In Conversation with Da Hongfei, Neo: China-Born Digital Asset Protocol

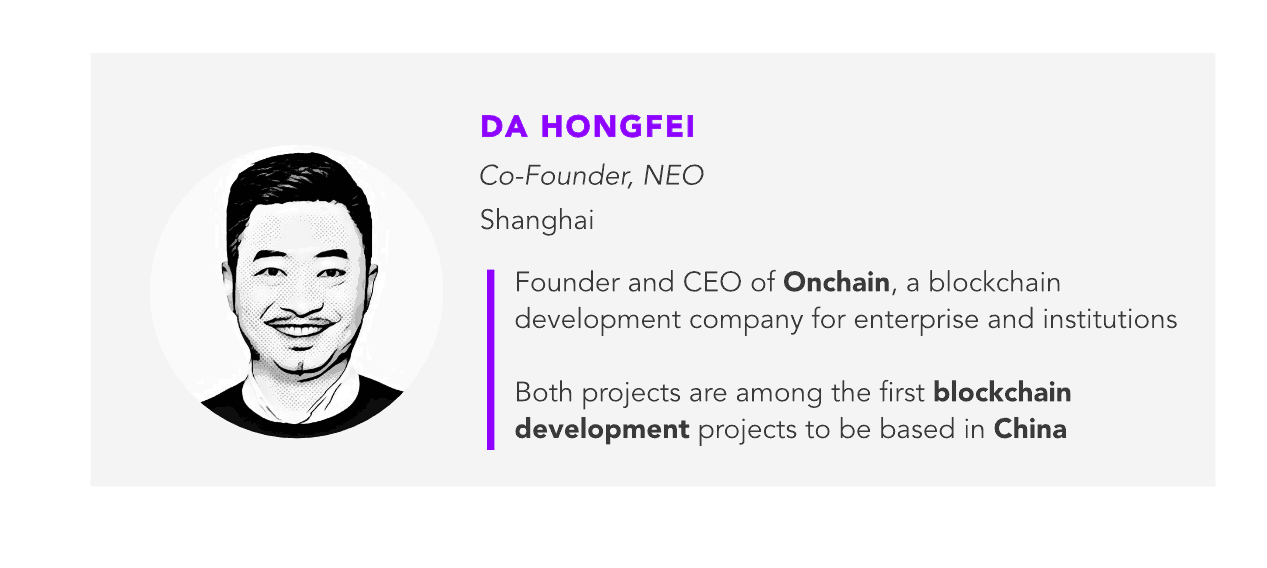

Chinese blockchain companies received a substantial windfall following President Xi Jinping’s bullish support for the development of the technology, and Shanghai-based Neo was one such enterprise. Forkast.News Editor-in-Chief Angie Lau sits down with Da Hongfei, Co-Founder of Neo to find out about the technology and how it will affect various industries in China.

Key Highlights

- Under the hood, the architecture [of Neo 3.0] is different. That means it will be more stable. You will have better performance. So that’s the underlying technology. And then we have new functionalities. We will have a built-in Oracle function. That means a smart contract can directly access Internet content within the smart contract itself. They can visit a website. It’s not doable within current blockchain devices.

- Neo ID is meant to be used to do KYC, AML, to build a reputation system on top of that. So you can link your identity within the physical world to the blockchain world.

- [Another] feature is NeoFS. I’m really excited by NeoFS. This is a distributed file system, so you can directly save big files like a video to a distributed file system that is linked with blockchain. You cannot do that within today’s existing blockchains.

- To beat the competitors, to beat the giants, you cannot just do the same thing and be a little bit better. You have to do it in a complete way and be much, much better. So the way a distributed storage works is if you are an ordinary user, you can share the storage with a laptop, you can share the storage maybe with your phone and with 5G. It will be very fast, and the bandwidth cost is really low. So it would be more like a shared storage system, like Uber, like in a shared economy.

Listen to the Podcast

Xi Jinping said Blockchain would play “an important role in the next round of technological innovation and industrial transformation,” which spurred investment into blockchain related enterprises. Currently, Neo has been trading up at nearly double its price from before the announcement in late October.

Neo is a cross-platform, code-agnostic blockchain seeking to revolutionize the sector starting with distributed storage. Referred to by some as the “Chinese Ethereum”, it is meant to operate as a platform for initial coin offerings and decentralized applications using smart contracts.

See related article: Blockchain: the Key to Realizing the Digital Industrial Revolution

An upcoming upgrade to the system, dubbed “Neo 3.0” will include an inbuilt oracle system to supplement its smart contract functions, an identification regime to improve KYC and AML compliance, and a distributed file system.

Full Transcript

Angie Lau: Welcome to In Conversation With in Shanghai. I’m Forkast.News Editor-in-Chief Angie Lau. Well, blockchain as a technology continues to evolve, and so too does the industry. If you think about it from Bitcoin, which proved peer-to-peer transactions, to Ethereum, which applied smart contracts to these transactions, so too was born other block chain platforms with their own unique characteristics and applications. And so we find ourselves here. One of those blogging platforms was born in 2014. Neo started as end shares, evolved into Neo, and it is one of those block chain technology platforms that is really evolving in this space. To understand that a little bit better, to understand China, to understand how all of these puzzle pieces fit together, we sit down now with Da Hong Fei. He is co-founder of Neo. Back in 2014 with Erik Zhang, you two came together and you saw the potential of blockchain technology for China. What inspired you to participate in this industry?

Da Hong Fei: First, it’s great to be talking with you here. You did a very good summary for Neo, maybe better than me. We were inspired by a couple of things: the first one is definitely Bitcoin. Most of the blockchain projects are inspired by Bitcoin. I came across Bitcoin fairly early in 2011, and I instantly fell in love with it. And we were also inspired by a crowdfunding activity back in 2013. There was one guy from China, a PHD candidate, who planned to do an ASIC miner, the most advanced chip to mine Bitcoin. And he did the crowdfunding on a forum. Nobody knew who he was. He just posted a Bitcoin address and asked for donations. And after a few months, he made it. He shipped the ASIC mining machine to those so-called investors or supporters. So we are inspired by Bitcoin technology, by the crowdfunding event, the activity. So we decided to invent a blockchain – back in that time, there was no such word. We were not calling it block chain, we called it a system that’s empowered by Bitcoin technology to facilitate crowdfunding. So in our deck, we said “this is a system with Bitcoin plus Kickstarter plus Nasdaq.” So that’s our original vision. And if you ask me now, what is the simplest way to explain what Neo is, I would say Neo is the digital asset protocol.

Angie Lau: The digital asset protocol. And so for those who are really new to the space, what does that even mean?

Da Hong Fei: You can imagine the future. In China, in Shanghai, we are already almost in a cashless society. I haven’t touched a coin, or any cash, for like half a year.

Angie Lau: Yeah, I experience the same thing. I have not broken out my cash one time. It’s all done by WeChat or Alipay.

Da Hong Fei: Yes. And you can say that most of the assets today, the physical assets or the assets you kept at financial institutions, will be digitized in the future, definitely. So everything, every asset, will be digitized. And the digital asset protocol, Neo, will be used for that purpose.

Angie Lau: Ok. So if I could understand it better, it’s the digital representation of everything I hold valuable in the physical space. For example, my house. Maybe my car. Maybe my jewelry. Stocks or bonds.

Da Hong Fei: Maybe your personal data.

Angie Lau: My personal data!

Da Hong Fei: That’s also possible. If you want to share it with some third party, you can do that. But you can make sure that they are used for certain purposes, and you will be audited and you will be recorded on the blockchain, and you probably will get paid for sharing your data, with your consent.

Angie Lau: That’s really interesting, especially in this digital space of ours, where a lot of content creators are creating IP that right now is hard to commoditize because of piracy, and dilution, and oversharing.

Da Hong Fei: And lots of intermediaries.

Angie Lau: Exactly. The third parties, right, that take their cut. So what you’re saying is that potentially at some point, my IP, my personal data, beyond all the physical assets, things that I can hold a value that can be digitized. Or a digital asset that can be held.

Da Hong Fei: In the digital asset age, we will have a bigger market for everything. So in a very primitive society, the market is really slow. We only trade living goods, your food, maybe clothes, but with the development of human society, we saw a bigger and bigger market, and I can imagine we will see an even bigger market in the future.

Angie Lau: As a Chinese citizen in 2011, when you saw the potential of this before you even created this platform, what was the current state of things in China that you really saw the potential of applying this technology to?

Da Hong Fei: In 2011, it was just out of my pure personal interest. I was just interested in the project and the technology, and along the way I realized the technology really has a great potential to change human society. So we coined the phrase “smart economy.” So we believe we are moving from today’s industrial economy to a smart economy where everything is digitized, where computer languages can be used to manage those digitized assets, and everything is built on a distributed system that can preserve the privacy and is also reliable because it’s distributed.

Angie Lau: These are universal goals that we all have. In this current state of conversation, however, we are really mired in U.S. – China trade wars, in suspicion. Where does technology lie in this conversation?

Da Hong Fei: That’s a tough question. I would say that technology itself is boundless. There is no nationality of a certain technology, especially in the blockchain industry. One of the principles of especially public blockchains is almost everything is open-sourced. So we can learn from each other. That’s also why the blockchain industry is moving so fast. So besides the jurisdiction of geographical boundaries, there exists a dimension of an organization, or group of people. I think we as the blocking industry, we’re living in that dimension. We’re not living within the geographic boundary. So that’s also the beauty of this industry, and why I like it.

Angie Lau: It’s truly decentralized, and so the team is not just here. It’s around the globe. And that’s important to your structure, how and why?

Da Hong Fei: Definitely. I was asked a question I haven’t heard before by a developer, because we’re doing a community assembly here. We have about 20 to 30, mostly developers from every corner of the world – from Brazil, from France, Switzerland, from US, from Shanghai, and they’re gathering together, discussing a lot of technical topics. So one topic is, why do we need different applications and implementations of Neo? So we have Neo protocol, but different implementations. There’s one that can be about a bump in the employment application.

But if everyone uses the same applications, same software, it would defeat the meaning of decentralization. So we need a variety. In the development of Neo, during the process, we had different input from many cultural backgrounds, many technical backgrounds. I think it’s crucial to Neo, such a decentralized project.

Angie Lau: That consensus mechanism exists, and people are becoming a little bit more familiar with it, that consensus governance is important. How do you ensure, though, that the regulators are also involved; the different governments are also involved? Or is that almost an impossible task, an adversarial task?

Da Hong Fei: I wouldn’t say it’s impossible. I would describe it as a tough job, because the older regulations are made according to the old scenarios, with old technologies, on top of the old infrastructures. But we’re doing something completely different. The old model is heavily relied on trust in third parties. So those third parties have to be strictly regulated.

But with the new technology, we are trying to build a trust in technology, not in the traditional trust model. So the regulation should change. But we are in the process of it. The regulators need to understand the technology first, and they need to understand that we’re not bad people. We’re not trying to, like, disrupt everything. We’re just trying to build a better system.

Angie Lau: That’s a tough line that not a lot of people are accepting. The one thing that’s happening in China is that there is incredible innovation here. But obviously it also must abide by the government initiatives, the policy initiatives, right. So how do you balance that?

Da Hong Fei: Neo is a pretty globalized operation. The new foundation is registered in Singapore, so it’s under the law of Singapore. And most of the court developers are actually not from China. Eric definitely lives in China.

Angie Lau: Eric Zhang, the Co-Founder.

Da Hong Fei: Yeah, he’s a co-founder, a developer and core developer. And other core developers, we have about a dozen, ten or nine out of them are actually not Chinese citizens, don’t speak Chinese. So they are communicating with each other in English. So it’s a very international team. Yeah. So that’s one of the reasons. The other one is that those decentralized applications, most of them are not in China. They are from Brazil, from Japan, Korea, and other places.

Angie Lau: The characteristic of Neo is also very interesting in that KYC is important, living within the regulatory framework is also really important, and we’ve seen this actually evolve into other blockchain protocols, and also other blockchain projects. They also see the importance of regulatory guidance. You want to make sure that you’re on the side of the regulators, otherwise they could shut you down.

Da Hong Fei: Yeah. In China, we don’t do gatherings or meetings to promote the token, to persuade people to invest in our tokens. We never did that.

Angie Lau: That’s a no-no here.

Da Hong Fei: That’s a no-no here. Chinese regulators does not like those speculative markets, speculative practices. So ICO and cryptocurrency exchange are not allowed to operate here in mainland China.

Angie Lau: And so how do you get a global community to take up Neo tokens, or even people in the Chinese community in China?

Da Hong Fei: Actually, we don’t. promote that. We don’t market you as an investment opportunity or investment vehicle. If you follow our Twitter, if you follow all the marketing events/efforts we did, we are merely pushing the technology. We are talking about the vision, talking about how blockchain technology can be used for real business. We’re not trying to invent a new token for people to buy.

Angie Lau: And that part of the tension that exists, because you need the token obviously it is the underlying functionality of the platform. It is, though, how people are able to transact.

Da Hong Fei: You need the economic model to make the public blockchain work.

Angie Lau: And so help me understand, and help our audience understand, in spite of the environment in which China says ICOs are banned, yet blockchain technology is still very much encouraged. How are you able to still function? Because you, at the end of the day, still have a token.

Da Hong Fei: Yes, we have a token. I would say we are pretty lucky. We are funded by the community very early, way earlier than when the Chinese regulators said it’s not allowed. So, first of all, we are funded by the community. And then we did a give-back plan. So we informed all the sponsors or the supporters, we said, we will give back the amount of money you gave us with no other conditions. So it’s completely out of goodwill. We did that first and second. Neo’s token already had a pretty big market cap, so we have sufficient funds to maintain operations. Currently, New Foundation manages multi millions of assets, we’re managing multi millions of assets, so we’re financially well-funded.

Angie Lau: Now you’re changing to Neo 3.0. Tell us a little bit about this. Why is the developer community interested in it? And then you heard from your community as well, who’s also asking, why do we need to change? So what is it about iterating now to a new platform? Because from what I understand, it’s a completely new protocol.

Da Hong Fei: It’s not a completely new protocol, it’s a complete new architecture. The architecture is different. So it won’t be completely compatible but your assets will still be there. So you will not lose money. Why we’re doing this is because alongside the way, we learned many lessons. We know something should be designed this way or that way, so we tried to make things right for the new version. And we figured out a smooth way to upgrade from an older version to a not-incompatible new version. That’s through a product called Cross-Channel Protocol, or Interoperability Protocol. So Neo 2.0 and Neo 3.0 will be both connected to a, you could it a hub. So the asset from Neo 2.0 can be transferred to Neo 3.0 smoothly. Neo 2.0 and Neo 3.0 will be running simultaneously for a while, and then when people are confident with the new architecture, then we will urge users to migrate from Neo 2.0 to Neo 3.0.

Angie Lau: What is it about Neo 3.0 that’s different from Neo 2.0?

Da Hong Fei: First, under the hood, the architecture is different. That means it will be more stable. You will have better performance. So that’s the underlying technology. And then we have new functionalities. There are three major new functionalities. The Oracle. We will have a built-in Oracle function. That means a smart contract can directly access Internet content within the smart contract itself. They can visit a website. It’s not doable within current blockchain devices.

Angie Lau: OK, give me a real world example.

Da Hong Fei: You can read the index of NASDAQ. You can tell what the price of, let’s say a Bitcoin, is. And then you can do some arbitrage, or you can do some collateral, things like that. Decentralized finance. So that’s the first new feature. The second new feature is Neo ID. Neo ID is meant to be used to do KYC, AML, to build a reputation system on top of that. So you can link your identity within the physical world to the blockchain world. And the third feature is NeoFS. I’m really excited by NeoFS. This is a distributed file system, so you can directly save big files like a video to a distributed file system that is linked with blockchain. You cannot do that within today’s existing blockchains.

Angie Lau: So this could really lower the cost for a lot of real world businesses.

Da Hong Fei: It will dramatically lower the cost. Saving data on blockchain is very expensive. It’s extremely expensive. It will bring the cost down to 1 percent or maybe even lower than that.

Angie Lau: So right now, anyone who uses cloud knows, sometimes as your data sets and your data files grow, your cloud subscription fees also exponentially grow with that. What if they were to flip to a decentralized cloud sharing? How does that…

Da Hong Fei: Eventually, I think it will be cheaper than Google Drive or Dropbox or other centralized storage services.

Angie Lau: There are certainly other blockchain protocols that are also working on this as well. But they’re shifting the narrative to cloud-based. How is that also helping shift the business logic for companies not only in China but globally?

Da Hong Fei: To beat the competitors, to beat the giants, you cannot just do the same thing and be a little bit better. You have to do it in a complete way and be much, much better. So the way a distributed storage works is if you are an ordinary user, you can share the storage with a laptop, you can share the storage maybe with your phone and with 5G. It will be very fast, and the bandwidth cost is really low. So it would be more like a shared storage system, like Uber, like in a shared economy.

Angie Lau: I want to also have you help me understand the incubator effect that’s happening in China. As you travel globally as I do, what is your sense of how technology is being incubated in Europe and in the U.S., and why China might be different, for better or worse?

Da Hong Fei: Let me think about it. I think the Chinese government is more active in supporting technological, technical companies, startups, not by directly subsidizing them, but indirectly. Like the Chinese government will build an industrial park. This is NGD’s office in Shanghai. We are in a kind of industrial park and they have special taxation, special human resource policies, within those industrial parks. So that’s the way that Chinese government supports tech startups. In the U.S., I think it’s more market-driven. It’s sponsored by venture capitalists, by the private sector. I don’t know about Europe, and I don’t have a very clear idea about Europe, actually.

Angie Lau: How important is the environment itself? I guess what I’m trying to understand is it’s not just block chain alone. I mean, you mentioned it already. You’re talking about cloud. You talked about 5G. Blockchain plus all of these things is really what’s happening in concert together in a different way. How are you also adopting blockchain to other technologies here in China? Are you the only one, and are other technologies doing that?

Da Hong Fei: That’s a great question. From 2011, or from 2009, the year that Bitcoin was invented, to maybe 2015, I would say that’s the face of coins. A lot of project call them Litecoin, name coin, a lot of different coins. And then from 2015 or maybe 2016 to now, present, 2019 or maybe even next year, is the age in the face of chance. We saw a lot of chance. This chance, that chance. A lot of chance. But the next phase, I believe, is I call it next generation Internet. That’s a term also used by the European Commission to describe the next computational architecture of the Internet. And there are many projects working on that direction. For example, I was in Berlin two weeks ago attending the Web3 summit. They use the word Web3 to refer to that next generation Internet. My understanding of next generation Internet is it’s more user-centric. Users have the control of their own data and it’s decentralized. Neo is a digital asset protocol, and I’m also involved with another protocol called Ontology. Ontology is a digital identity protocol, and together with maybe distributed five storage protocols, these protocols will be the building blocks for the next generation internet. So the next generation internet applications were talked to different building blocks using, let’s say, Ontology as an account or identity layer, use Neo as a digital asset layer, so there will be different protocols working together.

Angie Lau: That, you know, the space has evolved so quickly, it’s hard to catch up because what you’re talking about right now is this chain and that chain. The protocol itself has unique characteristics. So we saw Bitcoin, which is peer to peer transactions. Ethereum came along. Neo is often called the Ethereum of China because it takes this concept of smart contracts as it pertains to blockchains. Now, what we’re talking about is different protocols that have different unique characteristics. But in working in concert with each other in the same way that block chain might work with 5G, or work with cloud, or work with A.I., or IOT, in the same way it sounds like Neo would work with Ethereum and Bitcoin. And so you’re talking about interoperability, which is certainly the hot topic of discussion right now. Why is that important to corporations, to companies, to professionals who are learning about this right now as they try to understand how to apply block chain in their own industries?

Da Hong Fei: If we look at the history of the Internet, it was not a global network at the very first. It was local networks. But eventually people invented TCP/IP protocol, and used TCP/IP to connect those networks together to form the Internet. I believe the same thing will happen within the blockchain world. We have different blockchains. They don’t talk to each other right now. But we need an interoperability or cross-channel protocol to link them together. And it is crucial to enterprise because actually, those enterprises can adopt – they don’t like the idea of public blockchain, just like the companies in old age, they don’t like the idea of Internet. They like the idea of Intranet, a network that they can control. So at this stage, I think most of the business world will adopt a consortium or a federated or a private blockchain.

Angie Lau: That’s a great way to put it. Intranet is private. Internet is public. So in the same way, private blockchain is an Intranet. Blockchain architecture within your corporate structure that’s garden-walled, versus… but at the same time, they kind of need to talk to each other, right?

Da Hong Fei: Yes. I just said before, we’re doing a migration from Neo 2.0 to Neo 3.0. So that’s evolved from you could say Blockchain A to Blockchain B. This model, this approach, can also be used by the consortium of private blockchains from those enterprises. They can use someday in the future move all the assets, smart contracts, from their private blockchain to a new public blockchain, or merge with an existing public blockchain.

Angie Lau: Do you think this could also happen from a sovereign point of view, from a regulatory point of view, that within each nation you determine your own rules, but then you can still participate in public blockchain?

Da Hong Fei: Yeah, yeah, that’s definitely possible. That’s exactly what we are designing.

Angie Lau: That design also means that you have to be compliant to regulatory realities.

Da Hong Fei: Yes, we are working on a technical solution now, but after we figure out all the technical details, we need a governance model. We also need to make sure the governance model is compliant. I think probably we need an association, an independent entity to run that cross-channel protocol, to organize all the participating blockchains, and that organization will be very similar to WTO. That would be the free trade between different blockchains.

Angie Lau: You envision a block chain like the WTO.

Da Hong Fei: An organization to coordinate all the efforts to make the blockchains interact with each other.

Angie Lau: These conversations have already started. They’re happening at G7, G20, OECD, they’re happening at regulatory IOSCO around the world, right? At the same time, there doesn’t seem to be actual agreement as to the relevance, sometimes of even cryptocurrency or block chain all the way up to complete embrace of block chain technology. There’s such a huge divide. Do you think we’ll ever get there?

Da Hong Fei: Eventually human beings will figure out a way to regulate things.

Angie Lau: Do you think regulation is important?

Da Hong Fei: I think it’s important. I do think it’s important. Self regulation is not always the best practice. Sometimes we need a certain level of regulation. But you have to be transparent, has to be auditable, so people will do what you did to regulate.

Angie Lau: So it’s interesting because you’re Shanghai-based, you’re front-facing to China. You are taking a look at the regulatory landscape and you’re making sure you’re compliant here. Your community leaders in Brazil are doing that in Brazil, regulatory compliance to Brazilian rules of governance. They’re doing that in Spain. They’re doing that in the US. These are all very different environments; how does this balance out?

Da Hong Fei: Actually, we do not need to really focus, to be very concerned about the regulations, because the major job we are doing is not a business. We are building the infrastructure, the technology itself. It’s open-sourced. So it’s not our problem. It’s not our task to make sure a decentralized application is compliant in their country. It’s the developer of the DApp that has to make sure.

Angie Lau: Got it. So from what I understand, you’re simply creating the highway. And if you drive the car, and the highway goes into a different country or state with different rules, then you must comply there. But you’re simply building the highway..

Da Hong Fei: Yes. We’re building the OS.

Angie Lau: You’re building the OS. The OS is not only creating a community and an ecosystem that really welcomes the developers from the DApps, but at some point you have to prove your point to corporates in the real world who are conducting business. If they can’t see why they want to use any of these protocols – whether it be Ethereum, whether it be Bitcoin, whether it be whoever, there’s myriad block chains out there – then where does this leave the industry?

Da Hong Fei: You’re absolutely right. We need a real world adoption showcase for the blockchain, but we’re not there yet. Actually, we’re still at a very early stage. As you just said, we’re building the road. The road is not well built yet. The road probably is OK, but we don’t have signs, we don’t have menus, telling you how to drive, we don’t have –

Angie Lau: Directions?

Da Hong Fei: We don’t have directions, we don’t have maps. So we are building maybe 60 percent of all the infrastructure. I believe we are still at least two years away from mass adoption for real, large-scale, global scale business adoption.

Angie Lau: Proof of concept is huge. Everybody is watching on the sidelines right now. They’re saying, this is great. This could potentially be great for my business, but it hasn’t been proven yet. Who is proving it right now in China?

Da Hong Fei: I’d love to be one of them, to prove that blockchain will be the underlying technology infrastructure for the future internet. Yeah, I’m doing that not just by working on Neo, but also I have a private company. I funded a private company called Onchain, also in Shanghai. So we are also working with Chinese enterprises to do some private consulting blockchains, and even some local governments, to do some proof of concept.

Angie Lau: So Onchain is very interesting in that it is backed amongst investors such as Sequoia China and also Fosun. Fosun: huge Chinese conglomerate with interests in entertainment, travel, they even own an Australian oil company – ROC Oil.

Da Hong Fei: And a British soccer team.

Angie Lau: And they own a British soccer team. How do these industries help prove that point? What is Fosun? Why is Fosun one of the main investors in Onchain? What do they see in block chain technology that they want to apply into all the different verticals of their businesses?

Da Hong Fei: I think the reason why Fosun invested in us so early is because they have a good diversity of businesses in different countries. They own the club met, the hotel chain, the resort chain, they own some insurance companies in Europe, banks, pharmaceutical companies, all sorts of things. So I think those business gave them some idea that block chain can facilitate their business. So the investment department just talked to us, and finally, the big boss, Mr. Gore, made the final decision to invest in us. And we kept a close relationship with him. We often discuss what can be used within, for instance, portfolios.

Angie Lau: What is the most exciting thing that you’re working on that you want to prove?

Da Hong Fei: We’re working on a point system. They have an internal point system that will be used by many companies, investors, or control. We’ve made the majority share by Fosun, so we’re working on that.

Angie Lau: By point system, you mean like loyalty points?

Da Hong Fei: Like loyalty points. Actually, it’s not loyalty points. It’s not meant to be used by customers, but rather their employees. So an internal loyalty system, a points system. You can use that to purchase services or goods within the group, within the Fosun group.

Angie Lau: Employee benefits program.

Da Hong Fei: Kind of that, yes.

Angie Lau: OK. Which, you know, if you were to take it outside of corporate, it would be very similar to loyalty points. You want to kind of create leverage for your employees. It’s a perk, it’s a benefit.

Da Hong Fei: Yes. Yes.

Angie Lau: OK. And are you close?

Da Hong Fei: What do you mean by close?

Angie Lau: Are you close, have you already implemented the system?

Da Hong Fei: Not yet. We are working on it. It’s not close yet.

Angie Lau: Okay. When you take a look at what’s happening in China – yourself, your competitors, this is a very tight community, because the developer community is very tight, but it is also very, very competitive. What are you seeing that really excites you about the innovation that is happening here in China that others don’t see because they’re not here? There’s probably so many examples. I can think of supply chain, food….

Da Hong Fei: But everybody’s there, and…

Angie Lau: Yeah. So of course, for you, something that you’re not seeing anywhere else. What do you think the emerging market trends are when it comes to block chain that’s happening in China right now?

Da Hong Fei: Emerging market? You mean geographically, or –

Angie Lau: No, I mean what do you think is burgeoning, new, that’s happening in China right now? Because you talked about it, first it was coins, then it was chains. What is the next thing that’s happening in blockchain technology in China right now?

Da Hong Fei: We’re seeing a lot of fusion between blockchain technology and IOT. How to use blockchain to manage those sensors, millions of sensors. I also saw some interesting ideas about how 5G would change the blockchain game, and also some new breeds of blockchains, they are not using the typical conventional blockchain data structure. They’re using a different graphic data structure.

Angie Lau: So what does that mean? What do you mean by that?

Da Hong Fei: So blockchain is one block that links to another block as a chance. But, uh, they use DAG, so there will be like a graphic – I don’t know how to describe it in English, in layman’s terms. So it’s like a tangled chain, but eventually you will find the main chain. There will be a single source of truth, a single source of history. And it will be very fast. It will be very fast because transactions can be processed locally, and eventually will be merged onto a main block chain.

Angie Lau: You’re almost talking about edge computing. With the same analogy, you know, you have the cloud, but instead of this huge pipeline, if that transaction only pertains to one specific conversation, then you’d still be able to do that, but still link back to the cloud. This is happening so fast. It’s happening at breakneck speeds. If there is one thing that you want people to understand what’s happening in China, what would it be?

Da Hong Fei: If there’s one thing I want them to understand? I think to run a blockchain startup in China is not easy. At the beginning, running a blockchain startup in China can be tough because of the regulatory pressure, because of the language barrier, cultural differences, but I think in the long run it will be an advantage, because Chinese people are really good at building things. We’re good at engineering things. And engineering is a very important part of blockchain. And I think I’m lucky that I was born here, and I was born in a great time. I saw a lot of progress here in China.

Specifically, we’re in a global age. Globalization is everywhere, especially in this industry, the blockchain industry. So running a blockchain startup in China is actually at the very beginning, it’s tough. Your employees, your colleagues, they don’t speak fluent English. There are cultural differences, some value differences. And regulation in China is stricter than many countries. So at the very beginning, if you just look at it, you will think these are disadvantages. But I think we are lucky that we are born in this age. Everything developed so fast. I just witnessed all the progress we achieved in the past, almost four decades. I’m 39. So I’m really confident that in the long run, all these disadvantages will be translated into advantages.

Chinese people are really good at building things, at engineering. We build big bridges, roads, networks, bullet railways. There’s no doubt we’ll be good at building blockchains, building the infrastructure for the next generation Internet. So I’m really optimistic about the future.

Angie Lau: Amazing. Thank you so much for this conversation and your insight.

Da Hong Fei: Thanks.