading and settling tokenized securities and other financial assets. For us at Blockdata, these metrics are the driving forces that transform all these pilots and prototypes into production-ready services.

The big question is, are we actually seeing traditional infrastructures and their assets transitioning toward a blockchain-powered one?

We would say yes. Blockchain usage and adoption in capital markets are rapidly increasing this year, and we found seven major areas worth focusing your attention on. Let’s now break down what each development has to offer:

1. Major asset-tokenization platforms are showing strong growth.

These platforms are focused around the tokenization and issuance of securities and digital assets. They are the first step in moving traditional assets onto a blockchain ledger. Over the past months, we have seen a number of these platforms move towards non-fungible tokens (NFTs), or simply dissolve. This may be due to regulatory restrictions, a lack of funding, or simply the uncertainty of where securities and blockchain tied together over the last few years.

Some major players have stuck around, however, and in fact have shown strong signs of growth. Here are some major platforms that are active, production-ready, and rising in users and demand.

Polymath is an asset tokenization and issuance platform for securities. It has over 160 assets issued on its platform, worth over US$2 billion, as of June 2021.

Securitize used its own platform to issue their stock to investors. To date, it has over 300,000 accredited investors, and over 160 companies who have issued securities via their services. According to Securitize’s CEO, Carlos Domingo, their marketplace for private securities is “currently awaiting regulatory approval and is expected to go live in the next weeks.”

Bondex is a platform where companies can license in order to digitize their shareholder register and tokenize their shares or bonds. In May 2021, it was acquired by Nxchange, but currently operates as a standalone business.

Stokr, a security token investment platform, helped launch Blockstream’s bitcoin mining security token in March 2021. The token (BMN) now offers investors an alternative investment opportunity towards bitcoin mining.

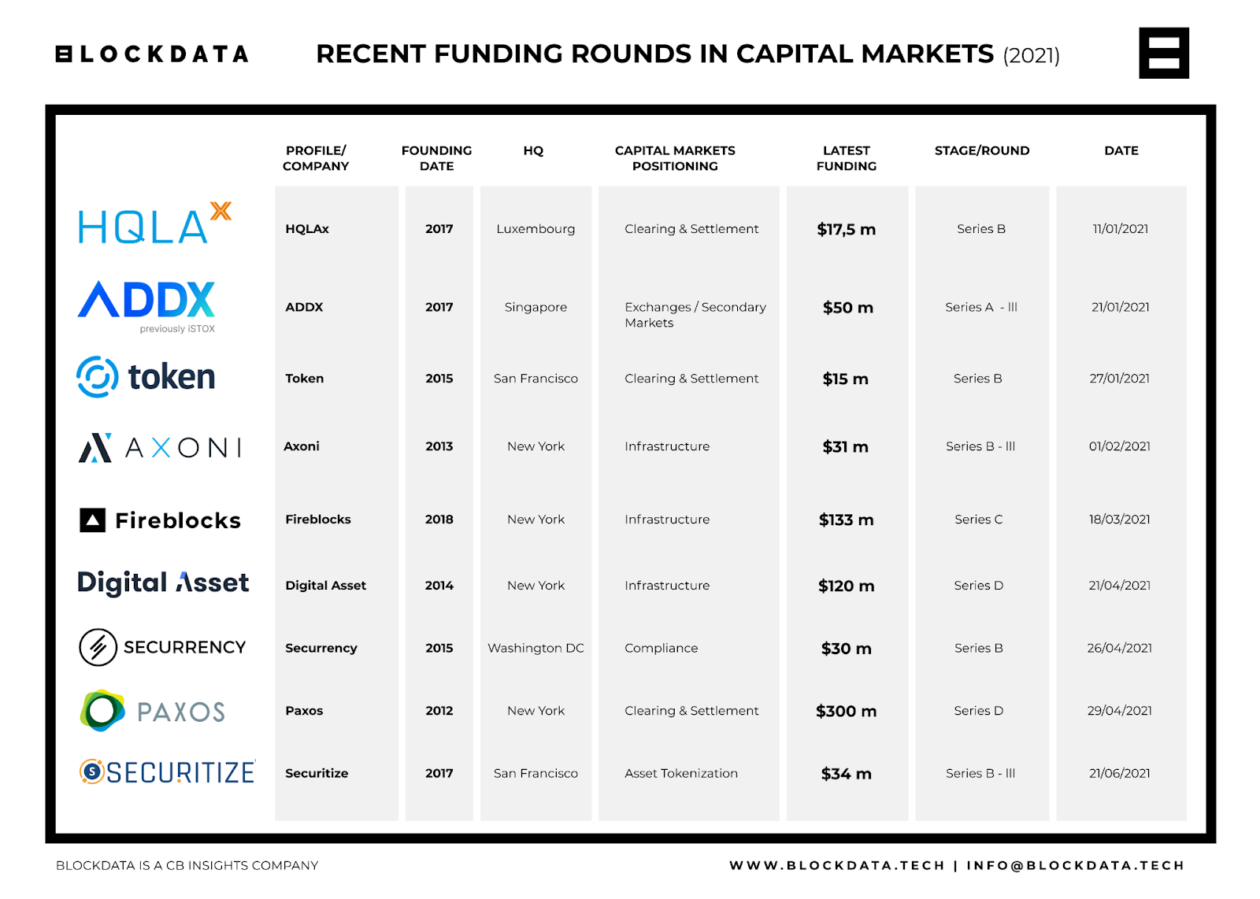

2. 9 Blockchain capital markets companies have raised a collective US$744 million in funding since the start of this year.

Funding is happening in all areas of capital markets: tokenization platforms, secondary exchanges and infrastructures. These companies raised impressive amounts from major traditional market players in the industry, with the majority of rounds being in Series B and later stages, showing how solutions are maturing.

Companies like Securitize have had their funding round led by the likes of Morgan Stanley, NTT Data and SMTB. Securrency’s recent investment has been led by U.S. Bank and publicly traded companies such as State Street and WisdomTree Investments. Infrastructure providers such as Axoni, have raised investment from the likes of Goldman Sachs, UBS, JPMorgan, Deutsche Bank and Wells Fargo, to name a few.

3. Banks are starting to make use of blockchain settlement services.

Blockchain can have a clear-cut impact on improving the clearing and settlement of financial assets, both in faster settlement times and reducing counterparty risk.

Companies like Credit Suisse, Société Générale, Nomura’s Instinet, Bank of America and WedBush Securities are using Paxos’ settlement service. This is a permissioned, post-trade blockchain network that facilitates settlement with delivery versus payment settlement finality.

If you’re new to this concept, it means they settle their U.S. stock trading on the same day, rather than the traditional two days.

As same-day settlement is high on the agenda for capital market actors, blockchain provides an alternative solution from a traditional central clearing counterparty who usually facilitates the DvP settlements.

With so many big clients on board and a day in time savings, it’s no wonder Paxos recently raised $300M in funding to help grow its institutional services. It is currently awaiting full licensing by the Securities and Exchange Commission.

4. In April, the European Investment Bank (EIB) launched its first-ever bond on a public blockchain.

The bond was valued at €100 million, or about US$118.5 million, in collaboration with Goldman Sachs and Santander and using Société Générale’s FORGE as the issuer and registrar. This is significant because of the public blockchain aspect. Many organizations struggle with the infrastructure not being fully under control by known, centralized entities.

The European Investment Bank (EIB) supports the digitalization of capital markets and how blockchain can bring a number of benefits to the current traditional system. This includes reduction of intermediaries and fixed costs, more market transparency (seeing trading flows and identity of asset owners), and shorter settlement time.

“The EIB is clearly well‑placed to lead the way now in the issuance of digital bonds on blockchain. These digital bonds will play a role in giving the Bank a quicker and more streamlined access to alternative sources of finance to boost finance for projects across the globe.”

— Mourinho Félix, vice president of European Investment Bank

“This is an important step in the adoption of this innovative technology and the potential efficiencies that can be derived across the life cycle of the debt issuance.”

— Richard Gnodde, CEO of Goldman Sachs International.

5. In May, DBS, the largest bank in Southeast Asia, issued its first digital bond of US$15 million via the DBS Digital Exchange.

The exchange has been live since December and claims to have strong market traction with rising demand. It is currently servicing more than 120 participants, and daily trading volumes have increased tenfold. Another notable point is that it is the first live full-service platform currently available and running on blockchain technology.

The DBS Digital Exchange stated that its new platform offers institutional and accredited investors the ability to tap into a fully integrated tokenization, trading and custody ecosystem for digital assets. This gives companies new alternative opportunities for fundraising and issuance of financial instruments.

6. The regulatory ‘CAST Framework’ was published in an open-source manner.

In Part 1, we mentioned the MiCA Framework as a motive for regulatory bodies to push for better regulation around digital cash. But another notable one is CAST, a framework designed for the issuance, custody, and OTC trades of financial instruments on a blockchain. It is a call to action to develop common market standards by major banks and financial institutions. It is constructed around three companies, an operational framework, legal and regulatory contracts, and technical rules.

This is a crucial step forward toward regulatory maturity, a major roadblock in a full-scale transition towards a DLT-based capital markets system.

As stated by the World Economic Forum, the industry “must continue to actively engage with regulators… capital markets firms must continue to be proactive at involving regulators early on in building new solutions.” This is exactly what the CAST Framework proposes, and something that Thomas Borrel, CPO at Polymath, is a strong advocate of now that it is open source.

CAST gives companies and market participants the opportunity to actively engage and work together with regulators to assist them in creating more solid, coherent regulatory steps for digital assets. “I would say regulation in capital markets is consolidating rather than maturing,” said Jelle Poll, co-founder and director of Dusk Network.

7. Infrastructure providers are now working with some of the biggest capital market players in the space.

Digital Asset is a capital markets infrastructure provider that is currently working with major juggernauts on developing blockchain-based capital market systems.

Announcements of collaborations and partnerships are usually based around hype and to gain media attention. But when digging a little deeper, the shortlist of players that are now developing their solutions with DAML is something worth noting.

As of July 2021, Digital Asset now works with:

- Nasdaq (June 2021)

- LiquidShare (July 2021)

- Broadbridge (June 2021)

- Australian Securities Exchange

- Singapore Stock Exchange, Hong Kong Stock Exchange & Clearing House

- DTCC (Depository Trust & Clearing Corporation)

Axoni, a leading capital markets infrastructure provider has also shown traction with major partnerships (and investment) coming from Deutsche Bank and UBS.

Solana, the provider for Digital Assets AG’s asset-tokenization infrastructure, raised US$314 million last month. Digital Assets AG uses Solana to offer users a new alternative for accessing traditional equity markets via the FTX Trading Platform. This is another great example of a company utilizing a public blockchain for a capital markets solution, rather than using permissioned chains. According to DAAG, tokenized shares of Facebook, Netflix, Google-parent Alphabet, Nvidia, PayPal, Square and Tesla will be available upon launch.

“The move from operating on a private blockchain to operating on Solana will offer a much more efficient, and cost-effective environment for the trading and utilization of tokenized stocks.”

— Brandon Williams, DAAG executive

Key takeaways

The state of blockchain in capital markets is shaping up. We are witnessing major moves and large investments into new projects.

Initiatives to improve capital markets infrastructures with blockchain are happening, and all parties are involved. Many governments, stock exchanges, banks, and other financial institutions are seeing the value and the need for current markets to change. There are also many who still don’t see the need to act, but the market will decide their fate.

The future definitely remains open, and dependent on a number of contributaries. This could slow down the development, but this may not be a bad thing. Regulation needs to be robust, and new market entrants have to qualify in order to take on a serious role in a new market infrastructure worth trillions of dollars.

One thing is certain, the demand is on the rise — investment, developments, live exchanges and serious contenders are looking to take a piece of the market pie.

Now it is just a matter of time until the new outcompetes the old.